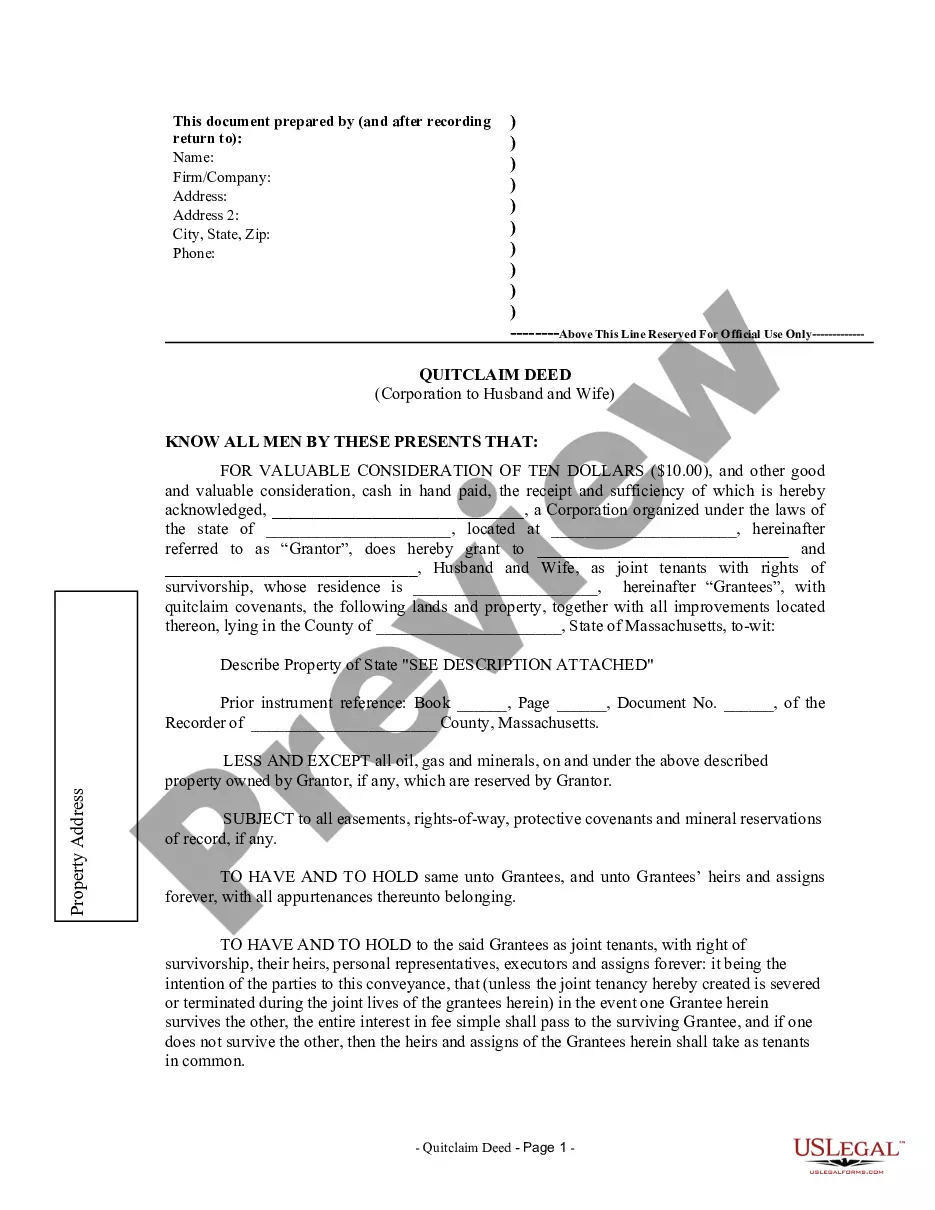

Boston Massachusetts Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Massachusetts Quitclaim Deed From Corporation To Husband And Wife?

Obtaining verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms repository.

It is an online compilation of over 85,000 legal documents catering to both personal and professional requirements as well as various real-life situations.

All the files are systematically sorted by usage area and jurisdiction, making it simple and swift to find the Boston Massachusetts Quitclaim Deed from Corporation to Husband and Wife.

Maintaining organized paperwork that complies with legal standards is crucial. Leverage the US Legal Forms library to always have essential document templates readily available for any needs!

- Examine the Preview mode and document description.

- Ensure you’ve selected the correct document that fulfills your needs and fully aligns with your local jurisdiction standards.

- Look for another template if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate document.

- Once satisfied, proceed to the next step.

Form popularity

FAQ

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

The quitclaim deed is the most commonly used deed in the purchase and sale of residential property in Massachusetts. It plays a fundamental role in the types of assurances the seller makes when transferring its rights, and in how the buyer takes title.

A Massachusetts quit claim deed is used to legally transfer land and buildings in Massachusetts from a grantor (seller) to a grantee (buyer). A quit claim deed is different from a warranty deed in that it does not provide any warranty as to whether or not the title is clear before the grantor bought the property.

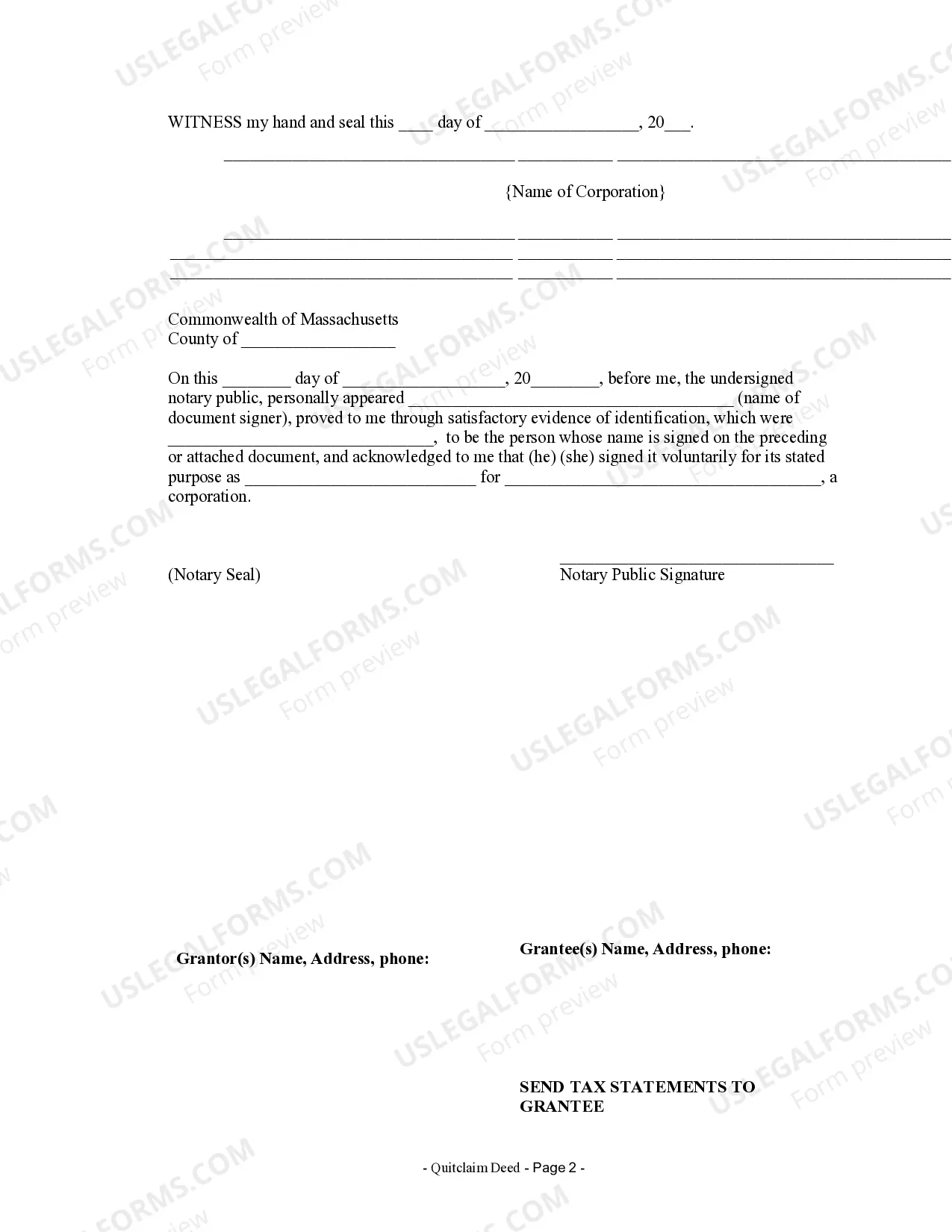

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

The registry of deeds charges a fee of $125 to record the deed which the buyer pays. All deeds must be notarized by a notary public who must verify the sellers' identification through a state issued driver's license or acceptable form of identification.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

One good reason to add a spouse to the deed of your home is for estate planning purposes, which may allow the property to transfer to your spouse outside the probate process, depending on the transfer language utilized in the granting clause. Another reason is for creditor purposes.

In order to change the owner(s) of record name(s) from maiden name to married name, a Marriage Certificate must be recorded at the Hampshire County Registry of Deeds. A deed must be recorded to add a spouse as an owner of record.

To change the names on a real estate deed, you will need to file a new deed with the Division of Land Records in the Circuit Court for the county where the property is located. The clerk will record the new deed.