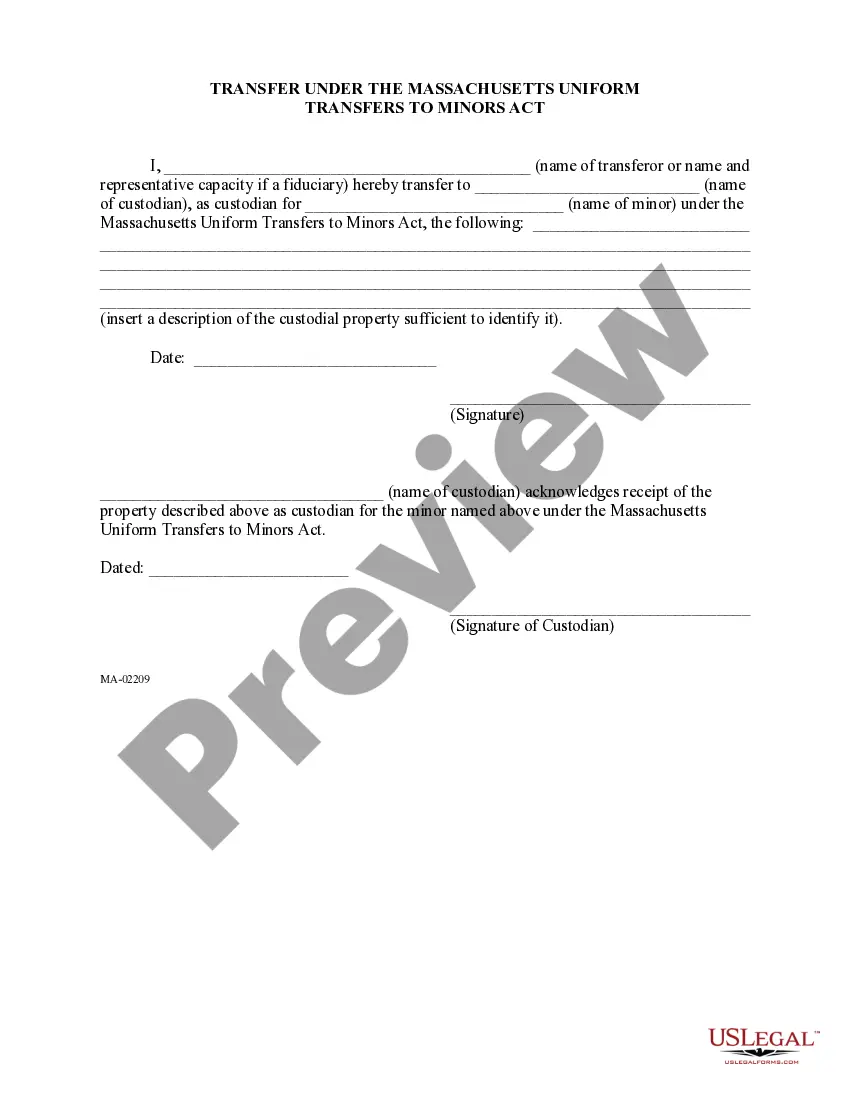

Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act is a legal mechanism that allows individuals to transfer assets to minors while still retaining control over the assets until the minor reaches a certain age. The Act provides a framework for transferring property, such as cash, securities, real estate, or other valuable assets, to a custodian who will manage and safeguard the assets on behalf of the minor. Under this Act, the transferor, also known as the donor or granter, can designate a custodian, typically a responsible adult, to oversee the management and distribution of the assets for the benefit of the minor. The custodian acts as a fiduciary, meaning they have a legal obligation to act in the best interest of the minor and manage the assets prudently. One significant aspect of the Cambridge Transfer is that it allows the transferor to define a specific age at which the minor will gain control over the assets, known as the age of termination. Until that age, the custodian has the authority to use the assets for the minor's benefit, such as paying for education, healthcare, or other needs. Once the minor reaches the age of termination, they gain full ownership and control over the assets. It is important to note that the Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act has different variations or types, depending on the nature of the assets being transferred. For example: 1. Cash Transfer: This variant involves transferring cash held in bank accounts or other financial institutions. The custodian holds and manages the cash until the minor reaches the age of termination. 2. Securities Transfer: Under this type, the transferor can transfer stocks, bonds, or other securities to the custodian. The custodian has the responsibility to manage the securities and make investment decisions on behalf of the minor. 3. Real Estate Transfer: This variant allows for the transfer of real estate property to a custodian. The custodian holds the property and manages any rental income or other benefits derived from the property until the minor reaches the age of termination. 4. Business Interest Transfer: In some cases, individuals may transfer ownership interests in a business to the custodian, who manages the business and its profits until the minor gains control. The Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act serves as a valuable tool for estate planning, ensuring that assets are efficiently transferred to minors, protected, and used for their benefit. It can provide a degree of financial security and help in managing and preserving wealth for future generations.

Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act

Description

How to fill out Cambridge Transfer Under The Massachusetts Uniform Transfers To Minors Act?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Too often, it’s almost impossible for someone with no legal background to draft this sort of paperwork cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our service offers a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act quickly using our reliable service. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, if you are a novice to our platform, make sure to follow these steps prior to downloading the Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act:

- Ensure the form you have chosen is specific to your area because the regulations of one state or area do not work for another state or area.

- Review the form and go through a short outline (if provided) of scenarios the document can be used for.

- If the one you chosen doesn’t suit your needs, you can start over and search for the suitable form.

- Click Buy now and choose the subscription plan that suits you the best.

- with your credentials or create one from scratch.

- Pick the payment gateway and proceed to download the Cambridge Transfer Under The Massachusetts Uniform Transfers to Minors Act as soon as the payment is completed.

You’re good to go! Now you can go ahead and print out the form or complete it online. If you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.