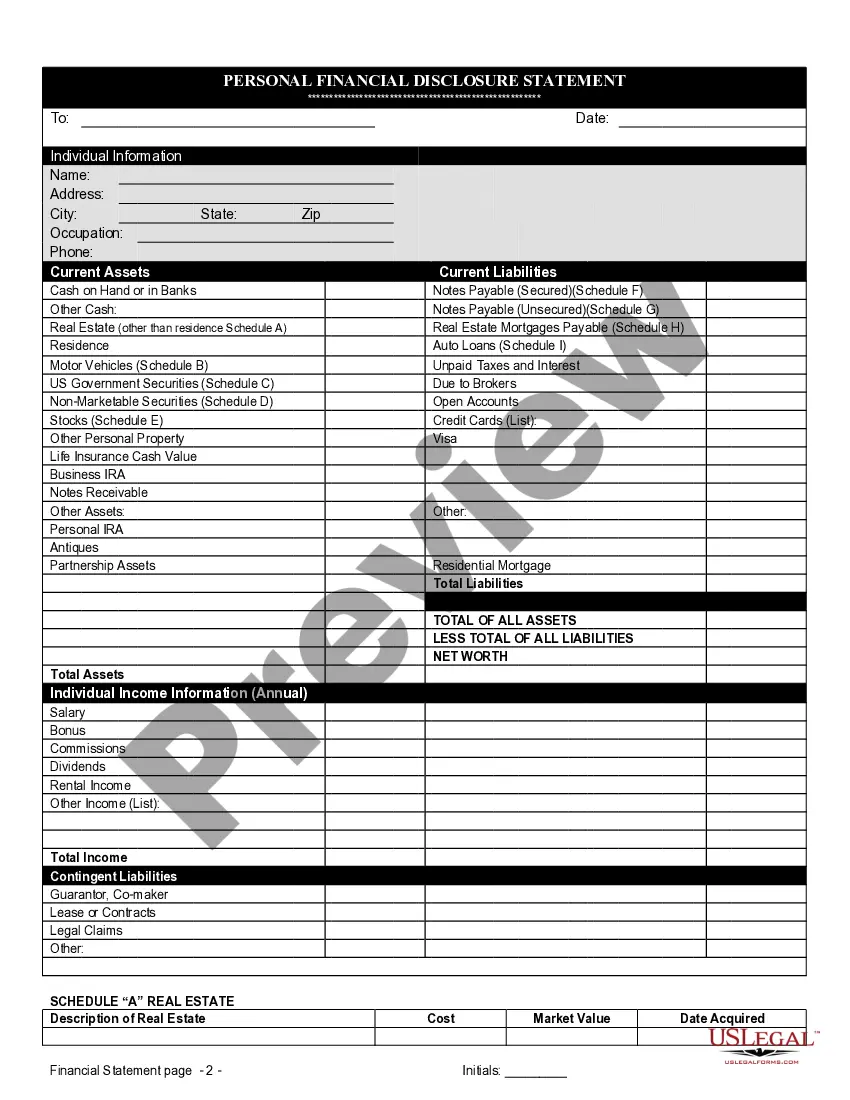

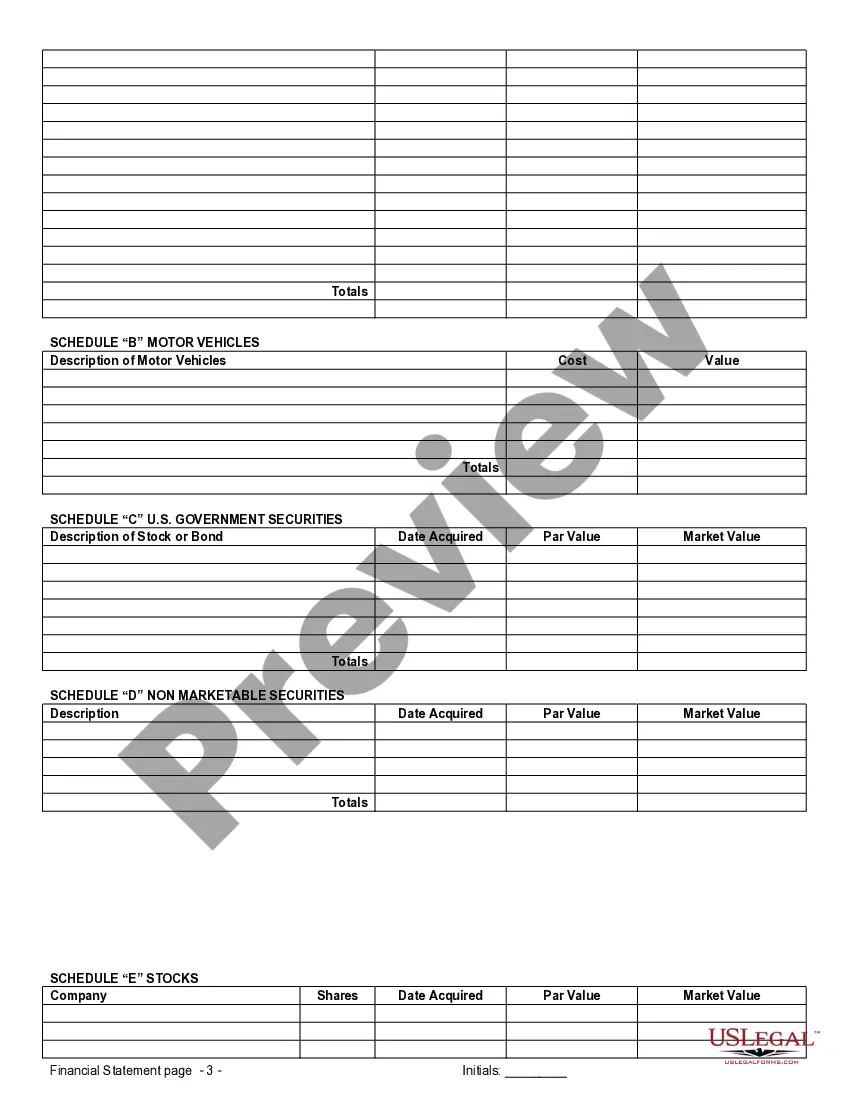

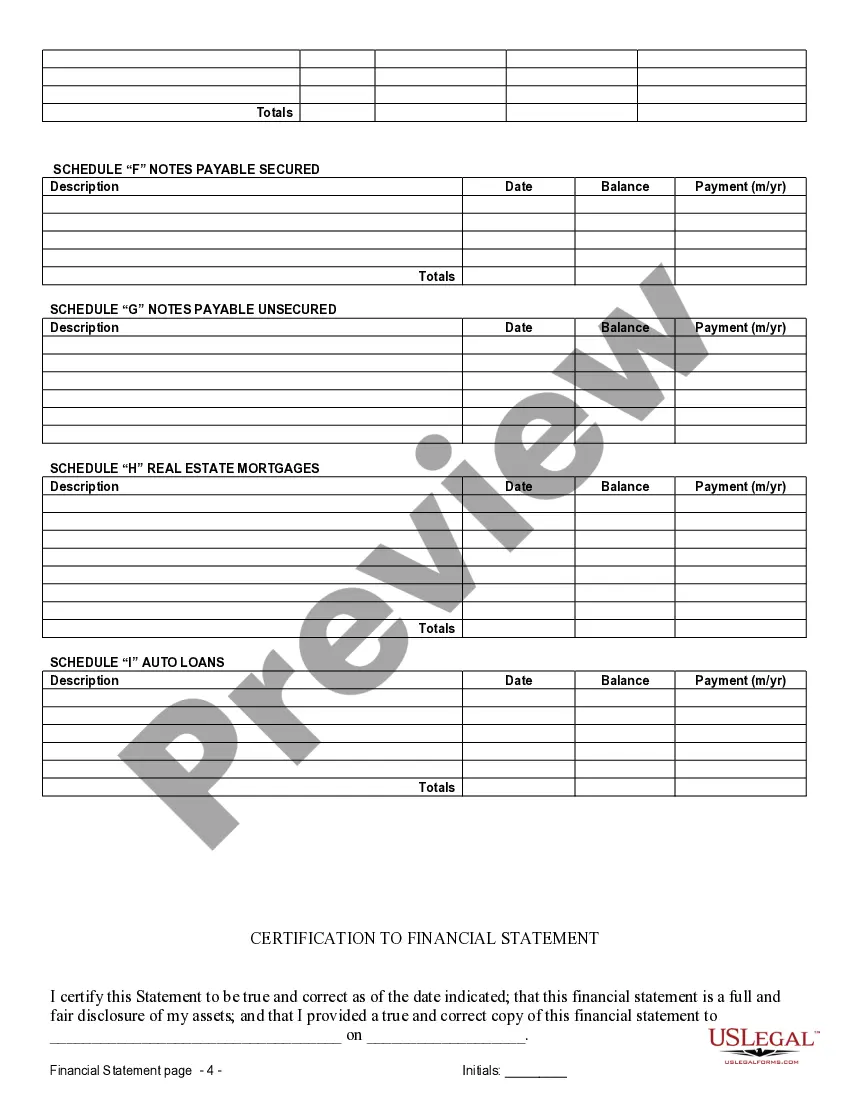

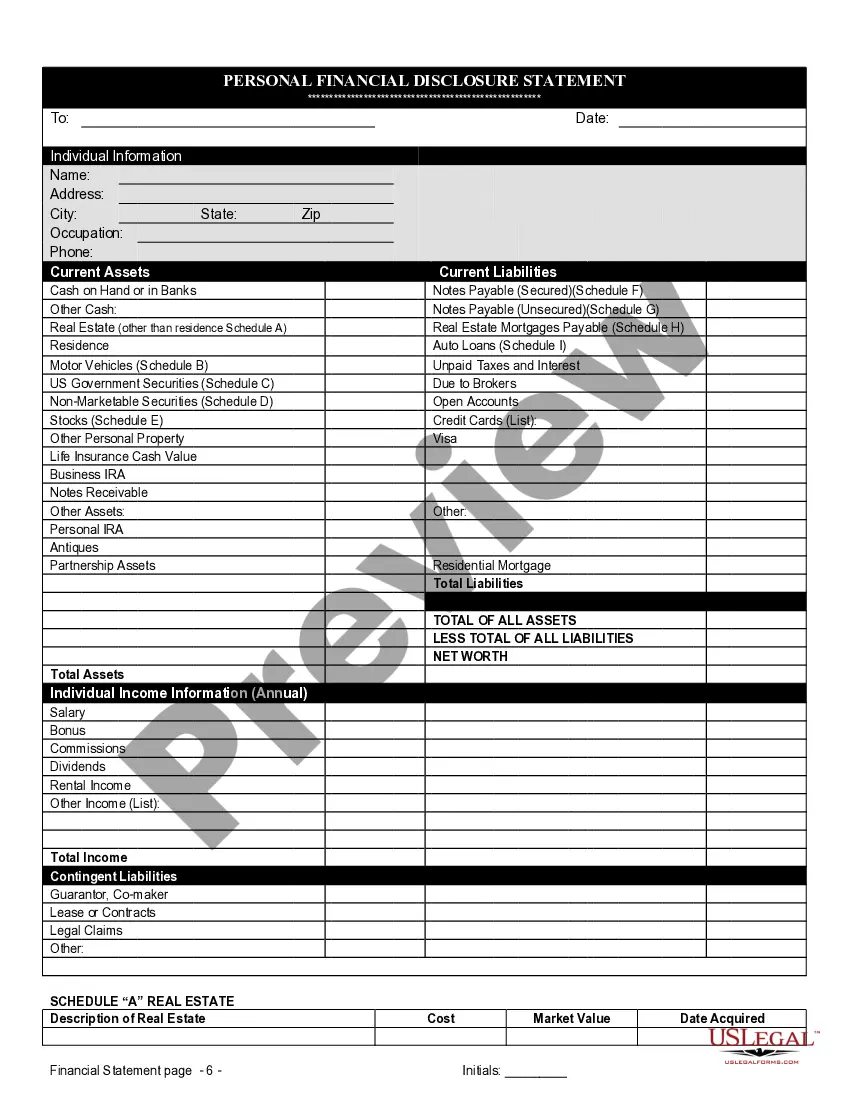

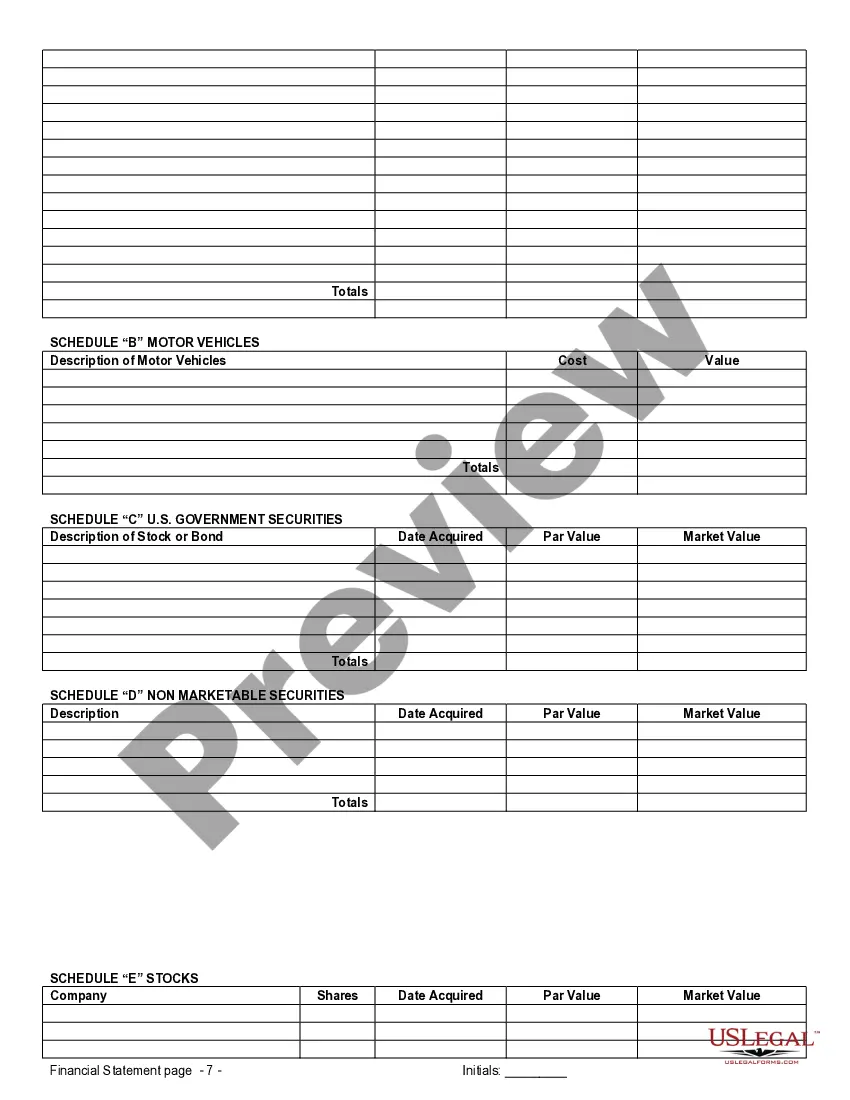

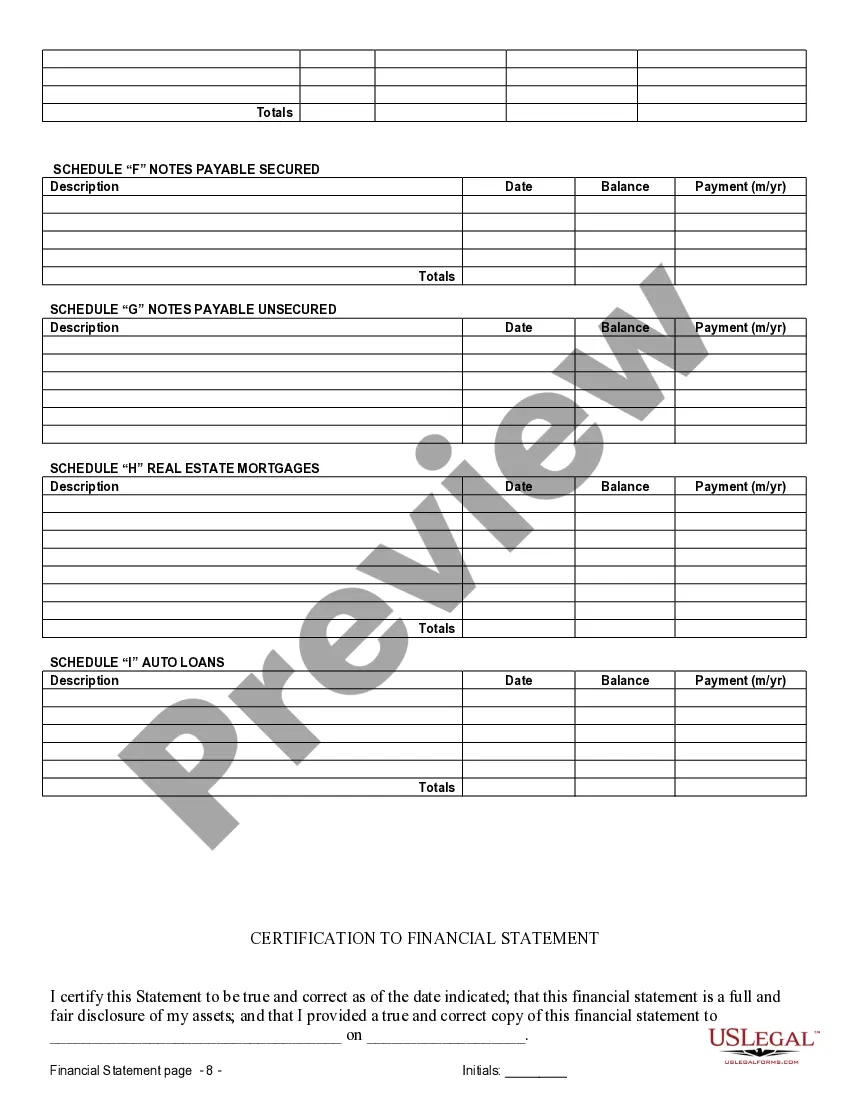

Cambridge Massachusetts Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Cambridge, Massachusetts, financial statements play a crucial role in ensuring transparency and protection for both parties involved. These financial statements provide a comprehensive view of each individual's financial standing, assets, liabilities, income, and expenses to help determine the division of assets and potential financial arrangements in case of divorce or separation. The financial statements required for a prenuptial or premarital agreement in Cambridge, Massachusetts can vary depending on the unique circumstances of the couple. Different types of financial statements commonly used in such agreements include: 1. Personal Balance Sheets: Personal balance sheets provide a snapshot of an individual's financial position by listing assets, such as savings accounts, investments, real estate, and vehicles, as well as liabilities like mortgages, loans, and credit card debt. These statements provide a comprehensive overview of each party's net worth, helping assess the division of assets in case the agreement is invoked. 2. Income Statements: Income statements, also known as profit and loss statements, lay out an individual's sources of income and expenses over a specified period. These statements often include information about employment income, dividends, rental income, or any other financial resources. This statement helps determine potential spousal support or alimony payments if a divorce or separation occurs. 3. Bank Statements: Bank statements serve as evidence of an individual's financial transactions, indicating income, expenses, and saving patterns more accurately. These statements can include records of account balances, deposits, withdrawals, and transfers. Bank statements are essential for evaluating spending habits and financial stability, especially when significant assets are involved. 4. Credit Reports: Credit reports provide a comprehensive overview of an individual's credit history, including existing debts, payment history, and any other financial obligations. These reports help determine the financial responsibility and potential risk associated with each party. Credit reports may also include information about any outstanding loans, such as student loans or car financing, as well as credit card balances. 5. Investment Portfolio Statements: Investment portfolio statements provide details about a person's investments, including stocks, bonds, mutual funds, or retirement accounts. These statements are crucial in evaluating an individual's financial growth and any potential income derived from these investments. They also help determine the division of investments in case of separation, ensuring a fair distribution. By requiring these financial statements as part of a prenuptial or premarital agreement in Cambridge, Massachusetts, couples ensure transparency and protect their financial interests. These statements serve as a point of reference that helps determine the division of assets, potential spousal support, or considerations for financial arrangements. It is always advisable to consult with a qualified attorney to navigate the legal intricacies and to ensure compliance with local laws and regulations when drafting a prenuptial or premarital agreement.

Cambridge Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement

State:

Massachusetts

City:

Cambridge

Control #:

MA-00590-D

Format:

Word;

Rich Text

Instant download

Description

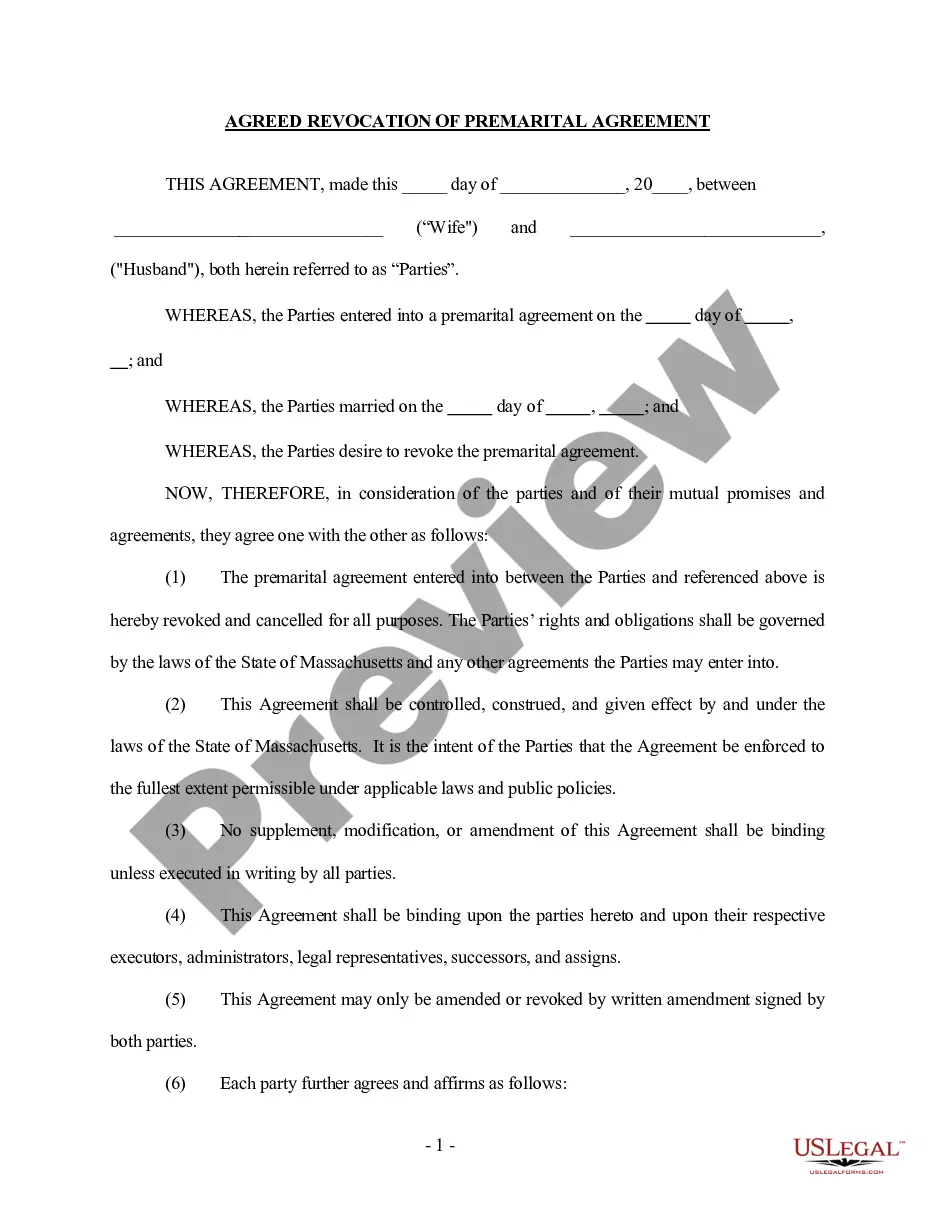

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Cambridge Massachusetts Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Cambridge, Massachusetts, financial statements play a crucial role in ensuring transparency and protection for both parties involved. These financial statements provide a comprehensive view of each individual's financial standing, assets, liabilities, income, and expenses to help determine the division of assets and potential financial arrangements in case of divorce or separation. The financial statements required for a prenuptial or premarital agreement in Cambridge, Massachusetts can vary depending on the unique circumstances of the couple. Different types of financial statements commonly used in such agreements include: 1. Personal Balance Sheets: Personal balance sheets provide a snapshot of an individual's financial position by listing assets, such as savings accounts, investments, real estate, and vehicles, as well as liabilities like mortgages, loans, and credit card debt. These statements provide a comprehensive overview of each party's net worth, helping assess the division of assets in case the agreement is invoked. 2. Income Statements: Income statements, also known as profit and loss statements, lay out an individual's sources of income and expenses over a specified period. These statements often include information about employment income, dividends, rental income, or any other financial resources. This statement helps determine potential spousal support or alimony payments if a divorce or separation occurs. 3. Bank Statements: Bank statements serve as evidence of an individual's financial transactions, indicating income, expenses, and saving patterns more accurately. These statements can include records of account balances, deposits, withdrawals, and transfers. Bank statements are essential for evaluating spending habits and financial stability, especially when significant assets are involved. 4. Credit Reports: Credit reports provide a comprehensive overview of an individual's credit history, including existing debts, payment history, and any other financial obligations. These reports help determine the financial responsibility and potential risk associated with each party. Credit reports may also include information about any outstanding loans, such as student loans or car financing, as well as credit card balances. 5. Investment Portfolio Statements: Investment portfolio statements provide details about a person's investments, including stocks, bonds, mutual funds, or retirement accounts. These statements are crucial in evaluating an individual's financial growth and any potential income derived from these investments. They also help determine the division of investments in case of separation, ensuring a fair distribution. By requiring these financial statements as part of a prenuptial or premarital agreement in Cambridge, Massachusetts, couples ensure transparency and protect their financial interests. These statements serve as a point of reference that helps determine the division of assets, potential spousal support, or considerations for financial arrangements. It is always advisable to consult with a qualified attorney to navigate the legal intricacies and to ensure compliance with local laws and regulations when drafting a prenuptial or premarital agreement.

Free preview

How to fill out Cambridge Massachusetts Financial Statements Only In Connection With Prenuptial Premarital Agreement?

If you’ve already utilized our service before, log in to your account and download the Cambridge Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your file:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Cambridge Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!