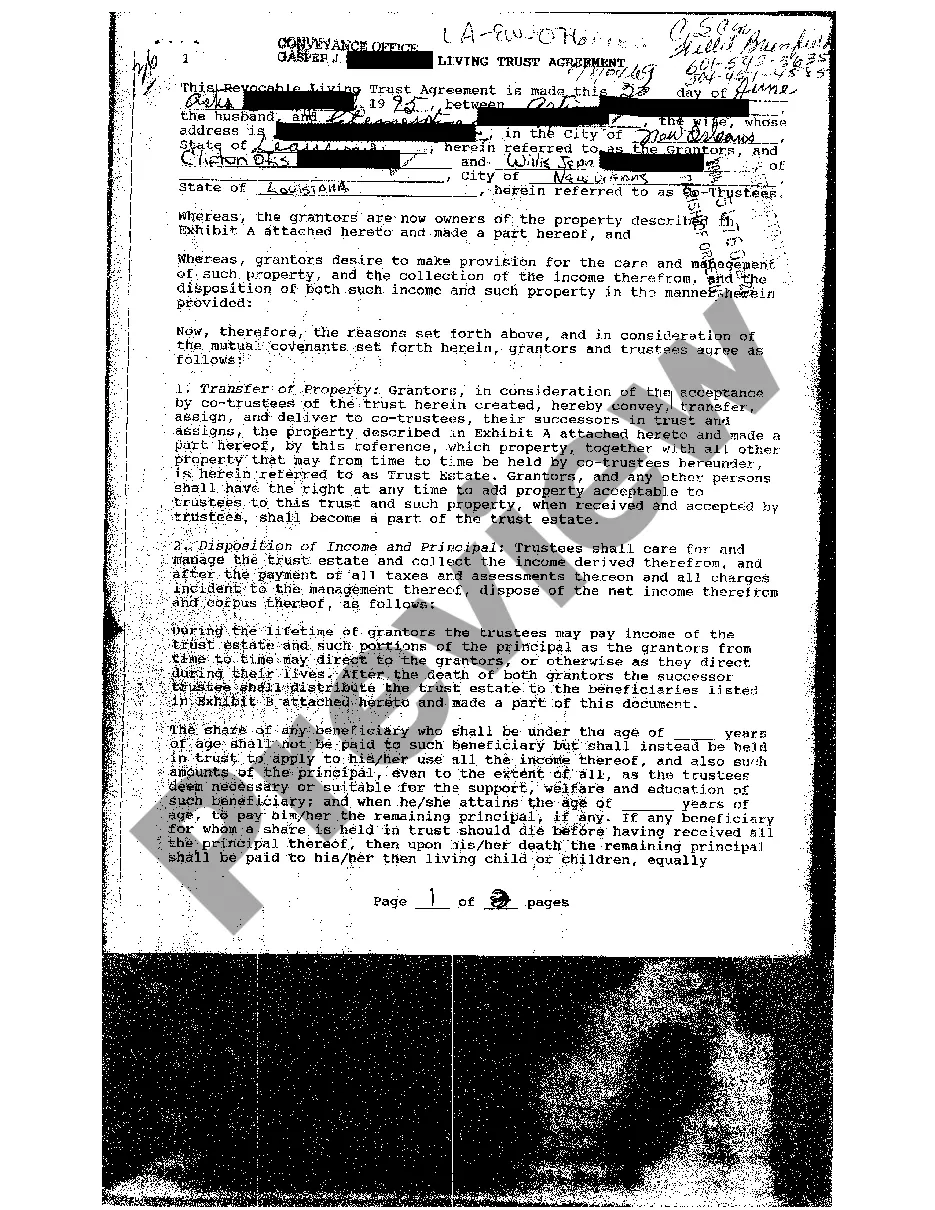

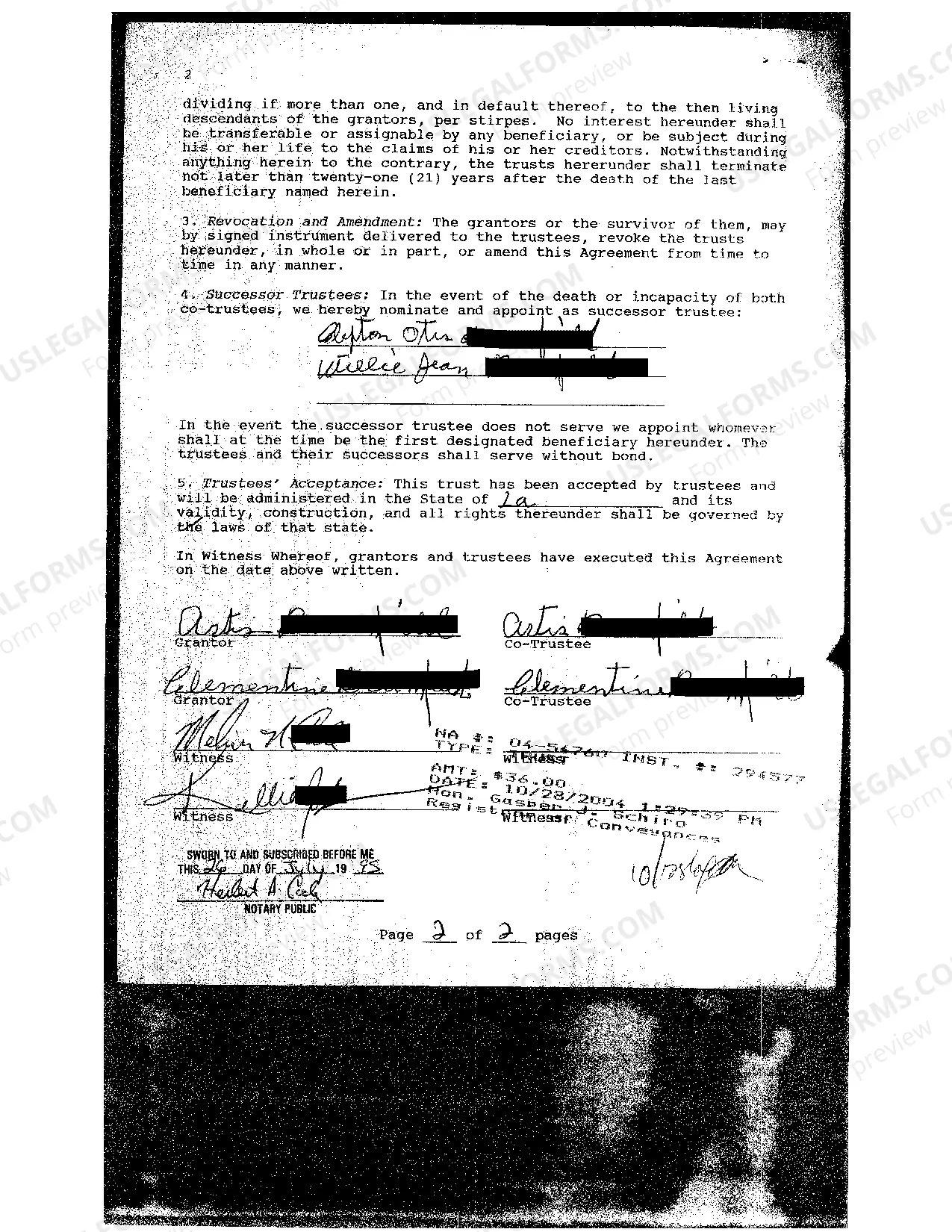

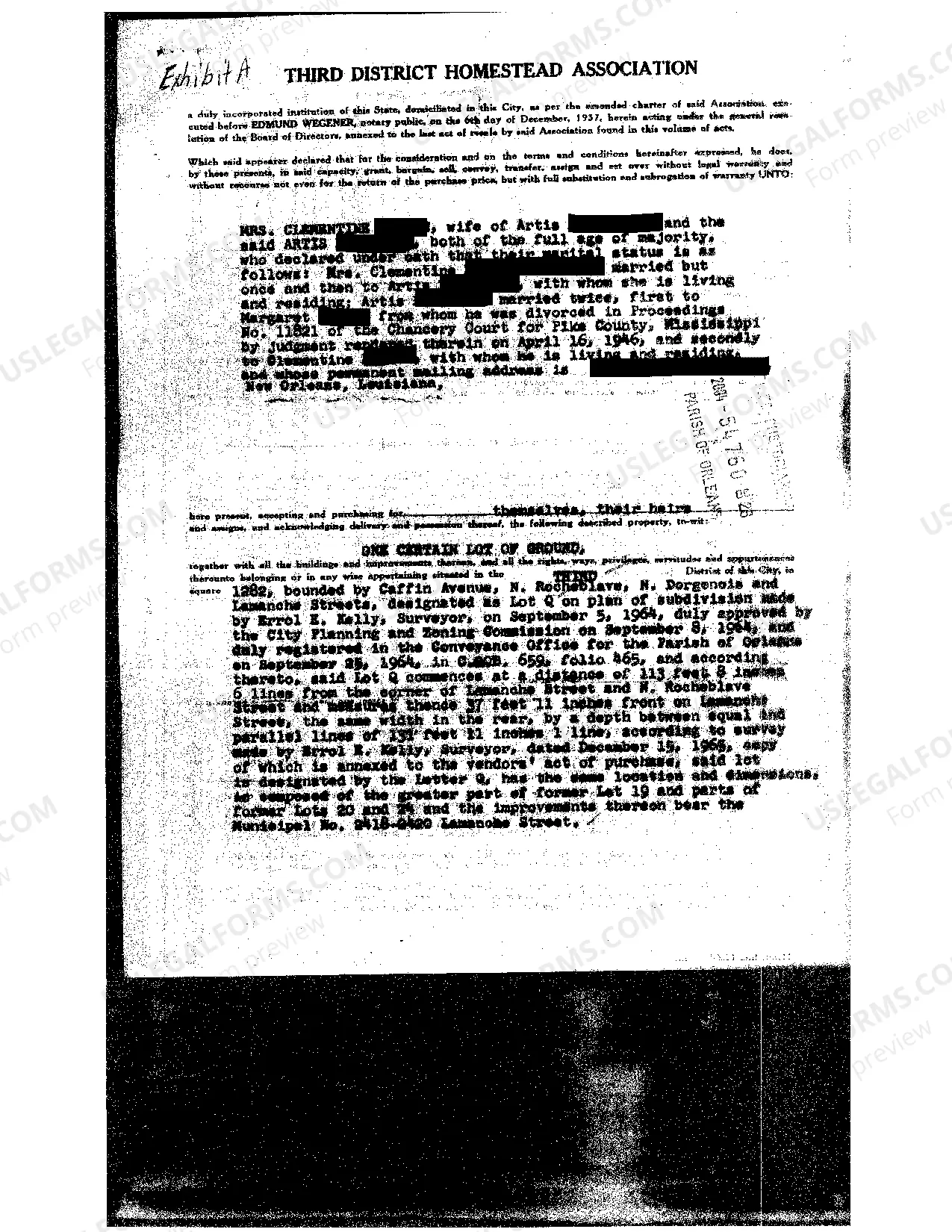

A living trust agreement, commonly known as a revocable living trust, is a legal document that enables individuals in New Orleans, Louisiana, to manage and distribute their assets during their lifetime and also after their demise. It serves as an efficient tool to avoid probate, ensuring a smooth and private asset transfer process while minimizing estate taxes and legal complexities. The New Orleans Louisiana Living Trust Agreement is tailored specifically to adhere to the state's laws and regulations. It provides individuals with greater control over their assets and allows them to designate beneficiaries, trustees, and instructions for managing their assets in the event of incapacitation or death. Some common types of living trust agreements include: 1. Revocable Living Trust: This is the most prevalent type of living trust agreement in New Orleans, Louisiana. It allows the trust creator or granter to retain control over their assets, make changes, and revoke or amend the trust as desired throughout their lifetime. It also enables a seamless transfer of assets to beneficiaries upon the granter's passing. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot typically be altered or revoked once it has been established. By transferring assets into this trust, the granter relinquishes control over them. Though this type of trust offers limited flexibility, it provides additional benefits like asset protection, estate tax reduction, and Medicaid planning. 3. Testamentary Trust: Unlike revocable and irrevocable living trusts, a testamentary trust is not established during the granter's lifetime but rather outlined within their last will and testament. It becomes effective only after the granter's demise. Testamentary trusts are useful for those who wish to address specific concerns such as providing for minor children, individuals with special needs, or to distribute assets gradually over time. 4. Charitable Remainder Trust: This type of living trust agreement allows individuals to donate assets to a charitable organization while retaining an income stream for themselves or their beneficiaries during their lifetime. It offers potential tax benefits and is often used as a means of contributing to a cause or charity while still deriving income from the contributed assets. In summary, the New Orleans Louisiana Living Trust Agreement is a legal instrument enabling residents of New Orleans to control, manage, and distribute their assets efficiently. Whether through a revocable, irrevocable, testamentary, or charitable remainder trust, individuals have the flexibility to customize their estate planning according to their specific needs and preferences. It is advisable to consult with an experienced estate planning attorney to establish a living trust agreement that aligns with one's goals and complies with Louisiana's legal requirements.

New Orleans Louisiana Living Trust Agreement

Description

How to fill out New Orleans Louisiana Living Trust Agreement?

Make use of the US Legal Forms and get instant access to any form you require. Our beneficial platform with a huge number of templates makes it simple to find and obtain almost any document sample you require. It is possible to export, complete, and sign the New Orleans Louisiana Living Trust Agreement in a couple of minutes instead of browsing the web for hours trying to find the right template.

Utilizing our catalog is an excellent way to raise the safety of your form submissions. Our experienced lawyers regularly review all the records to make certain that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you obtain the New Orleans Louisiana Living Trust Agreement? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you view. Additionally, you can find all the earlier saved files in the My Forms menu.

If you haven’t registered an account yet, stick to the instructions below:

- Open the page with the form you require. Make sure that it is the template you were seeking: check its title and description, and use the Preview option when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the downloading procedure. Click Buy Now and select the pricing plan you like. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Export the document. Choose the format to obtain the New Orleans Louisiana Living Trust Agreement and change and complete, or sign it according to your requirements.

US Legal Forms is probably the most significant and reliable document libraries on the internet. Our company is always happy to help you in virtually any legal procedure, even if it is just downloading the New Orleans Louisiana Living Trust Agreement.

Feel free to take advantage of our service and make your document experience as straightforward as possible!