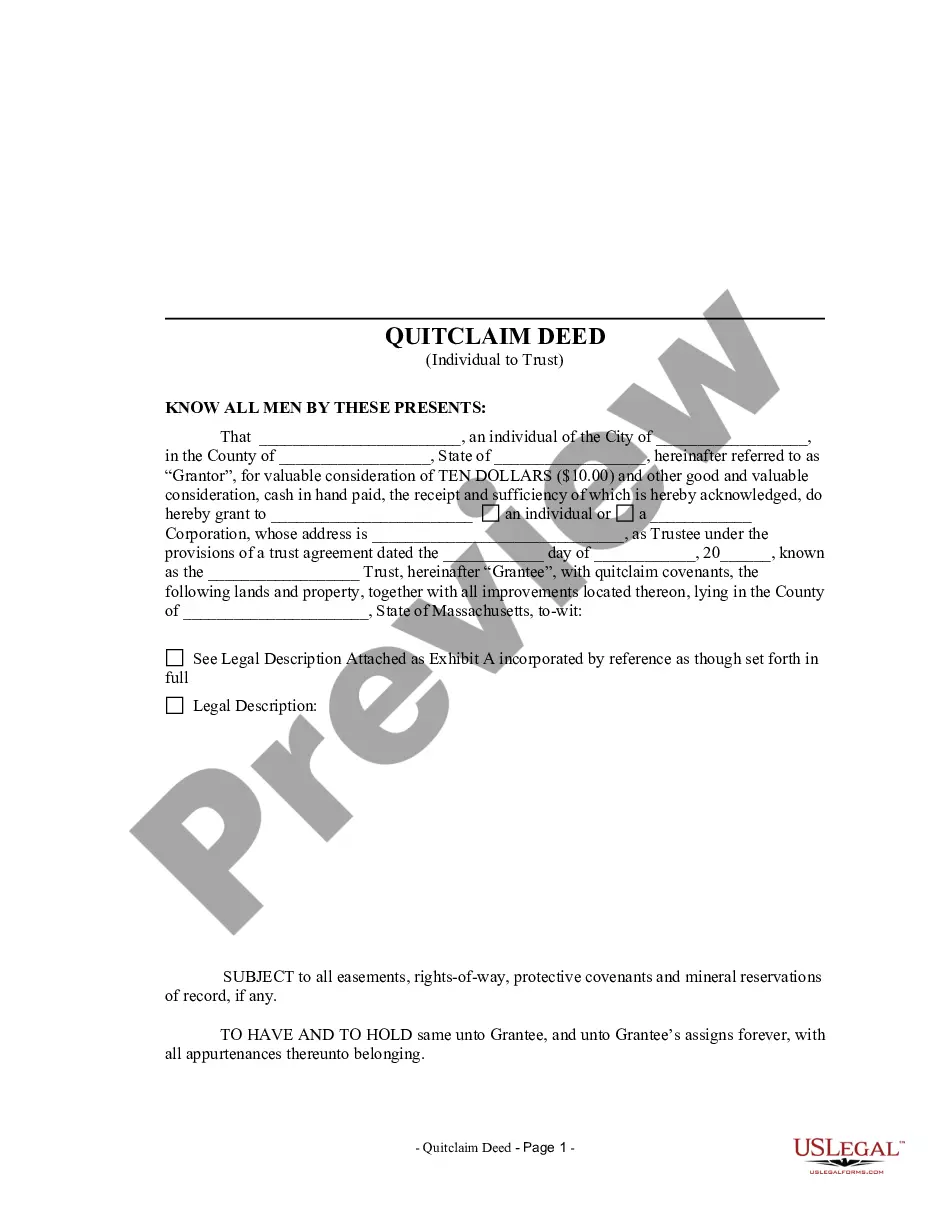

This form is a Quitclaim Deed where the Grantor is an Individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Boston Massachusetts Quitclaim Deed from an Individual Grantor to a Trust as Grantee

Description

How to fill out Massachusetts Quitclaim Deed From An Individual Grantor To A Trust As Grantee?

If you have previously used our service, Log In to your profile and save the Boston Massachusetts Quitclaim Deed from an Individual Grantor to a Trust as Grantee onto your device by clicking the Download button. Ensure your subscription is current. Otherwise, renew it according to your payment arrangement.

If this is your initial experience with our service, follow these straightforward steps to obtain your document.

You have uninterrupted access to every document you have purchased: you can find it in your profile within the My documents section whenever you need to reference it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or professional requirements!

- Confirm you have located the correct document. Review the description and use the Preview option, if available, to verify if it satisfies your needs. If it doesn't suit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Boston Massachusetts Quitclaim Deed from an Individual Grantor to a Trust as Grantee. Select the file format for your document and store it on your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

The quitclaim deed is the most commonly used deed in the purchase and sale of residential property in Massachusetts. It plays a fundamental role in the types of assurances the seller makes when transferring its rights, and in how the buyer takes title.

Per Massachusetts General Law Chapter 183 § 4, quitclaim deeds must be filed with the Registry of Deeds Office in the county where the property is located.

How Much Are Transfer Taxes in Massachusetts? The amount of the transfer tax depends on how much the property sells for and its location. The basic transfer tax rate in Massachusetts is $2.28 per $500 of property value. However, some counties charge additional transfer taxes.

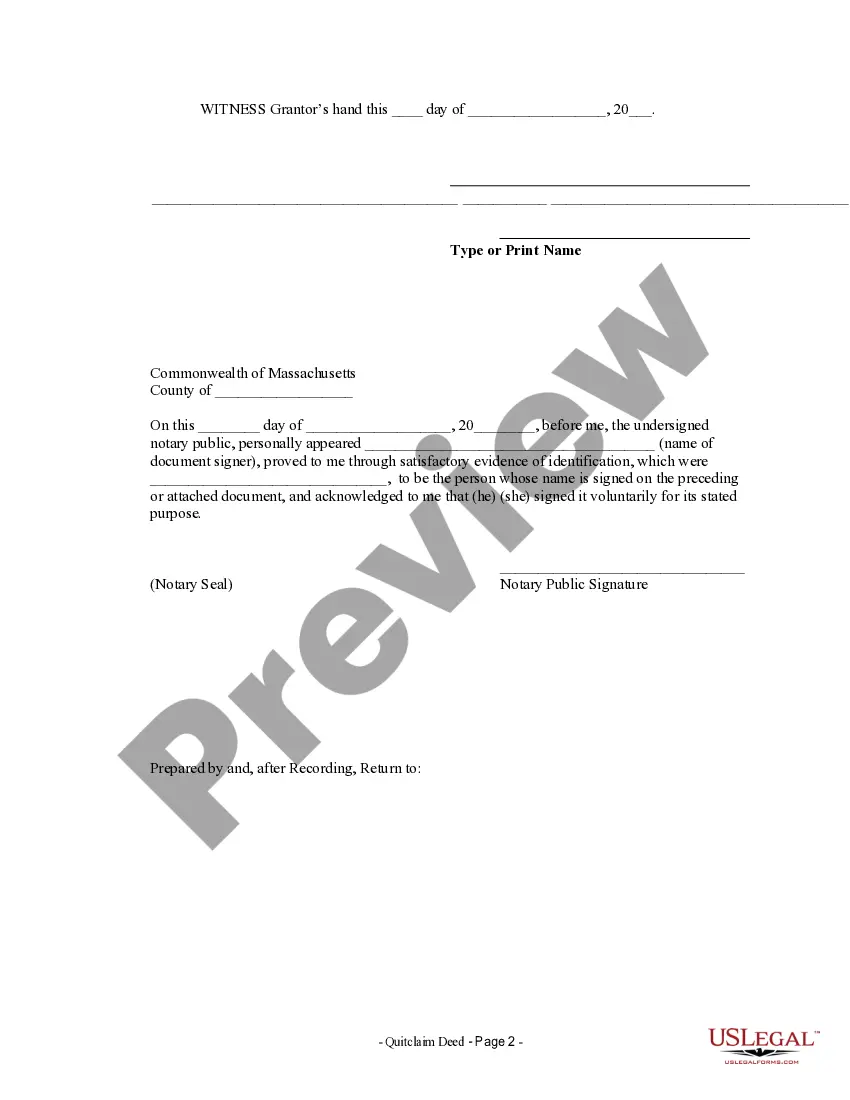

How to Write a Massachusetts Quitclaim Deed Preparer's name and address. Name and address of the person to whom the recorded property deed should be returned. County where the property is located. The consideration paid for the property. Grantee's name and address. The legal description of the property.

A deed in which a grantor disclaims all interest in a parcel of real property and then conveys that interest to a grantee. Unlike grantors in other types of deeds, the quitclaim grantor does not promise that his interest in the property is actually valid.

The alternative spellings quit claim deed and quit-claim deed are generally acceptable?though used less frequently. Oklahoma legal professionals also use the word quitclaim as a verb indicating that an owner is transferring an interest without warranty. Release deed can be a synonym for quitclaim deed in some contexts.

Real estate conveyances in Massachusetts are governed under Massachusetts General Laws Chapters 183 and 184. Quitclaim deeds with limited covenants are used to transfer the rights, title, and interest in real estate, if any, from the grantor (seller) to the grantee (buyer).

A Massachusetts quit claim deed is used to legally transfer land and buildings in Massachusetts from a grantor (seller) to a grantee (buyer). A quit claim deed is different from a warranty deed in that it does not provide any warranty as to whether or not the title is clear before the grantor bought the property.

The registry of deeds charges a fee of $125 to record the deed which the buyer pays. All deeds must be notarized by a notary public who must verify the sellers' identification through a state issued driver's license or acceptable form of identification.