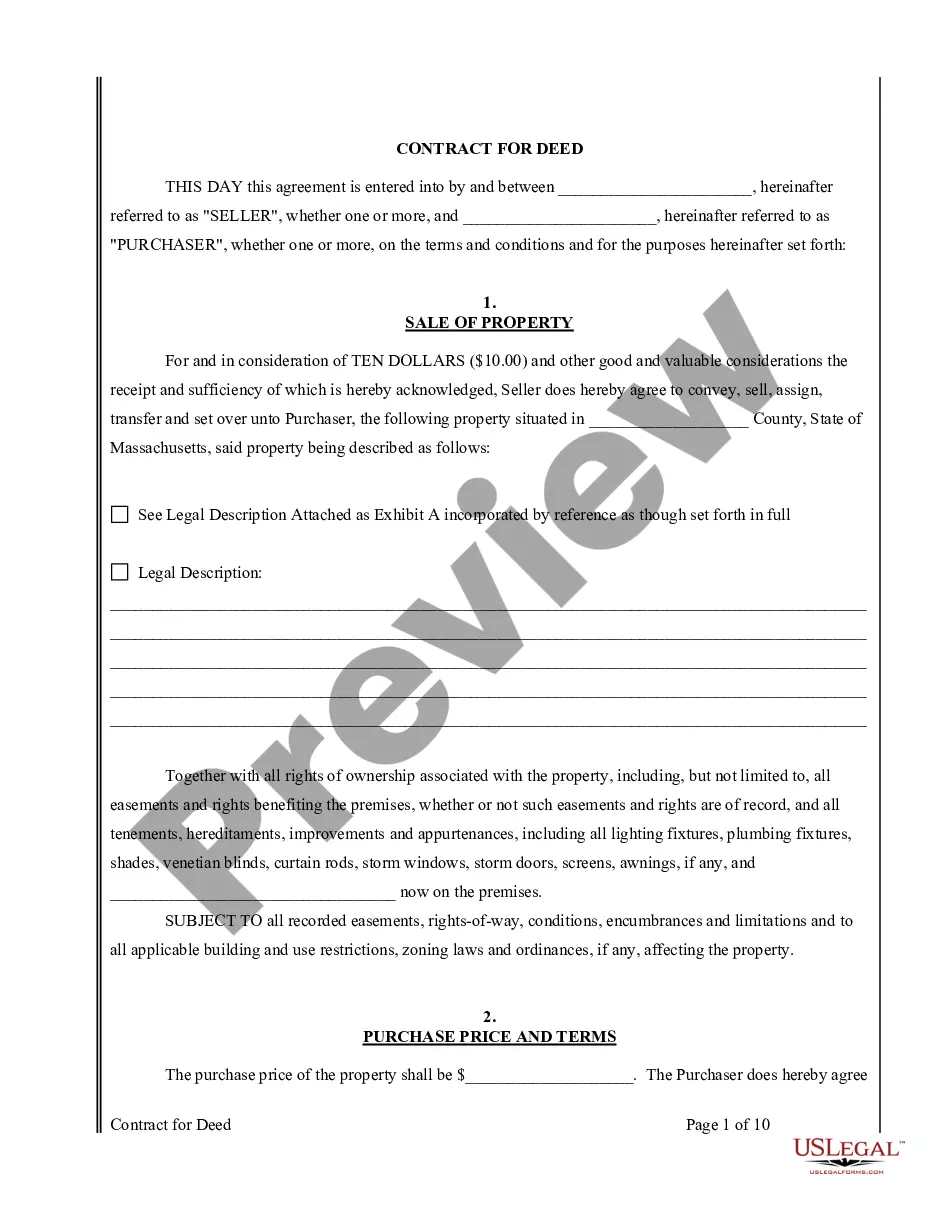

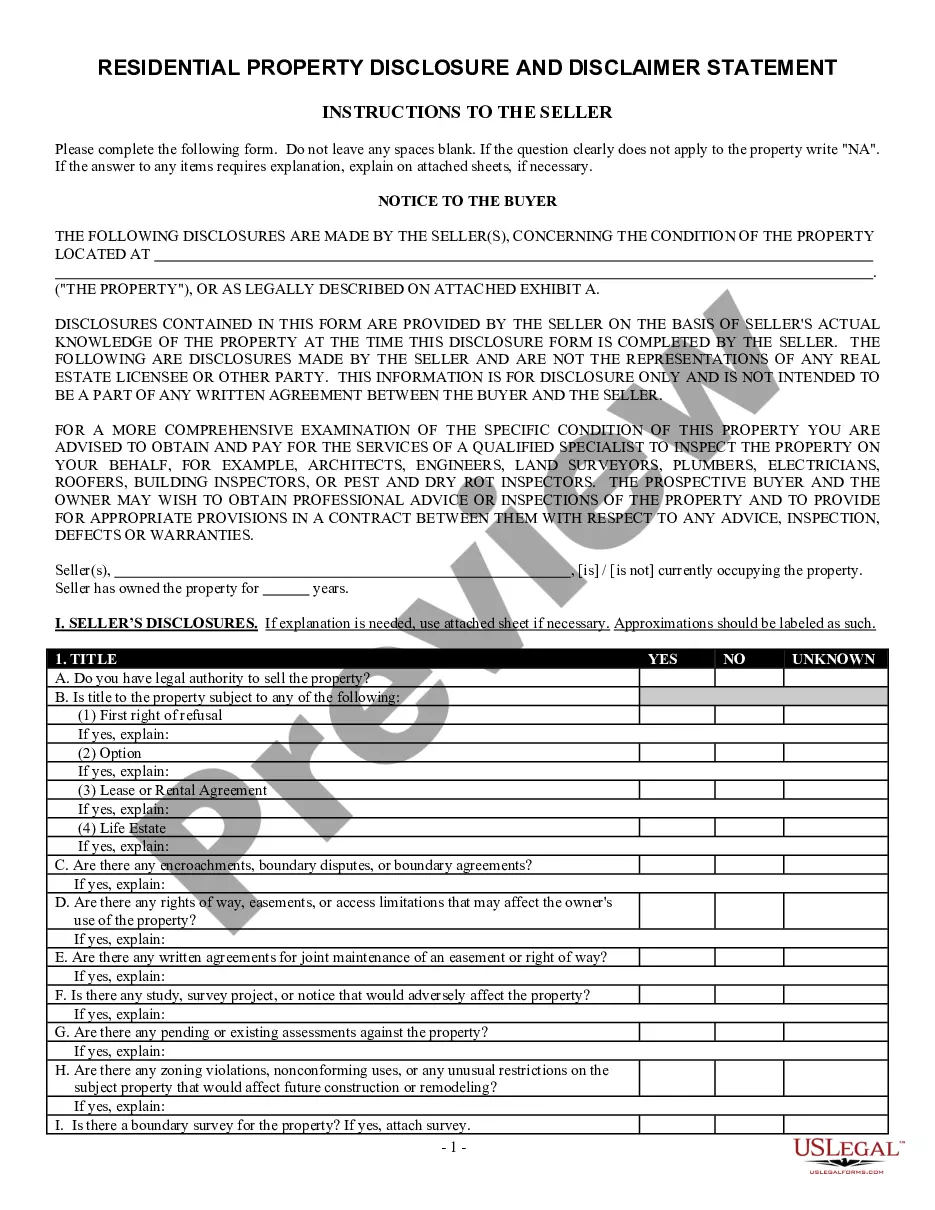

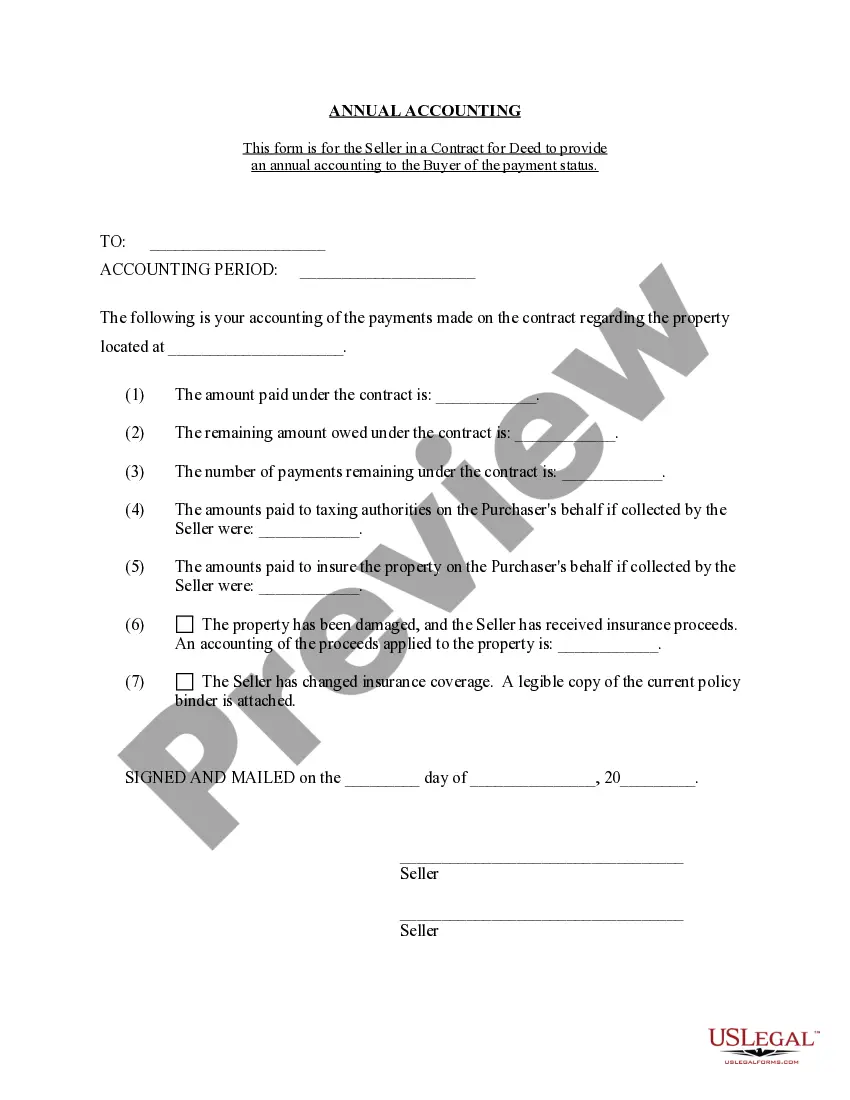

The Boston Massachusetts Contract for Deed Seller's Annual Accounting Statement is a legal document that provides a detailed financial summary for sellers involved in contract for deed transactions in Boston, Massachusetts. This statement serves as a means for sellers to report and disclose the financial information related to the contract for deed agreement. This annual accounting statement is specifically designed for sellers who have entered into contract for deed arrangements in Boston, Massachusetts. A contract for deed, also known as a land contract or installment land contract, is an agreement where the seller finances the purchase of a property, allowing the buyer to make regular payments over a specified period. The buyer does not receive the legal title to the property until the full amount has been paid. The purpose of the annual accounting statement is to provide transparency and accountability to both parties involved in the contract for deed agreement. It allows the seller to track and report any payments made by the buyer, as well as expenses incurred in relation to the property. The document includes relevant keywords such as: 1. Contract for Deed: Refers to the specific type of agreement being utilized, where the seller provides financing for the purchase of the property. 2. Seller: The individual or entity selling the property in a contract for deed transaction. 3. Annual Accounting Statement: The financial summary provided by the seller on an annual basis, which details the transaction's financial information. 4. Boston, Massachusetts: Specifies the jurisdiction in which the contract for deed agreement is taking place, indicating that the statement follows the local laws and regulations of Massachusetts. Different types of Boston Massachusetts Contract for Deed Seller's Annual Accounting Statements may exist depending on the specific terms outlined in each contract for deed agreement. For instance, some statements may include additional sections or information specific to the property or the agreement. However, regardless of the specific format, all annual accounting statements aim to provide clarity on the financial aspects of the contract for deed transaction. In summary, the Boston Massachusetts Contract for Deed Seller's Annual Accounting Statement is a legally required document that enables sellers to report and disclose financial information related to contract for deed transactions in Boston, Massachusetts. It promotes transparency and accountability in these agreements by tracking payments made by the buyer and detailing any expenses incurred by the seller. Various types of annual accounting statements may exist depending on the specifics of each contract for deed agreement.

Boston Massachusetts Contract for Deed Seller's Annual Accounting Statement

State:

Massachusetts

City:

Boston

Control #:

MA-00470-4

Format:

Word;

Rich Text

Instant download

Description

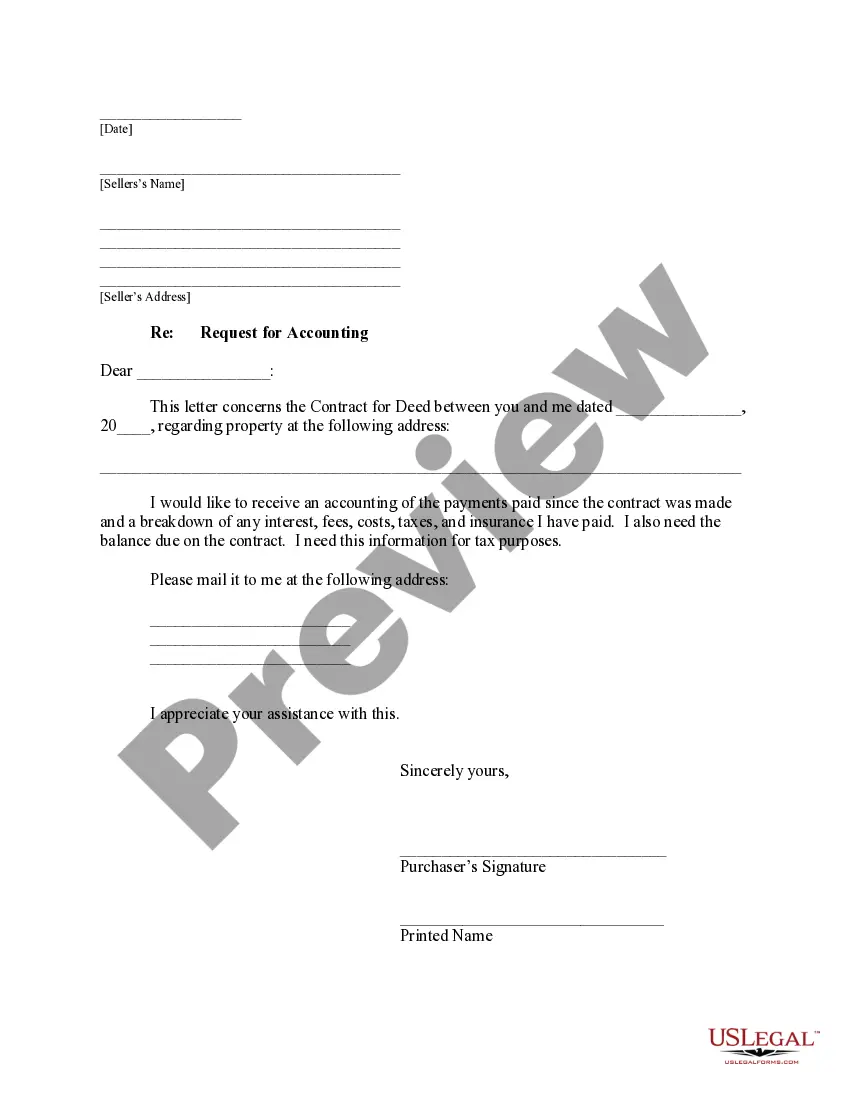

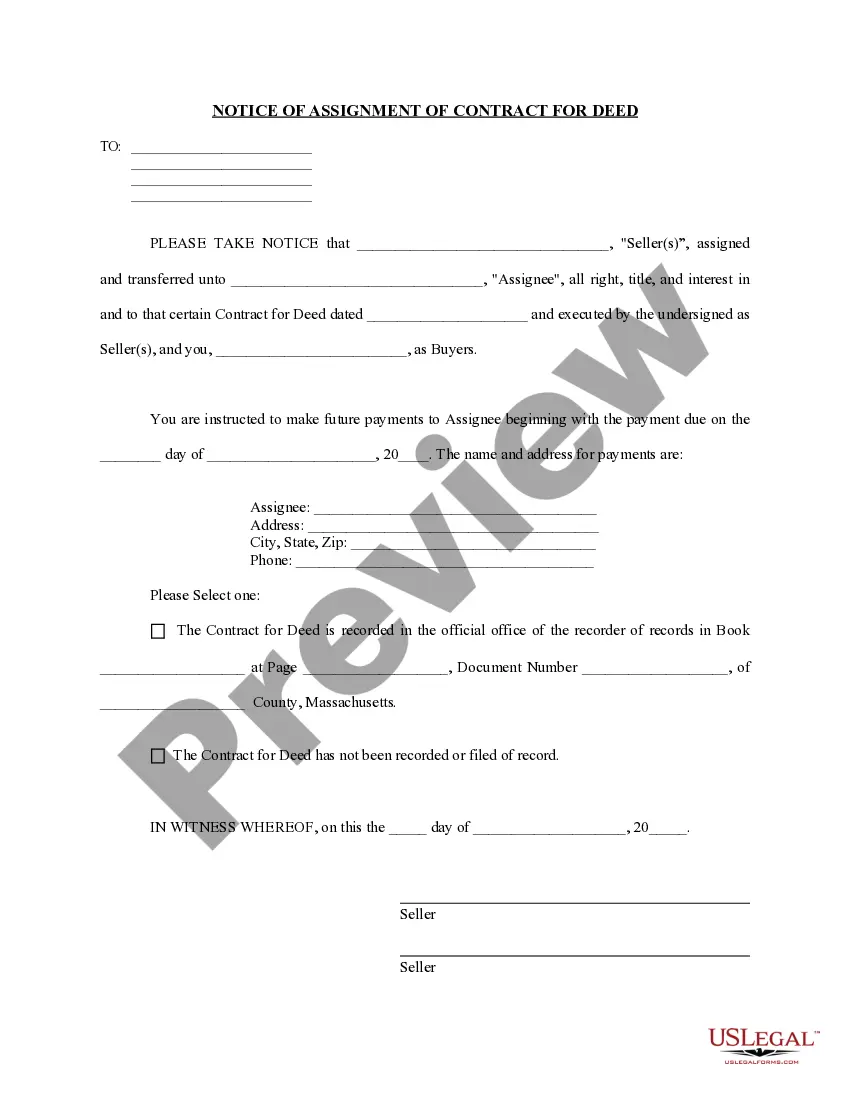

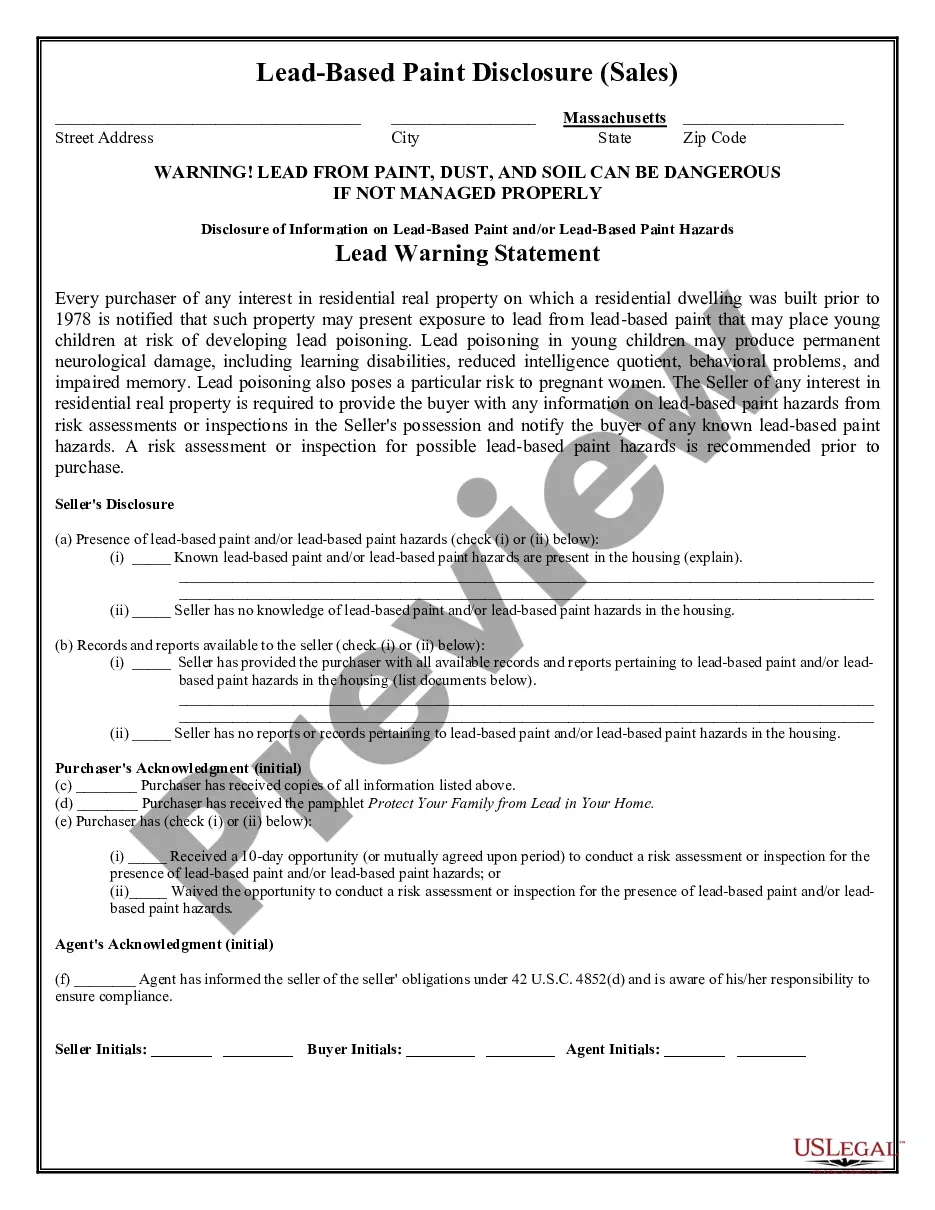

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

The Boston Massachusetts Contract for Deed Seller's Annual Accounting Statement is a legal document that provides a detailed financial summary for sellers involved in contract for deed transactions in Boston, Massachusetts. This statement serves as a means for sellers to report and disclose the financial information related to the contract for deed agreement. This annual accounting statement is specifically designed for sellers who have entered into contract for deed arrangements in Boston, Massachusetts. A contract for deed, also known as a land contract or installment land contract, is an agreement where the seller finances the purchase of a property, allowing the buyer to make regular payments over a specified period. The buyer does not receive the legal title to the property until the full amount has been paid. The purpose of the annual accounting statement is to provide transparency and accountability to both parties involved in the contract for deed agreement. It allows the seller to track and report any payments made by the buyer, as well as expenses incurred in relation to the property. The document includes relevant keywords such as: 1. Contract for Deed: Refers to the specific type of agreement being utilized, where the seller provides financing for the purchase of the property. 2. Seller: The individual or entity selling the property in a contract for deed transaction. 3. Annual Accounting Statement: The financial summary provided by the seller on an annual basis, which details the transaction's financial information. 4. Boston, Massachusetts: Specifies the jurisdiction in which the contract for deed agreement is taking place, indicating that the statement follows the local laws and regulations of Massachusetts. Different types of Boston Massachusetts Contract for Deed Seller's Annual Accounting Statements may exist depending on the specific terms outlined in each contract for deed agreement. For instance, some statements may include additional sections or information specific to the property or the agreement. However, regardless of the specific format, all annual accounting statements aim to provide clarity on the financial aspects of the contract for deed transaction. In summary, the Boston Massachusetts Contract for Deed Seller's Annual Accounting Statement is a legally required document that enables sellers to report and disclose financial information related to contract for deed transactions in Boston, Massachusetts. It promotes transparency and accountability in these agreements by tracking payments made by the buyer and detailing any expenses incurred by the seller. Various types of annual accounting statements may exist depending on the specifics of each contract for deed agreement.

How to fill out Boston Massachusetts Contract For Deed Seller's Annual Accounting Statement?

If you’ve already utilized our service before, log in to your account and save the Boston Massachusetts Contract for Deed Seller's Annual Accounting Statement on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Boston Massachusetts Contract for Deed Seller's Annual Accounting Statement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!