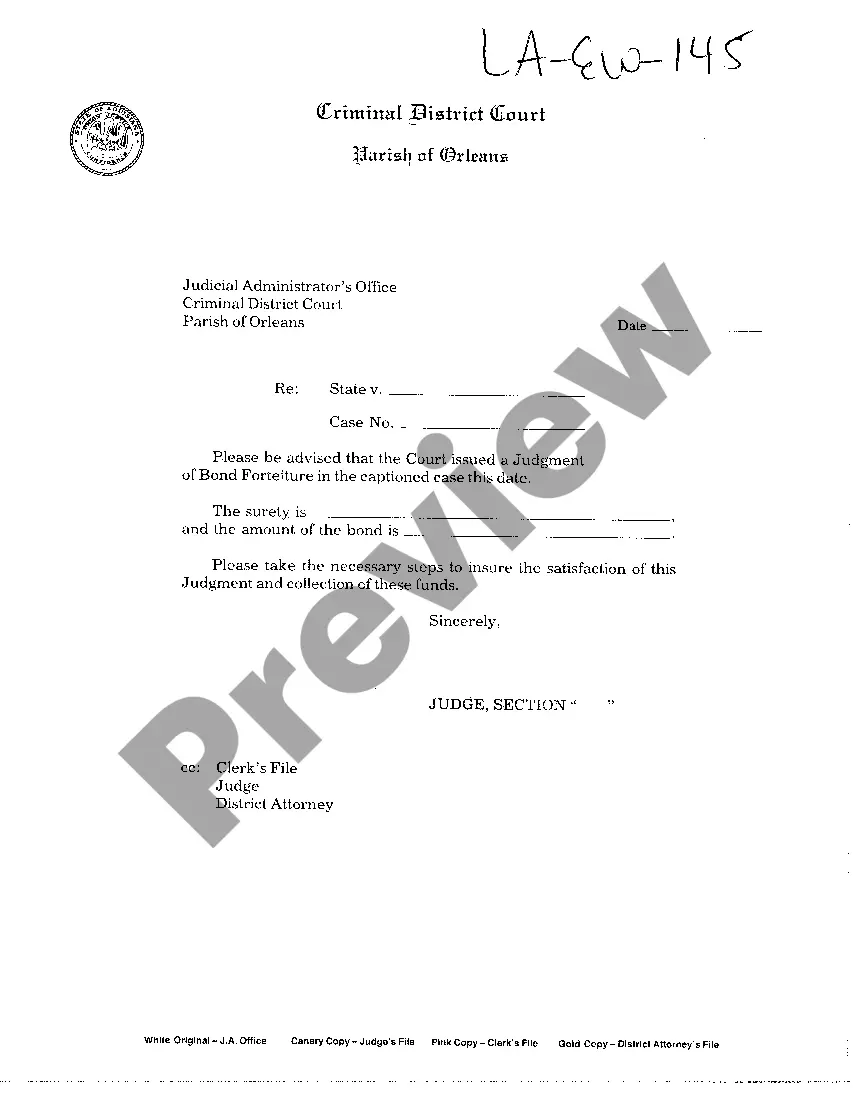

In Baton Rouge, Louisiana, a surety bond called the "Judgment of Bond Forfeiture Issued" plays a crucial role in various legal and financial matters. This type of surety bond is designed to ensure that individuals or businesses fulfill their legal obligations and financial responsibilities as required by law. By understanding the key aspects of this bond, one can navigate the legal landscape with confidence. The Baton Rouge Louisiana Surety Bond — Judgment of Bond Forfeiture Issued provides a guarantee that an individual or business will meet their obligations in a specific legal situation. This bond is typically required when a person has been released from custody on bail, pending a court hearing or trial. In such cases, the bond serves as a promise to the court that the defendant will appear for their scheduled court dates. If the defendant fails to appear as promised or violates any conditions set by the court, the bond can be declared forfeit. A "Judgment of Bond Forfeiture" is then issued, and the surety bond company becomes responsible for paying the bond amount to the court. This ensures that the court is not left uncompensated in the event of non-compliance. It is important to note that there are different types of Baton Rouge Louisiana Surety Bond — Judgment of Bond Forfeiture Issued, each tailored to specific legal situations. Some common types of surety bonds include bail bonds, performance bonds, fidelity bonds, and construction bonds. — Bail Bonds: These bonds are typically used in criminal cases and are designed to secure the release of a defendant from custody while awaiting trial. — Performance Bonds: These bonds are often required in construction projects to ensure that contractors complete the work as agreed upon in the contract. — Fidelity Bonds: These bonds are used by employers to protect against employee theft or dishonest acts that could result in financial loss. — Construction Bonds: These bonds are specific to construction projects and provide assurance to project owners that contractors will fulfill their contractual obligations, including payment to subcontractors and suppliers. In Baton Rouge, obtaining a surety bond often requires working with a reputable surety bond company or agent. This professional will assess the applicant's financial and legal situation to determine their eligibility and the appropriate bond amount. If approved, the surety bond is issued, and the applicant can move forward with their legal matters while fulfilling their obligations. Overall, the Baton Rouge Louisiana Surety Bond — Judgment of Bond Forfeiture Issued is an integral component of the legal system, providing both financial security and accountability. By leveraging this type of bond, individuals and businesses can navigate legal processes confidently, knowing that they have taken the necessary steps to meet their obligations and protect their interests.

Baton Rouge Louisiana Surety Bond - Judgment of Bond Forfeiture Issued

State:

Louisiana

City:

Baton Rouge

Control #:

LA-EW-145

Format:

PDF

Instant download

This form is available by subscription

Description

Surety Bond - Judgment of Bond Forfeiture Issued

In Baton Rouge, Louisiana, a surety bond called the "Judgment of Bond Forfeiture Issued" plays a crucial role in various legal and financial matters. This type of surety bond is designed to ensure that individuals or businesses fulfill their legal obligations and financial responsibilities as required by law. By understanding the key aspects of this bond, one can navigate the legal landscape with confidence. The Baton Rouge Louisiana Surety Bond — Judgment of Bond Forfeiture Issued provides a guarantee that an individual or business will meet their obligations in a specific legal situation. This bond is typically required when a person has been released from custody on bail, pending a court hearing or trial. In such cases, the bond serves as a promise to the court that the defendant will appear for their scheduled court dates. If the defendant fails to appear as promised or violates any conditions set by the court, the bond can be declared forfeit. A "Judgment of Bond Forfeiture" is then issued, and the surety bond company becomes responsible for paying the bond amount to the court. This ensures that the court is not left uncompensated in the event of non-compliance. It is important to note that there are different types of Baton Rouge Louisiana Surety Bond — Judgment of Bond Forfeiture Issued, each tailored to specific legal situations. Some common types of surety bonds include bail bonds, performance bonds, fidelity bonds, and construction bonds. — Bail Bonds: These bonds are typically used in criminal cases and are designed to secure the release of a defendant from custody while awaiting trial. — Performance Bonds: These bonds are often required in construction projects to ensure that contractors complete the work as agreed upon in the contract. — Fidelity Bonds: These bonds are used by employers to protect against employee theft or dishonest acts that could result in financial loss. — Construction Bonds: These bonds are specific to construction projects and provide assurance to project owners that contractors will fulfill their contractual obligations, including payment to subcontractors and suppliers. In Baton Rouge, obtaining a surety bond often requires working with a reputable surety bond company or agent. This professional will assess the applicant's financial and legal situation to determine their eligibility and the appropriate bond amount. If approved, the surety bond is issued, and the applicant can move forward with their legal matters while fulfilling their obligations. Overall, the Baton Rouge Louisiana Surety Bond — Judgment of Bond Forfeiture Issued is an integral component of the legal system, providing both financial security and accountability. By leveraging this type of bond, individuals and businesses can navigate legal processes confidently, knowing that they have taken the necessary steps to meet their obligations and protect their interests.

How to fill out Baton Rouge Louisiana Surety Bond - Judgment Of Bond Forfeiture Issued?

If you’ve already used our service before, log in to your account and download the Baton Rouge Louisiana Surety Bond - Judgment of Bond Forfeiture Issued on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Baton Rouge Louisiana Surety Bond - Judgment of Bond Forfeiture Issued. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!