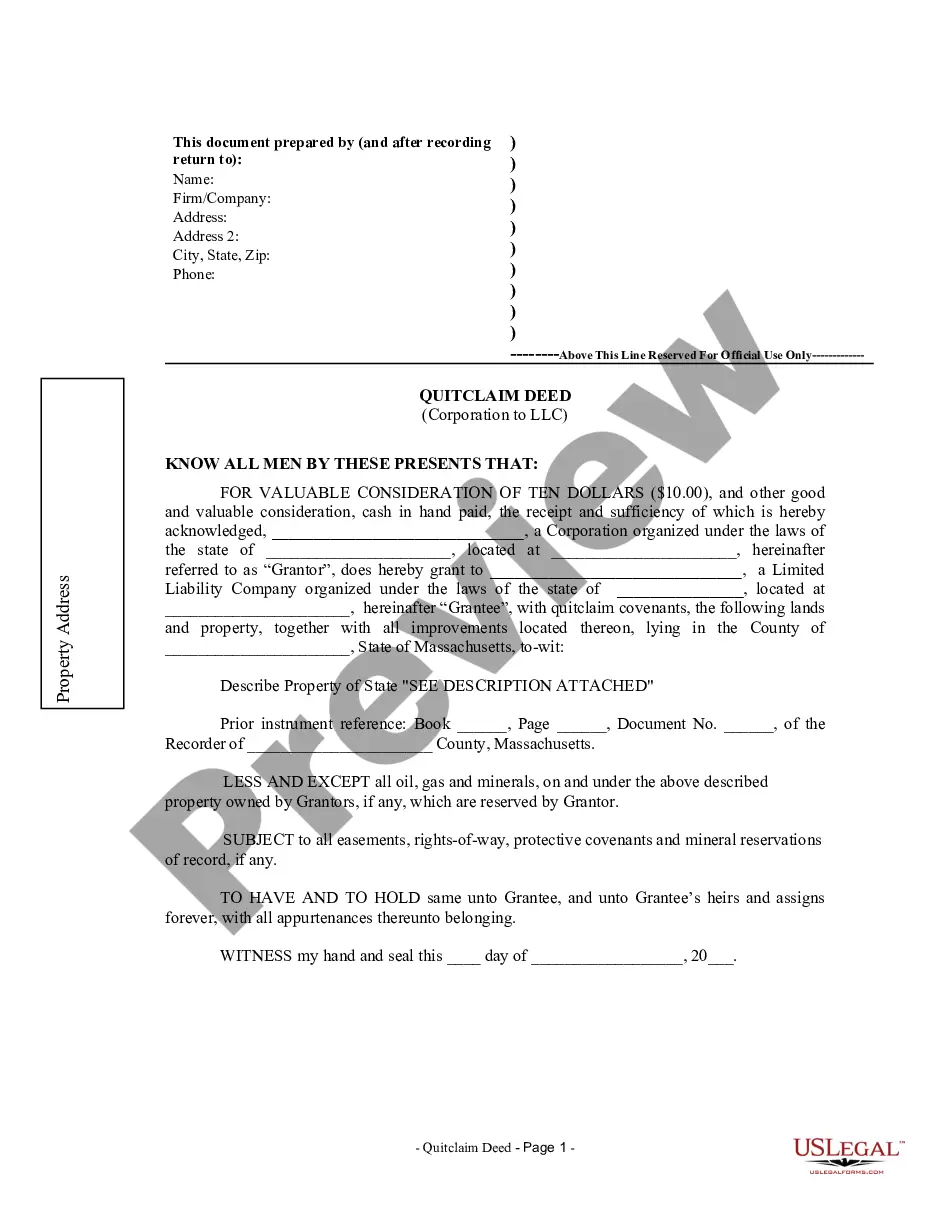

Boston Massachusetts Quitclaim Deed from Corporation to LLC

Description

How to fill out Massachusetts Quitclaim Deed From Corporation To LLC?

Utilize the US Legal Forms and gain immediate access to any document you need.

Our advantageous website featuring thousands of document templates allows you to easily locate and obtain nearly any document sample you might require.

You can download, complete, and sign the Boston Massachusetts Quitclaim Deed from Corporation to LLC in just a few minutes instead of spending hours on the Internet searching for the correct template.

Using our catalog is an excellent approach to enhance the security of your document submissions. Our professional attorneys routinely review all documents to ensure that the forms are applicable to a specific state and adhere to updated laws and regulations.

If you haven’t created an account yet, follow the steps outlined below.

- How can you obtain the Boston Massachusetts Quitclaim Deed from Corporation to LLC.

- If you possess a subscription, simply Log In to your account. The Download option will become visible on all samples you examine.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

The alternative spellings quit claim deed and quit-claim deed are generally acceptable?though used less frequently. Oklahoma legal professionals also use the word quitclaim as a verb indicating that an owner is transferring an interest without warranty. Release deed can be a synonym for quitclaim deed in some contexts.

How to File a Quitclaim Deed Obtain a quitclaim deed form. Your very first step is obtaining your quitclaim deed.Fill out the quitclaim deed form.Get the quitclaim deed notarized.Take the quitclaim deed to the County Recorder's Office.File the appropriate paperwork.

Per Massachusetts General Law Chapter 183 § 4, quitclaim deeds must be filed with the Registry of Deeds Office in the county where the property is located.

A Massachusetts quit claim deed is used to legally transfer land and buildings in Massachusetts from a grantor (seller) to a grantee (buyer). A quit claim deed is different from a warranty deed in that it does not provide any warranty as to whether or not the title is clear before the grantor bought the property.

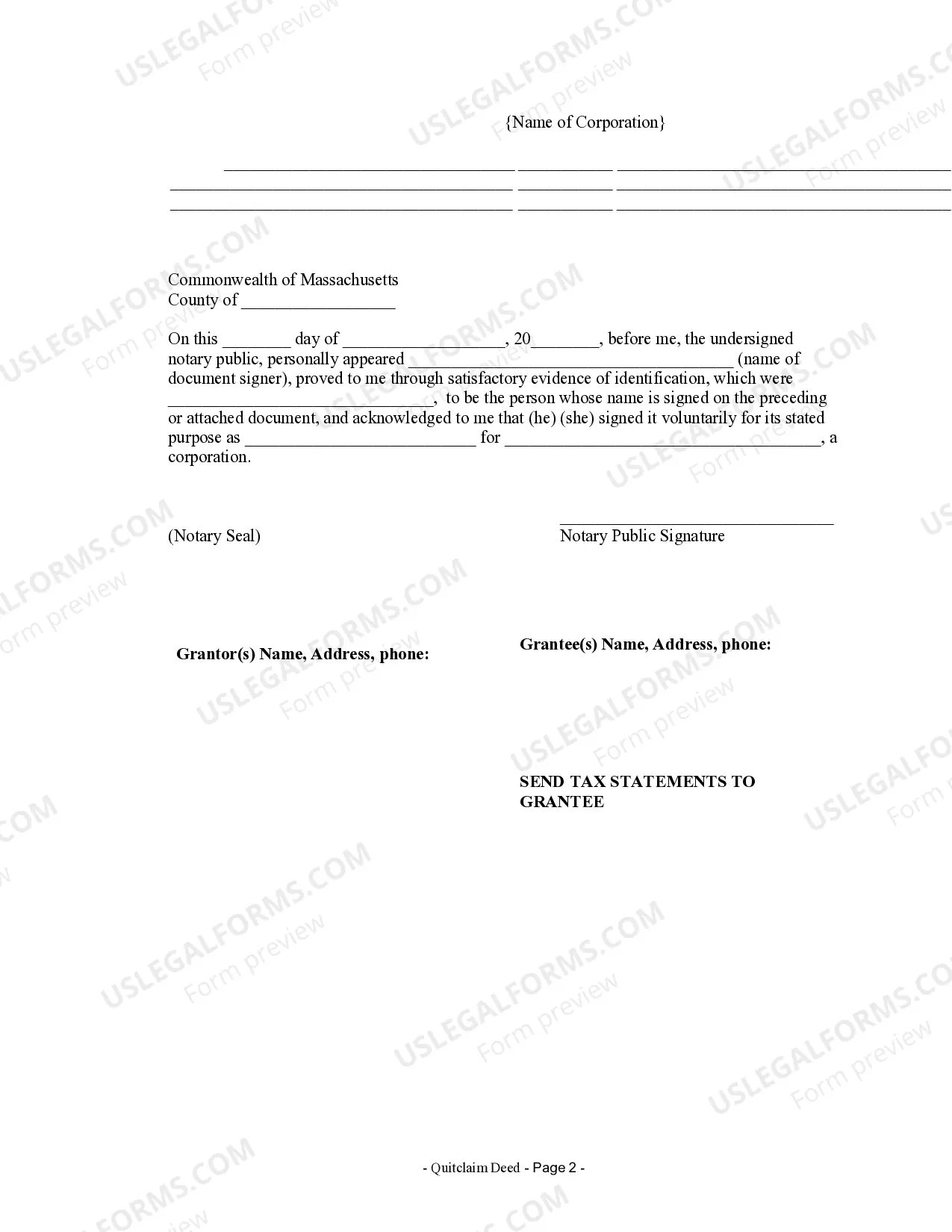

Most deeds are signed by the corporation's president and treasurer. This may be, and often is, one and the same person. A less common method of signing is to have the corporation hold a meeting and cast a vote authorizing someone other than a corporate office to sign real estate documents.

The registry of deeds charges a fee of $125 to record the deed which the buyer pays. All deeds must be notarized by a notary public who must verify the sellers' identification through a state issued driver's license or acceptable form of identification.

How to Write a Massachusetts Quitclaim Deed Preparer's name and address. Name and address of the person to whom the recorded property deed should be returned. County where the property is located. The consideration paid for the property. Grantee's name and address. The legal description of the property.

The quitclaim deed is the most commonly used deed in the purchase and sale of residential property in Massachusetts. It plays a fundamental role in the types of assurances the seller makes when transferring its rights, and in how the buyer takes title.