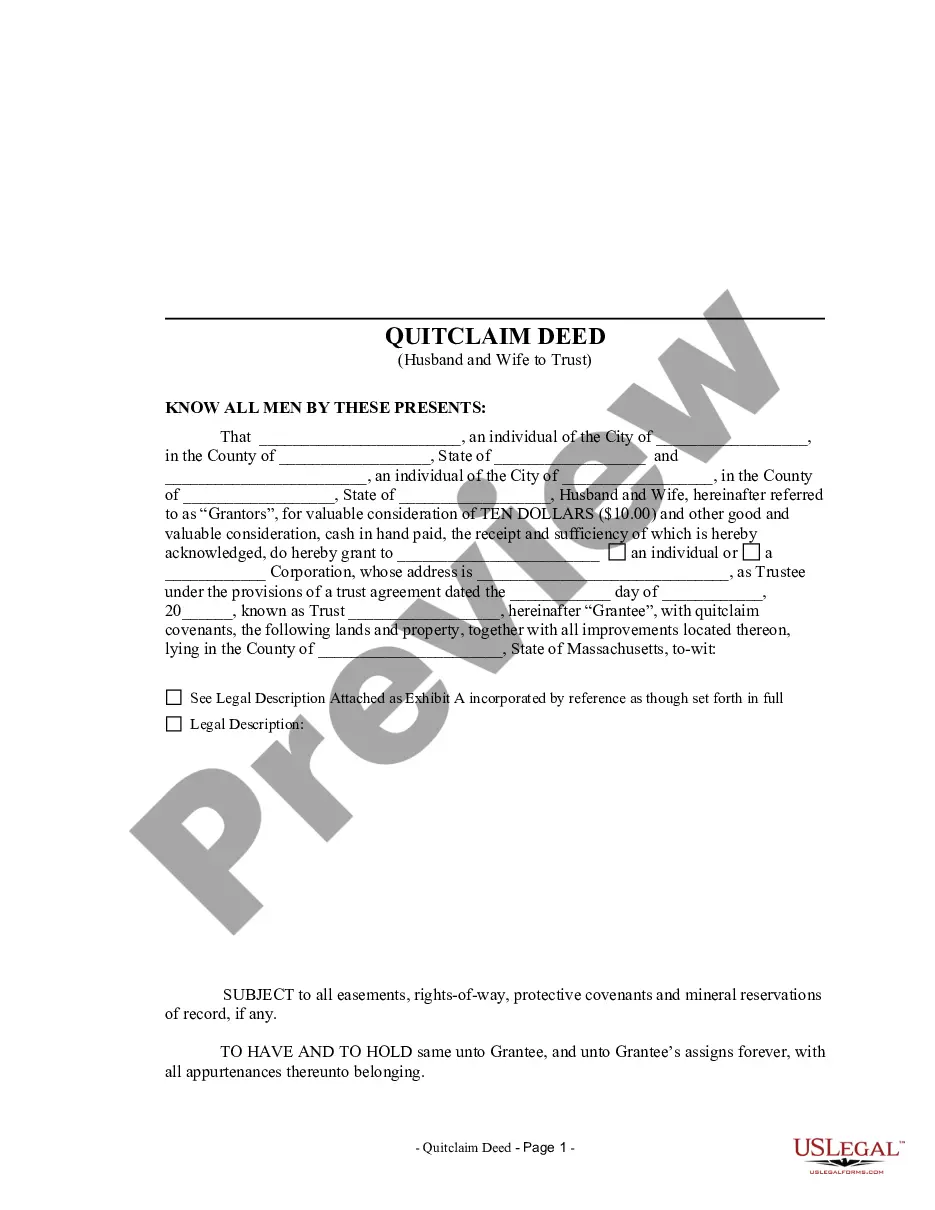

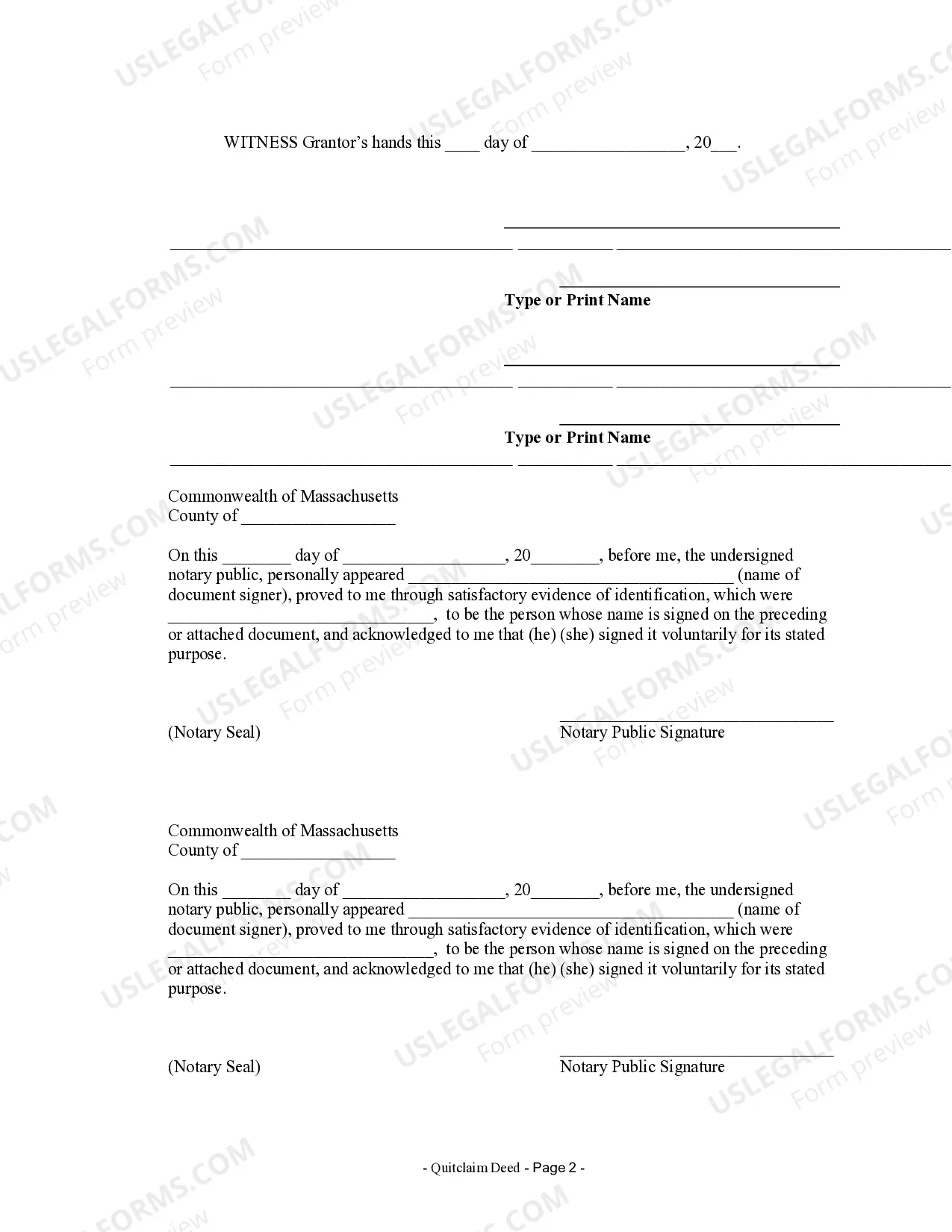

This form is a Quitclaim Deed where the Grantors are husband and wife and the Grantee is a trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Boston Massachusetts Quitclaim Deed — Husband and Wife to Trust is a legally binding document that transfers the ownership of real estate property from a married couple to a trust. This type of deed is commonly used by spouses who wish to place their property under the ownership of a trust for various purposes, such as estate planning, asset protection, or avoiding probate. The Quitclaim Deed is the most common type of deed used in such transactions. It is a legal tool that allows a property owner (in this case, the husband and wife) to transfer their interest or rights in a property to another party (the trust) without providing a guarantee or warranty of the property's title. The quitclaim does not offer any assurance about the ownership history or outstanding claims on the property, making it essential for both parties to perform thorough due diligence before executing the deed. By executing a Quitclaim Deed — Husband and Wife to Trust, the couple effectively relinquishes their ownership rights to the property and conveys them to the trust. While this may seem straightforward, it is crucial to consult legal professionals to ensure compliance with local laws and regulations, as well as to address any potential complications or tax implications that may arise from such a transfer. Different variations of the Quitclaim Deed — Husband and Wife to Trust may include additional provisions or specifications tailored to the specific needs and circumstances of the spouses and the trust. Some possible types of Quitclaim Deed variations include: 1. Joint Revocable Trust Quitclaim Deed: This type of deed is used when a married couple wishes to transfer property to a revocable trust in which both partners are beneficiaries. The trust can be altered, revoked, or amended during the lifetimes of both spouses. 2. Irrevocable Trust Quitclaim Deed: In cases where the couple wants to place their property into an irrevocable trust, which cannot be altered once established, an Irrevocable Trust Quitclaim Deed may be used. This type of trust is commonly utilized for estate planning purposes to minimize estate taxes or protect assets. 3. Life Estate Quitclaim Deed: This variation of the Quitclaim Deed allows the couple to transfer their property to a trust while retaining a life estate. This grants the couple the right to live on the property for the duration of their lives, after which ownership automatically transfers to the trust. Overall, a Boston Massachusetts Quitclaim Deed — Husband and Wife to Trust serves as a legal instrument for transferring property ownership from a married couple to a trust. Given the significant legal and financial implications involved, seeking professional advice and assistance is highly recommended when dealing with any form of property transfer.A Boston Massachusetts Quitclaim Deed — Husband and Wife to Trust is a legally binding document that transfers the ownership of real estate property from a married couple to a trust. This type of deed is commonly used by spouses who wish to place their property under the ownership of a trust for various purposes, such as estate planning, asset protection, or avoiding probate. The Quitclaim Deed is the most common type of deed used in such transactions. It is a legal tool that allows a property owner (in this case, the husband and wife) to transfer their interest or rights in a property to another party (the trust) without providing a guarantee or warranty of the property's title. The quitclaim does not offer any assurance about the ownership history or outstanding claims on the property, making it essential for both parties to perform thorough due diligence before executing the deed. By executing a Quitclaim Deed — Husband and Wife to Trust, the couple effectively relinquishes their ownership rights to the property and conveys them to the trust. While this may seem straightforward, it is crucial to consult legal professionals to ensure compliance with local laws and regulations, as well as to address any potential complications or tax implications that may arise from such a transfer. Different variations of the Quitclaim Deed — Husband and Wife to Trust may include additional provisions or specifications tailored to the specific needs and circumstances of the spouses and the trust. Some possible types of Quitclaim Deed variations include: 1. Joint Revocable Trust Quitclaim Deed: This type of deed is used when a married couple wishes to transfer property to a revocable trust in which both partners are beneficiaries. The trust can be altered, revoked, or amended during the lifetimes of both spouses. 2. Irrevocable Trust Quitclaim Deed: In cases where the couple wants to place their property into an irrevocable trust, which cannot be altered once established, an Irrevocable Trust Quitclaim Deed may be used. This type of trust is commonly utilized for estate planning purposes to minimize estate taxes or protect assets. 3. Life Estate Quitclaim Deed: This variation of the Quitclaim Deed allows the couple to transfer their property to a trust while retaining a life estate. This grants the couple the right to live on the property for the duration of their lives, after which ownership automatically transfers to the trust. Overall, a Boston Massachusetts Quitclaim Deed — Husband and Wife to Trust serves as a legal instrument for transferring property ownership from a married couple to a trust. Given the significant legal and financial implications involved, seeking professional advice and assistance is highly recommended when dealing with any form of property transfer.