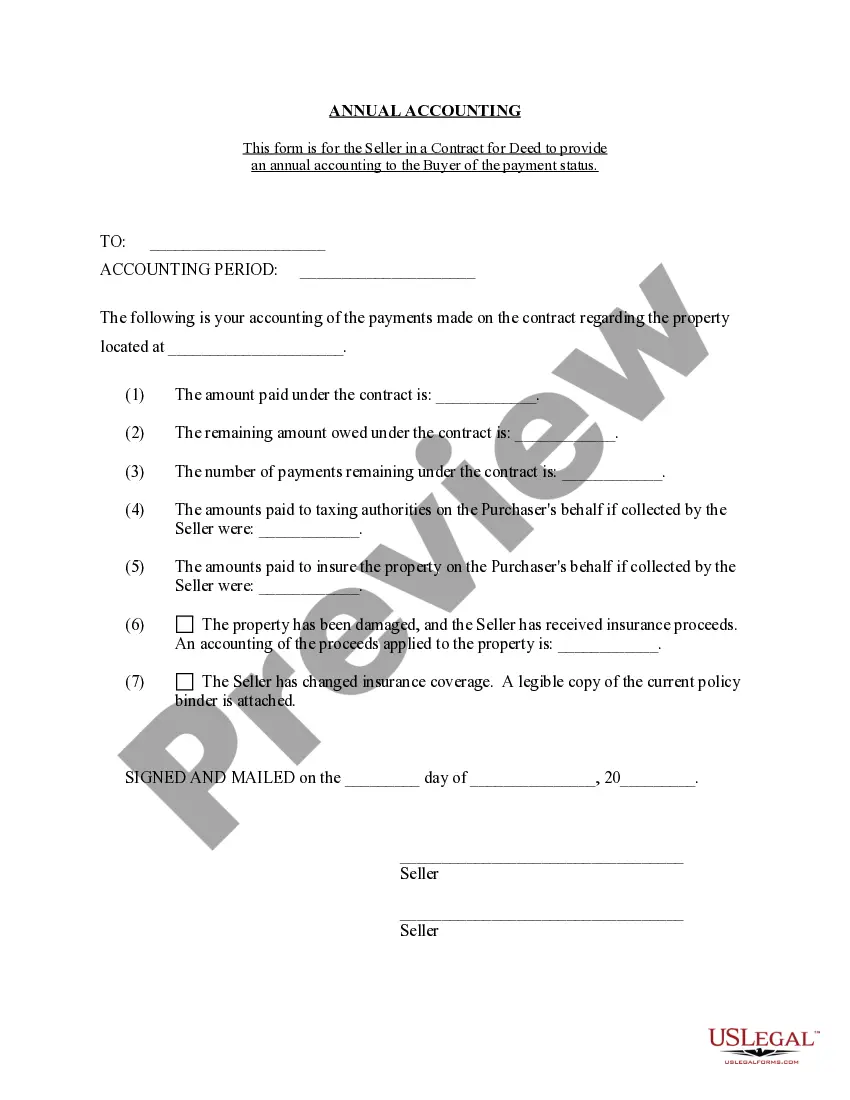

The Cambridge Massachusetts Contract for Deed Seller's Annual Accounting Statement is a crucial document that outlines the financial transactions and obligations between a seller and buyer under a contract for deed agreement in Cambridge, Massachusetts. This statement serves as a comprehensive record of the ongoing financial relationship between the parties involved. Keywords: Cambridge Massachusetts, Contract for Deed, Seller's Annual Accounting Statement, financial transactions, obligations, buyer, seller, agreement, comprehensive record. Types of Cambridge Massachusetts Contract for Deed Seller's Annual Accounting Statement: 1. Basic Contract for Deed Seller's Annual Accounting Statement: This type of statement provides a comprehensive overview of the financial transactions and obligations between the seller and the buyer for a property purchased under a contract for deed in Cambridge, Massachusetts. It includes details on the payments received, outstanding balances, taxes paid, and any other relevant expenses. Keywords: basic, overview, financial transactions, obligations, payments, outstanding balances, taxes, expenses. 2. Detailed Contract for Deed Seller's Annual Accounting Statement: This type of statement goes beyond the basic overview and provides a more detailed breakdown of the financial transactions and obligations. It includes itemized listings of each payment made, any interest accrued, outstanding principal balances, and specific expenses related to the property. Keywords: detailed, breakdown, itemized listings, payments, interest, outstanding principal balances, expenses. 3. Tax-specific Contract for Deed Seller's Annual Accounting Statement: This type of statement focuses specifically on the tax-related aspects of the contract for deed agreement in Cambridge, Massachusetts. It includes details on property taxes paid by the seller, any tax credits or deductions applicable, and any additional tax-related obligations of the buyer or seller. Keywords: tax-specific, property taxes, tax credits, deductions, obligations. 4. Expense-specific Contract for Deed Seller's Annual Accounting Statement: This type of statement highlights specific expenses related to the property or contract for deed agreement. It includes details on expenses such as maintenance costs, insurance premiums, utility payments, and any other relevant financial obligations that are part of the agreement. Keywords: expense-specific, maintenance costs, insurance premiums, utilities, financial obligations. 5. Delinquency Report Contract for Deed Seller's Annual Accounting Statement: This type of statement focuses on delinquency in payments or non-compliance with the contract for deed agreement. It includes details on any missed or late payments, penalties incurred, and actions taken by the seller or any required interventions to rectify the situation. Keywords: delinquency report, missed payments, late payments, penalties, interventions. It is important to consult with legal professionals or real estate experts in Cambridge, Massachusetts to ensure compliance with local laws and regulations when preparing or reviewing a Contract for Deed Seller's Annual Accounting Statement.

Cambridge Massachusetts Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Cambridge Massachusetts Contract For Deed Seller's Annual Accounting Statement?

Make use of the US Legal Forms and obtain immediate access to any form sample you want. Our helpful website with a huge number of templates allows you to find and obtain almost any document sample you will need. It is possible to download, fill, and sign the Cambridge Massachusetts Contract for Deed Seller's Annual Accounting Statement in a matter of minutes instead of browsing the web for several hours trying to find an appropriate template.

Using our library is a wonderful strategy to raise the safety of your form filing. Our experienced lawyers regularly review all the records to make sure that the templates are appropriate for a particular region and compliant with new acts and polices.

How do you get the Cambridge Massachusetts Contract for Deed Seller's Annual Accounting Statement? If you already have a subscription, just log in to the account. The Download button will appear on all the samples you view. In addition, you can find all the earlier saved documents in the My Forms menu.

If you haven’t registered an account yet, stick to the instruction listed below:

- Find the form you need. Ensure that it is the form you were hoping to find: verify its headline and description, and utilize the Preview function when it is available. Otherwise, utilize the Search field to find the appropriate one.

- Start the saving process. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Save the document. Select the format to get the Cambridge Massachusetts Contract for Deed Seller's Annual Accounting Statement and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable form libraries on the web. Our company is always ready to help you in any legal procedure, even if it is just downloading the Cambridge Massachusetts Contract for Deed Seller's Annual Accounting Statement.

Feel free to benefit from our form catalog and make your document experience as efficient as possible!