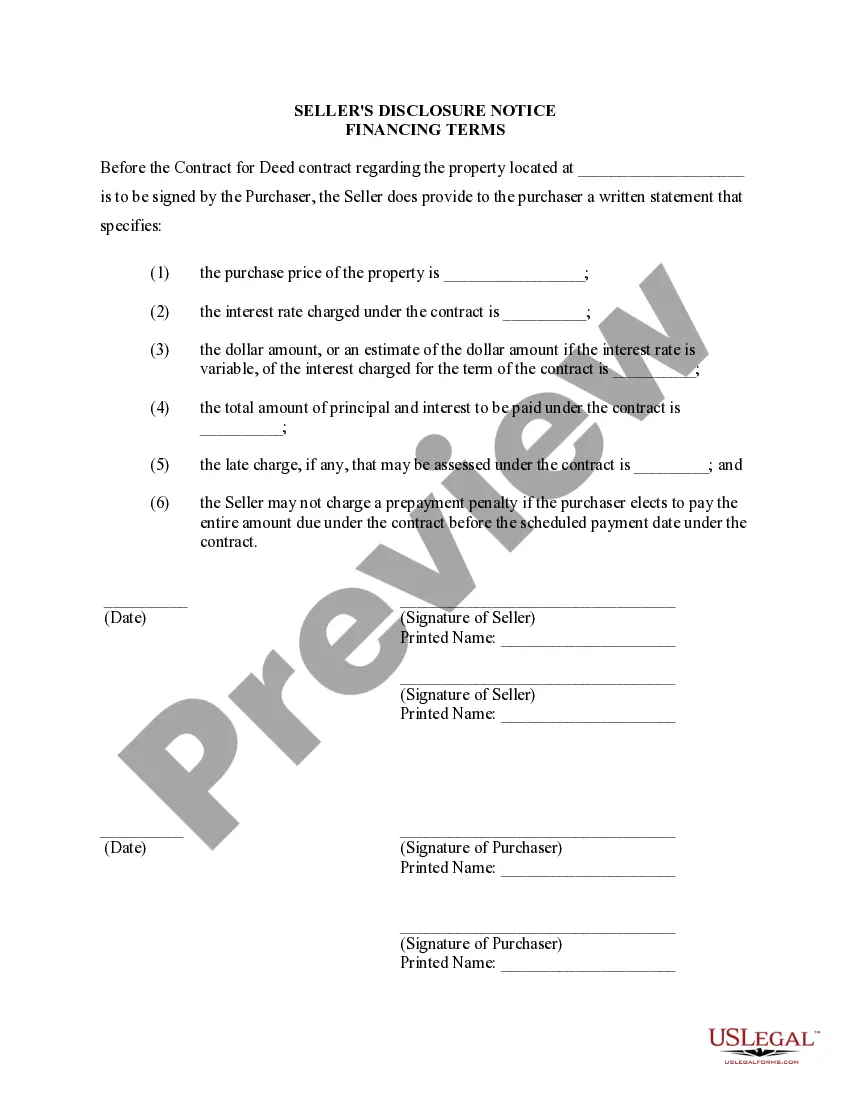

Middlesex Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an important legal document that outlines the specific financing terms and conditions agreed upon between the seller and the buyer in relation to the purchase of residential property using a land contract. This disclosure document serves as a crucial resource for both the seller and the buyer, as it provides transparent information regarding the financial aspects of the property transaction. It is required by law to ensure that all parties involved have a clear understanding and agreement on the financing terms. There are different types of Middlesex Massachusetts Seller's Disclosures of Financing Terms for Residential Property, which may vary depending on the specific terms and conditions agreed upon between the involved parties. Some common types of seller's disclosures pertaining to financing terms in Middlesex Massachusetts include: 1. Interest Rates and Terms: This type of disclosure outlines the agreed-upon interest rate, repayment period, and any other relevant terms associated with the financing arrangement. It ensures that the buyer is aware of the interest rate they will be charged and the duration of the loan. 2. Down Payment and Price: This disclosure specifies the amount of the down payment required by the buyer and ensures that the seller is transparent about the agreed-upon purchase price. It may also include information about any additional fees or costs associated with the property purchase. 3. Payment Schedule and Due Dates: This disclosure document highlights the payment schedule for the buyer, stating the due dates and frequency of payments. It ensures that both parties are aware of when the payments are expected and when they are considered overdue. 4. Default and Remedies: This disclosure outlines the consequences and remedies in case of non-payment or default by the buyer. It may specify late payment penalties, potential foreclosure procedures, and any other actions the seller can take to protect their interests in case of default. 5. Property Disclosure: Although not strictly related to financing terms, it is essential to include a property disclosure in the Middlesex Massachusetts Seller's Disclosure. This section provides information regarding the property's condition, potential defects, and any known issues that may affect its value or desirability. 6. Arbitration or Mediation Clause: In some cases, the parties may include an arbitration or mediation clause in the financing terms disclosure to resolve any disputes that may arise during the course of the land contract. This clause specifies the process and procedures to be followed in the case of a disagreement. In conclusion, the Middlesex Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed a/k/a Land Contract is a comprehensive document that addresses the financial aspects of the property purchase. It aims to ensure transparency and protect the interests of both the buyer and the seller by clearly outlining the agreed-upon financing terms.

Middlesex Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract

Description

How to fill out Middlesex Massachusetts Seller's Disclosure Of Financing Terms For Residential Property In Connection With Contract Or Agreement For Deed A/k/a Land Contract?

We always want to reduce or prevent legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney solutions that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Middlesex Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Middlesex Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Middlesex Massachusetts Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is suitable for your case, you can select the subscription option and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!