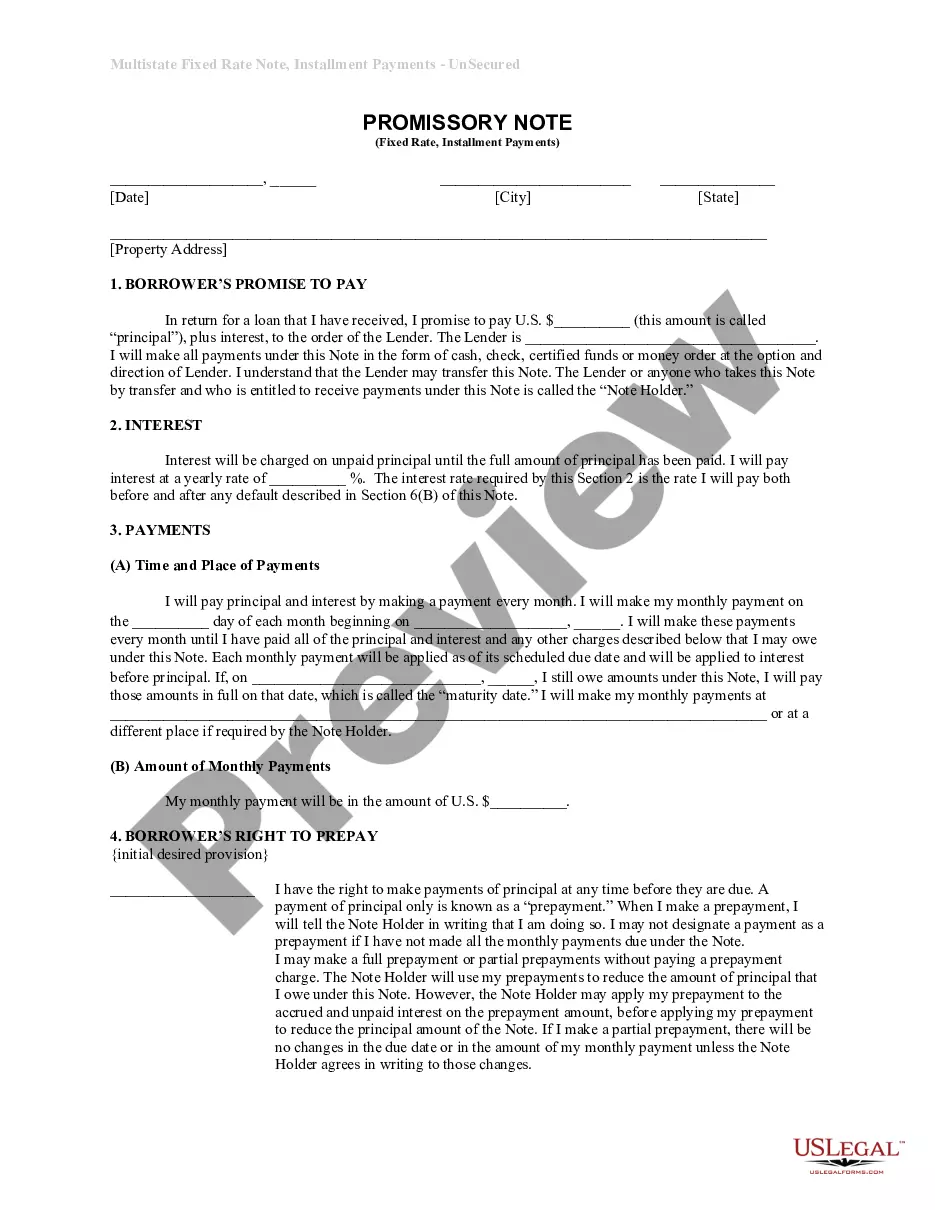

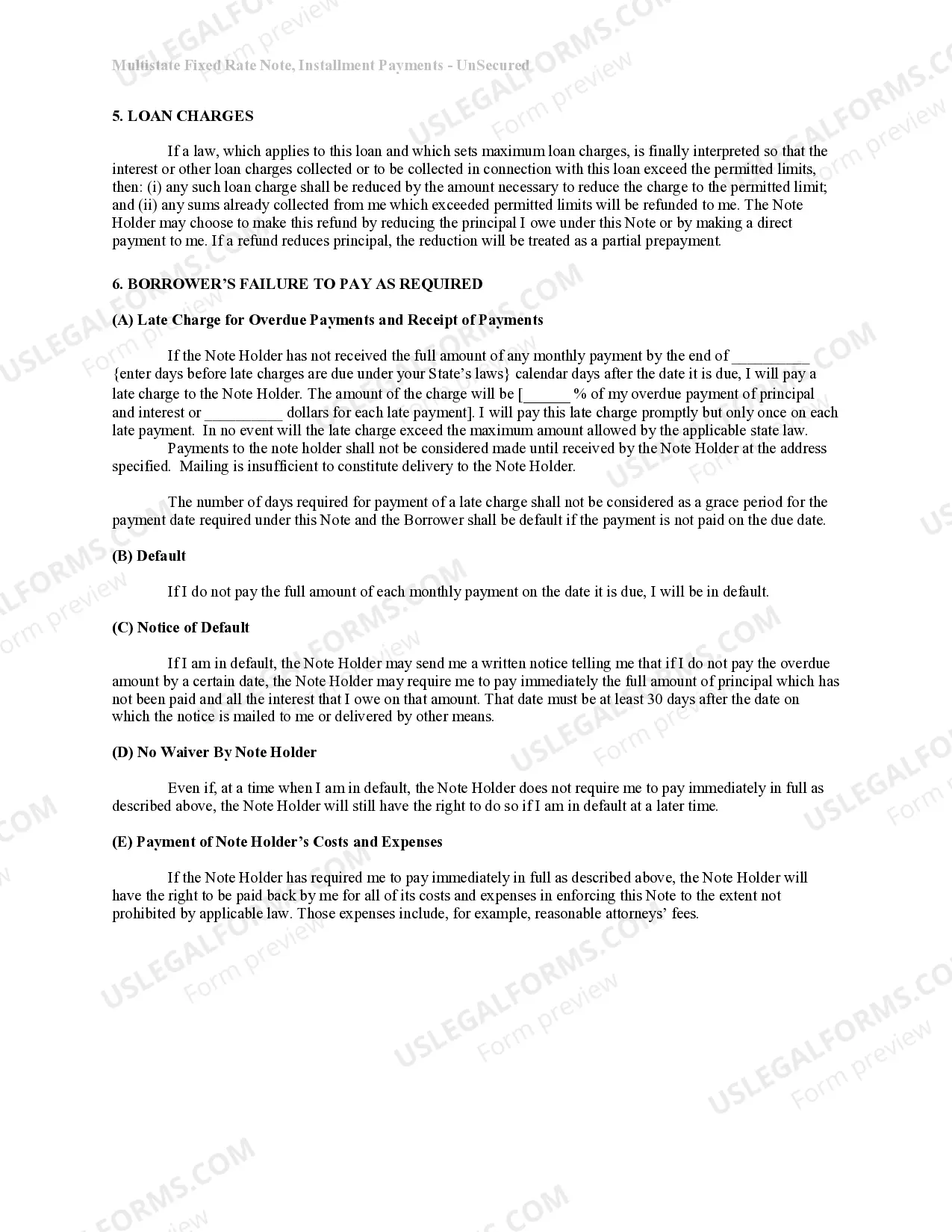

A Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines an agreement between a lender and a borrower. This promissory note serves as evidence of a loan transaction in which the borrower promises to repay the borrowed funds within a specific timeframe, in equal installments, at a fixed interest rate. The Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate is designed to protect the rights and obligations of both parties involved. It clearly states the loan amount, the repayment schedule, the interest rate, and any fees or penalties that may apply. This document is often used for personal loans, business loans, and various financial arrangements in Shreveport, Louisiana. One important aspect of this promissory note is that it is unsecured, meaning it does not require any form of collateral to secure the loan. This means that the borrower is not required to pledge any assets as collateral; instead, their promise to repay the loan serves as the sole guarantee. Within the category of Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate, different variations may exist. Some common types include: 1. Shreveport Louisiana Unsecured Personal Installment Payment Promissory Note for Fixed Rate: This type of promissory note is used for personal loans between individuals. It outlines the terms and conditions of a personal loan agreement, ensuring both parties understand their rights and obligations. 2. Shreveport Louisiana Unsecured Business Installment Payment Promissory Note for Fixed Rate: This promissory note is specifically tailored for business loans made within Shreveport, Louisiana. It includes provisions that cater to the unique needs of businesses, such as repayment terms based on cash flow or business cycles. 3. Shreveport Louisiana Unsecured Student Loan Installment Payment Promissory Note for Fixed Rate: This promissory note is commonly used for educational loans in Shreveport. It outlines the terms and conditions of borrowing funds for educational purposes, such as tuition fees, books, and living expenses, and stipulates the repayment schedule after the borrowing party completes their education. 4. Shreveport Louisiana Unsecured Medical Loan Installment Payment Promissory Note for Fixed Rate: This promissory note is specific to medical expenses. It defines the terms and conditions of borrowing funds for medical treatments, surgeries, or other healthcare-related expenses, ensuring a clear understanding between the lender and the borrower. In conclusion, a Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document used to establish a loan agreement between a lender and a borrower, where repayment occurs in scheduled installments at a fixed interest rate. This document safeguards the rights and responsibilities of both parties and can come in various forms to accommodate different loan purposes.

Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out Shreveport Louisiana Unsecured Installment Payment Promissory Note For Fixed Rate?

If you are looking for a relevant form template, it’s difficult to choose a better platform than the US Legal Forms site – one of the most extensive libraries on the web. Here you can get a large number of templates for company and personal purposes by categories and states, or key phrases. Using our advanced search feature, getting the most recent Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate is as elementary as 1-2-3. Additionally, the relevance of each and every record is verified by a group of expert attorneys that regularly check the templates on our website and update them according to the most recent state and county requirements.

If you already know about our platform and have a registered account, all you need to receive the Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate is to log in to your user profile and click the Download option.

If you use US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the form you need. Read its explanation and use the Preview function to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to find the needed file.

- Affirm your choice. Select the Buy now option. Following that, select your preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your bank card or PayPal account to finish the registration procedure.

- Receive the form. Select the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the acquired Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate.

Each form you save in your user profile does not have an expiry date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to have an extra duplicate for enhancing or creating a hard copy, you may return and save it again whenever you want.

Make use of the US Legal Forms professional library to gain access to the Shreveport Louisiana Unsecured Installment Payment Promissory Note for Fixed Rate you were looking for and a large number of other professional and state-specific templates on one platform!