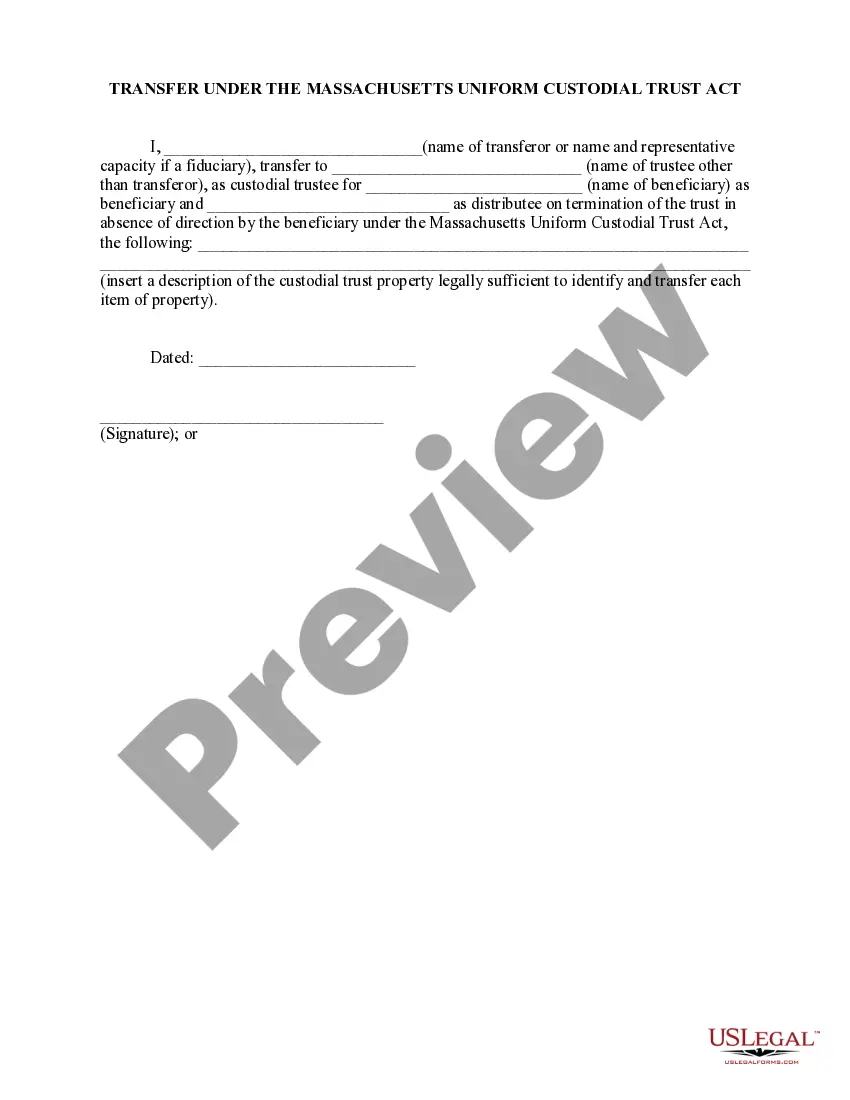

The Boston Transfer Under The Massachusetts Uniform Custodial Trust Act refers to a legal provision implemented in Massachusetts that allows for the transfer of custodial assets, specifically financial accounts, to a trust managed by a custodian. This act aims to provide a robust asset protection strategy while ensuring efficient transfer of assets to beneficiaries. The Massachusetts Uniform Custodial Trust Act (MUC TA) was enacted to standardize and streamline the transfer process for custodial accounts, bringing multiple types of custodial arrangements under a single legal framework. The act assigns key responsibilities and duties to the custodians, often financial institutions, managing these trusts. Under the MUC TA, there are different types of custodial trusts that can be established in Boston: 1. Uniform Transfers to Minors Act (TMA) Trust: This type of custodial trust allows individuals to transfer assets to a minor beneficiary. The custodian manages the assets until the minor reaches' adulthood, usually at the age of 18 or 21, depending on state-specific provisions. 2. Uniform Gifts to Minors Act (UGA) Trust: Similar to the TMA trust, the UGA trust enables the transfer of assets to a minor beneficiary. However, the age of adulthood for UGA trusts is generally fixed at 18. 3. 2503© Trust: This trust refers to a qualified tuition program under Section 529 of the Internal Revenue Code. It allows for the tax-advantaged transfer of funds for educational purposes to a designated beneficiary. The custodian manages the trust until the beneficiary is ready to utilize the funds for qualified educational expenses. The Boston Transfer Under The Massachusetts Uniform Custodial Trust Act facilitates the transfer of assets to these trusts in a structured and secure manner. Custodians play a crucial role in managing and investing the transferred assets for the benefit of the beneficiaries, adhering to the fiduciary responsibilities outlined by the act. The act ensures a clear chain of title and protection of custodial assets, promoting transparency and accountability in the transfer process. Additionally, it addresses potential concerns related to estate planning, taxation, and financial responsibilities associated with custodial arrangements in Boston. By adopting the provisions of the MUC TA, individuals in Boston can leverage the benefits of different custodial trusts while ensuring compliance with state laws and regulations.

Boston Transfer Under The Massachusetts Uniform Custodial Trust Act

Description

How to fill out Boston Transfer Under The Massachusetts Uniform Custodial Trust Act?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Boston Transfer Under The Massachusetts Uniform Custodial Trust Act gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Boston Transfer Under The Massachusetts Uniform Custodial Trust Act takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Check the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Boston Transfer Under The Massachusetts Uniform Custodial Trust Act. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!