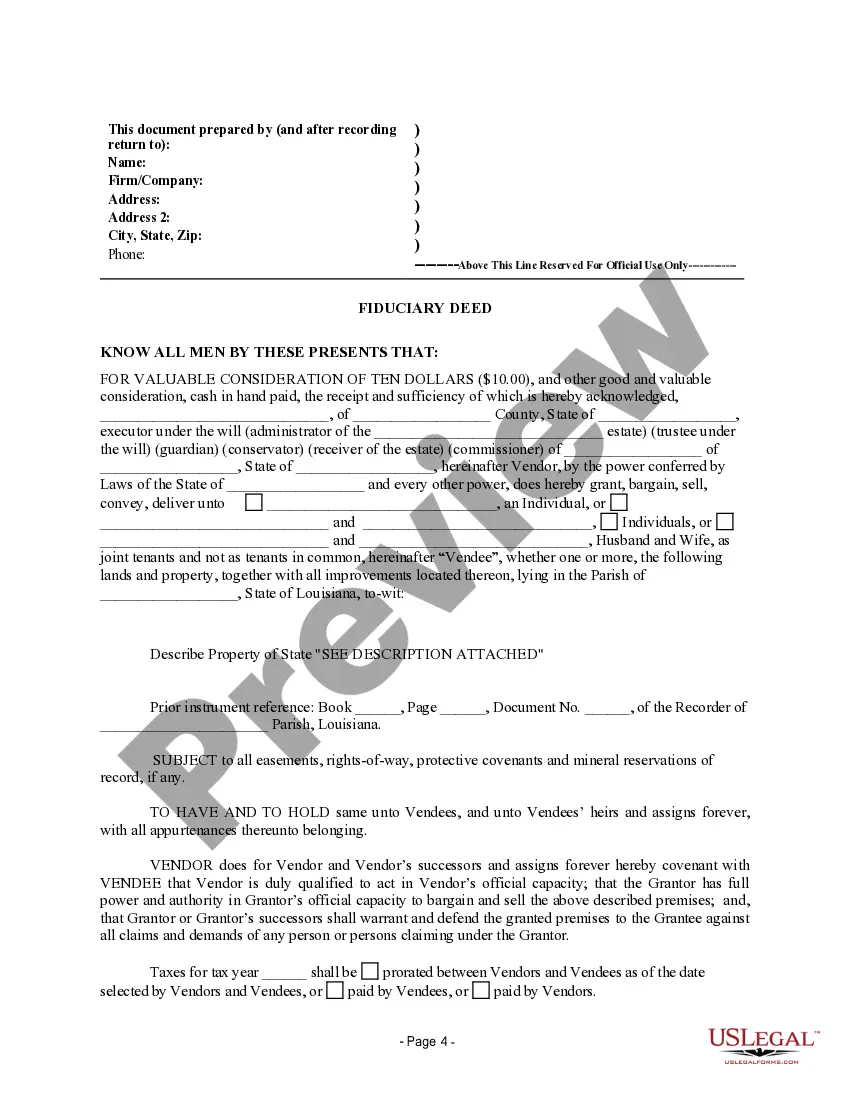

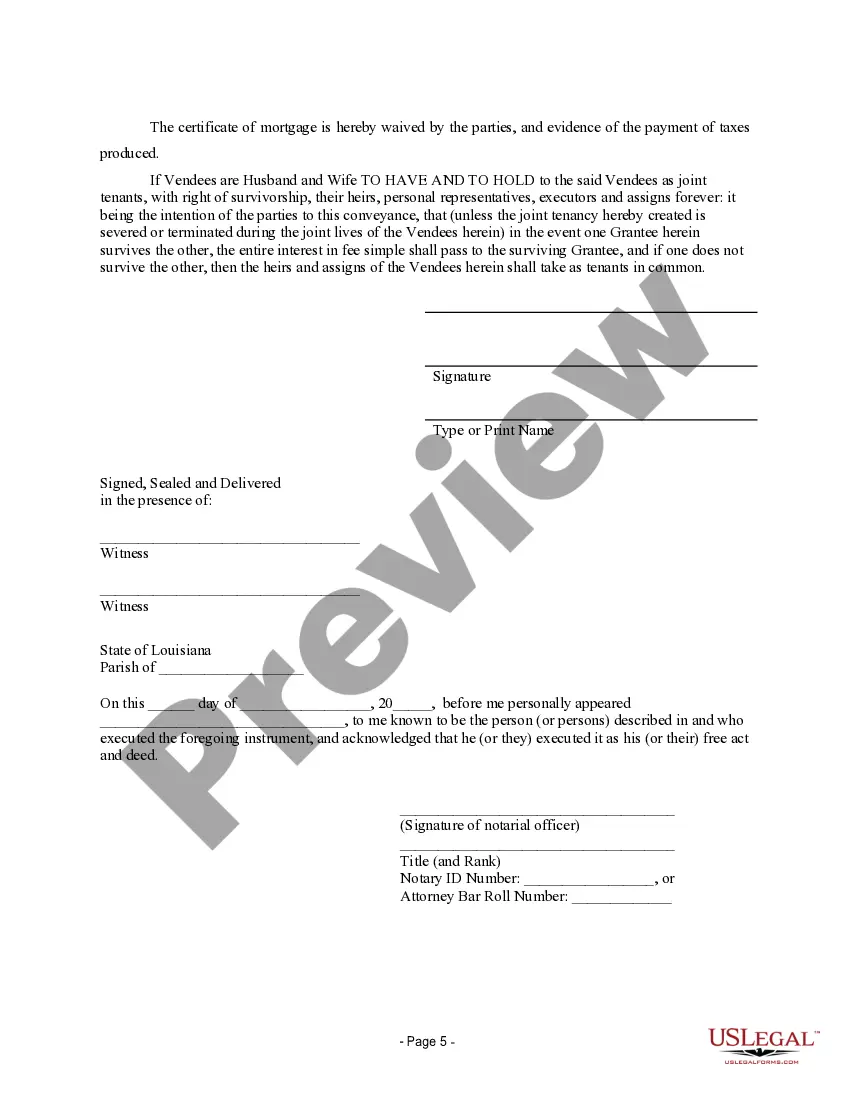

A fiduciary deed is a legal instrument used in New Orleans, Louisiana by various fiduciaries such as Executors, Trustees, Trustees, Administrators, and other individuals who hold a position of trust and responsibility. This document allows them to transfer or convey property owned by a decedent or a trust. The New Orleans Louisiana Fiduciary Deed serves as evidence of the fiduciary's authority and adherence to the legal requirements in handling the decedent's or trust's assets. There are several types of New Orleans Louisiana Fiduciary Deeds tailored to specific fiduciary roles: 1. Executor's Fiduciary Deed: This deed is utilized by an executor, appointed through a decedent's will, to legally transfer property from the decedent's estate to beneficiaries or heirs as stated in the will. This process ensures a smooth distribution of assets according to the wishes of the deceased. 2. Trustee's Fiduciary Deed: Trustees, who oversee and manage assets held in trust, use this deed to transfer property owned by the trust to designated beneficiaries. It ensures compliance with the trust agreement's provisions, assuring the proper transfer of assets. 3. Trust or's Fiduciary Deed: A trust or can execute this deed to convey property into a trust that they have established. By transferring assets into the trust, the trust or ensures proper management and distribution according to the trust's terms. This type of fiduciary deed streamlines the process of funding a trust. 4. Administrator's Fiduciary Deed: Administrators, typically appointed by the court in cases where there is no valid will or designated executor, use this deed to transfer property from the estate to rightful heirs. It allows for the legal distribution of assets in accordance with state laws of intestacy. All types of New Orleans Louisiana Fiduciary Deeds require strict adherence to legal formalities, including notarization, proper execution, and recording. These deeds provide the necessary documentation and safeguards to maintain transparency and ensure lawful property transfers. Executing a New Orleans Louisiana Fiduciary Deed requires a comprehensive understanding of state laws, probate procedures, and trust administration. Seeking legal assistance from an experienced attorney specializing in estate planning and probate is highly recommended ensuring compliance and proper execution of these important documents.

New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out New Orleans Louisiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

We consistently aim to minimize or evade legal complications when navigating intricate legal or financial issues.

To achieve this, we seek legal alternatives that are generally quite expensive.

Nevertheless, not all legal situations are similarly intricate. Most can be handled by ourselves.

US Legal Forms is an online directory of current DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and requests for dissolution. Our library allows you to manage your issues independently without needing a lawyer.

You can create your account in just a few minutes. Ensure to verify whether the New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries complies with the laws and regulations of your state and area.

- Benefit from US Legal Forms whenever you need to obtain and download the New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries or any other document rapidly and securely.

- Simply Log In to your account and click the Get button next to it.

- If you happen to misplace the form, you can always retrieve it again from the My documents tab.

- The process is similarly straightforward if you're not familiar with the platform!

Form popularity

FAQ

One significant disadvantage of a warranty deed lies in the extensive liability it places on the seller. If a title dispute arises later, the grantor may be held responsible for legal issues regarding the property title. This is particularly relevant when using a New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries; fiduciaries may want to avoid such liability. Thus, it is essential to understand which type of deed best suits your needs during property transfers.

A fiduciary deed is a legal document that allows appointed fiduciaries, such as executors or trustees, to convey real estate on behalf of an estate or trust. This type of deed simplifies the transfer process in accordance with the fiduciary's authority. In New Orleans, Louisiana, a Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries ensures that property transfers comply with state laws and respect the intentions of the deceased or trustor. It plays a critical role in managing and distributing assets.

A warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries is specifically designed for fiduciaries to transfer property held in trust or on behalf of an estate. This means a fiduciary deed does not offer the same level of personal guarantee as a warranty deed. Understanding these differences can help you choose the right option for your unique situation.

A trustee's trust deed is a specific type of deed used to facilitate the transfer of property under a trust's terms. It affirms the authority of the trustee to convey the property. This document plays a crucial role in the New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, ensuring that all legal standards are met and respected throughout the property transfer process.

A fiduciary deed is a specialized instrument used by fiduciaries, like trustees or executors, to transfer property. This deed reflects that the fiduciary is acting in the best interest of others as per their legal obligations. When dealing with the New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, this document ensures that the transfer is handled with the utmost responsibility and legality.

A trustee's deed is a legal document used when a trustee transfers property held within a trust. This deed serves to verify that the trustee is acting within their authority, based on the trust agreement. By utilizing the New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, you can ensure that the transfer adheres to the trust's guidelines and protections.

The main difference lies in the guarantees each deed provides. A trustee's deed guarantees that the trustee is legally authorized to make the transfer, while a quitclaim deed only transfers whatever interest the grantor has, without any assurances. In transactions involving the New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, the trustee's deed offers more security and clarity.

A trustee commonly uses a trustee's deed when transferring property. This deed provides legal proof of the transfer, ensuring that the rights to the property are conveyed according to the terms set forth in the trust. In the context of the New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, it ensures that all parties are protected during the transaction.

Transferring property to a family member in Louisiana typically requires preparing and executing a deed that documents the transfer. This deed should include details such as both parties' names and a description of the property. For those using a New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, following the proper legal steps will ensure a smooth and lawful transfer.

A deed generally contains detailed information including the names of the seller and buyer, a description of the property, and the date of the transaction. It may also provide certain rights or restrictions related to the property. When using a New Orleans Louisiana Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries, ensure that all necessary information is included to enhance clarity and enforceability.