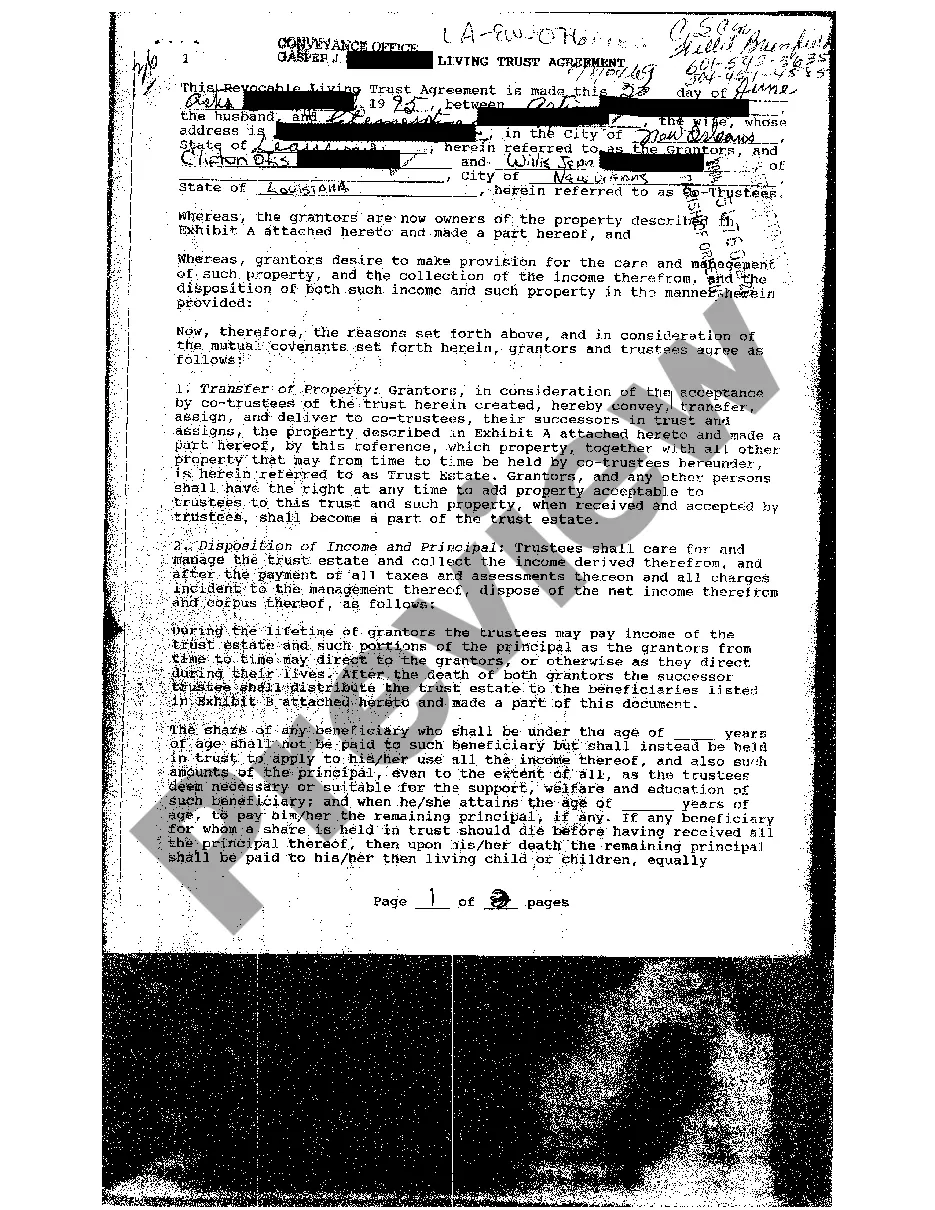

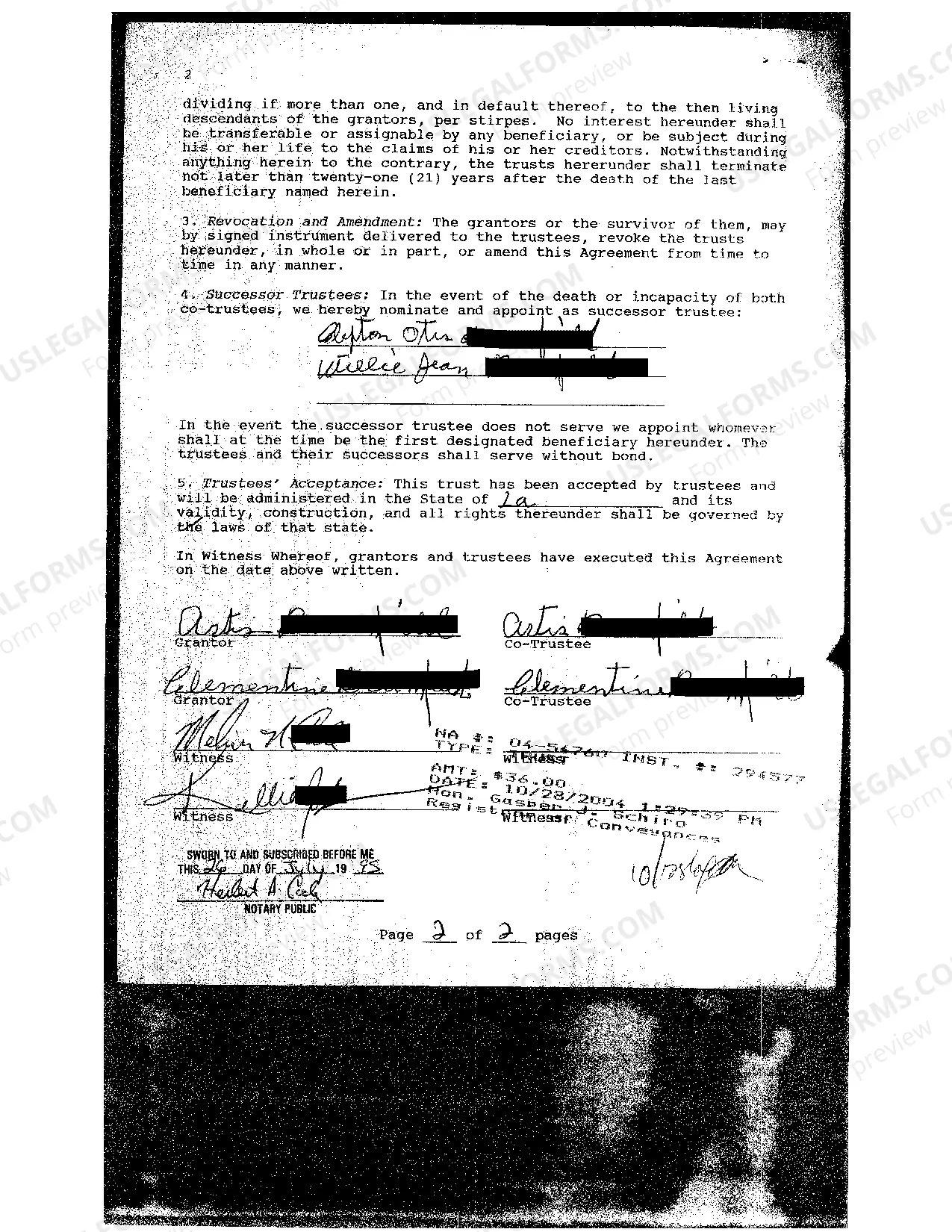

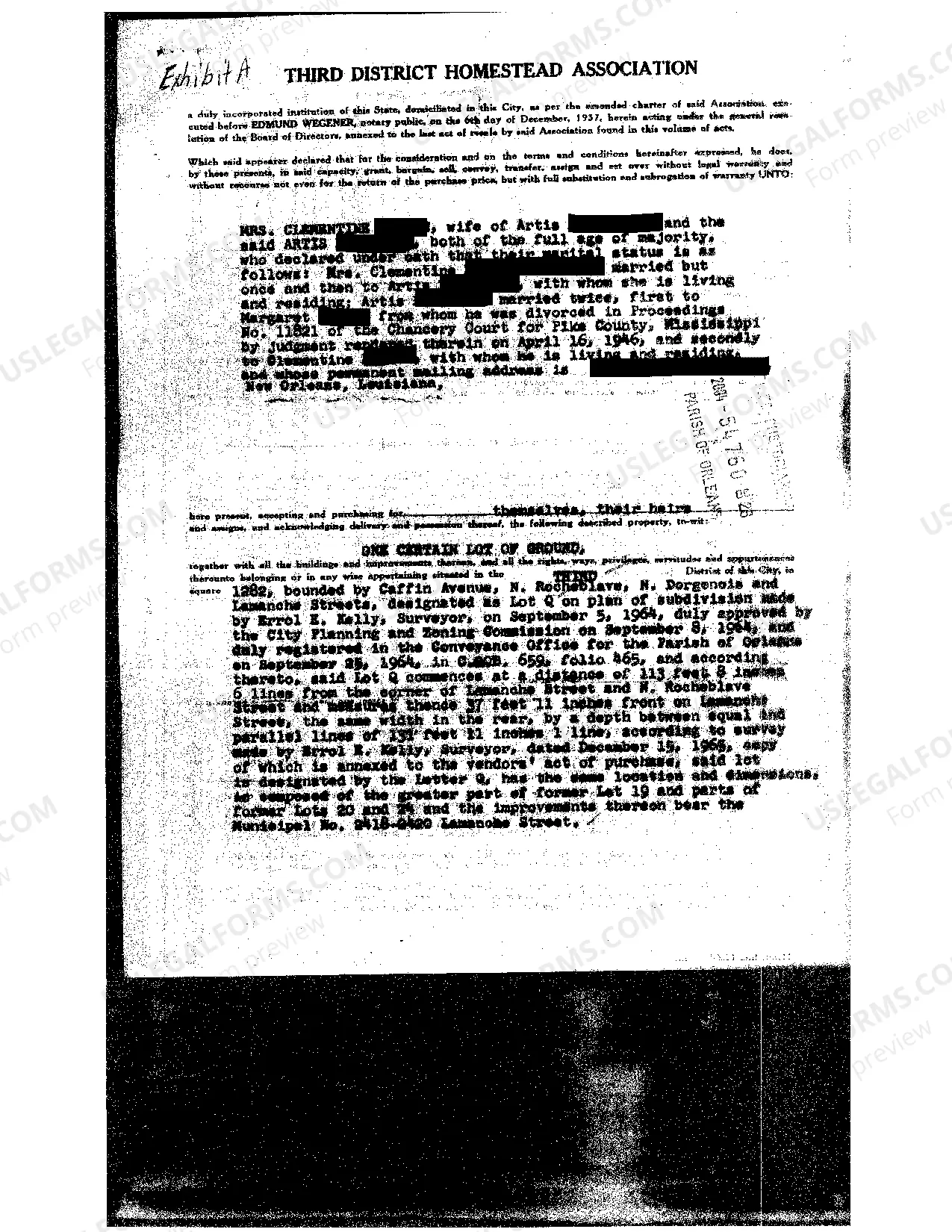

Shreveport Louisiana Living Trust Agreement, also known as a revocable living trust, is a legally binding document that allows individuals in Shreveport, Louisiana, to set up a trust to manage their assets during their lifetime and distribute them after their death. This agreement offers numerous benefits, including privacy, asset protection, flexibility, and the ability to avoid probate. The first type of Shreveport Louisiana Living Trust Agreement is the Revocable Living Trust. This trust can be altered, amended, or revoked by the granter at any time during their lifetime. It provides a mechanism for managing assets and allows the granter to retain control over their property while they are alive. Upon their death, the trust assets can be distributed to designated beneficiaries or held in further trust for their benefit. The second type is the Irrevocable Living Trust, which cannot be changed or terminated without the consent of the beneficiaries or a court order. This type of trust is often used for asset protection, estate tax planning, and Medicaid planning purposes. Another variation is the Special Needs Trust, designed to financially support individuals with disabilities while allowing them to retain eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). A Qualified Personnel Residence Trust (PRT) is another type of living trust that allows individuals to remove the value of their primary residence or vacation home from their taxable estate, potentially reducing estate taxes while retaining the right to live in the property. Family trusts, also known as dynasty trusts, are established to provide for multiple generations and protect family wealth from estate taxes, lawsuits, and creditors. These trusts can help maintain a legacy and ensure the smooth transfer of assets to future generations. Lastly, a Charitable Remainder Trust (CRT) is a living trust that enables individuals to receive an income stream from assets while supporting a chosen charitable organization. These trusts offer tax advantages and allow individuals to leave a lasting impact on causes close to their heart. In summary, a Shreveport Louisiana Living Trust Agreement is a versatile estate planning tool that provides individuals with control, privacy, and flexibility over their assets during their lifetime and ensures smooth asset distribution after their death. The different types of living trust agreements available cater to various needs such as asset protection, minimizing taxes, supporting charitable causes, and providing for future generations.

Shreveport Louisiana Living Trust Agreement

Description

How to fill out Shreveport Louisiana Living Trust Agreement?

Benefit from the US Legal Forms and obtain instant access to any form template you need. Our beneficial website with a large number of document templates makes it simple to find and get almost any document sample you need. You are able to export, complete, and sign the Shreveport Louisiana Living Trust Agreement in just a matter of minutes instead of browsing the web for many hours seeking the right template.

Utilizing our catalog is a great way to improve the safety of your form submissions. Our professional attorneys regularly check all the documents to ensure that the forms are relevant for a particular state and compliant with new acts and regulations.

How can you get the Shreveport Louisiana Living Trust Agreement? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. Furthermore, you can get all the previously saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Open the page with the form you require. Make sure that it is the form you were looking for: verify its name and description, and utilize the Preview feature if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the saving process. Select Buy Now and select the pricing plan you like. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Download the document. Indicate the format to get the Shreveport Louisiana Living Trust Agreement and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and reliable template libraries on the internet. Our company is always happy to assist you in virtually any legal procedure, even if it is just downloading the Shreveport Louisiana Living Trust Agreement.

Feel free to benefit from our platform and make your document experience as efficient as possible!