Title: Unveiling Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party: Types and Details Introduction: The Baton Rouge, Louisiana area witnessed an increase in foreclosure cases in recent years, resulting in mortgagee sales to third parties. In this comprehensive guide, we will delve into what Baton Rouge Louisiana foreclosed mortgagee sales to third parties entail, outlining their significance and exploring different types available. Discover the key terms and acquire a deeper understanding of this real estate transaction process. 1. Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party: Foreclosed mortgagee sales refer to the process in which a lender, typically a bank or financial institution, sells a property that was seized from a borrower due to their default on the mortgage payments. In Baton Rouge, these sales can be held to recoup the unpaid loan amount and clear the lender's outstanding debt. 2. Types of Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party: a. Public Auctions: The most common type of foreclosed mortgagee sale, public auctions allow interested buyers to bid on properties. These auctions are typically conducted by designated authorities or auctioneers, providing a chance for potential buyers to acquire foreclosed properties at competitive prices. b. Online Auctions: With the advent of technology, online auctions have gained popularity in Baton Rouge. In this type of foreclosure sale, interested buyers participate via online platforms, bidding on properties from the comfort of their homes. Online auctions offer convenience and wider property access to potential buyers. c. Real Estate Owned (RED) Sales: When a foreclosed property fails to sell at auction, it becomes Real Estate Owned (RED) by the lender. RED sales involve the lender directly marketing and selling the property without the auction process. Buyers can negotiate with the lender on the purchase price and terms. d. Short Sales: Although not technically a foreclosure process, short sales are relevant to Baton Rouge foreclosed mortgagee sales. In a short sale, the lender agrees to accept less than the total amount owed by the borrower to facilitate a quick sale, avoiding the formal foreclosure process. 3. Key Aspects of Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party: a. Title Research: Before purchasing a property through a foreclosure sale, conducting thorough title research is crucial to understand any liens, encumbrances, or legal complications associated with the property. b. Inspection and Due Diligence: It is essential for potential buyers to perform a thorough inspection and due diligence on the property to assess its overall condition, potential repair costs, and market value. c. Financing and Funding: Buyers must ensure they have adequate financing or funding in place before participating in foreclosed mortgagee sales. Pre-approval or having available resources is crucial to successfully acquiring a property. d. Legal Assistance: Given the complexities involved, seeking legal advice or assistance from real estate professionals can aid in navigating the legal aspects, documentation, and closing procedures of the sale. Conclusion: Baton Rouge Louisiana foreclosed mortgagee sales to third parties offer an opportunity for buyers to secure properties at potentially discounted prices. Understanding the different types of sales, conducting due diligence, and being aware of associated legal considerations can help buyers navigate this real estate transaction process successfully. Stay informed, research diligently, and seize the chance to acquire an investment property through these foreclosure sales.

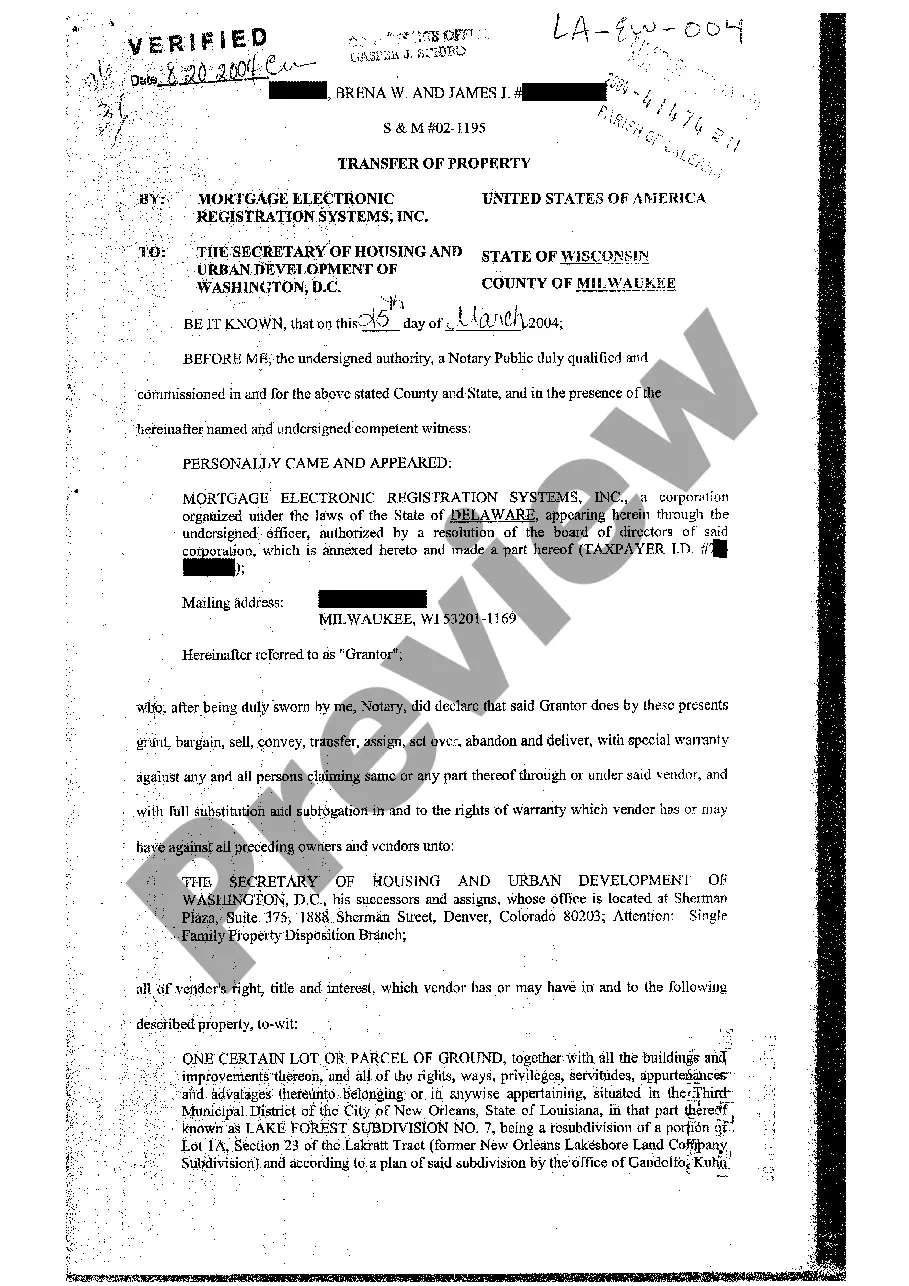

Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party

Description

How to fill out Baton Rouge Louisiana Foreclosed Mortgagee Sale To Third Party?

Finding verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party gets as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Baton Rouge Louisiana Foreclosed Mortgagee Sale to Third Party. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!