New Orleans Louisiana Merger Document is a legally binding agreement that outlines the consolidation or acquisition of two or more business entities operating in the New Orleans area. This document plays a crucial role in defining the terms, conditions, and obligations held by the merging companies, ensuring a smooth transition and harmonious integration. In the vibrant city of New Orleans, several types of merger documents are commonly utilized to facilitate various merger and acquisition transactions. These include: 1. Merger Agreement: This document outlines the merger process, specifying the terms and conditions agreed upon by the participating companies. It covers aspects such as the method and timing of the merger, treatment of stock options, allocation of assets and liabilities, shareholder agreements, and any additional provisions necessary to finalize the merger. 2. Asset Purchase Agreement: In this type of merger document, one company acquires the assets of another company operating in New Orleans, Louisiana. All relevant assets, including real estate, intellectual property, contracts, and equipment, are delineated in detail. The agreement also specifies the purchase price, payment terms, and any contingencies associated with the acquisition. 3. Stock Purchase Agreement: This merger document entails the acquisition of a company, where the buyer purchases the majority or all of the target company's shares. The agreement encompasses the transfer of ownership, the price per share, warranties and representations, indemnification clauses, and any covenants related to the post-merger operations. 4. Joint Venture Agreement: Rather than a complete merger or acquisition, companies may opt for a joint venture to collaborate on a specific project or venture in New Orleans. This agreement establishes the terms and conditions of the partnership, including profit-sharing, governance structure, intellectual property rights, and dispute resolution mechanisms. 5. Shareholders Agreement: This document is often associated with mergers where two or more companies decide to create a new entity. The shareholders' agreement outlines the rights, obligations, and responsibilities of the shareholders in the newly formed company. It covers aspects such as the appointment of directors, dividend distribution, voting rights, and mechanisms for resolving shareholder disputes. When creating the New Orleans Louisiana Merger Document, it is vital to ensure that the content accurately reflects the specifics of the merger or acquisition, complying with the applicable laws and regulations. Seeking legal counsel and professional assistance from mergers and acquisitions experts is highly recommended drafting a comprehensive and effective merger document that protects the rights and interests of all parties involved.

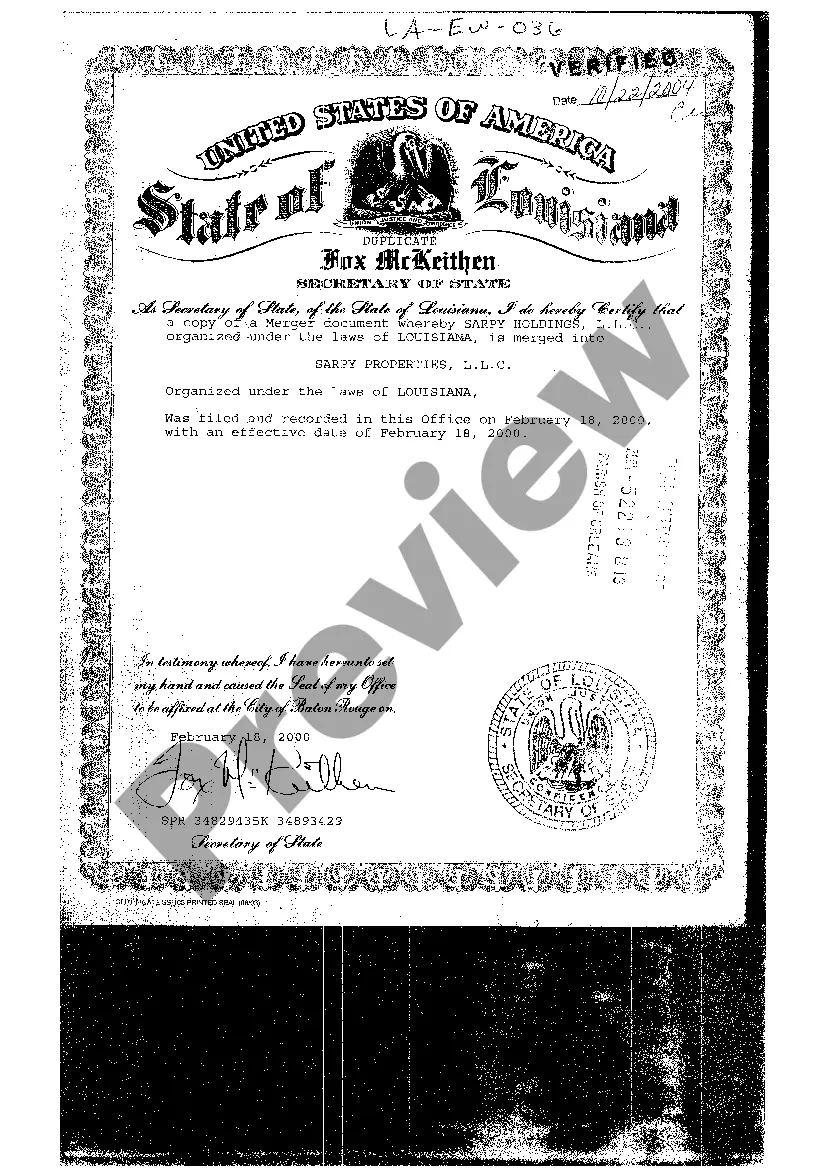

New Orleans Louisiana Merger Document

Description

How to fill out New Orleans Louisiana Merger Document?

Take advantage of the US Legal Forms and obtain instant access to any form template you need. Our useful platform with a huge number of document templates simplifies the way to find and obtain almost any document sample you require. It is possible to save, fill, and certify the New Orleans Louisiana Merger Document in just a few minutes instead of browsing the web for hours searching for an appropriate template.

Using our collection is a great way to increase the safety of your document submissions. Our experienced lawyers regularly check all the records to ensure that the forms are appropriate for a particular region and compliant with new laws and polices.

How can you obtain the New Orleans Louisiana Merger Document? If you have a subscription, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can get all the previously saved records in the My Forms menu.

If you don’t have an account yet, stick to the instructions listed below:

- Find the template you require. Make certain that it is the template you were seeking: verify its title and description, and make use of the Preview option when it is available. Otherwise, utilize the Search field to look for the needed one.

- Launch the downloading process. Select Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Export the document. Select the format to obtain the New Orleans Louisiana Merger Document and revise and fill, or sign it according to your requirements.

US Legal Forms is probably the most considerable and trustworthy document libraries on the web. We are always ready to help you in any legal procedure, even if it is just downloading the New Orleans Louisiana Merger Document.

Feel free to make the most of our form catalog and make your document experience as straightforward as possible!