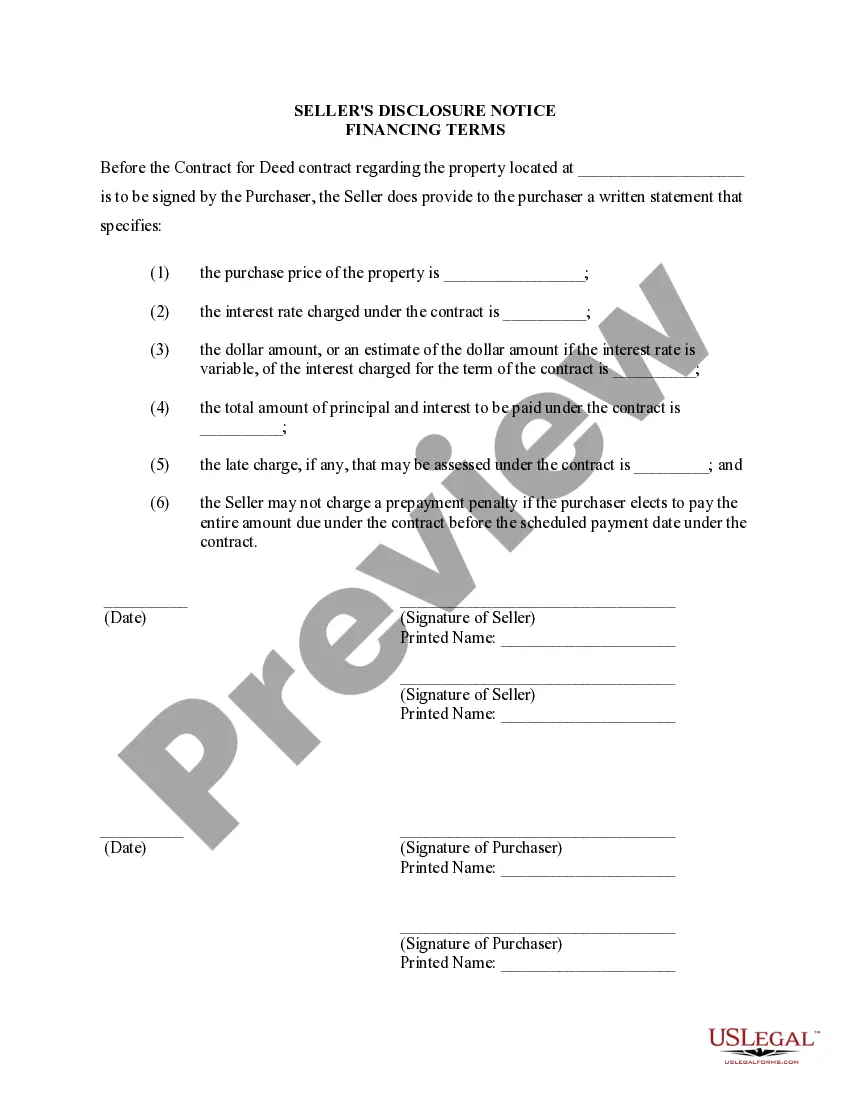

Lowell Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract When entering into a Contract or Agreement for Deed, also known as a Land Contract, in Lowell, Massachusetts, it is important for sellers to provide a detailed Seller's Disclosure of Financing Terms to ensure transparency and understanding between both parties involved. This disclosure document outlines the specific financial terms and conditions of the sale, ensuring that all parties are aware of their rights and responsibilities. There may be variations or types of Seller's Disclosure of Financing Terms, depending on the particular situation or agreement. Below are some examples: 1. Traditional Land Contract Seller's Disclosure: This type of disclosure is used when a seller agrees to finance the purchase of a residential property directly with the buyer, rather than involving a third-party lender. The document will detail the terms of the financing agreement, including the purchase price, down payment, interest rate, payment schedule, and any other legal provisions associated with the transaction. 2. Contract for Deed Seller's Disclosure: This disclosure is used when the seller agrees to finance the purchase of a residential property but retains legal ownership until the buyer fulfills the agreed-upon terms of the contract. It safeguards both parties by specifying the contract period, required payments, interest rates, default consequences, and any other relevant financial provisions. 3. Seller-Financed Mortgage Seller's Disclosure: In this case, the seller acts as the mortgage lender, providing financing for the buyer's purchase of the residential property. The disclosure will outline the loan terms, such as the principal amount, interest rate, loan duration, repayment schedule, and any applicable penalties or fees. 4. Lease Purchase Agreement Seller's Disclosure: A Lease Purchase Agreement combines elements of a lease and a sale, commonly used when the buyer cannot immediately secure traditional financing. This disclosure will outline the lease terms, including rental payments and duration, as well as the terms for purchasing the property at a later date, such as the purchase price, down payment requirements, and any related financial considerations. Regardless of the specific type of Seller's Disclosure of Financing Terms, it is crucial for sellers in Lowell, Massachusetts to provide this document to potential buyers. This disclosure ensures that both parties are fully informed of the financial details of the transaction, promoting transparency, and reducing the risk of misunderstandings or disputes. It is highly recommended consulting with a real estate attorney or professional to ensure compliance with local laws and regulations when drafting and executing these disclosure documents.

Lowell Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Lowell Massachusetts Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

We always want to reduce or avoid legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal services that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Lowell Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Lowell Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Lowell Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract would work for you, you can pick the subscription option and make a payment.

- Then you can download the form in any available file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!

Form popularity

FAQ

In a contract for deed, a homebuyer agrees to make regular payments to a home seller. Generally, a seller financing a buyer's purchase doesn't check the buyer's credit or report the buyer's payments to the credit bureaus. As a result, a buyer's forfeiture of a contract for deed wouldn't affect his credit negatively.

It is not necessary for the seller to go to court to cancel the contract. In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.

Here are some of the risks: The seller retains the right to the property until you pay in full, no matter how much money you put into it. If you miss any payments, the seller can quickly cancel the contract and keep every cent you've paid (state laws vary on how this goes down)

Instead of purchasing a home with a mortgage, the buyer agrees to directly pay the seller in monthly installments. The buyer is able to occupy the home after the closing of the sale, but the seller still retains legal title to the property. Actual ownership passes to the buyer only after the final payment is made.

In order to cancel a contract for deed, a seller needs to complete a form called a notice of cancellation of contract for deed, and have the notice personally served on the buyer.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

When a transaction is covered by the Three-Day Cooling-Off Law, you have three business days to cancel the contract. Under the law, you must make cancellation requests in writing to the address provided by the seller.

Land contract cons. Higher interest rates ? Since the seller is taking most of the risk, they may insist on a higher interest rate than a traditional mortgage. Ownership is unclear ? The seller retains the property title until the land contract is paid in full.