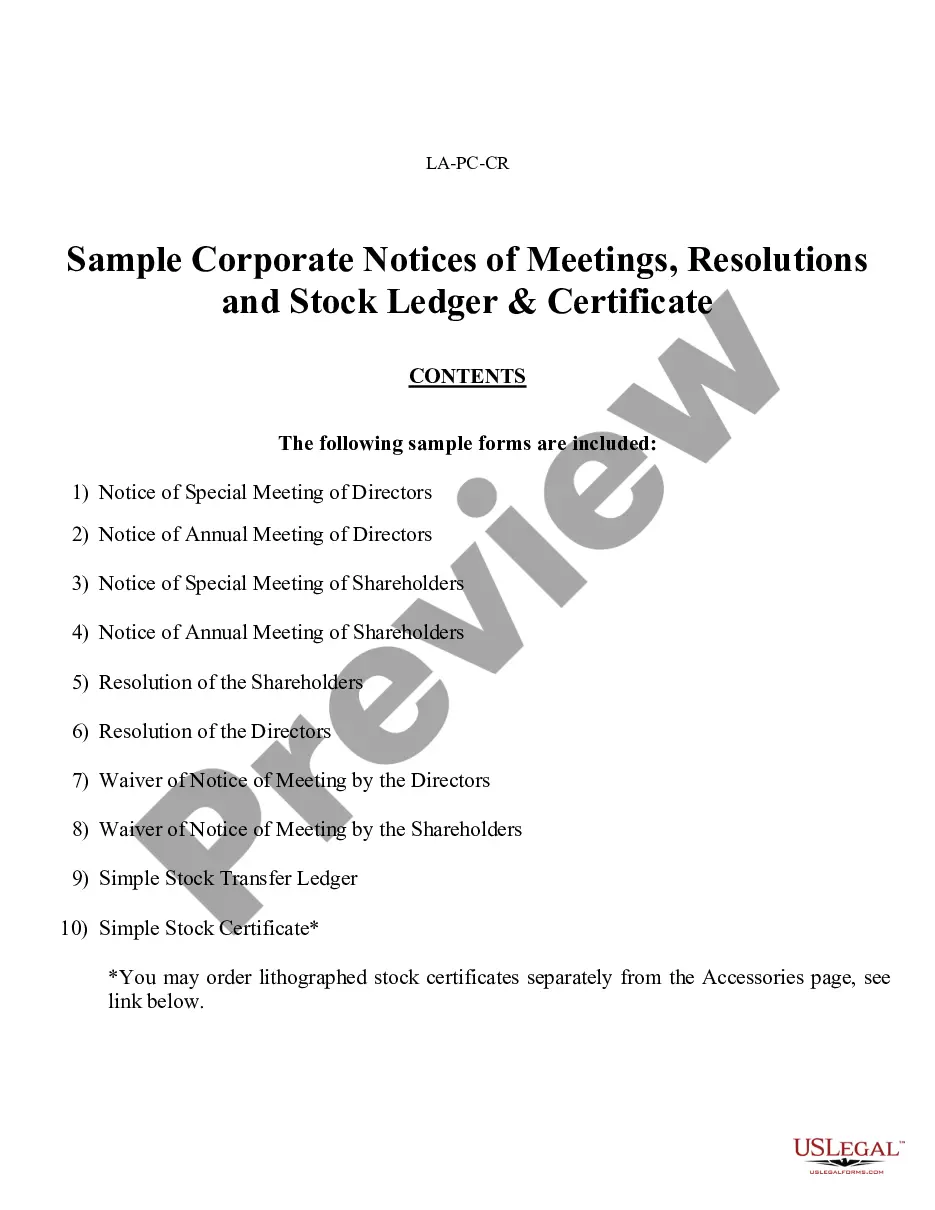

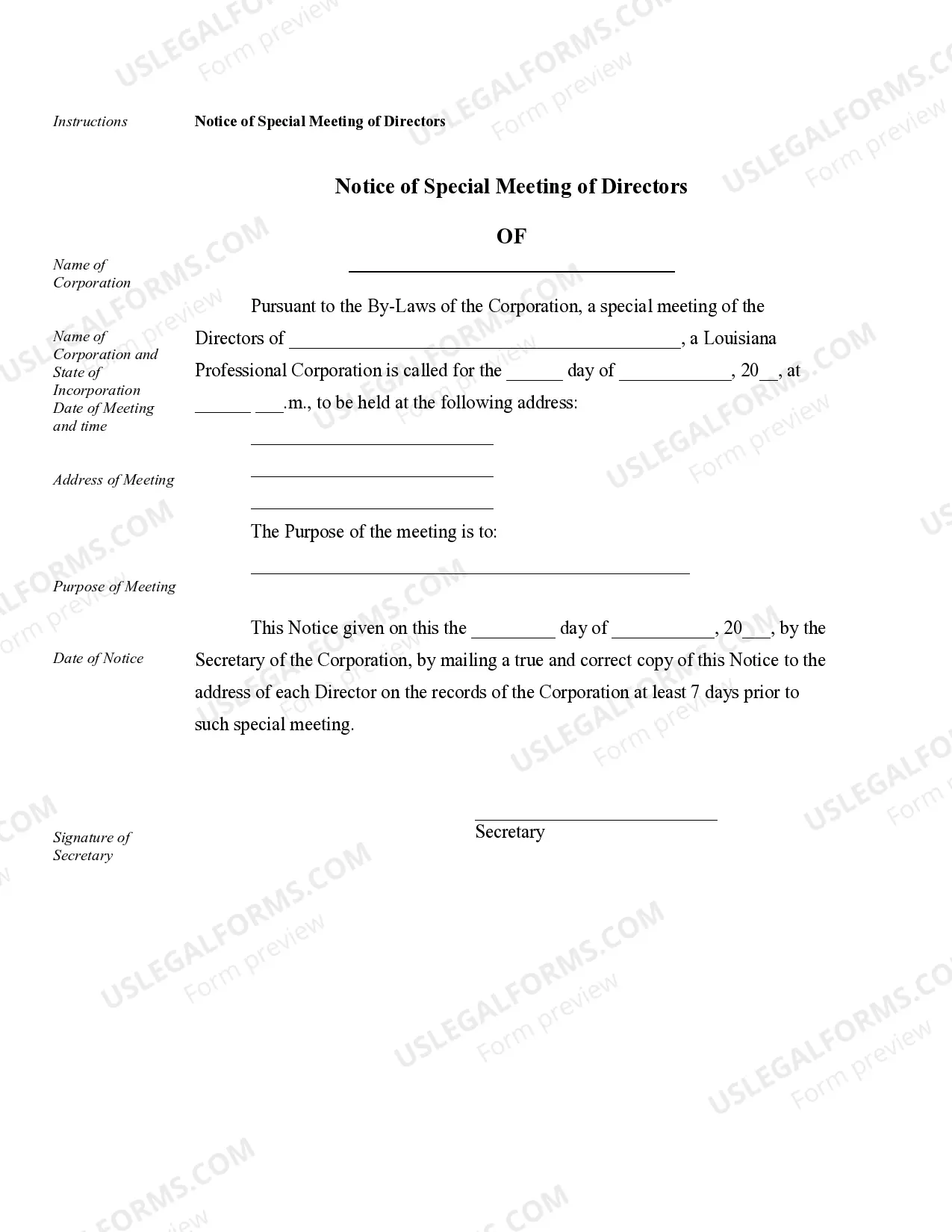

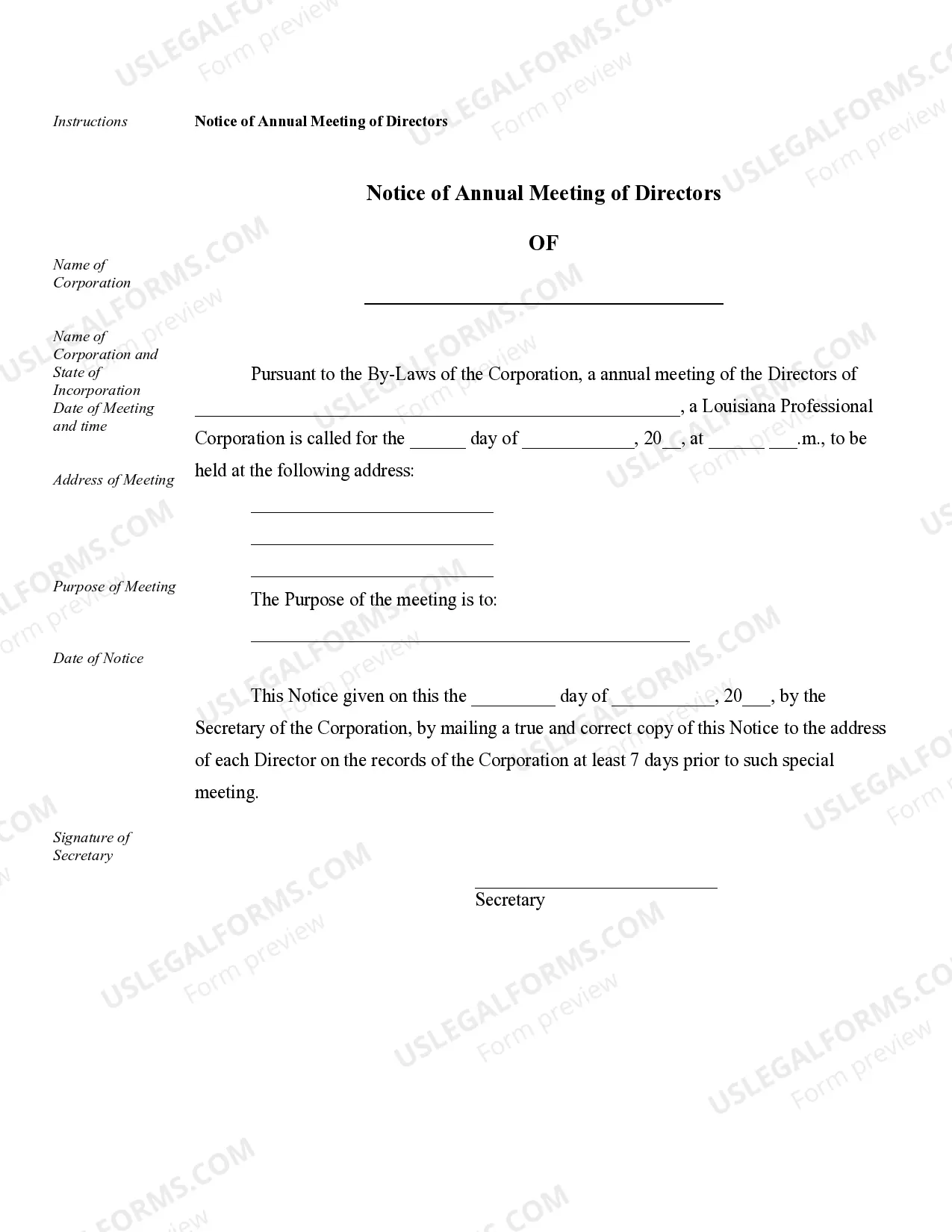

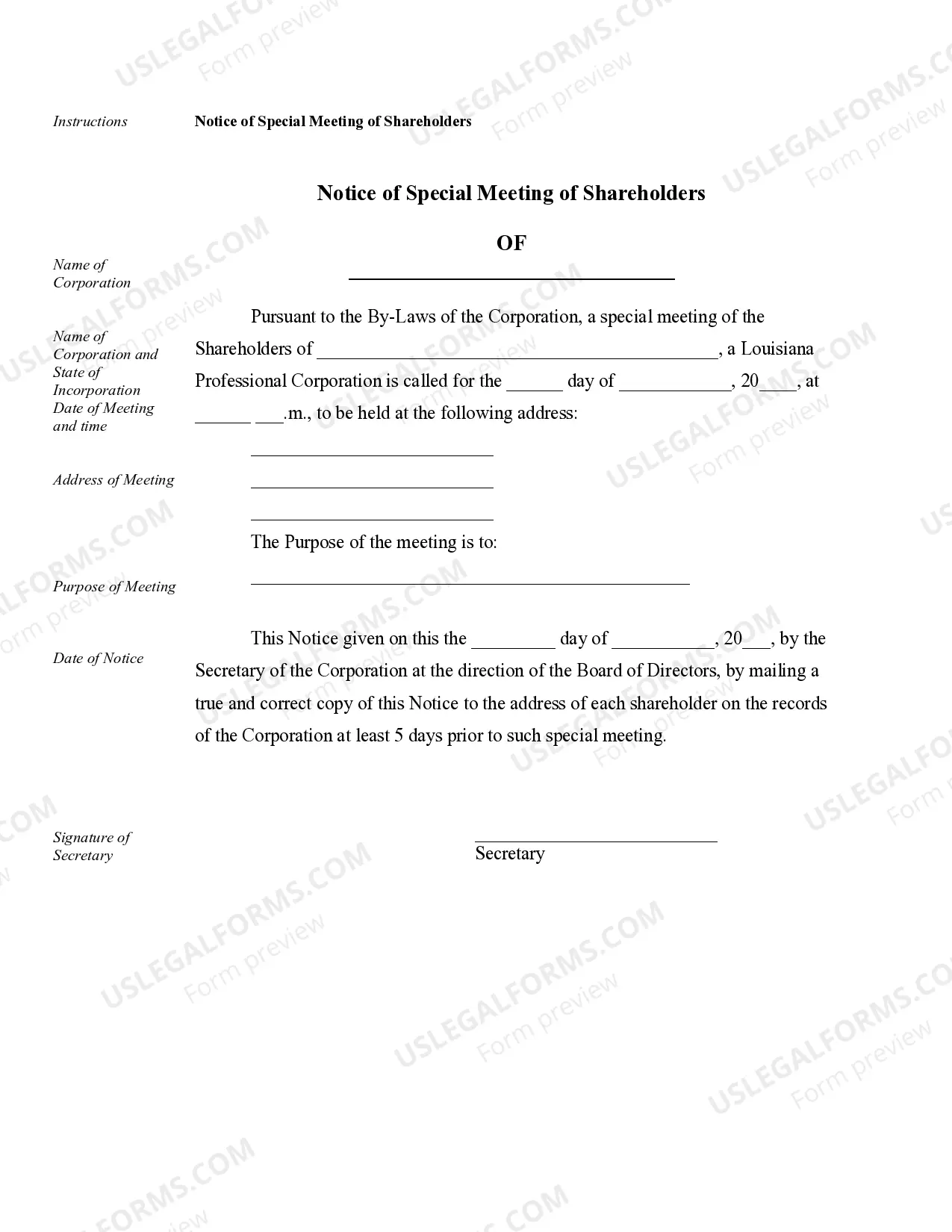

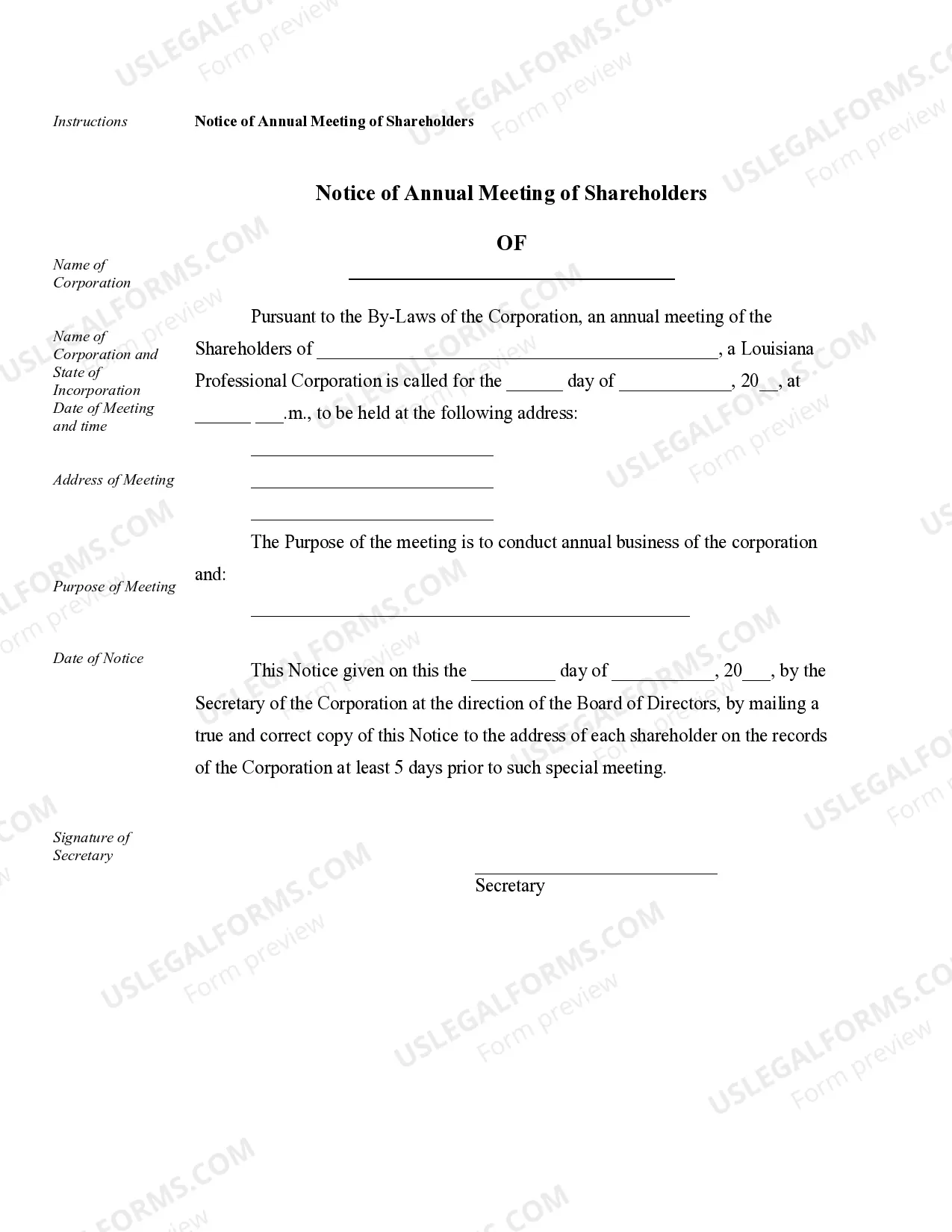

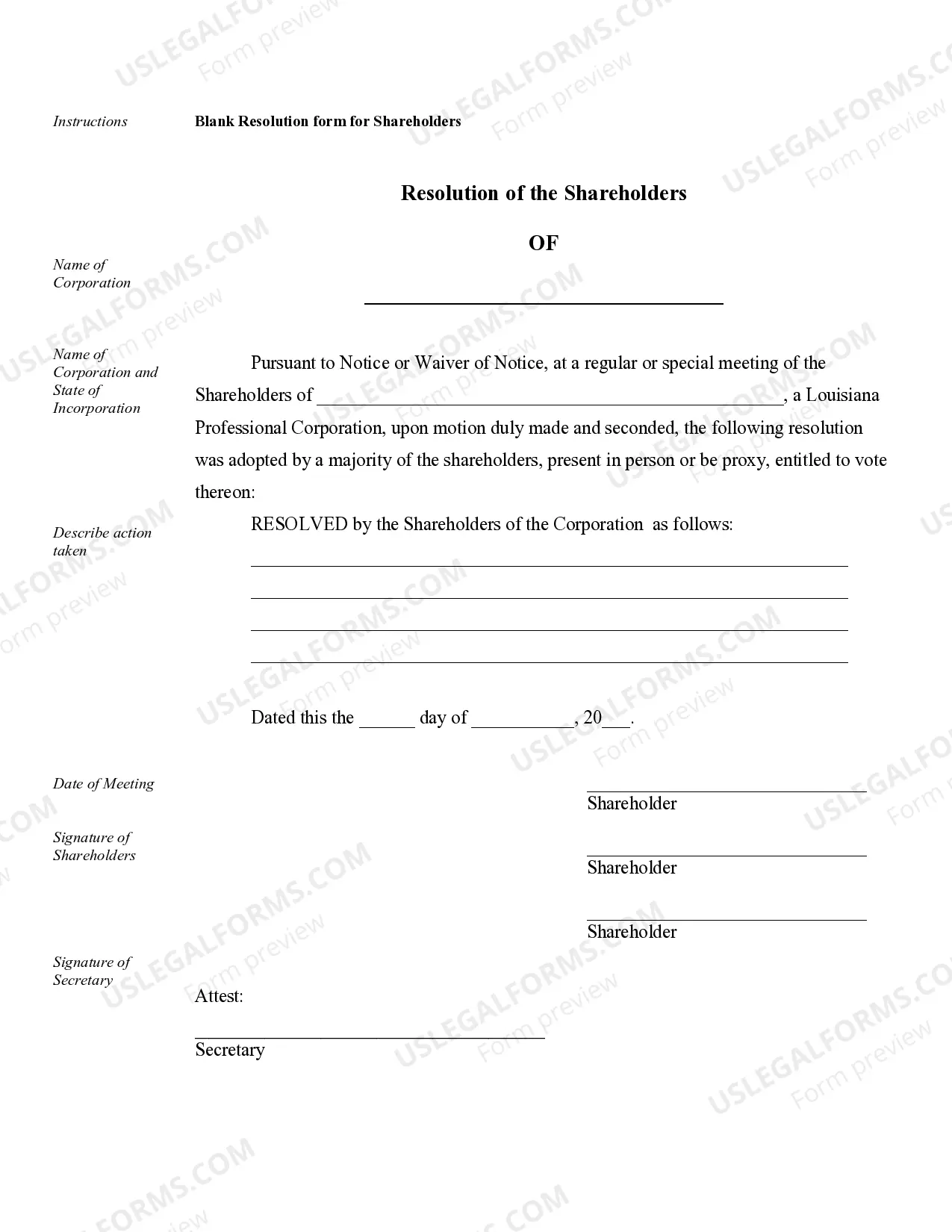

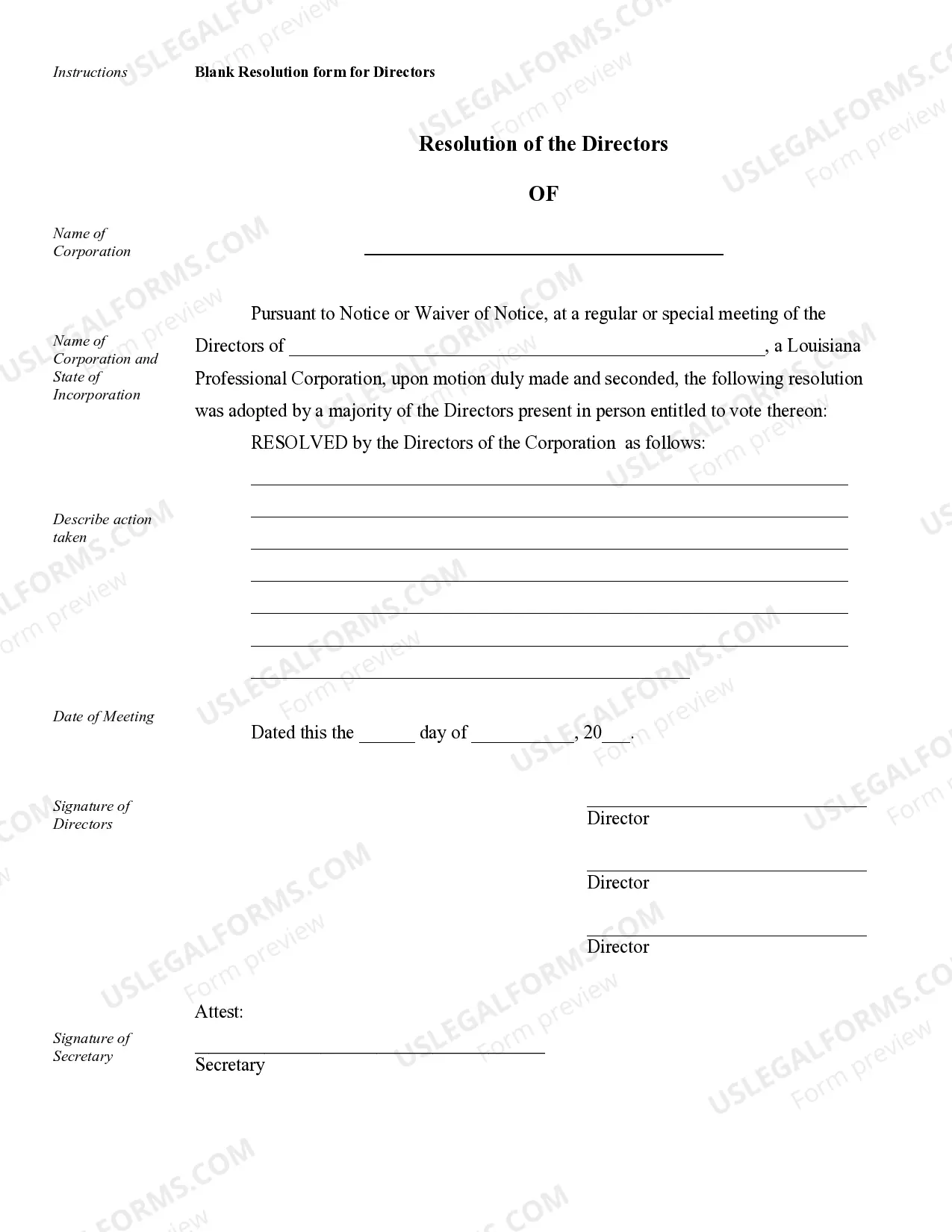

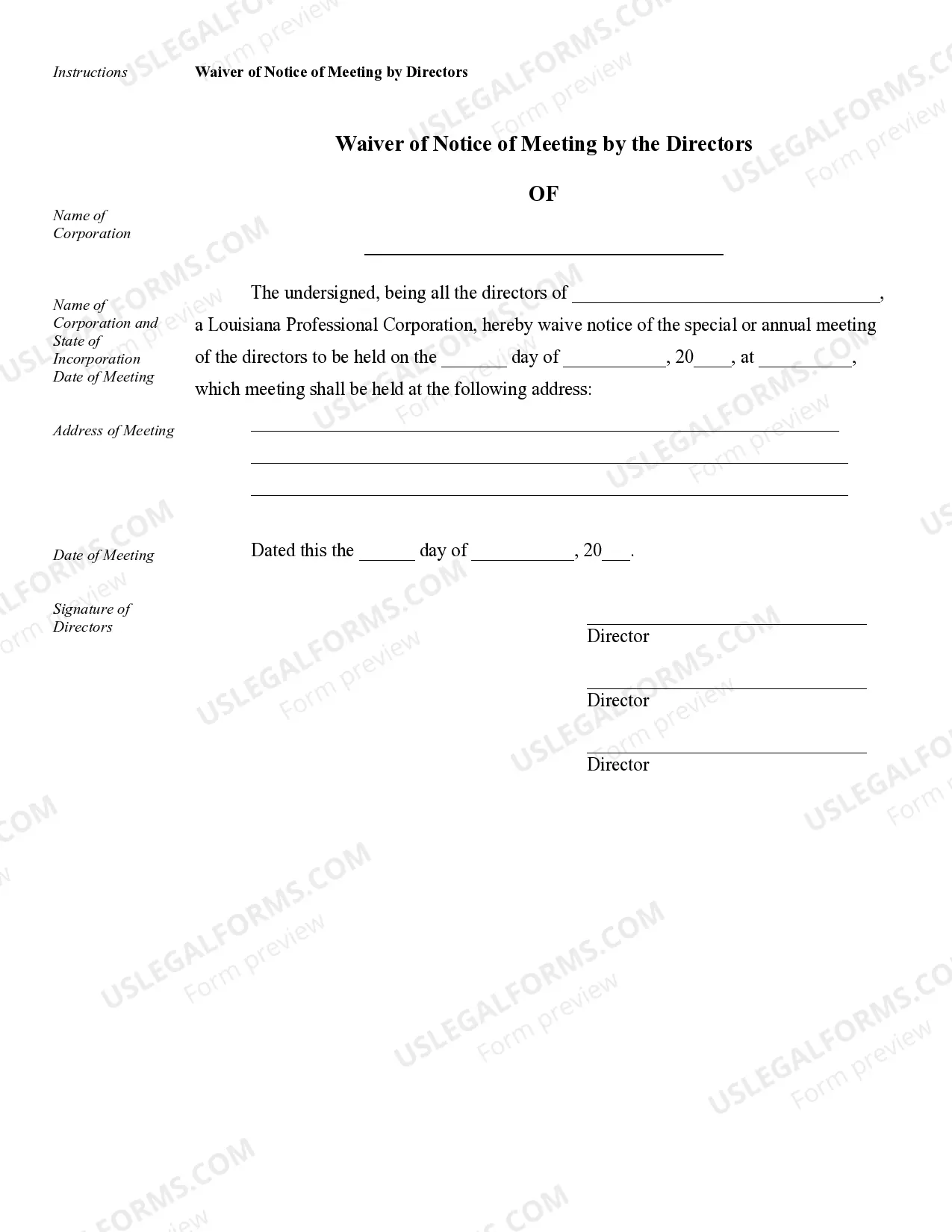

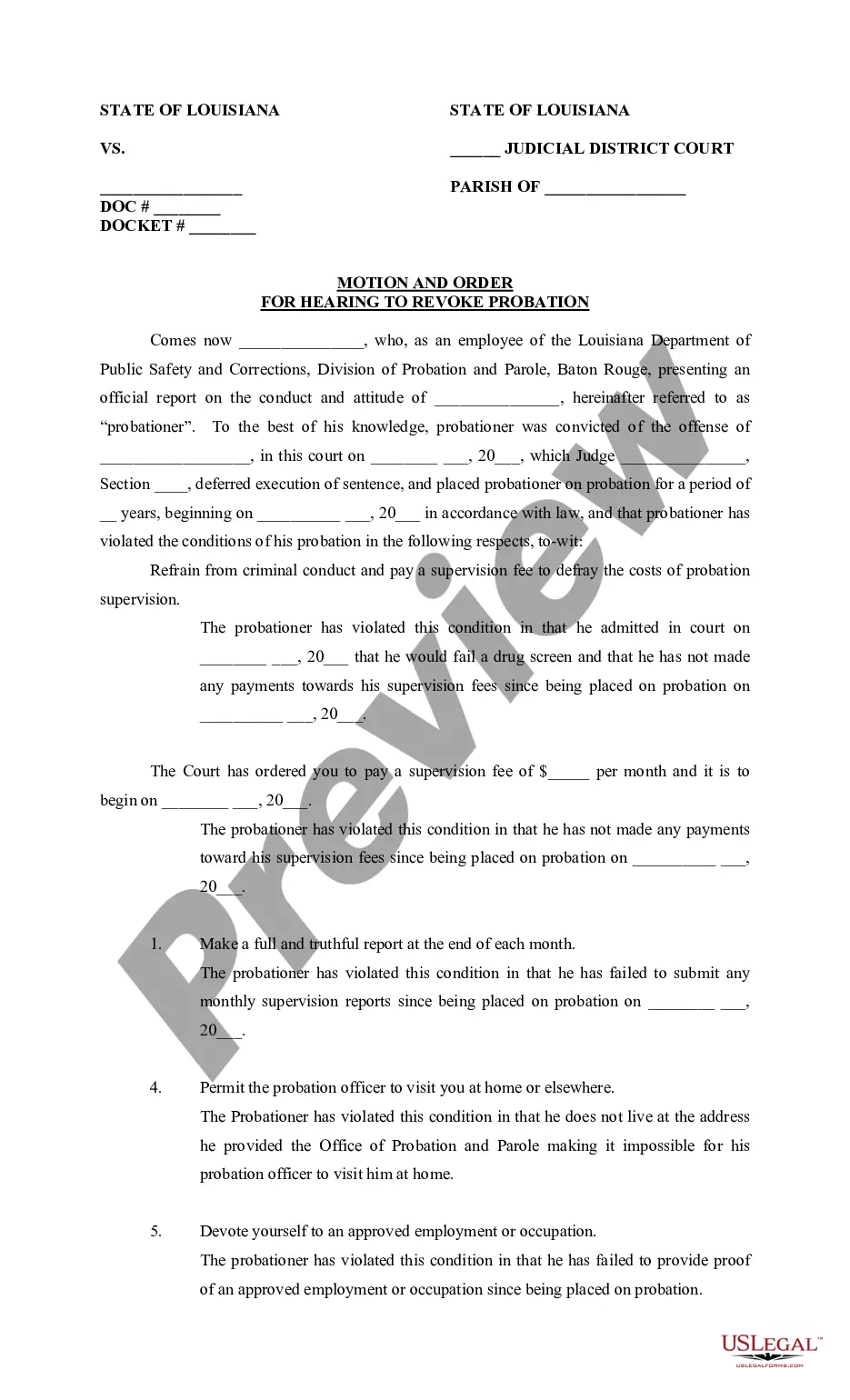

Baton Rouge Sample Corporate Records for a Louisiana Professional Corporation are comprehensive and necessary documents that help maintain a business's legal and financial operations. These records serve as evidence of the corporation's compliance with state regulations and provide valuable information for internal and external stakeholders. They are maintained and updated regularly to ensure transparency, accountability, and proper functioning of the professional corporation. Some essential Baton Rouge Sample Corporate Records for a Louisiana Professional Corporation include: 1. Articles of Incorporation: These are the foundational documents that establish the professional corporation as a legal entity in Louisiana. They contain crucial details such as the corporation's name, registered address, purpose, duration, and the names and addresses of initial shareholders. 2. Bylaws: A set of rules and regulations that govern the internal affairs of a professional corporation. Baton Rouge Sample Corporate Records would include a well-drafted set of bylaws tailored to the corporation's specific needs. Bylaws typically cover matters such as company structure, officer qualifications, meeting protocols, and shareholder rights. 3. Shareholder Resolutions: These records document decisions made by the shareholders of the professional corporation. Examples include resolutions to elect or remove directors, issue additional stock, approve major investments or acquisitions, or make changes to the bylaws. 4. Minutes of Board Meetings: Detailed records of proceedings and decisions made during board meetings. This includes discussions on corporate strategy, financial matters, appointment of officers, and other significant decisions that impact the corporation's operations. 5. Stock Ledger: An accurate and up-to-date record of all issued and outstanding shares, along with details such as the name of the shareholder, the number of shares held, the class of shares, and any transfers or issuance. 6. Financial Statements: Comprehensive financial records, including income statements, balance sheets, cash flow statements, and notes to the financial statements. These statements provide an overview of the corporation's financial health, performance, and compliance with accounting standards. 7. Annual Reports: Baton Rouge Sample Corporate Records include annual reports, which summarize the corporation's activities, financial performance, and achievements over the course of a year. These reports often include narratives, financial statements, and disclosures required by state and federal regulations. 8. Tax Records: Documentation related to the corporation's tax obligations, including federal and state tax returns, payroll tax filings, and any correspondence with tax authorities. 9. Employee Records: Records pertaining to the corporation's employees, such as contracts, job descriptions, personnel files, and information related to employee benefits, compensation plans, and performance evaluations. 10. Contracts and Agreements: Copies of all contracts and agreements entered into by the corporation, such as client contracts, vendor agreements, leases, and licensing agreements. These records help establish legal obligations and ensure compliance with contractual obligations. Baton Rouge Sample Corporate Records for a Louisiana Professional Corporation are crucial for maintaining transparency, compliance, and effective corporate governance. Their accuracy, accessibility, and completeness contribute to the proper functioning and success of the professional corporation in the dynamic business environment.

Baton Rouge Sample Corporate Records for a Louisiana Professional Corporation

Description

How to fill out Baton Rouge Sample Corporate Records For A Louisiana Professional Corporation?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, usually, are extremely costly. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Baton Rouge Sample Corporate Records for a Louisiana Professional Corporation or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re unfamiliar with the platform! You can register your account in a matter of minutes.

- Make sure to check if the Baton Rouge Sample Corporate Records for a Louisiana Professional Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Baton Rouge Sample Corporate Records for a Louisiana Professional Corporation is proper for your case, you can choose the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!