Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Massachusetts Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Take advantage of US Legal Forms and gain instant access to any form template you require.

Our valuable platform, featuring thousands of documents, makes it easy to locate and acquire nearly any document sample you desire.

You can download, complete, and verify the Middlesex Massachusetts Financial Statements solely related to Prenuptial Premarital Agreement within minutes, rather than spending hours online searching for an appropriate template.

Utilizing our database is an excellent method to enhance the security of your document submissions.

If you haven't created an account yet, follow the instructions below.

- Visit the page featuring the template you need. Ensure that it is the correct template: check its title and description, and utilize the Preview function if it is available. Otherwise, use the Search field to find the appropriate one.

- Initiate the download process. Select Buy Now and pick the pricing plan that suits you. Then, register for an account and process your payment using a credit card or PayPal.

- Download the document. Select the format to receive the Middlesex Massachusetts Financial Statements solely related to Prenuptial Premarital Agreement and alter and complete, or sign it according to your preferences.

- Our experienced attorneys consistently assess all documents to guarantee that the templates are suitable for specific jurisdictions and comply with the latest laws and regulations.

- How do you access the Middlesex Massachusetts Financial Statements solely related to Prenuptial Premarital Agreement.

- If you already possess a subscription, simply Log In to your account. The Download option will be available for all the samples you view.

- Furthermore, you can locate all previously saved documents in the My documents section.

Form popularity

FAQ

To fill out a financial affidavit for divorce, start by carefully reading the affidavit requirements. Include accurate details about your current financial situation, focusing on assets and liabilities. Utilizing platforms like US Legal Forms can simplify this process, especially when dealing with Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement, ensuring your documentation is correctly formatted and completed.

Filling out a financial statement involves collecting your financial data and entering it into the specific format required. You should provide clear information regarding your income, expenses, and assets. By ensuring your information corresponds to the requirements for Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement, you make the process smoother and more reliable.

To prepare financial statements for divorce, begin by gathering relevant financial documents. These include income records, bank statements, and details of any debts. When you focus on Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement, accuracy is essential, as these statements will play a significant role in the divorce proceedings.

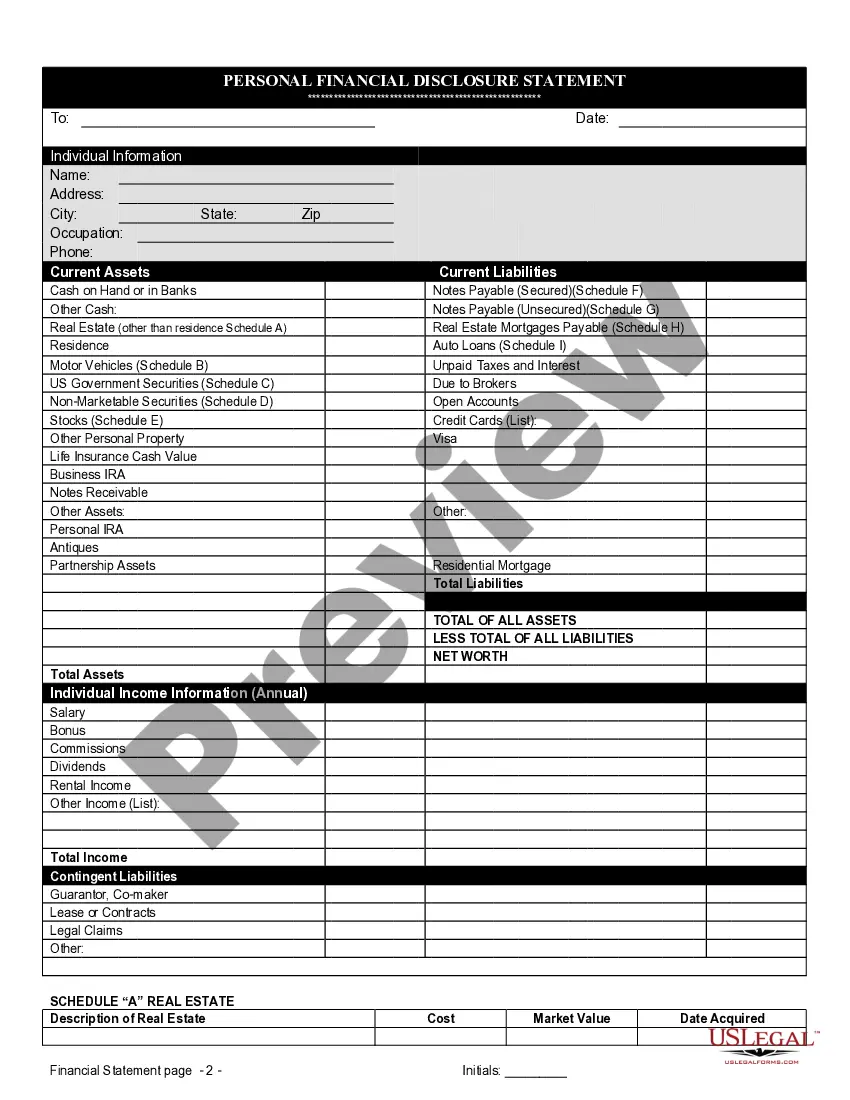

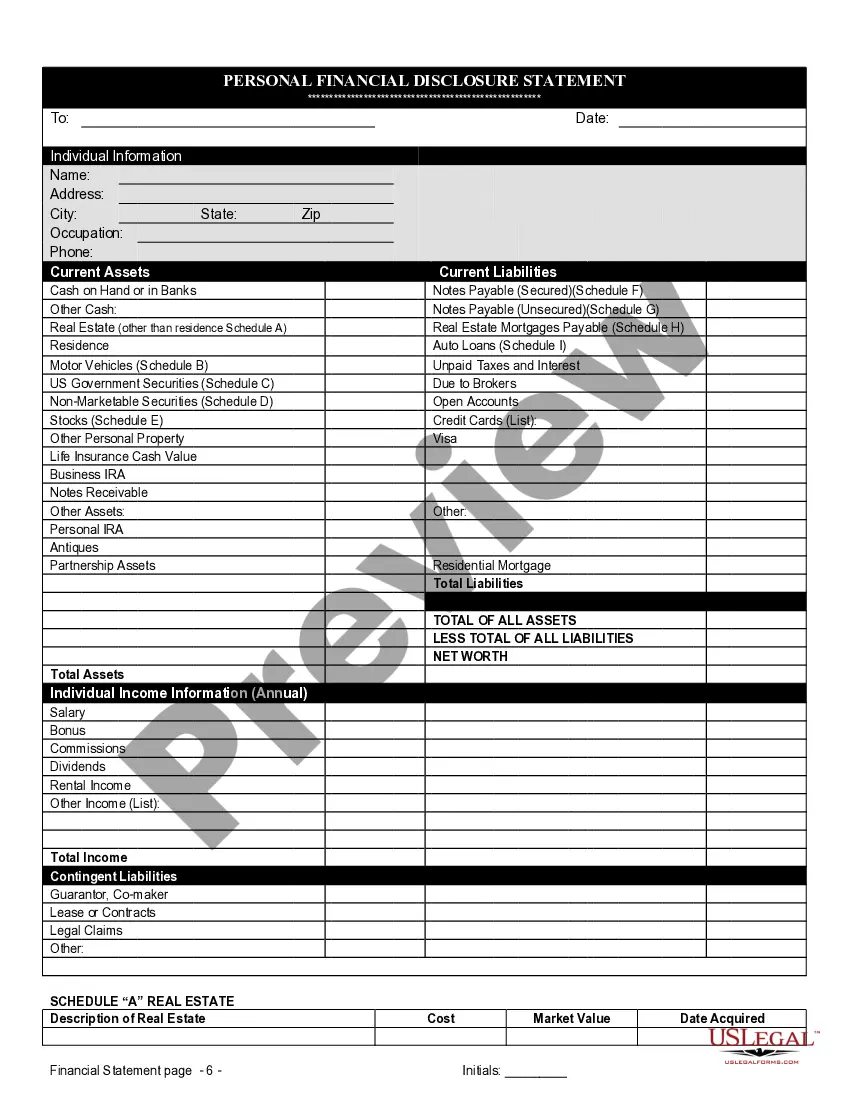

A financial statement form is a document that outlines your financial status. It details your income, expenses, assets, and liabilities. Completing a financial statement form is crucial when preparing legal documents, especially in situations involving Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement.

Rule 401 in Massachusetts pertains to the admissibility of evidence based on its relevance. This rule states that evidence is relevant if it makes a material fact more or less probable. In matters related to financial statements for prenuptial agreements, understanding Rule 401 can guide what information must be disclosed. Resources such as USLegalForms can assist you in ensuring compliance with such legal standards while preparing Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement.

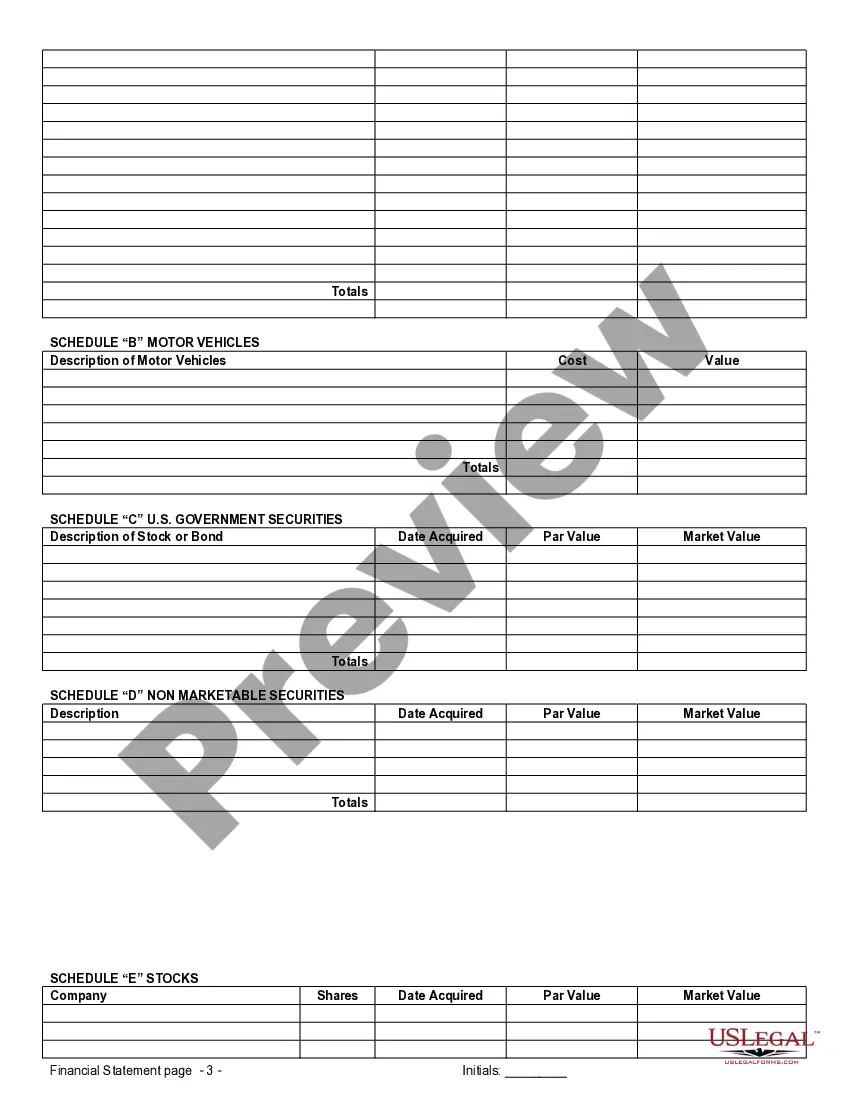

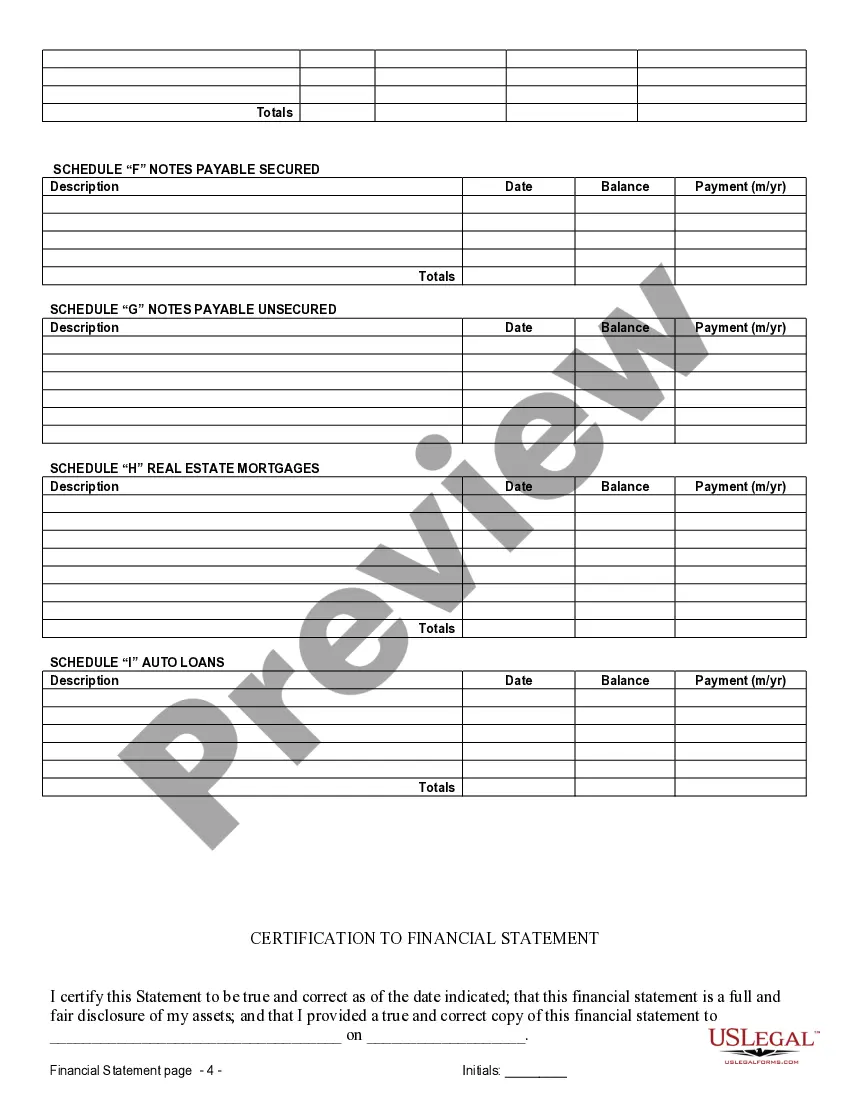

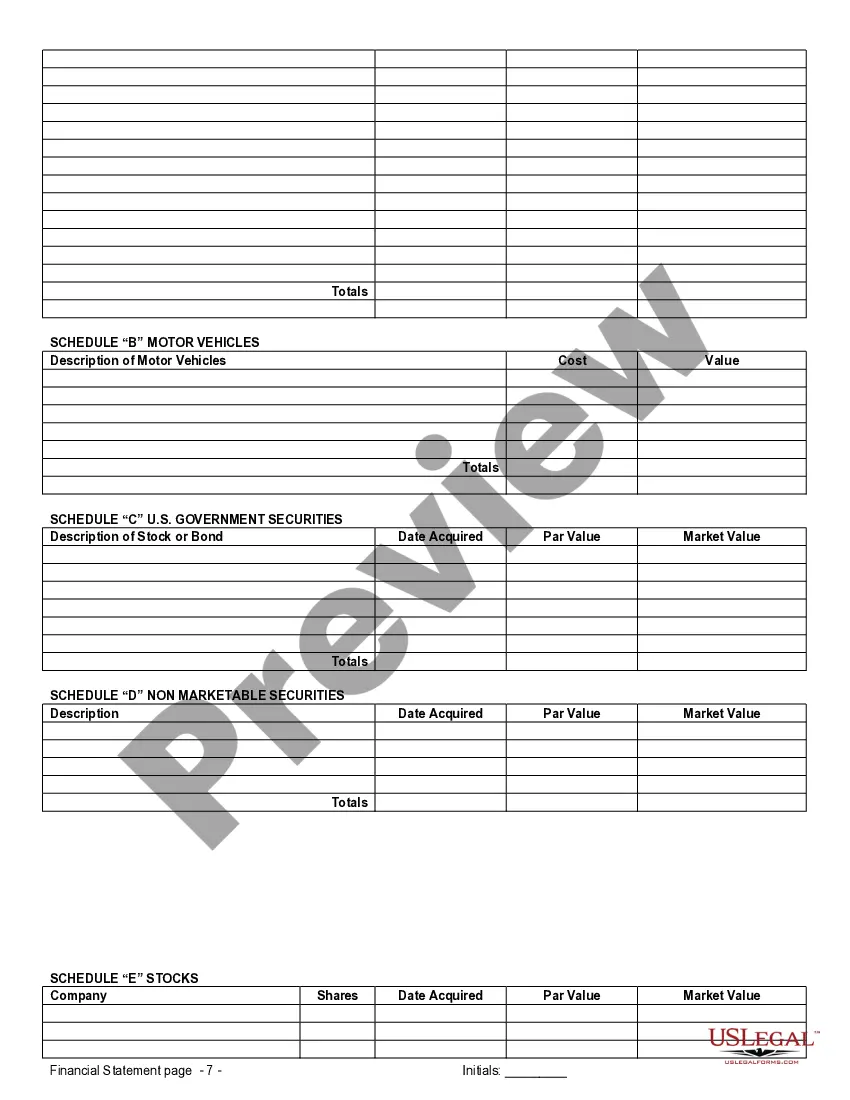

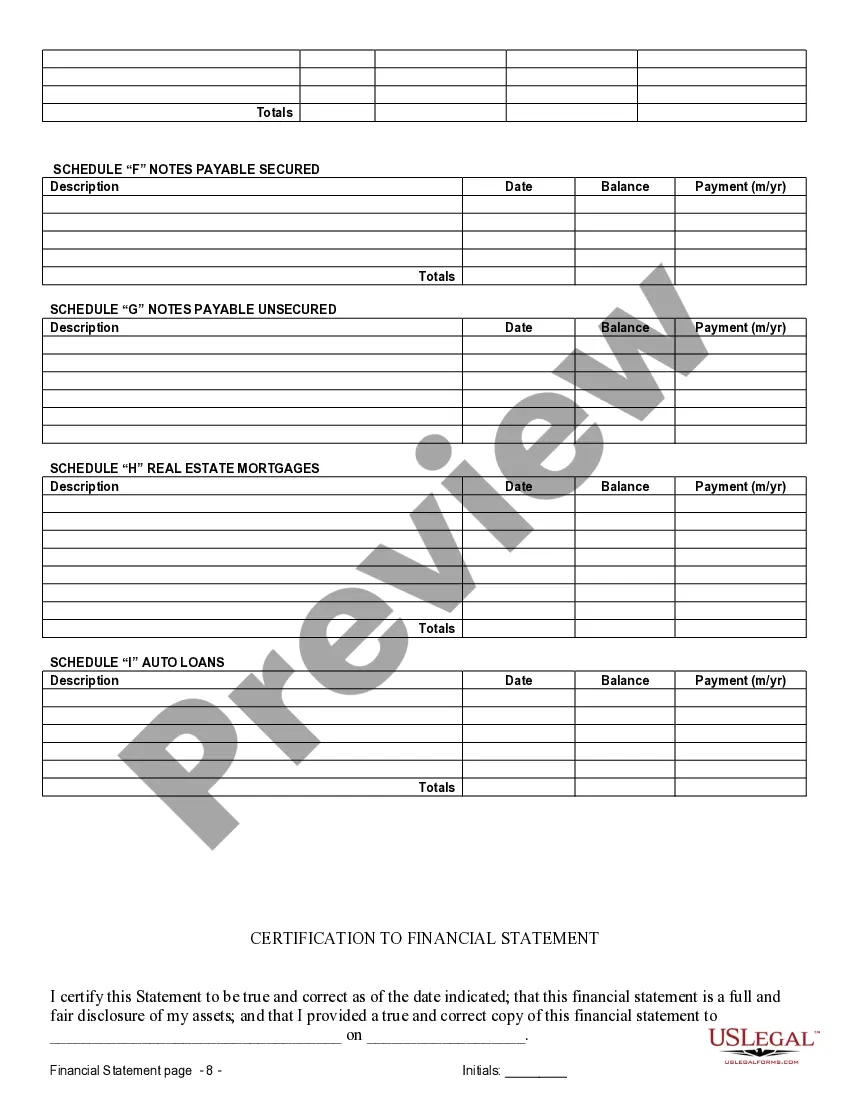

A financial schedule in a prenuptial agreement outlines the assets and debts each party brings to the marriage. This schedule helps define how finances will be handled both during and after the marriage. It is crucial for individuals in Middlesex, Massachusetts, to have a clear financial plan in place to avoid misunderstandings. USLegalForms can provide the necessary templates and support for completing Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement.

Filling out a long form of a financial statement involves detailed record-keeping and accurate completion of each section. Start by listing all sources of income, including salaries and investments. Next, document assets and liabilities, alongside their estimated values. For clarity and guidance, consider exploring USLegalForms to help you navigate the complexities of Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement.

Creating a prenuptial agreement requires specific documents to ensure full financial transparency. Essential documents include income statements, asset evaluations, and liability details. Additionally, both parties should provide tax returns and a list of savings accounts. Using USLegalForms can help streamline the process and ensure comprehensive Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement.

A financial statement holds significant importance in divorce proceedings. It provides a clear picture of each spouse's financial situation, which affects settlements and asset division. In Middlesex, Massachusetts, failing to accurately represent financial information can lead to challenges. Consequently, thorough documentation through resources like USLegalForms can enhance your approach to Middlesex Massachusetts Financial Statements only in Connection with Prenuptial Premarital Agreement.

Full financial disclosure in a prenuptial agreement involves transparent communication about each party's assets, debts, and income. This process protects both individuals and helps avoid future disputes. In Middlesex County, Massachusetts, understanding financial statements is essential to ensure all relevant information is shared. By utilizing USLegalForms, you can simplify this complex process.