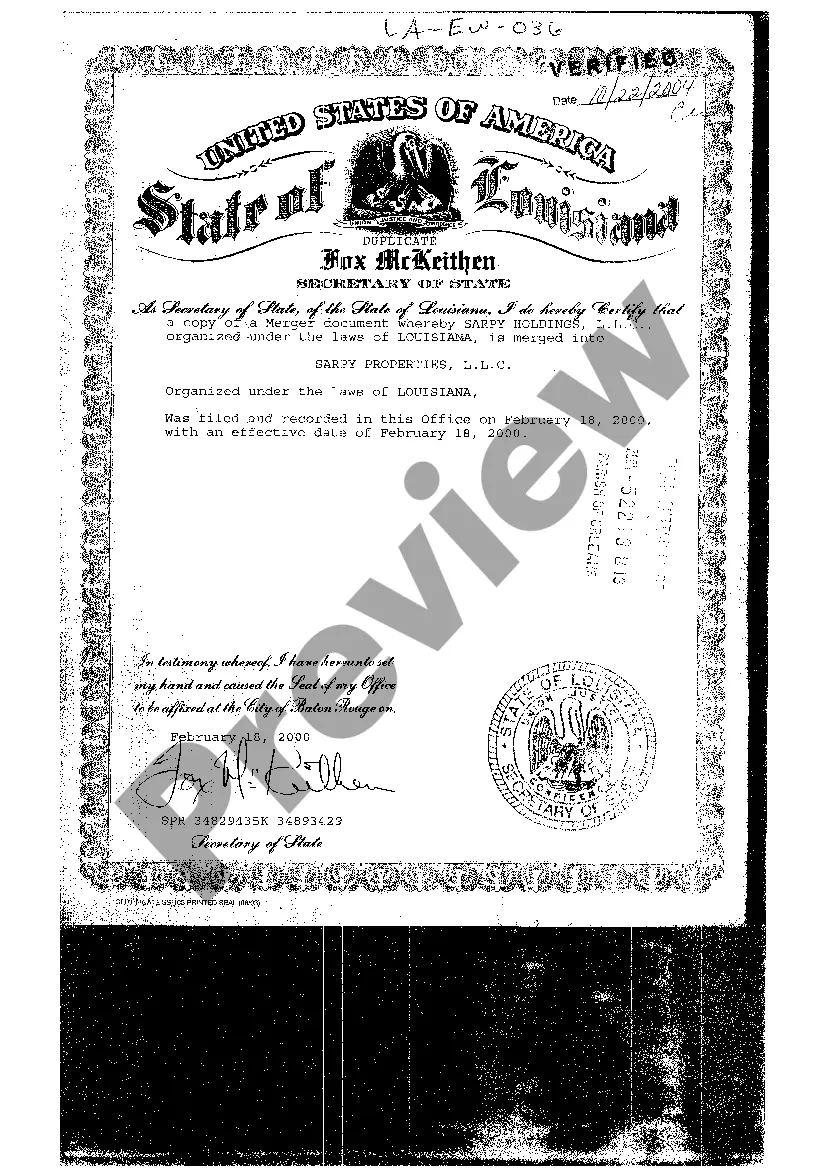

Baton Rouge Louisiana Merger Document is a legally binding agreement that outlines the consolidation of two or more companies operating in Baton Rouge, Louisiana. This crucial document lays out the terms and conditions under which the merger will take place and encompasses various aspects such as company valuation, management structure, asset transfer, and financial arrangements. By facilitating the merging of separate entities, the Baton Rouge Louisiana Merger Document aims to create a unified and synergized organization that can capitalize on shared strengths and resources. Different types of Baton Rouge Louisiana Merger Documents may include: 1. Stock-for-Stock Merger Document: This type of merger document involves the exchange of company shares between the merging entities, with their stockholders receiving stock in the new combined company proportionate to their ownership in the original companies. 2. Asset Purchase Merger Document: In this type of merger, one company acquires the assets and liabilities of another company. The Baton Rouge Louisiana Merger Document specifies the terms of the asset transfer, including the purchase price, asset valuation, and conditions under which the acquisition will occur. 3. Cash Merger Document: In a cash merger, one company purchases another by offering cash compensation to the target company's shareholders. The Baton Rouge Louisiana Merger Document outlines the cash payment structure, including the amount per share, payment terms, and other financial details. 4. Triangular Merger Document: A triangular merger involves the creation of a new subsidiary that acquires the target company. The parent company of the subsidiary then merges with the target company, resulting in the combination of the acquiring and target entities. The Baton Rouge Louisiana Merger Document for such complex mergers must address the legal and financial considerations specific to this type of transaction. 5. Reverse Merger Document: A reverse merger occurs when a publicly traded company acquires a private company, allowing the private company to become publicly traded without an initial public offering (IPO). The Baton Rouge Louisiana Merger Document for reverse mergers outlines the terms of this unique transaction, including stock issuance, valuation, and regulatory compliance. In summary, the Baton Rouge Louisiana Merger Document is a comprehensive agreement that enables the consolidation of companies in Baton Rouge, Louisiana. Its purpose is to delineate the terms, conditions, and financial aspects of the merger, ensuring a smooth and legally compliant transition.

Baton Rouge Louisiana Merger Document

Description

How to fill out Baton Rouge Louisiana Merger Document?

Do you need a reliable and inexpensive legal forms provider to buy the Baton Rouge Louisiana Merger Document? US Legal Forms is your go-to choice.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t generic and frameworked based on the requirements of particular state and county.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Baton Rouge Louisiana Merger Document conforms to the laws of your state and local area.

- Go through the form’s details (if available) to find out who and what the document is intended for.

- Start the search over in case the template isn’t suitable for your specific scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is completed, download the Baton Rouge Louisiana Merger Document in any available format. You can return to the website at any time and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal papers online for good.