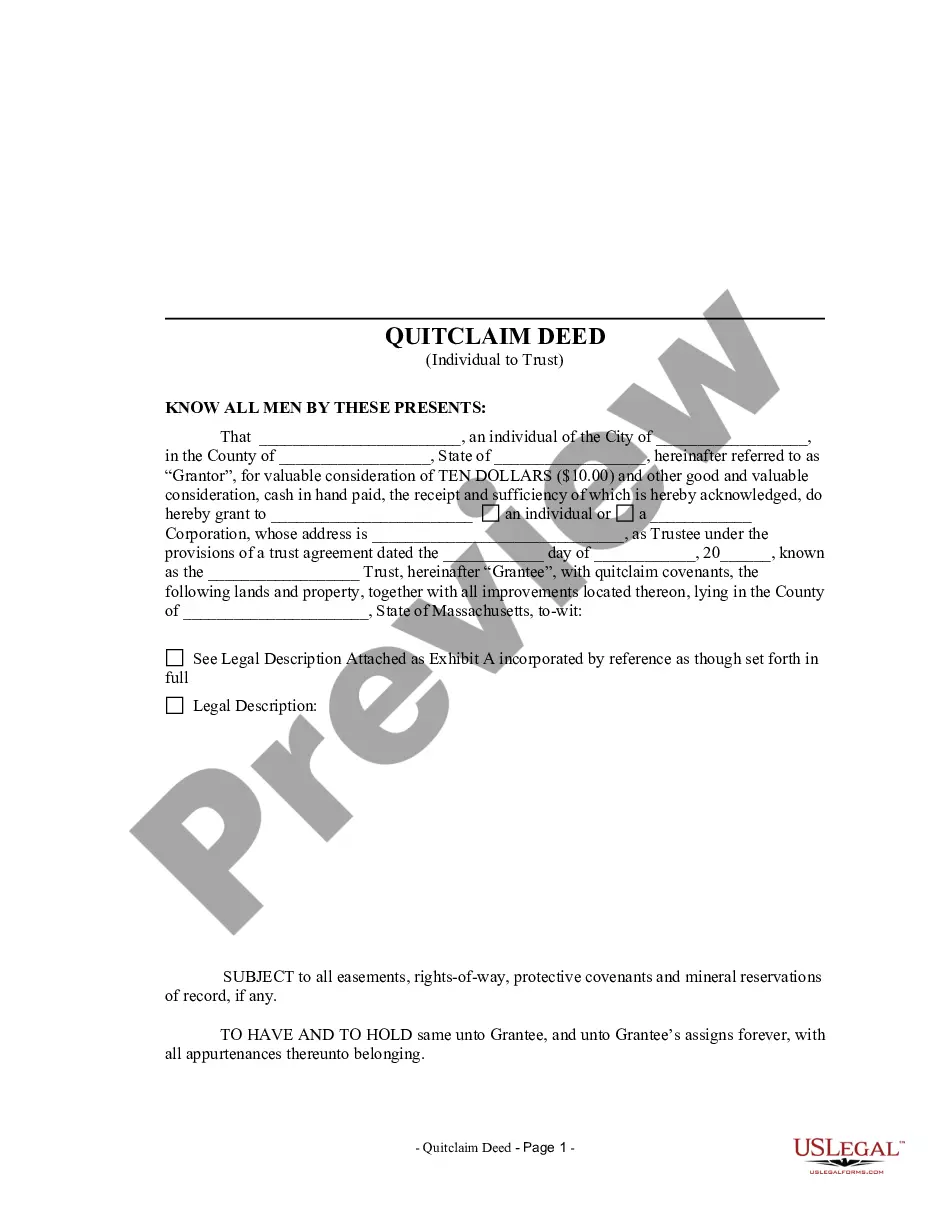

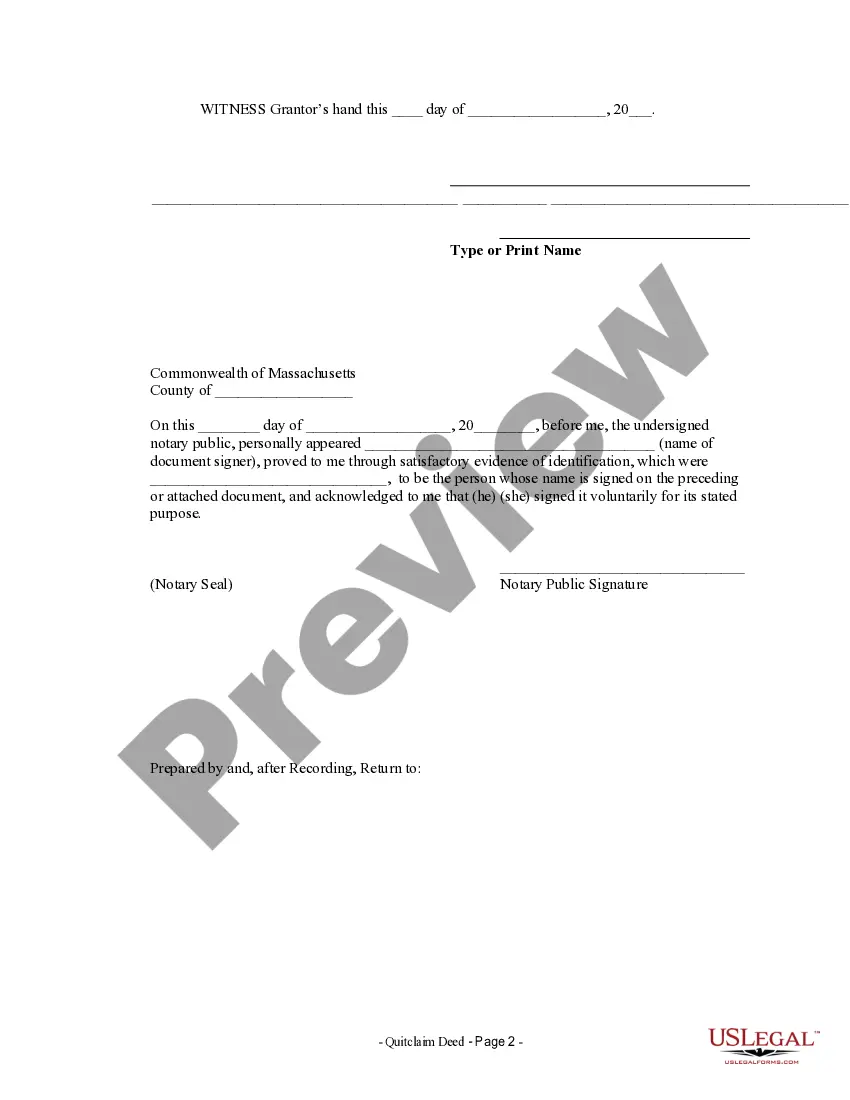

This form is a Quitclaim Deed where the Grantor is an Individual and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Lowell, Massachusetts Quitclaim Deed from an Individual Granter to a Trust as Grantee A quitclaim deed is a legal document used to transfer the ownership interest that an individual (granter) has in a property to a trust (grantee). In the context of Lowell, Massachusetts, there are certain key aspects that individuals should be aware of when considering a quitclaim deed from an individual granter to a trust as a grantee. Firstly, it is important to understand the purpose of a trust. A trust is a legally created entity that holds assets on behalf of beneficiaries, providing certain benefits related to estate planning, asset protection, and tax benefits. By transferring property ownership through a quitclaim deed to a trust, the granter can effectively pass on real estate holdings to the trust, ensuring its protection and management for future generations. The specific types of Lowell, Massachusetts quitclaim deeds from an individual granter to a trust as a grantee can vary based on the specific circumstances and objectives of the parties involved. Common types may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is used when the granter transfers ownership of their property to a revocable living trust. The granter retains control over the assets during their lifetime, and the trust can be amended or revoked as per the granter's wishes. 2. Irrevocable Living Trust Quitclaim Deed: In contrast to a revocable living trust, an irrevocable living trust cannot be changed or revoked once established. By transferring the property through this type of quitclaim deed, the granter relinquishes all control and ownership rights over the property. 3. Charitable Remainder Trust Quitclaim Deed: This type of quitclaim deed is utilized when the granter intends to contribute the property to a charitable remainder trust. The trust will manage the property and provide income to the granter or other designated beneficiaries for a specified period. Afterward, the remaining assets in the trust are donated to a chosen charity. 4. Special Needs Trust Quitclaim Deed: If the granter wishes to protect the property for the benefit of a person with special needs, a special needs trust may be established. The quitclaim deed transfers the property to the trust, ensuring continued financial security and eligibility for government benefits for the individual with special needs. It is crucial to consult with legal professionals experienced in real estate law and trusts when considering a Lowell, Massachusetts quitclaim deed from an individual granter to a trust as a grantee. They can guide you through the process, ensuring that all legal requirements and implications are properly addressed, and that the deed suits your specific needs and objectives.

Lowell, Massachusetts Quitclaim Deed from an Individual Granter to a Trust as Grantee A quitclaim deed is a legal document used to transfer the ownership interest that an individual (granter) has in a property to a trust (grantee). In the context of Lowell, Massachusetts, there are certain key aspects that individuals should be aware of when considering a quitclaim deed from an individual granter to a trust as a grantee. Firstly, it is important to understand the purpose of a trust. A trust is a legally created entity that holds assets on behalf of beneficiaries, providing certain benefits related to estate planning, asset protection, and tax benefits. By transferring property ownership through a quitclaim deed to a trust, the granter can effectively pass on real estate holdings to the trust, ensuring its protection and management for future generations. The specific types of Lowell, Massachusetts quitclaim deeds from an individual granter to a trust as a grantee can vary based on the specific circumstances and objectives of the parties involved. Common types may include: 1. Revocable Living Trust Quitclaim Deed: This type of deed is used when the granter transfers ownership of their property to a revocable living trust. The granter retains control over the assets during their lifetime, and the trust can be amended or revoked as per the granter's wishes. 2. Irrevocable Living Trust Quitclaim Deed: In contrast to a revocable living trust, an irrevocable living trust cannot be changed or revoked once established. By transferring the property through this type of quitclaim deed, the granter relinquishes all control and ownership rights over the property. 3. Charitable Remainder Trust Quitclaim Deed: This type of quitclaim deed is utilized when the granter intends to contribute the property to a charitable remainder trust. The trust will manage the property and provide income to the granter or other designated beneficiaries for a specified period. Afterward, the remaining assets in the trust are donated to a chosen charity. 4. Special Needs Trust Quitclaim Deed: If the granter wishes to protect the property for the benefit of a person with special needs, a special needs trust may be established. The quitclaim deed transfers the property to the trust, ensuring continued financial security and eligibility for government benefits for the individual with special needs. It is crucial to consult with legal professionals experienced in real estate law and trusts when considering a Lowell, Massachusetts quitclaim deed from an individual granter to a trust as a grantee. They can guide you through the process, ensuring that all legal requirements and implications are properly addressed, and that the deed suits your specific needs and objectives.