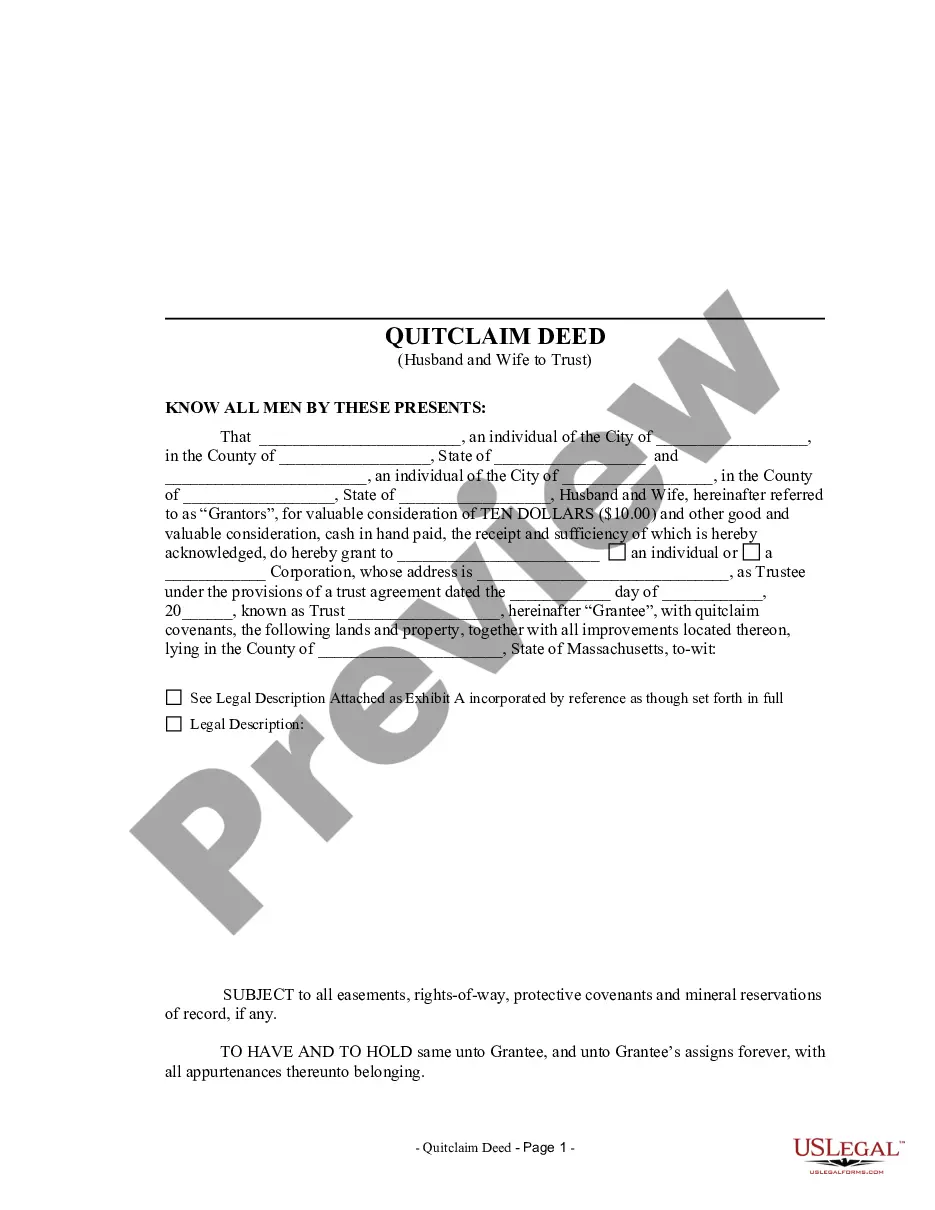

This form is a Quitclaim Deed where the Grantors are husband and wife and the Grantee is a trust. Grantors convey and quitclaim the described property to grantee. This deed complies with all state statutory laws.

A Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust is a legal document through which a married couple (husband and wife) transfers their ownership interest in a property to a trust. This type of deed is commonly used when couples want to protect their assets, estate plan, or establish a revocable living trust. By conveying the ownership to a trust, the property fund can be further managed, distributed, or protected according to the couple's wishes. With a Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust, the couple is essentially relinquishing their ownership rights and transferring them to the trust entity. The trust becomes the new owner of the property, and the couple becomes the trust's granters. This type of deed provides flexibility, as the couple or trust can revise or revoke the trust in the future, allowing for changes in beneficiaries or terms. There are a few variations of the Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust, such as: 1. Revocable Living Trust: The most common type of trust used in estate planning, a revocable living trust allows the couple to maintain control over their assets while providing for the management and distribution of their property upon death or incapacitation. 2. Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked without the consent of the beneficiaries. This type of trust is often used for specific purposes, such as asset protection, tax planning, or Medicaid planning. 3. Family Trust: A family trust is created specifically for the benefit of family members, such as children or grandchildren. It allows the couple to transfer their property to the trust and designate how and when the assets should be distributed to the beneficiaries. 4. Charitable Trust: If the couple intends to donate their property or a portion of it to a charitable organization, a charitable trust can be established. This type of trust offers tax benefits while supporting a cause or charity important to the couple. Overall, a Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust is an essential legal instrument for couples looking to transfer their property ownership to a trust entity. It offers numerous benefits, including flexibility, asset protection, and streamlined estate planning.A Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust is a legal document through which a married couple (husband and wife) transfers their ownership interest in a property to a trust. This type of deed is commonly used when couples want to protect their assets, estate plan, or establish a revocable living trust. By conveying the ownership to a trust, the property fund can be further managed, distributed, or protected according to the couple's wishes. With a Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust, the couple is essentially relinquishing their ownership rights and transferring them to the trust entity. The trust becomes the new owner of the property, and the couple becomes the trust's granters. This type of deed provides flexibility, as the couple or trust can revise or revoke the trust in the future, allowing for changes in beneficiaries or terms. There are a few variations of the Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust, such as: 1. Revocable Living Trust: The most common type of trust used in estate planning, a revocable living trust allows the couple to maintain control over their assets while providing for the management and distribution of their property upon death or incapacitation. 2. Irrevocable Trust: Unlike a revocable living trust, an irrevocable trust cannot be altered or revoked without the consent of the beneficiaries. This type of trust is often used for specific purposes, such as asset protection, tax planning, or Medicaid planning. 3. Family Trust: A family trust is created specifically for the benefit of family members, such as children or grandchildren. It allows the couple to transfer their property to the trust and designate how and when the assets should be distributed to the beneficiaries. 4. Charitable Trust: If the couple intends to donate their property or a portion of it to a charitable organization, a charitable trust can be established. This type of trust offers tax benefits while supporting a cause or charity important to the couple. Overall, a Lowell Massachusetts Quitclaim Deed — Husband and Wife to Trust is an essential legal instrument for couples looking to transfer their property ownership to a trust entity. It offers numerous benefits, including flexibility, asset protection, and streamlined estate planning.