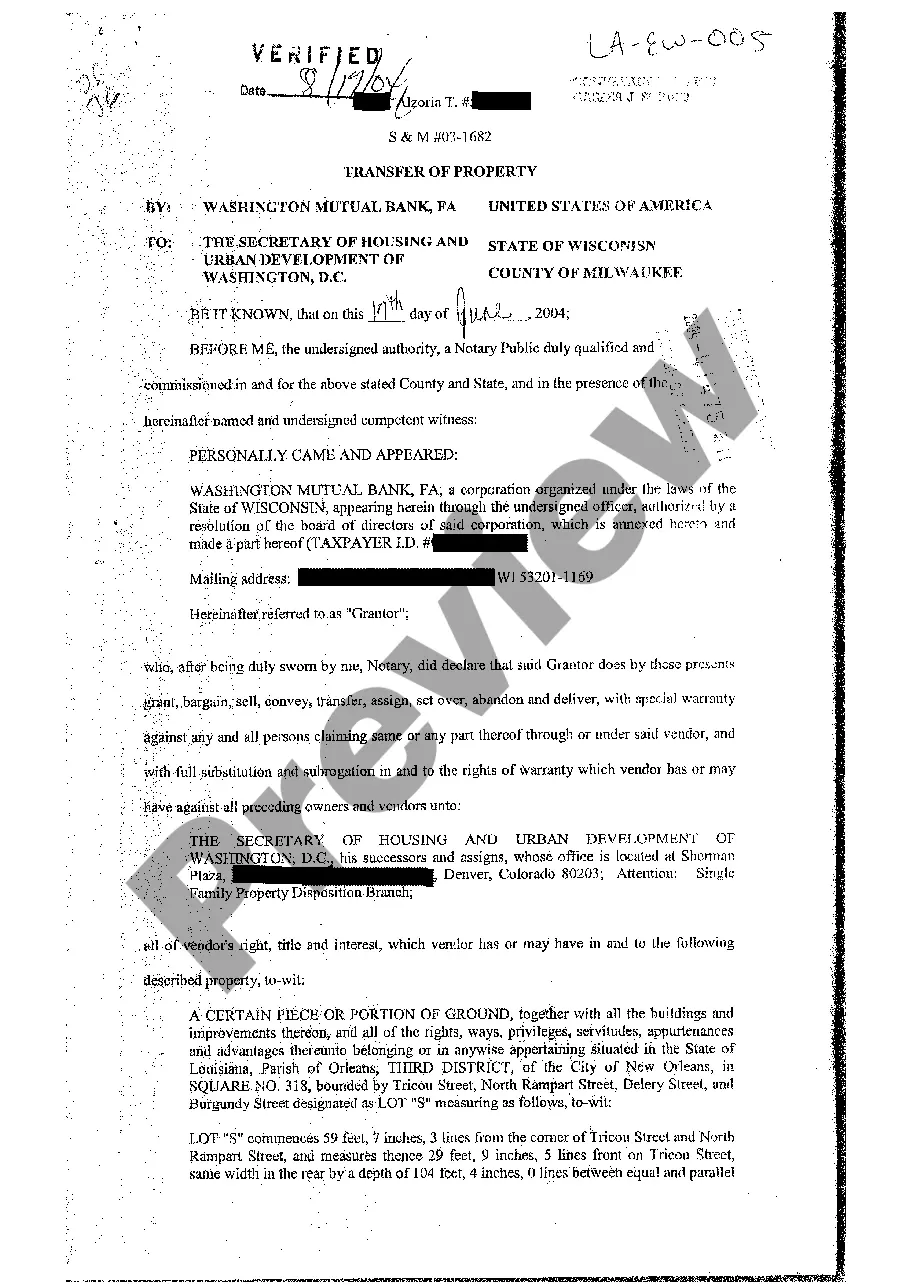

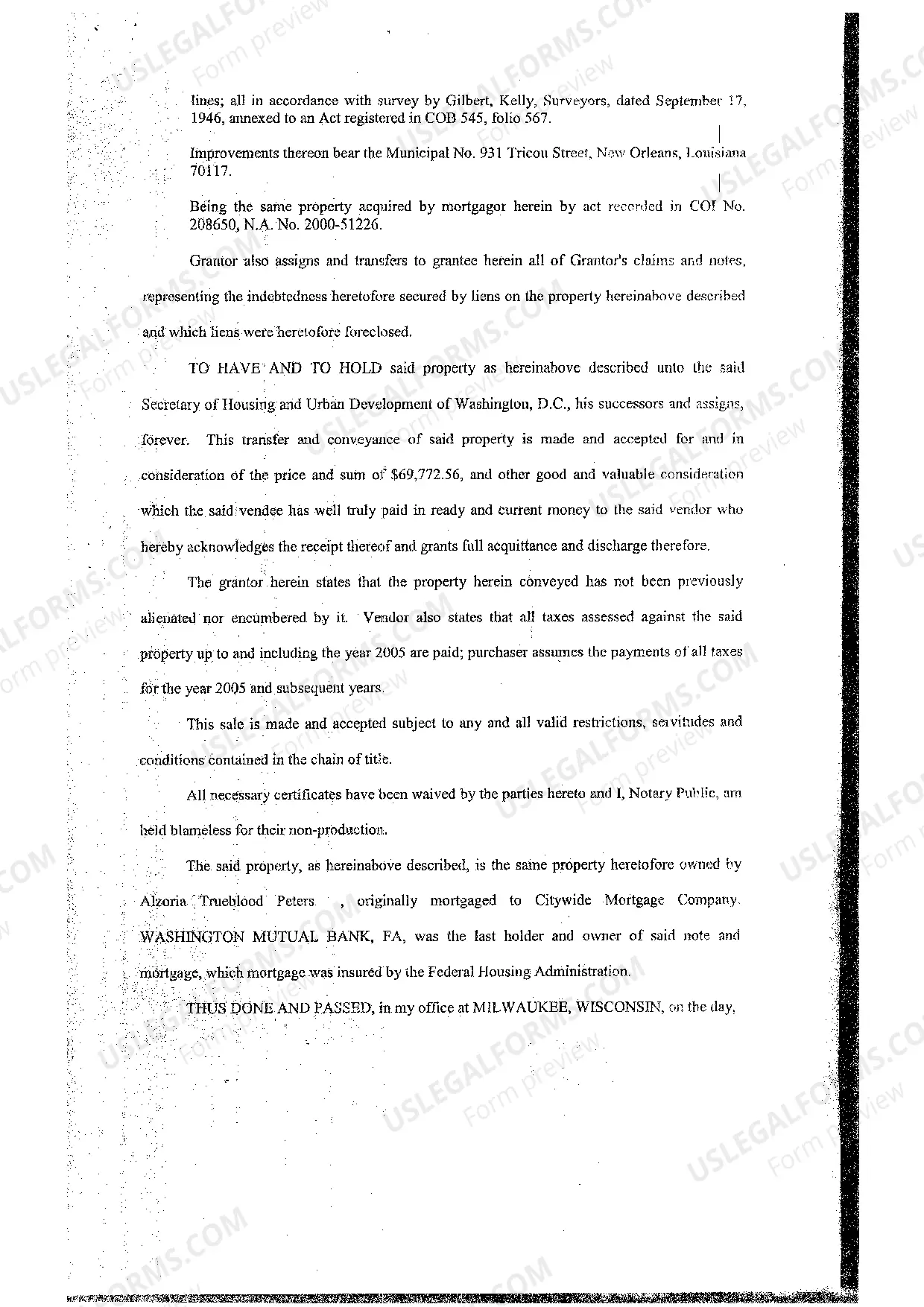

A Shreveport Louisiana Foreclosed Mortgagee Sale to a Third Party with a Written Contract of Authority to Sell refers to a legal process where a fully secured creditor, typically a bank or financial institution holding a mortgage, sells the property to a third-party buyer due to the borrower's default on their mortgage payments. This sale is conducted under the supervision of a written contract of authority, which grants the mortgagee or lender the legal right to sell the property and recover the outstanding debt. There are different types of Shreveport Louisiana Foreclosed Mortgagee Sales to Third Party with Written Contracts of Authority to Sell, classified according to the stage at which the foreclosure process takes place: 1. Pre-Foreclosure Sale: This type of foreclosure occurs before the lender initiates the foreclosure process. It happens when the borrower is unable to meet their mortgage obligations, and the lender agrees to sell the property at a fair market value in an attempt to avoid the formal foreclosure process. 2. Sheriff's Sale: After the borrower defaults on their mortgage, the lender may choose to proceed with a Sheriff's Sale. In this type of foreclosure, the property is auctioned off to the highest bidder to recover the outstanding balance owed by the borrower. The sale is authorized and conducted by the local sheriff's department. 3. Public Auction: A public auction is another common type of foreclosure sale, where the property is auctioned off to interested buyers. These auctions are typically held at a public venue, such as a courthouse or convention center, and are open to anyone interested in purchasing the foreclosed property. 4. Bank-Owned Sales: If the property fails to sell at a Sheriff's Sale or a public auction, it becomes known as "Real Estate Owned" (RED) or "Bank-Owned." In this case, the lender becomes the rightful owner of the property and can sell it directly to a third party through traditional real estate channels. The Shreveport Louisiana Foreclosed Mortgagee Sale to Third Party with a Written Contract of Authority to Sell is a legally binding transaction that allows lenders to recover their investment when borrowers default on their mortgage loans. It provides an opportunity for buyers to acquire properties at potentially lower prices, although conducting thorough due diligence is essential.

Shreveport Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell

Description

How to fill out Shreveport Louisiana Foreclosed Mortgagee Sale To Third Party With Written Contract Of Authority To Sell?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Shreveport Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell? US Legal Forms is your go-to choice.

No matter if you require a basic agreement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we offer aren’t universal and framed based on the requirements of specific state and area.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please remember that you can download your previously purchased form templates anytime in the My Forms tab.

Are you new to our website? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Shreveport Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell conforms to the laws of your state and local area.

- Read the form’s description (if provided) to learn who and what the document is intended for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Shreveport Louisiana Foreclosed Mortgagee Sale to Third Party with Written Contract of Authority to Sell in any provided file format. You can return to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending hours learning about legal papers online for good.