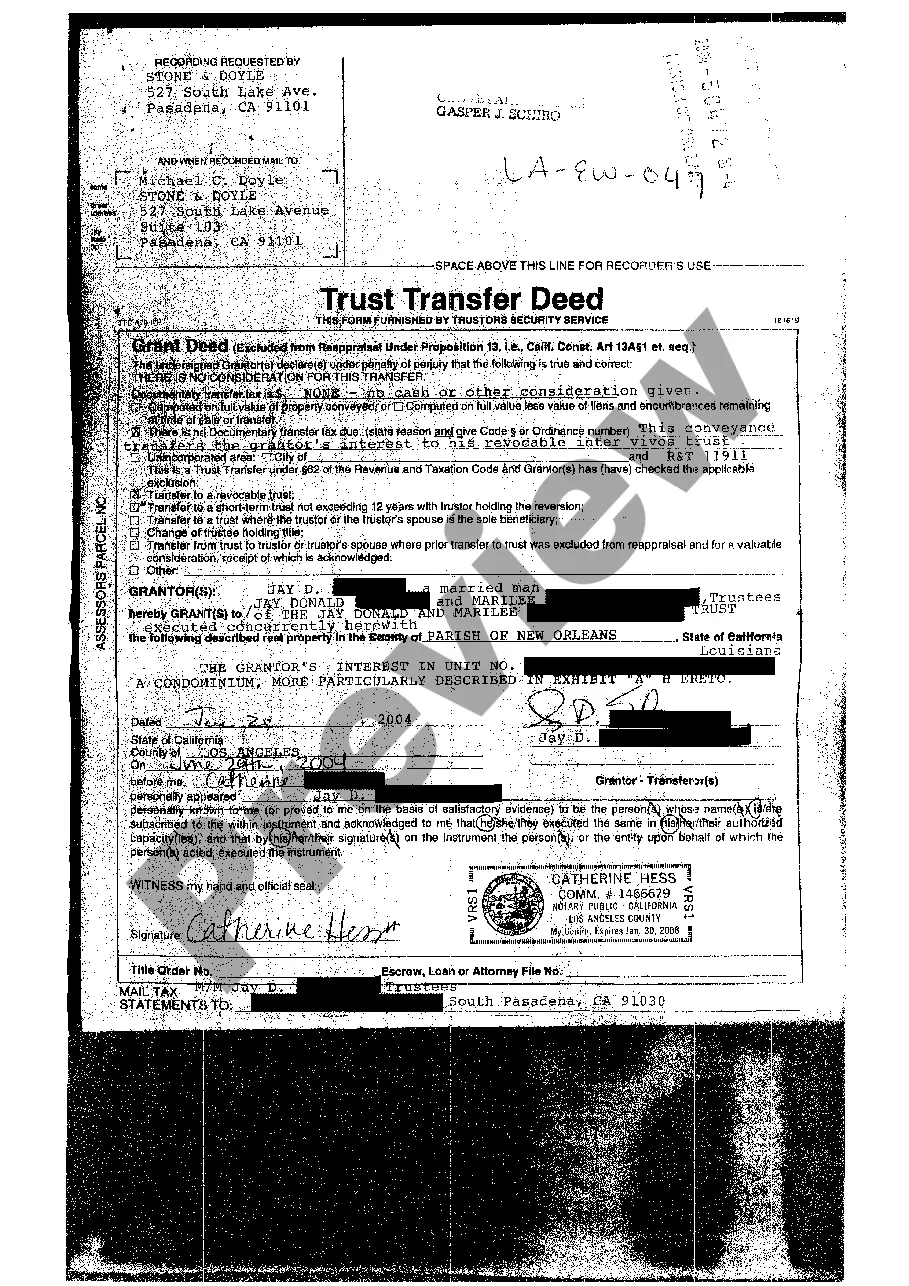

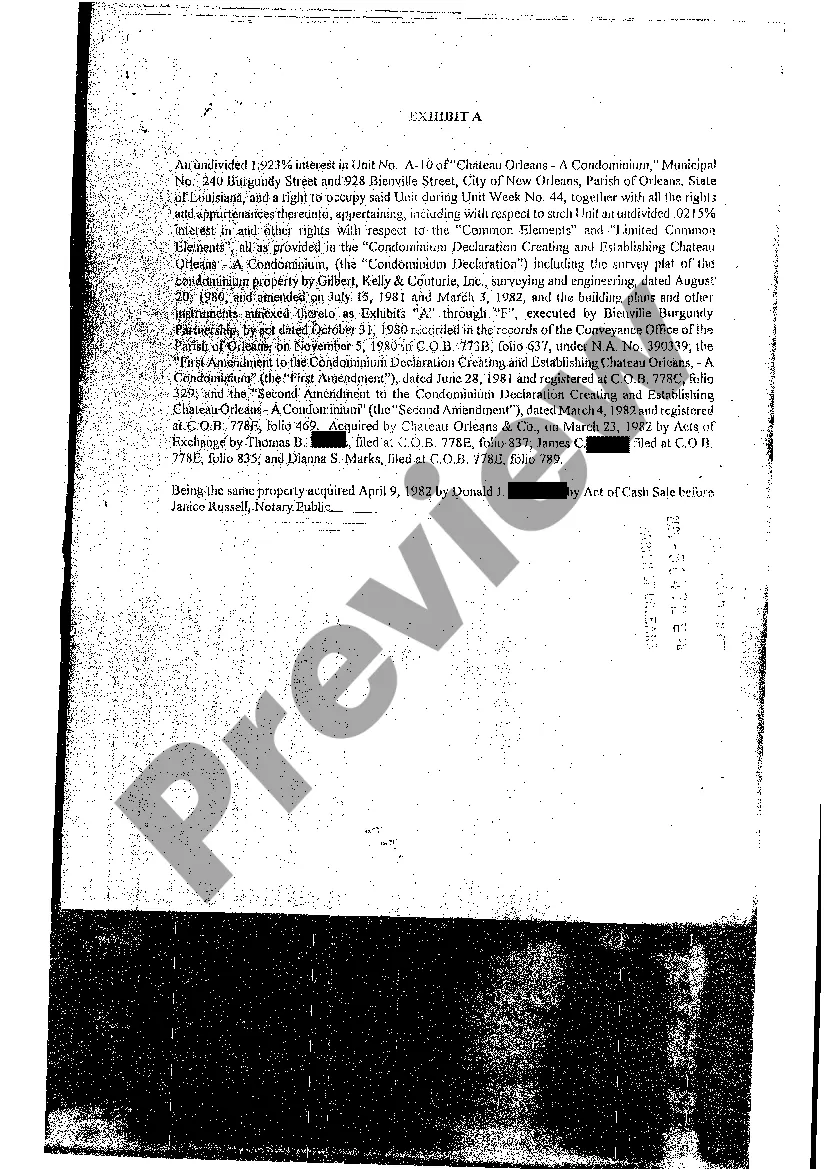

Baton Rouge Louisiana Trust Transfer Deed refers to a legal document that facilitates the transfer of property ownership from an individual to a trust located in Baton Rouge, Louisiana. This process involves the transferor, who is the current property owner, officially conveying their property rights to a trust, which acts as the new owner. The Baton Rouge Louisiana Trust Transfer Deed serves as a critical part of estate planning and asset protection strategies, ensuring a smooth transition of property ownership and management. By transferring property to a trust, individuals can plan for the future, protect their assets, and potentially minimize tax liabilities. There are several types of Trust Transfer Deeds commonly used in Baton Rouge, Louisiana. These include: 1. Revocable Living Trust Transfer Deed: This type of trust allows the transferor (also known as the granter or settler) to retain control and make amendments or revoke the trust at any time during their lifetime. It provides flexibility and enables the transfer of property while still maintaining the ability to manage and use it. 2. Irrevocable Living Trust Transfer Deed: Unlike a revocable trust, this type of trust cannot be modified or revoked by the granter once it is established. Once the property is transferred to an irrevocable trust, the granter relinquishes ownership rights, offering more asset protection and potential tax benefits. 3. Testamentary Trust Transfer Deed: This type of trust transfer occurs upon the granter's death, as outlined in their last will and testament. The property is transferred to the trust, which becomes effective upon the granter's passing. Testamentary trusts are subject to probate court proceedings and are often utilized for specific purposes, such as providing for minor children or managing funds for charitable causes. 4. Charitable Trust Transfer Deed: This type of trust transfer is specifically designed to benefit charitable organizations or causes. The property is transferred to a trust, and the income generated is used to support the designated charitable purposes. Charitable trusts may provide tax advantages for the granter and offer opportunities for philanthropic endeavors. It is essential to consult with an experienced attorney specializing in estate planning and trusts to ensure compliance with Baton Rouge, Louisiana's specific legal requirements and to select the most appropriate trust transfer type based on individual circumstances. These documents contain intricate legal terms and considerations, making professional guidance invaluable to ensure accuracy and achieve desired outcomes.

Baton Rouge Louisiana Trust Transfer Deed

Description

How to fill out Baton Rouge Louisiana Trust Transfer Deed?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone with no legal background to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms comes in handy. Our service offers a massive library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

No matter if you need the Baton Rouge Louisiana Trust Transfer Deed or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Baton Rouge Louisiana Trust Transfer Deed quickly using our trustworthy service. In case you are already a subscriber, you can go ahead and log in to your account to download the needed form.

However, if you are new to our library, ensure that you follow these steps prior to obtaining the Baton Rouge Louisiana Trust Transfer Deed:

- Ensure the form you have chosen is good for your location considering that the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if provided) of scenarios the paper can be used for.

- If the one you chosen doesn’t meet your needs, you can start over and look for the needed form.

- Click Buy now and choose the subscription plan that suits you the best.

- utilizing your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Baton Rouge Louisiana Trust Transfer Deed as soon as the payment is through.

You’re all set! Now you can go ahead and print the form or fill it out online. If you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Give it a try today and see for yourself.