The New Orleans Louisiana Memorandum of Trust — Short is a legal document specifically designed to outline the essential details of a trust agreement concisely. It serves as a summary of the trust's provisions and clarifies the key components that beneficiaries and trustees need to be aware of. Keywords: New Orleans Louisiana, Memorandum of Trust, Short, legal document, trust agreement, summary, provisions, beneficiaries, trustees. Types of New Orleans Louisiana Memorandum of Trust — Short: 1. Revocable Living Trust Memorandum: This type of memorandum is commonly used in estate planning to indicate the intentions of the trust granter during their lifetime. It outlines the beneficiaries, assets included in the trust, distribution instructions, and any revocable clauses. 2. Testamentary Trust Memorandum: This memorandum is created within a will, effective only upon the granter's death. It provides a short summary of the testamentary trust's terms, including the designated trustee, beneficiaries' names, and specific instructions on asset distribution. 3. Special Needs Trust Memorandum: This memorandum is often used to establish a trust for individuals with disabilities or special needs. It outlines the support, care, and assistance necessary for the beneficiary, including provisions for government benefits, medical care, and education. 4. Charitable Trust Memorandum: For individuals looking to make philanthropic contributions, this memorandum highlights the establishment of a charitable trust for specific causes or organizations. It includes details on the trustees, charitable purposes, and how funds will be distributed to support the designated charity. 5. Spendthrift Trust Memorandum: This type of memorandum is created to protect trust assets from beneficiaries' creditors or from being squandered irresponsibly. It outlines specific guidelines and restrictions on the distribution of funds, ensuring the preservation of the trust's assets for the beneficiary's long-term benefit. In conclusion, the New Orleans Louisiana Memorandum of Trust — Short serves as a condensed yet comprehensive document summarizing the key provisions of various types of trusts. From revocable living trusts to spendthrift trusts, this memorandum ensures that the essential information is easily accessible and provides a solid foundation for trust administration in New Orleans, Louisiana.

New Orleans Louisiana Memorandum Of Trust - Short

Description

How to fill out New Orleans Louisiana Memorandum Of Trust - Short?

If you are searching for a legitimate form, it’s impossible to discover a more user-friendly venue than the US Legal Forms site – one of the largest digital libraries.

With this collection, you can locate countless templates for commercial and personal uses by categories and regions, or keywords.

Utilizing our sophisticated search option, obtaining the latest New Orleans Louisiana Memorandum Of Trust - Short is as straightforward as 1-2-3.

Confirm your choice. Select the Buy now option. Subsequently, choose your desired pricing plan and enter details to register an account.

Complete the purchase. Use your credit card or PayPal account to finish the registration process.

- Moreover, the accuracy of each record is validated by a team of qualified lawyers who regularly review the templates on our site and revise them according to the latest state and county stipulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to acquire the New Orleans Louisiana Memorandum Of Trust - Short is to Log In to your user profile and select the Download option.

- If this is your first time using US Legal Forms, simply adhere to the instructions below.

- Ensure you have located the sample you require. Review its details and utilize the Preview option (if available) to examine its content.

- If it does not fulfill your needs, employ the Search option at the top of the page to find the suitable document.

Form popularity

FAQ

First, there is a front-end cost to establish and fund the trust. Secondly, there is a back-end cost to ?administer? the trust after the death of the settlor. On the front-end, many promoters charge between $3,500 and $8,000 to establish a revocable trust.

Here's a good rule of thumb: If you have a net worth of at least $100,000 and have a substantial amount of assets in real estate, or have very specific instructions on how and when you want your estate to be distributed among your heirs after you die, then a trust could be for you.

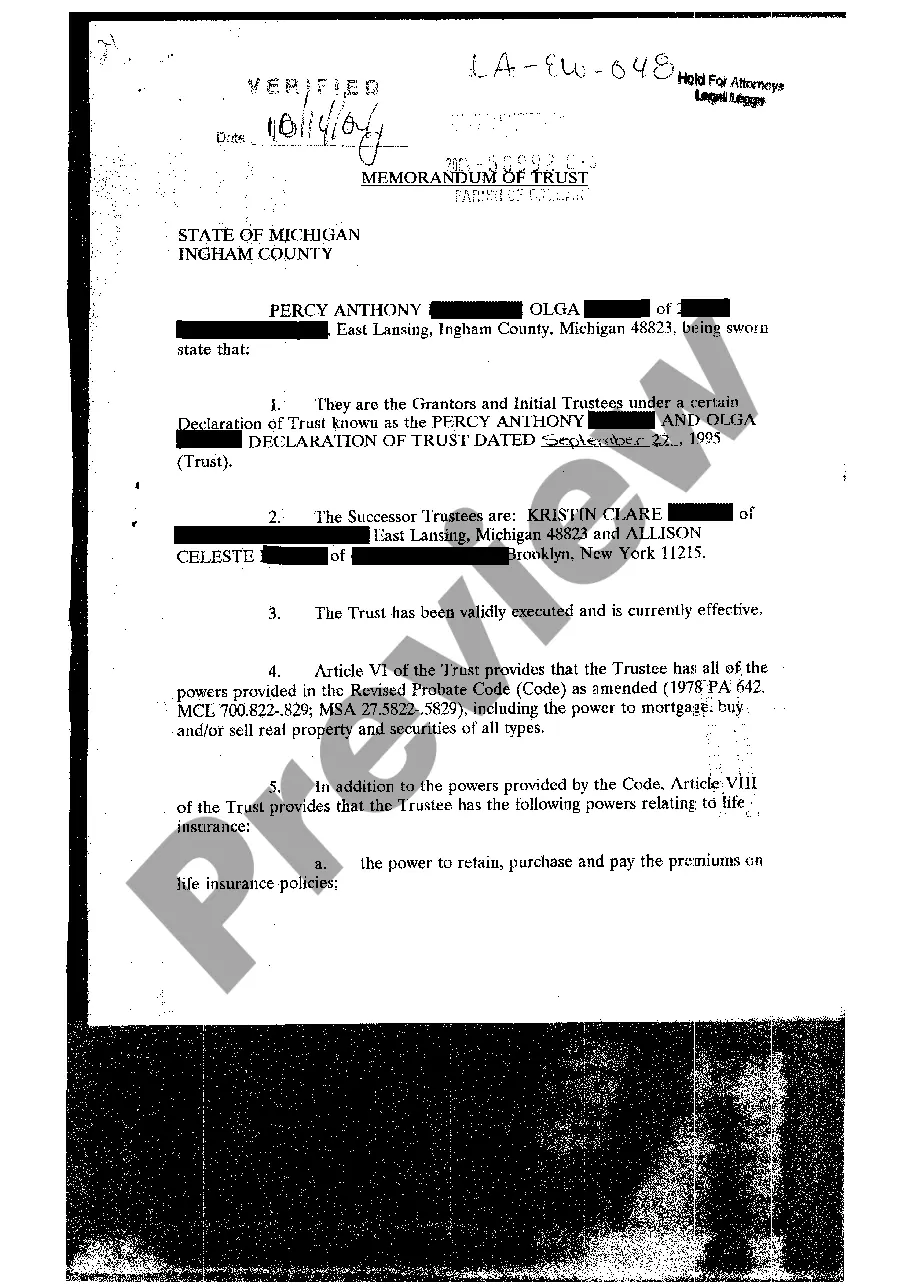

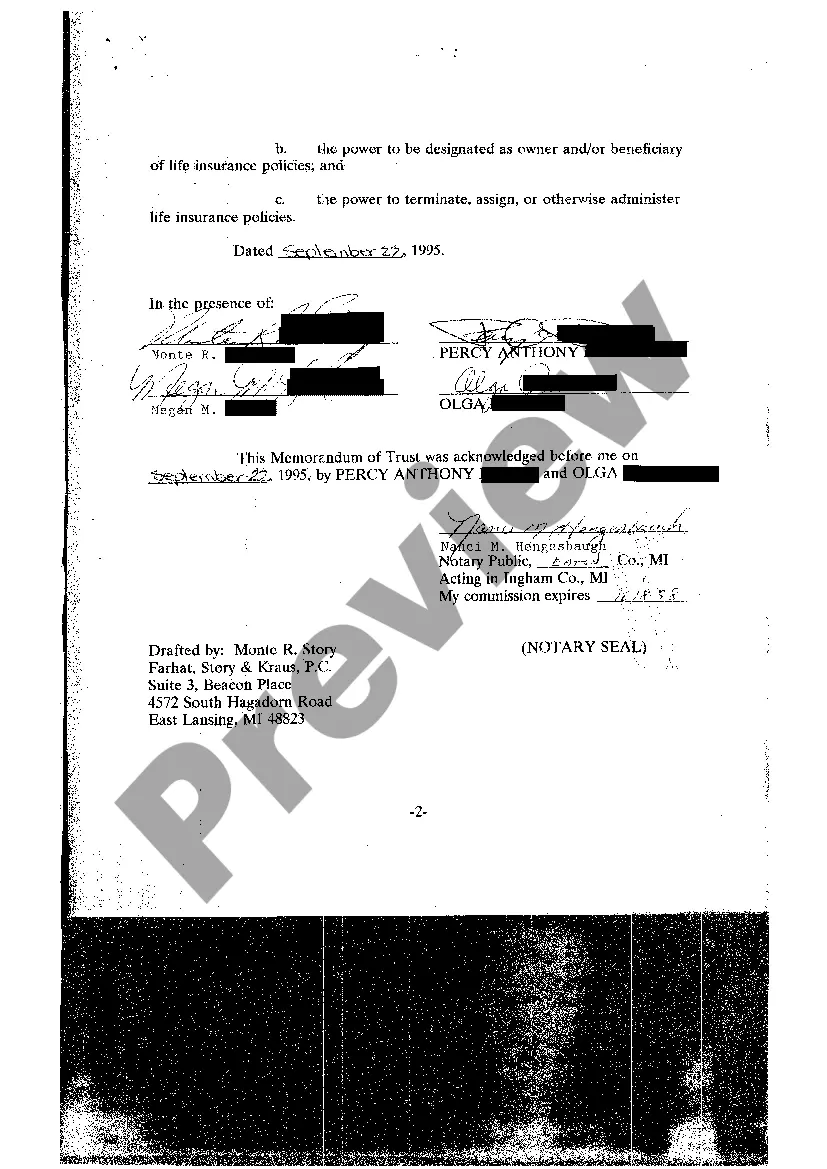

The memorandum is an abbreviated or synopsized version of the entire trust document. This shortened form allows the transfer of assets into the trust while preserving the identity of the grantor and trustees. Living trusts avoid probate.

A Louisiana living trust passes the assets in the trust to your beneficiaries without going through probate, the process in which a will is verified and enacted by a court. Probate can take many months and incurs the expense of an executor and attorney as well as court fees.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

The price of making a living trust depends on the method you use to form it. One way is to use a online program and create the trust document yourself. This will cost you a few hundred dollars or so. You can also use the services of a lawyer, for which you'll probably pay more than $1,000.

Most trust amendments or revocations in Louisiana are done by authentic act. An authentic act, generally, is a writing executed before a notary public and two witnesses, and signed by the person amending their trust, the witnesses, and the notary. Most trust amendments are done this way.

How to Create a Living Trust in Louisiana Decide which type of trust you want.Take stock of your property.Pick a trustee.Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

With your property in trust, you typically continue to live in your home and pay the trustees a nominal rent, until your transfer to residential care when that time comes. Placing the property in trust may also be a way of helping your surviving beneficiaries avoid inheritance tax liabilities.

The True Cost of a Revocable Trust First, there is a front-end cost to establish and fund the trust. Secondly, there is a back-end cost to ?administer? the trust after the death of the settlor. On the front-end, many promoters charge between $3,500 and $8,000 to establish a revocable trust.