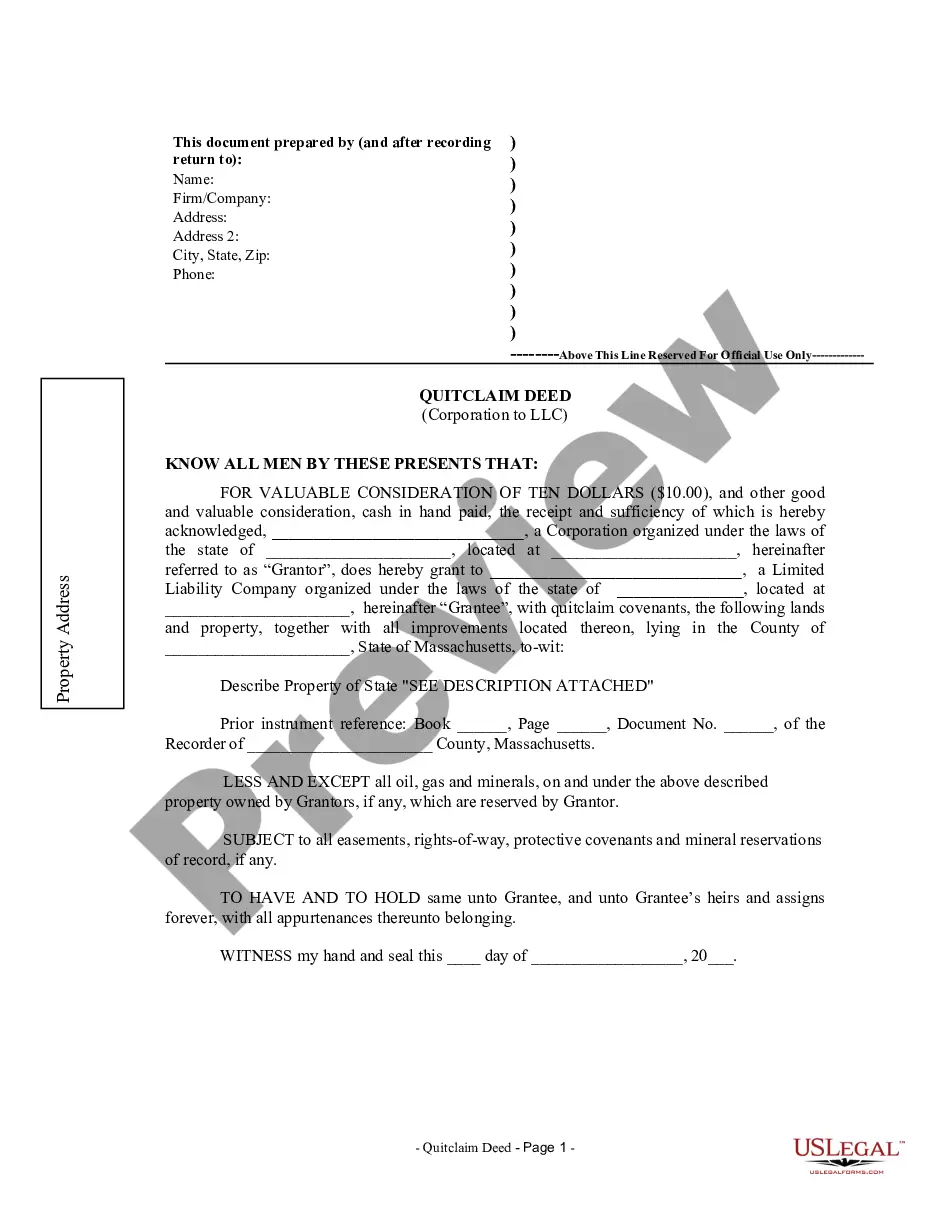

Cambridge Massachusetts Quitclaim Deed from Corporation to LLC

Description

How to fill out Massachusetts Quitclaim Deed From Corporation To LLC?

If you have previously utilized our service, sign in to your account and store the Cambridge Massachusetts Quitclaim Deed from Corporation to LLC on your device by clicking the Download button. Ensure your subscription is active. Otherwise, renew it according to your billing plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You have continuous access to all paperwork you have purchased: you can locate it in your profile under the My documents section whenever you wish to reuse it. Utilize the US Legal Forms service to quickly search for and save any template for your personal or professional requirements!

- Ensure you’ve found an appropriate document. Review the description and use the Preview option, if accessible, to verify if it suits your requirements. If it doesn’t match, use the Search tab above to find the correct one.

- Buy the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Create an account and process a payment. Enter your credit card information or use the PayPal option to finalize the purchase.

- Acquire your Cambridge Massachusetts Quitclaim Deed from Corporation to LLC. Choose the file format for your document and save it onto your device.

- Complete your template. Print it off or utilize professional online editors to fill it in and sign it electronically.

Form popularity

FAQ

While transferring a property to your LLC might seem advantageous, it does not inherently exempt you from capital gains tax. The IRS treats these transactions as taxable events, despite the ownership structure. It is vital to consult with a tax advisor and consider using a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC for any property transfers.

One major disadvantage of placing a property in an LLC is the potential for higher costs and taxes. While it provides liability protection, it may subject you to additional fees, such as annual franchise taxes. Understanding these implications is key, especially when considering a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC.

Many people place their property in an LLC for liability protection and asset management. An LLC separates personal assets from business liabilities, offering peace of mind. Additionally, it can streamline the transfer process, as seen in a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC, making future dealings more efficient.

Yes, you can create a quitclaim deed on your own, especially for a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC. However, it's important to ensure that you understand the legal requirements in your state. Utilizing platforms like US Legal Forms can simplify the process, providing templates and guidance to ensure that your deed is correctly executed and filed.

Transferring deeds to an LLC involves creating a new quit claim deed that reflects the new ownership structure. In the case of a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC, you'll prepare the deed, sign it, and then file it with your local registry. It’s essential to maintain proper records to document the transfer. To assist you in this process, consider using USLegalForms for the necessary templates and guidance.

Yes, you can complete a quit claim deed yourself if you have a good understanding of how it works. For a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC, you will need to follow specific procedures and ensure you fill out the deed correctly. However, using platforms like USLegalForms can simplify the process and help you avoid common pitfalls. This way, you can ensure that your deed meets all legal requirements.

To transfer personal assets to your LLC, you must execute a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC. Begin by preparing the deed, which will require you to list the assets and specify the entity transferring them. After completing the deed, file it with the appropriate local authority to make the transfer official. It's wise to consult legal resources or platforms like USLegalForms to ensure your transfer adheres to local laws.

To successfully execute a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC, you must meet several requirements. First, you need to ensure that the deed includes clear identification of both the grantor and grantee. Additionally, the deed should describe the property accurately and be signed by the grantor in the presence of a notary public. Finally, after completion, the deed must be recorded in the appropriate county registry of deeds to ensure it is legally recognized.

A Cambridge Massachusetts Quitclaim Deed from Corporation to LLC can come with several concerns. One primary issue is the lack of warranties, meaning the grantor does not assure the grantee of the property's title quality. This uncertainty can lead to disputes or challenges later. To avoid potential problems, using resources like US Legal Forms can be beneficial, guiding you through the process and helping you understand all implications.

Yes, you can complete a Cambridge Massachusetts Quitclaim Deed from Corporation to LLC on your own. However, doing so can be complex and may involve specific legal requirements that you need to fulfill. While many individuals choose to proceed independently, using a professional platform like US Legal Forms can provide guidance and ensure accuracy in your deed.