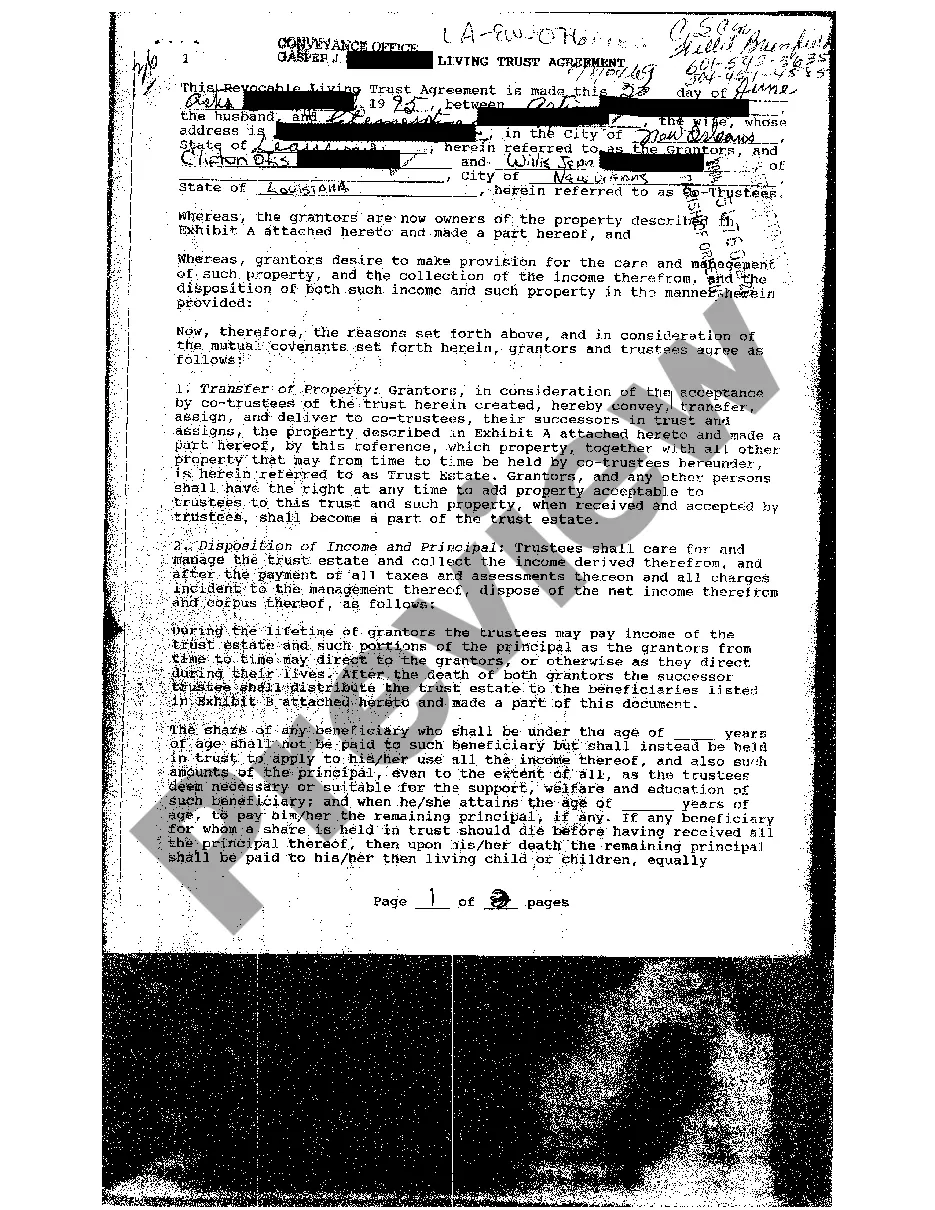

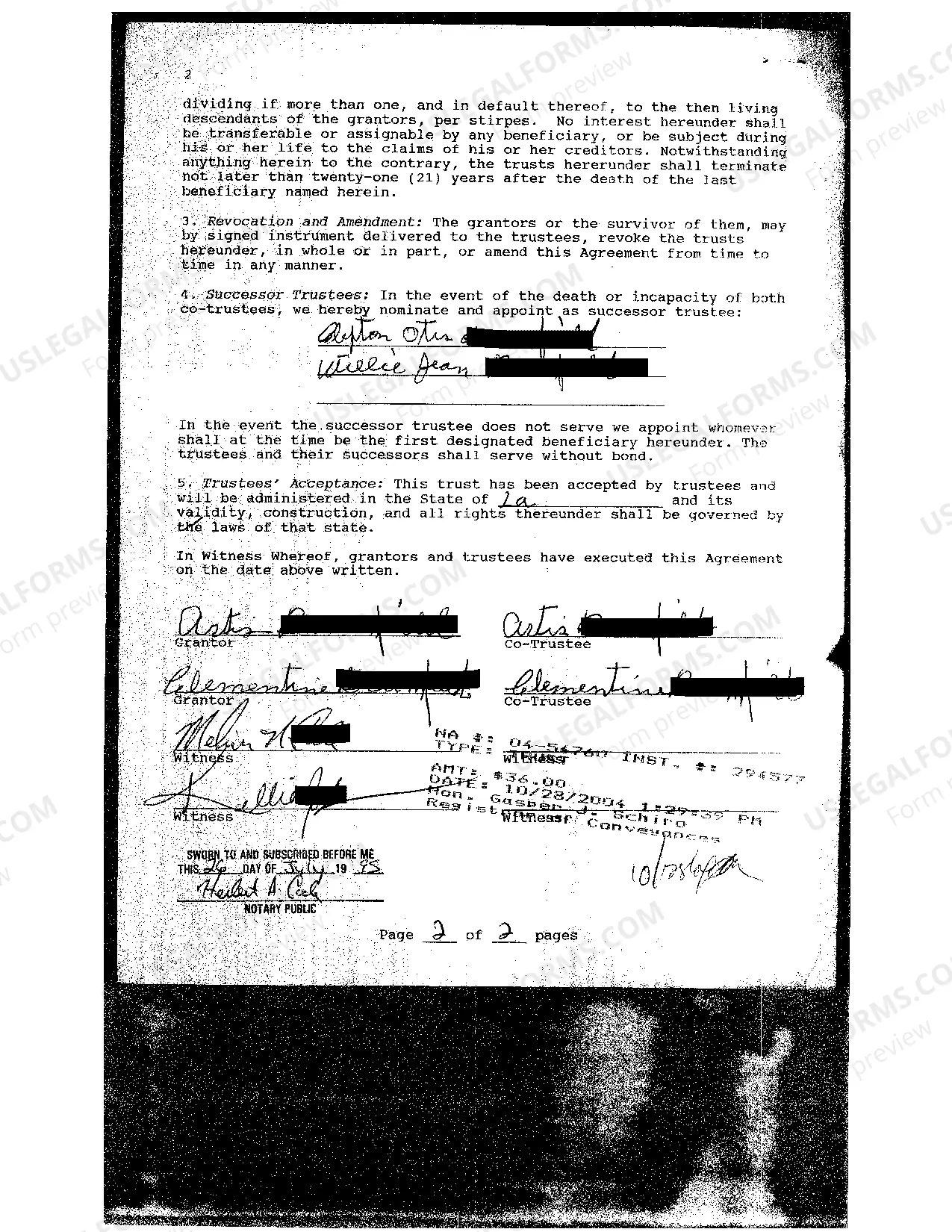

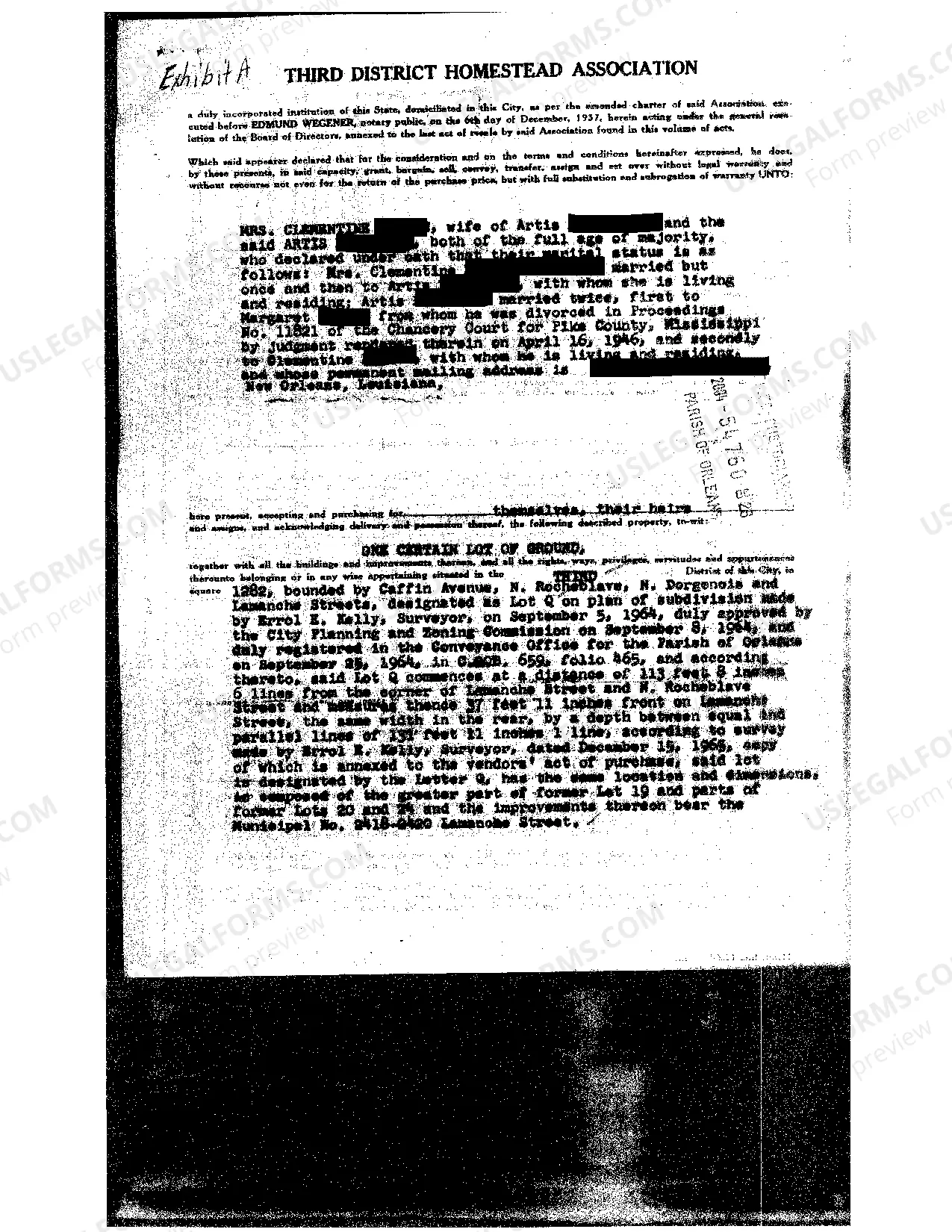

A Baton Rouge Louisiana Living Trust Agreement, also referred to as a revocable living trust, is a legal document used for estate planning purposes. It allows an individual, known as the granter or settler, to transfer their assets to a trust while maintaining control over them during their lifetime. Upon the granter's death, the assets are distributed to the beneficiaries named in the trust document, without the need for probate. One type of Baton Rouge Louisiana Living Trust Agreement is the individual living trust. In this type of trust, a single individual creates and maintains the trust, selecting their beneficiaries and outlining the terms and conditions of asset distribution. Another type is the joint living trust, which is created and managed by a married couple together. It allows the couple to transfer their assets into a single trust and specify how they will be distributed upon their death. A joint living trust often includes provisions for asset management and distribution in case of incapacity of either spouse. Baton Rouge Louisiana Living Trust Agreements offer various benefits, including privacy, flexibility, and potential cost savings. By avoiding probate, which can be time-consuming and expensive, the trust assets can be distributed to the beneficiaries more quickly and efficiently. Additionally, a living trust allows the granter to control the management of their assets during their lifetime and provides the option to make changes or revoke the trust if circumstances change. It is important to note that a living trust does not replace other important estate planning documents, such as a will or power of attorney. These documents work together to ensure that an individual's wishes are carried out and their affairs are properly managed. When considering a Baton Rouge Louisiana Living Trust Agreement, it is advisable to consult with an experienced estate planning attorney who can provide guidance tailored to one's specific situation. They can help draft the trust document, ensure all legal requirements are met, and offer advice on asset protection and tax planning strategies.

Baton Rouge Louisiana Living Trust Agreement

Description

How to fill out Baton Rouge Louisiana Living Trust Agreement?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for attorney solutions that, usually, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Baton Rouge Louisiana Living Trust Agreement or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Baton Rouge Louisiana Living Trust Agreement complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Baton Rouge Louisiana Living Trust Agreement is proper for you, you can select the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!