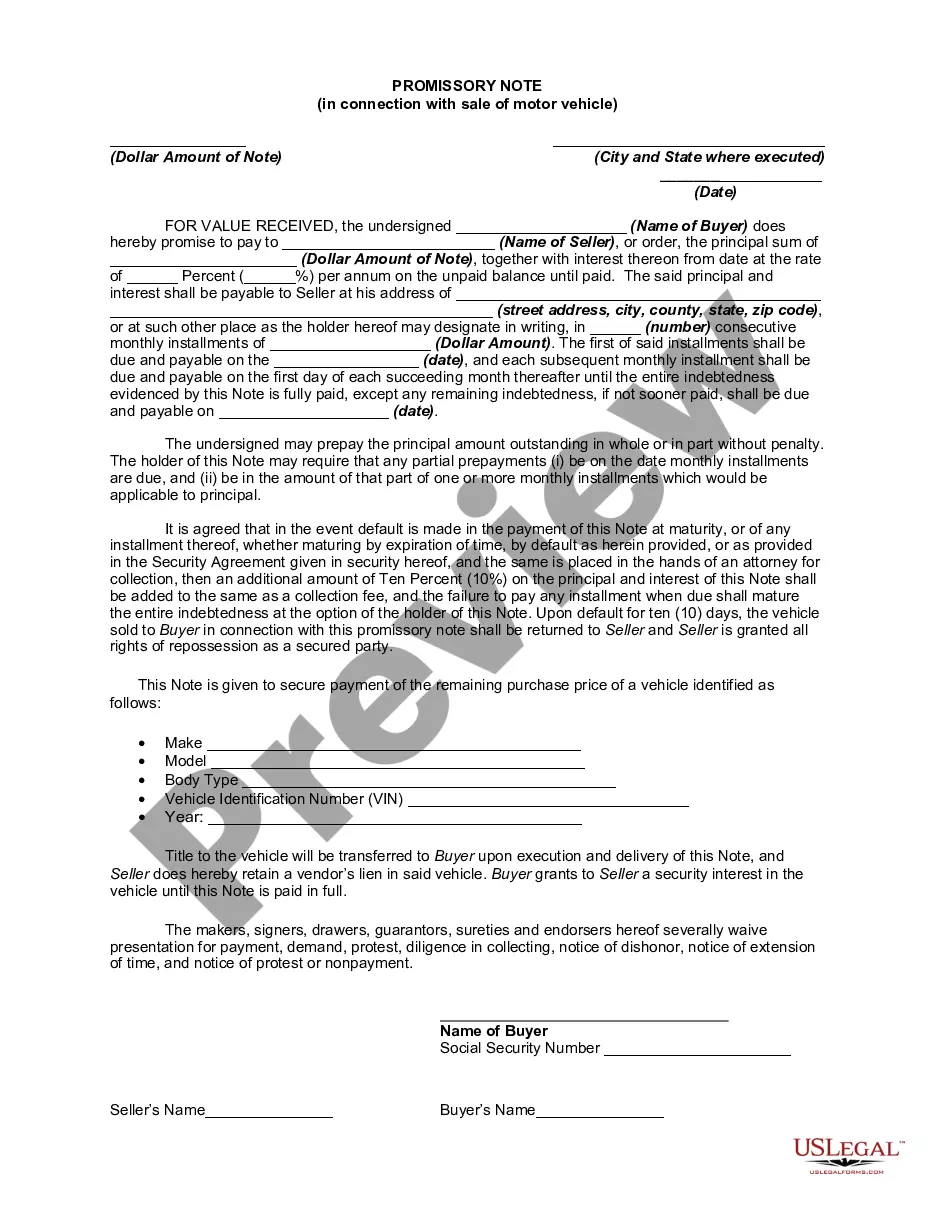

This note may be used in connection with a purchase of a motor vehicle in Massachusetts and reserves a vendor's lien in favor of the Seller.

A Boston Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and seller. It serves as evidence of the debt owed by the buyer to the seller, specifying the repayment terms and interest rate for the loan. Keywords: Boston Massachusetts, promissory note, loan, sale, motor vehicle, car, auto There are different types of promissory notes used in the context of a vehicle sale, each with its specific purpose and conditions. Some of these include: 1. Secured Promissory Note: This type of note includes collateral to secure the loan, often the vehicle itself. In the event of default, the seller has the right to repossess the vehicle to recover the outstanding debt. 2. Unsecured Promissory Note: An unsecured promissory note does not have collateral attached to the loan. It relies solely on the buyer's promise to repay the debt. In case of default, the seller may have to pursue other legal means to recover the owed amount. 3. Installment Promissory Note: This note specifies the repayment of the loan in regular installments over a defined period, typically with interest calculated on the outstanding balance. It allows for more manageable payments for the buyer and a predictable schedule for the seller. 4. Balloon Promissory Note: A balloon note defers a portion of the total repayment to the end of the loan term. It means that while the buyer makes regular payments during the loan period, a lump sum or a "balloon payment" is required at the end. This type of loan is often utilized when the buyer anticipates receiving a large sum or financing option at the end of the loan term. 5. Simple Interest Promissory Note: A simple interest note calculates interest only on the outstanding balance, rather than compounding it over time. This type of note benefits the buyer, as they effectively pay less interest if they repay the loan early. When utilizing a Boston Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto, it is crucial to include specific details like the buyer's and seller's names and addresses, the vehicle's description (make, model, year, VIN), the loan amount, interest rate, repayment terms (installments or lump sum), due dates, and any applicable late fees or penalties. Both parties should carefully review and understand the terms before signing the document to ensure mutual agreement and compliance with Massachusetts state laws.A Boston Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto is a legally binding document that outlines the terms and conditions of a loan agreement between a buyer and seller. It serves as evidence of the debt owed by the buyer to the seller, specifying the repayment terms and interest rate for the loan. Keywords: Boston Massachusetts, promissory note, loan, sale, motor vehicle, car, auto There are different types of promissory notes used in the context of a vehicle sale, each with its specific purpose and conditions. Some of these include: 1. Secured Promissory Note: This type of note includes collateral to secure the loan, often the vehicle itself. In the event of default, the seller has the right to repossess the vehicle to recover the outstanding debt. 2. Unsecured Promissory Note: An unsecured promissory note does not have collateral attached to the loan. It relies solely on the buyer's promise to repay the debt. In case of default, the seller may have to pursue other legal means to recover the owed amount. 3. Installment Promissory Note: This note specifies the repayment of the loan in regular installments over a defined period, typically with interest calculated on the outstanding balance. It allows for more manageable payments for the buyer and a predictable schedule for the seller. 4. Balloon Promissory Note: A balloon note defers a portion of the total repayment to the end of the loan term. It means that while the buyer makes regular payments during the loan period, a lump sum or a "balloon payment" is required at the end. This type of loan is often utilized when the buyer anticipates receiving a large sum or financing option at the end of the loan term. 5. Simple Interest Promissory Note: A simple interest note calculates interest only on the outstanding balance, rather than compounding it over time. This type of note benefits the buyer, as they effectively pay less interest if they repay the loan early. When utilizing a Boston Massachusetts Promissory Note — Loan in connection with the sale of a motor vehicle, car, or auto, it is crucial to include specific details like the buyer's and seller's names and addresses, the vehicle's description (make, model, year, VIN), the loan amount, interest rate, repayment terms (installments or lump sum), due dates, and any applicable late fees or penalties. Both parties should carefully review and understand the terms before signing the document to ensure mutual agreement and compliance with Massachusetts state laws.