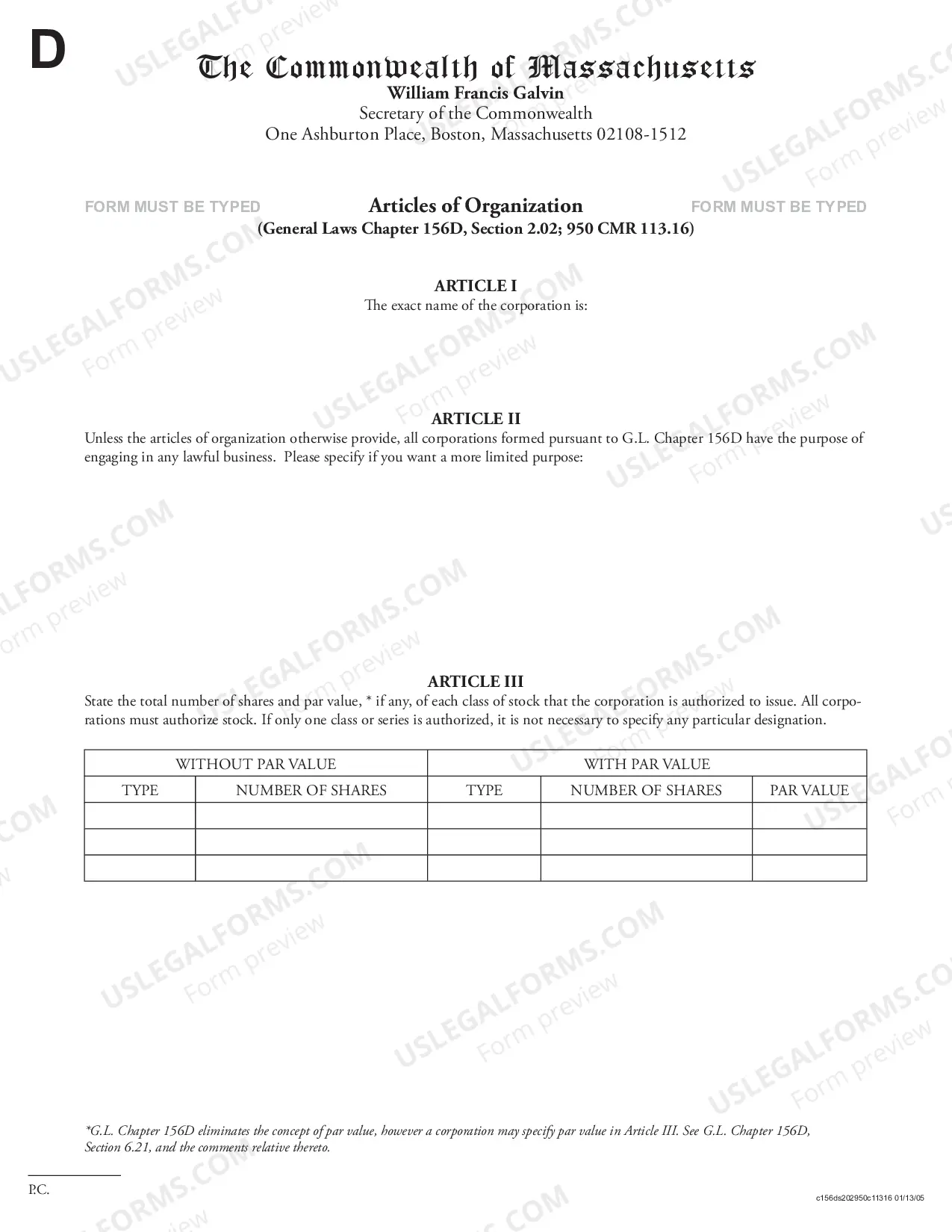

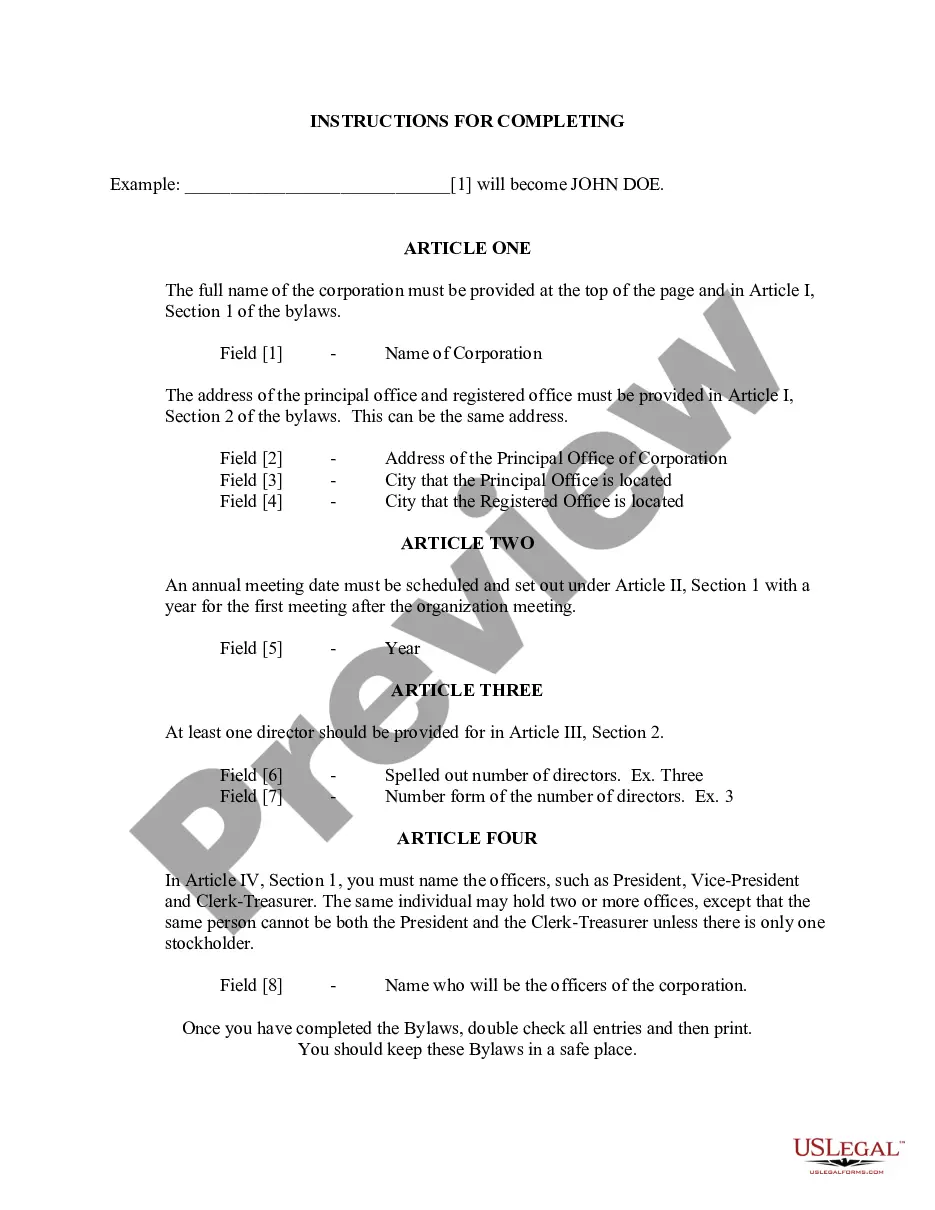

The Boston Massachusetts Articles of Organization for Domestic Nonprofit Corporation is a legal document that serves as the foundation for establishing a nonprofit organization within the state of Massachusetts. It outlines the fundamental details and structure of the entity and is required for official registration with the Massachusetts Secretary of the Commonwealth. The Articles of Organization contain several essential components. Firstly, they include the name of the nonprofit corporation, which must be unique and distinguishable from other entities already registered within the state. The chosen name should reflect the purpose or mission of the nonprofit and often includes terms like "foundation," "charitable," or "nonprofit." Additionally, the Articles of Organization specify the registered office address of the nonprofit. This address should be a physical location within the Commonwealth of Massachusetts where legal documents can be delivered and official correspondence received. The registered office must have a registered agent, who acts as a point of contact between the nonprofit and the state government. The purpose statement is another crucial element in the Articles of Organization. It outlines the primary goals and objectives of the nonprofit, highlighting its intended activities and charitable initiatives. This description helps determine the nonprofit's tax-exempt status and ensures that its activities align with state regulations governing nonprofit organizations. Furthermore, the document includes information about the initial directors who will oversee the nonprofit's operations. It typically requires the names, addresses, and signatures of the directors. There are various types of nonprofit corporations that can file Articles of Organization in Boston, Massachusetts, depending on their specific purposes and structures. Some of these types include: 1. 501(c)(3) Nonprofit Corporation: This is the most common type and is eligible for federal tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. 501(c)(3) organizations are required to operate exclusively for charitable, educational, religious, scientific, or literary purposes. 2. Religious Corporation: These are nonprofits organized primarily for religious purposes and may have specific requirements related to their beliefs and practices. 3. Educational Corporation: Nonprofits focused on educational endeavors, such as schools, colleges, or educational foundations, fall under this category. 4. Public Charities: These nonprofits are primarily engaged in charitable activities for the benefit of the public and often rely on public support and funding. 5. Foundations: Foundations are nonprofit organizations that typically provide grants, scholarships, or support to other charitable organizations. They may have private foundations or public charities' status. It is important to understand the specific requirements and regulations associated with each type of nonprofit when drafting and filing the Articles of Organization. Consulting with legal professionals or referring to the Massachusetts Nonprofit Corporation Act can provide detailed guidance on meeting all legal obligations during the formation process.

Boston Massachusetts Articles of Organization for Domestic Nonprofit Corporation

Description

How to fill out Boston Massachusetts Articles Of Organization For Domestic Nonprofit Corporation?

Utilize US Legal Forms and gain immediate access to any form template you need.

Our helpful website with a plethora of document templates makes it easy to locate and acquire nearly any document sample you require.

You can save, complete, and sign the Boston Massachusetts Articles of Organization for Domestic Nonprofit Corporation within minutes instead of spending hours online searching for an appropriate template.

Using our repository is an excellent approach to enhance the security of your document filing. Our experienced attorneys routinely review all documents to ensure that the forms are applicable to specific states and conform to recent laws and regulations.

If you haven't created an account yet, follow the instructions below.

Locate the template you need. Ensure that it is the correct template: review its title and description, and use the Preview feature if available. Otherwise, use the Search box to find the desired one.

- How can you obtain the Boston Massachusetts Articles of Organization for Domestic Nonprofit Corporation.

- If you have an account, simply Log In to your account. The Download option will be available for all the samples you view.

- Additionally, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

Go to the Secretary of State's Website in order to lookup a business entity (Corporation, LLC, Limited Partnership) in Massachusetts (Click Here to see if an entity name is available).

You can find information on any corporation or business entity in Massachusetts or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

Thus, SEC treats the Articles of Incorporation (AOI), By-Laws, and related documents as public records which are available to the public.

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by mail, in person, or online, but we recommend online. Online processing costs $15 and is sent out the next business day. Normal processing takes up to 5 days, plus additional time for mailing, and costs $12.

Trying to find information on a private Massachusetts company? The Massachusetts Secretary of State Corporation Records is a good place to start. You can search by entity, identification number, file number, or by individual.

You can get the Certificate of Organization form directly from the secretary of commonwealth website for Massachusetts. If you opt to file by mail, the applicable filing fee is $500. Make sure you complete all the steps if opting to file this way: Fill in the form by hand with black or blue ink, or on your computer.

You can get the Certificate of Organization form directly from the secretary of commonwealth website for Massachusetts. If you opt to file by mail, the applicable filing fee is $500. Make sure you complete all the steps if opting to file this way: Fill in the form by hand with black or blue ink, or on your computer.

The process of forming a corporation and filing Articles of Incorporation falls under Massachusetts statute G.L. c156D. Any information in the Articles of Incorporation/Articles of Organization will become part of the permanent public record.

Definition of Domestic Profit Corporations A domestic profit corporation operates in the country in which it began, whereas a foreign corporation operates in a country outside of its home country.