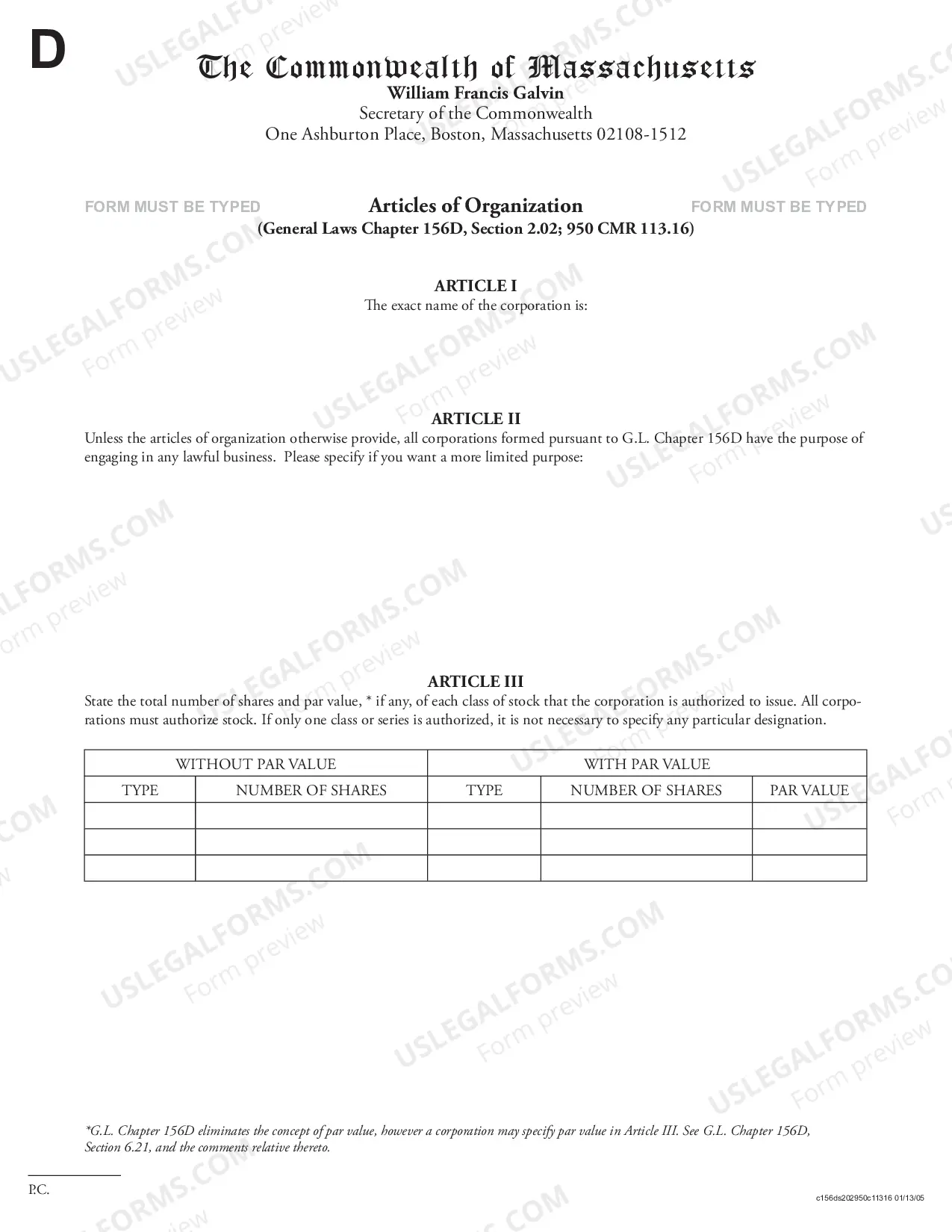

The Lowell Massachusetts Articles of Organization for Domestic Nonprofit Corporation is a legal document that establishes and governs the formation of a nonprofit organization in the city of Lowell, Massachusetts. This document is required by the Massachusetts Secretary of the Commonwealth to be filed in order to obtain legal recognition and status as a nonprofit corporation. The Articles of Organization play a vital role in outlining the key details and purpose of the nonprofit entity. It provides a comprehensive description of the organization's mission, objectives, and activities. The document also specifies the names and addresses of the incorporates, who are the individuals responsible for initiating the formation of the nonprofit corporation. In addition to the mandatory elements, there are different types of Lowell Massachusetts Articles of Organization for Domestic Nonprofit Corporation that can be filed, depending on the specific needs and goals of the organization. Some of these include: 1. General Purpose Nonprofit: This type of organization operates for charitable, educational, religious, literary, scientific, or benevolent purposes as defined by the Internal Revenue Service (IRS). These nonprofits are commonly established to benefit the community and address various social issues. 2. Public Charity Nonprofit: A public charity nonprofit focuses on providing services, benefits, and support to the public. These organizations typically rely on a diverse range of funding sources and contributions from the public. 3. Private Foundation: A private foundation is a charitable organization that is primarily funded by a family, an individual, or a corporation. It functions to distribute its income or assets for charitable purposes, but it operates separately from the public. 4. Membership Organization: A membership organization is a nonprofit corporation that grants membership to individuals who contribute dues or fees. These nonprofits often aim to serve the specific needs and interests of their members, who may have voting rights and receive benefits. 5. Religious Corporation: This type of nonprofit corporation is established exclusively for religious, spiritual, or faith-based purposes. It may provide religious services, promote religious teachings, and engage in related activities. Before filing the Articles of Organization, it is important to consult with legal professionals or seek guidance from the Massachusetts Secretary of the Commonwealth to ensure compliance with all relevant laws and regulations. Additionally, organizations may need to include specific keywords or phrases in their Articles of Organization to accurately reflect their purpose and activities, such as "charitable," "educational," "nonpartisan," or "advocacy," depending on their focus.

Lowell Massachusetts Articles of Organization for Domestic Nonprofit Corporation

Description

How to fill out Lowell Massachusetts Articles Of Organization For Domestic Nonprofit Corporation?

No matter the social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s practically impossible for a person with no law education to create such papers from scratch, mainly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our platform offers a massive collection with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Lowell Massachusetts Articles of Organization for Domestic Nonprofit Corporation or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Lowell Massachusetts Articles of Organization for Domestic Nonprofit Corporation quickly employing our reliable platform. In case you are already a subscriber, you can go on and log in to your account to download the needed form.

However, in case you are unfamiliar with our platform, make sure to follow these steps before downloading the Lowell Massachusetts Articles of Organization for Domestic Nonprofit Corporation:

- Be sure the template you have chosen is suitable for your location considering that the rules of one state or county do not work for another state or county.

- Preview the document and go through a brief description (if provided) of scenarios the document can be used for.

- In case the form you selected doesn’t meet your requirements, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- utilizing your credentials or create one from scratch.

- Select the payment gateway and proceed to download the Lowell Massachusetts Articles of Organization for Domestic Nonprofit Corporation as soon as the payment is completed.

You’re good to go! Now you can go on and print out the document or fill it out online. In case you have any problems getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.