Boston Transfer under the Massachusetts Uniform Transfers to Minors Act refers to a legal mechanism that allows individuals in Boston, Massachusetts to transfer assets or property to minors, while ensuring protection and management of such assets until the minor reaches the age of adulthood. This Act is derived from the Uniform Transfers to Minors Act (TMA). Under the Act, the transferor, often referred to as the donor or custodian, can establish a custodial account for the minor by designating a custodian who will manage the transferred assets on behalf of the minor until they reach a certain age, usually 18 or 21 years old. The Act provides flexibility in terms of the types of property or assets that can be transferred, including but not limited to, cash, securities, real estate, and other valuable assets. The transfer can be made by way of a gift, bequest, or any other form recognized by law. The custodial account established under the Boston Transfer can have different types under the Massachusetts Uniform Transfers to Minors Act. These may include: 1. Cash or Securities Account: The custodian holds and manages cash or securities on behalf of the minor until they reach the age of majority. The custodian has the authority to invest, reinvest, and manage these funds for the minor's benefit. 2. Real Estate Account: The custodian manages real estate property transferred to the minor until they reach the age of majority or a specified age, ensuring any income generated from the property is used for the minor's benefit. 3. Miscellaneous Account: This type of account allows for the transfer of valuable assets such as artwork, collectibles, or any other non-traditional asset, which the custodian manages until the minor comes of age. The Act places important obligations and responsibilities on the custodian, who must act in the best interest of the minor, prudently manage the assets, and provide regular accounting of the assets' status. The custodian has the authority to make decisions on behalf of the minor regarding the use, investment, and conservation of the transfer. It is essential to note that the Boston Transfer under the Massachusetts Uniform Transfers to Minors Act provides certain tax benefits, as income generated from the transferred assets is often taxed at the minor's lower income tax rate. However, it is advisable to consult with a legal or financial professional to fully understand the tax implications and any limitations associated with these transfers. In summary, the Boston Transfer under the Massachusetts Uniform Transfers to Minors Act allows individuals in Boston to transfer assets to minors, providing a legal framework for the management and protection of these assets until the minor reaches' adulthood. Different types of custodial accounts can be established depending on the nature of the assets being transferred, and the custodian is responsible for managing the assets in the minor's best interest.

Boston Transfer Under The Massachusetts Uniform Transfers to Minors Act

Description

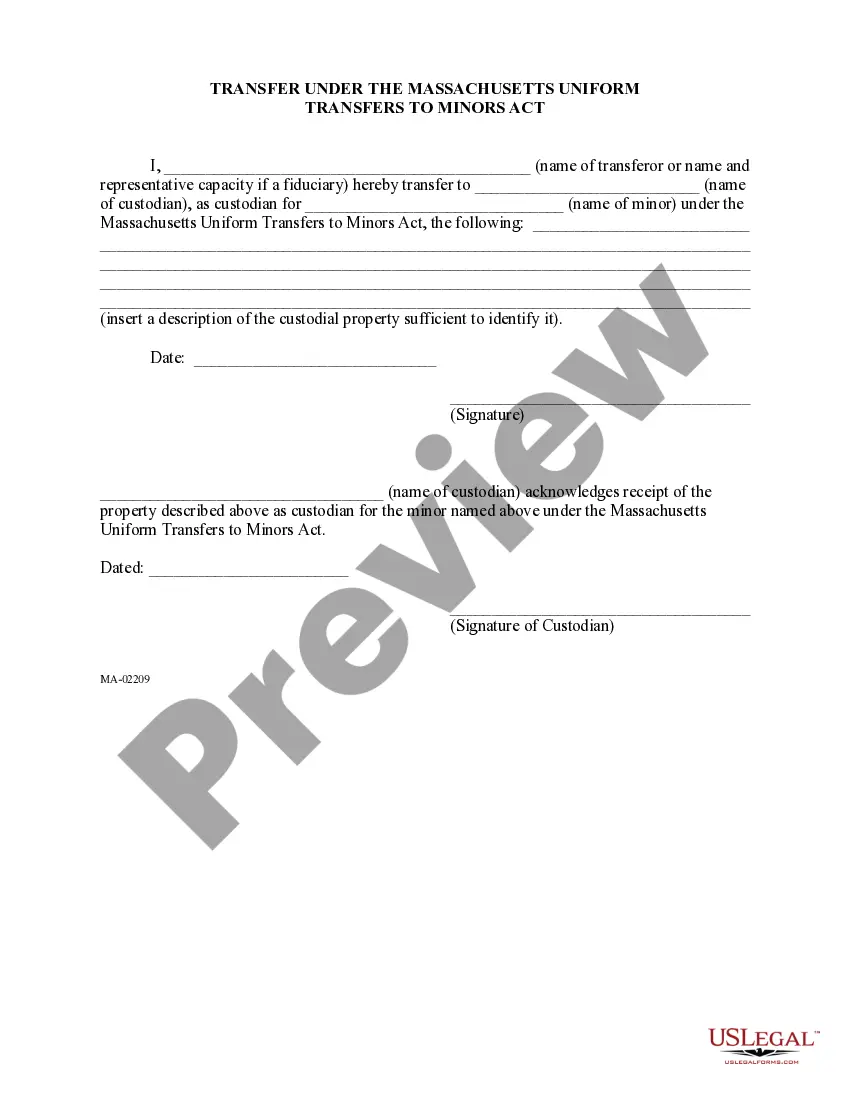

How to fill out Boston Transfer Under The Massachusetts Uniform Transfers To Minors Act?

Do you need a reliable and inexpensive legal forms supplier to get the Boston Transfer Under The Massachusetts Uniform Transfers to Minors Act? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set regulations for cohabitating with your partner or a set of documents to advance your separation or divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of particular state and area.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Boston Transfer Under The Massachusetts Uniform Transfers to Minors Act conforms to the laws of your state and local area.

- Go through the form’s description (if provided) to learn who and what the form is good for.

- Start the search over if the form isn’t good for your legal scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Boston Transfer Under The Massachusetts Uniform Transfers to Minors Act in any provided file format. You can get back to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time learning about legal paperwork online once and for all.