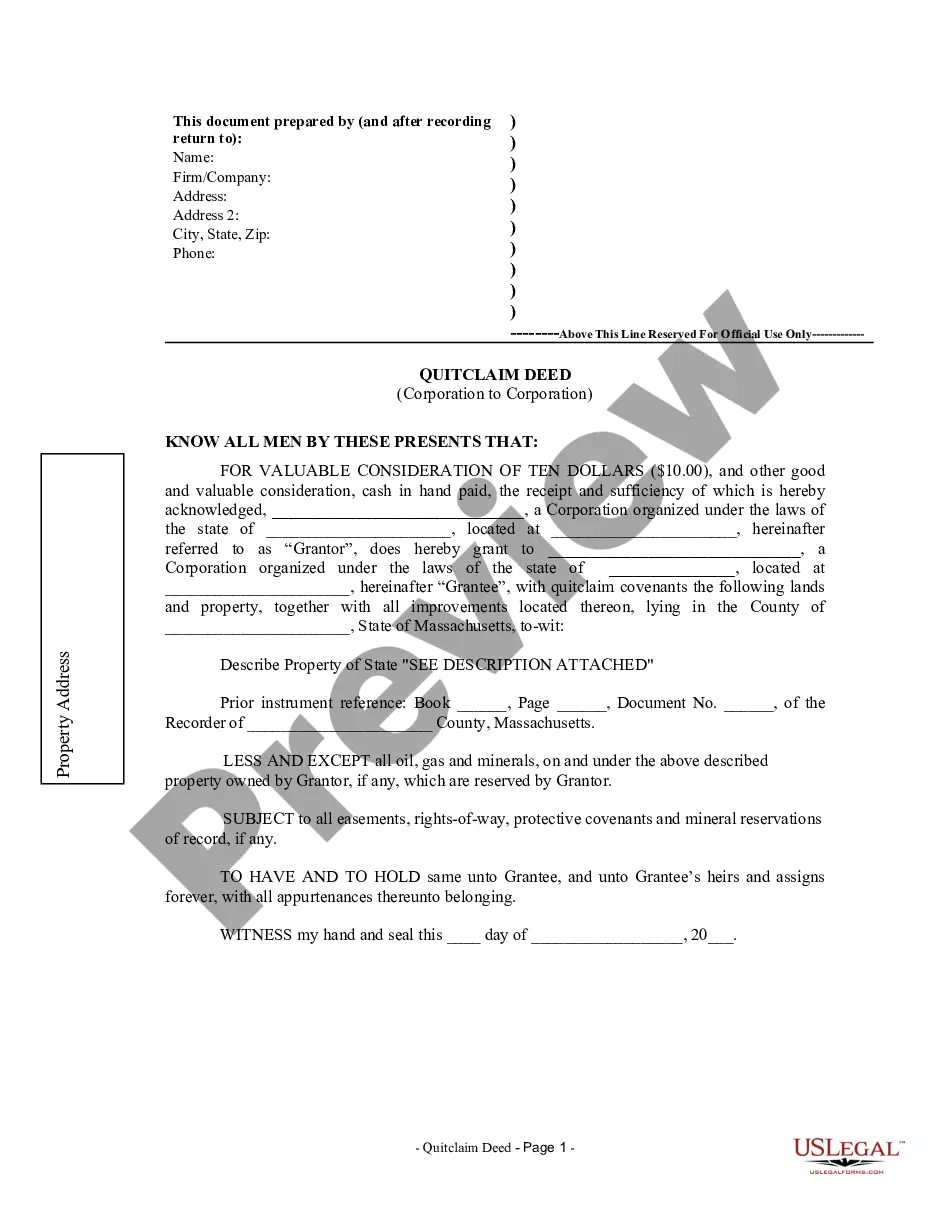

A Boston Massachusetts Quitclaim Deed from Corporation to Corporation is a legal document transferring property ownership rights between two corporate entities. This type of deed is commonly used when a corporation wants to transfer its property interests to another corporation without making any warranties regarding the title of the property. A quitclaim deed is a legal instrument used to transfer a property owner's interest, rights, and claims to another party. Unlike a warranty deed, a quitclaim deed does not provide any guarantees or assurances about the title's validity. It only transfers the interest that the granter (the corporation) may have in the property, if any. When a quitclaim deed is used to transfer property ownership from one corporation to another in Boston, Massachusetts, certain legal requirements must be met. The deed must contain the correct legal description of the property, including its boundaries and location. It must also clearly identify the participating corporations, including their legal names and addresses. In Boston, there may be different variations of the Quitclaim Deed from Corporation to Corporation, such as: 1. Statutory Form: This is a standard template provided by the Massachusetts General Laws that can be used in a quitclaim deed from one corporation to another. It ensures compliance with the legal requirements and simplifies the transfer process. 2. Fee or Tax Deed: This type of quitclaim deed is used when the transfer involves the payment of outstanding taxes or fees related to the property by the grantee corporation. It may be necessary to clear any outstanding liabilities before the transfer can be completed. 3. Merger or Acquisition Deed: This type of quitclaim deed is used when a corporation is undergoing a merger or acquisition process. It allows for the seamless transfer of property ownership between the acquiring and acquired corporations. The Boston Massachusetts Quitclaim Deed from Corporation to Corporation must be executed with the appropriate legal formalities. This typically involves the presence of a notary public or another authorized official who witnesses the signing of the deed by the authorized representatives of both corporations. The deed must then be recorded in the appropriate county registry of deeds or with the Massachusetts Secretary of the Commonwealth to provide public notice of the transfer. It is crucial for both corporations involved in the transaction to seek legal advice and conduct thorough due diligence to protect their interests. Consulting with real estate attorneys, title companies, or other professionals experienced in property transactions can ensure that all legal requirements are met and potential risks are adequately addressed.

Boston Massachusetts Quitclaim Deed from Corporation to Corporation

Description

How to fill out Boston Massachusetts Quitclaim Deed From Corporation To Corporation?

If you are looking for a valid form template, it’s extremely hard to choose a better place than the US Legal Forms website – probably the most extensive online libraries. Here you can get a large number of form samples for company and individual purposes by types and regions, or keywords. Using our advanced search option, discovering the latest Boston Massachusetts Quitclaim Deed from Corporation to Corporation is as elementary as 1-2-3. Furthermore, the relevance of each and every file is confirmed by a team of expert attorneys that regularly review the templates on our platform and update them in accordance with the latest state and county requirements.

If you already know about our platform and have an account, all you should do to get the Boston Massachusetts Quitclaim Deed from Corporation to Corporation is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the sample you want. Read its information and use the Preview feature (if available) to see its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to get the appropriate record.

- Affirm your decision. Select the Buy now option. After that, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the template. Pick the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Boston Massachusetts Quitclaim Deed from Corporation to Corporation.

Every template you save in your account has no expiry date and is yours permanently. You always have the ability to access them via the My Forms menu, so if you need to get an additional version for editing or printing, you may return and save it once again whenever you want.

Make use of the US Legal Forms extensive library to get access to the Boston Massachusetts Quitclaim Deed from Corporation to Corporation you were looking for and a large number of other professional and state-specific samples in a single place!