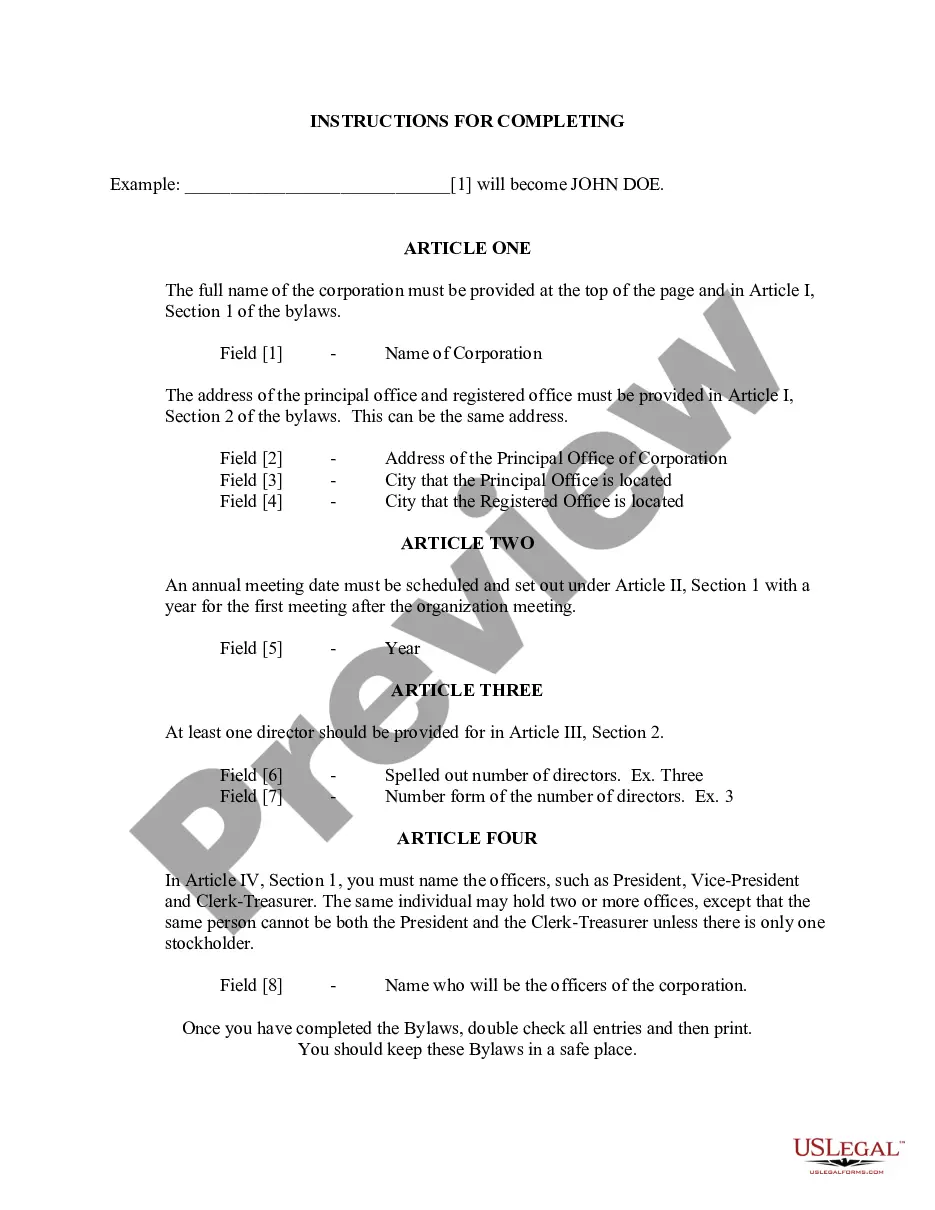

The Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation is a legal document that outlines the formation and establishment of a nonprofit corporation within the city. This document is required by the state of Massachusetts to be filed with the Secretary of the Commonwealth in order to officially form a nonprofit organization. The Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation consist of several important sections that include: 1. Name and Purpose: The document begins by stating the name of the nonprofit corporation and its primary purpose. This section defines the mission and goals of the organization, highlighting its charitable, educational, religious, scientific, or other nonprofit activities. 2. Principal Office and Agent: The Articles specify the principal office address of the nonprofit corporation within Cambridge. Additionally, the document identifies the name and address of the registered agent who will act as the official representative of the organization to receive legal documents and notices. 3. Members or Directors: This section outlines whether the nonprofit corporation will have members or be managed by a board of directors. It details the qualifications, responsibilities, and eligibility criteria for members or directors and may specify the number of directors if applicable. 4. Powers: Here, the Articles enumerate the powers and authorities granted to the nonprofit corporation. These powers typically include the ability to conduct fundraising activities, employ staff, acquire and dispose of assets, and engage in other activities necessary to fulfill its stated purpose. 5. Dissolution: The document outlines the procedures for the dissolution or winding up of the nonprofit corporation, including the distribution of its remaining assets in accordance with applicable laws and regulations. 6. Amendments: This section details the process for making changes or amendments to the Articles of Organization. It may specify the approval required, such as a majority or super majority vote of the members or board of directors. In addition to the general Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation, there may be variations or additional documents associated with specific types of nonprofit corporations in Cambridge. Some of these variations may include: 1. Cambridge Massachusetts Articles of Organization for Charitable Nonprofit Corporation: These are specific Articles tailored for organizations dedicated to charitable activities such as poverty alleviation, education, healthcare, or environmental conservation. 2. Cambridge Massachusetts Articles of Organization for Religious Nonprofit Corporation: These Articles are designed for nonprofit organizations focused on religious, spiritual, or faith-based activities. 3. Cambridge Massachusetts Articles of Organization for Educational Nonprofit Corporation: These Articles are applicable to nonprofit organizations primarily engaged in educational activities, such as schools, colleges, universities, or research institutions. It is crucial to consult the Cambridge city guidelines and legal counsel to determine the right set of Articles of Organization based on the specific nature and purpose of the nonprofit corporation being established in Cambridge, Massachusetts.

Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation

Description

How to fill out Cambridge Massachusetts Articles Of Organization For Domestic Nonprofit Corporation?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s world. Very often, it’s almost impossible for a person with no law education to create such papers cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform offers a huge collection with over 85,000 ready-to-use state-specific forms that work for practically any legal case. US Legal Forms also is an excellent asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation in minutes employing our trusted platform. In case you are already a subscriber, you can go on and log in to your account to download the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps before obtaining the Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation:

- Be sure the form you have chosen is specific to your area because the rules of one state or county do not work for another state or county.

- Preview the document and read a brief outline (if available) of cases the paper can be used for.

- In case the one you selected doesn’t meet your needs, you can start again and look for the necessary document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your credentials or register for one from scratch.

- Choose the payment gateway and proceed to download the Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation as soon as the payment is done.

You’re all set! Now you can go on and print out the document or complete it online. If you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.

Form popularity

FAQ

No, a domestic non-profit corporation and a 501(c)(3) organization are not the same, although they often overlap. A domestic non-profit corporation focuses on state-level registration, while 501(c)(3) status is a federal designation that provides certain tax benefits. For your domestic nonprofit corporation to benefit from tax exemptions through the IRS, you must apply separately for 501(c)(3) status after filing the Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation. Understanding this distinction helps clarify your organization's potential advantages.

A domestic non-profit corporation is a legal organization formed under state laws to operate for charitable, educational, religious, or other public purposes within the U.S. This type of corporation must file the Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation to gain legal status. It provides a structured way to serve the community while limiting personal liability and securing potential tax exemptions. This is an excellent model for individuals looking to make a difference in their local area.

A nonprofit generally refers to any organization that operates without the goal of making a profit, while a nonprofit corporation is a specific legal entity formed to engage in charitable activities and protect its members. The Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation provide a framework for establishing this legal entity, ensuring compliance with state regulations. By becoming a nonprofit corporation, you gain legal protections and tax benefits that a general nonprofit lacks.

A domestic nonprofit corporation is an entity organized for a public or mutual benefit purpose, without the intention of making a profit. In contrast, a nonprofit cooperative corporation is owned and operated by its members, who benefit directly from its services. The Cambridge Massachusetts Articles of Organization for Domestic Nonprofit Corporation focus more on public interest activities rather than member benefits. Understanding these differences can help you choose the right structure for your nonprofit goals.

Nonprofits in Massachusetts must file various documents, including their articles of organization, initial reports, and annual financial statements. Additionally, if seeking 501(c)(3) status, they must comply with IRS requirements. Staying organized and up-to-date on filing deadlines is crucial to maintaining compliance. To simplify the filing process, consider using the templates and resources provided by USLegalForms.

While it is possible to start and run a nonprofit as an individual, most nonprofits benefit from having a board of directors to provide oversight and support. A board allows for diverse perspectives and shared responsibilities, enhancing the organization’s effectiveness. If you need guidance on structuring your nonprofit, resources from USLegalForms can help you establish your governance framework.

Incorporation is not strictly required for a nonprofit organization, but it offers significant advantages. By incorporating, your nonprofit gains legal recognition and limited liability protection for its directors and officers. Moreover, incorporation can enhance your fundraising capabilities and lend credibility to your organization. Using platforms like USLegalForms can assist you in understanding the benefits and navigating the incorporation process.

To register a nonprofit organization in Massachusetts, you must file articles of organization with the Secretary of the Commonwealth. This includes providing details such as the organization’s name, purpose, and structure. After approval, you can apply for tax-exempt status at the federal level. For a smooth registration, explore the templates available on USLegalForms to guide you through each step.

Articles of incorporation and 501(c)(3) status are distinct but interconnected. Articles of incorporation are the foundational documents required to legally establish a nonprofit corporation in Cambridge, Massachusetts. On the other hand, 501(c)(3) status is a tax-exempt designation that your organization can apply for after incorporation. To fully understand this process, consider resources offered by USLegalForms.

A domestic nonprofit corporation can become a 501(c)(3) organization, but they are not the same. A domestic nonprofit corporation is the legal structure that governs an organization, while 501(c)(3) status provides federal tax-exempt status. To achieve 501(c)(3) designation, your organization must apply to the IRS and meet specific criteria. Using services from platforms like USLegalForms can help streamline this process.