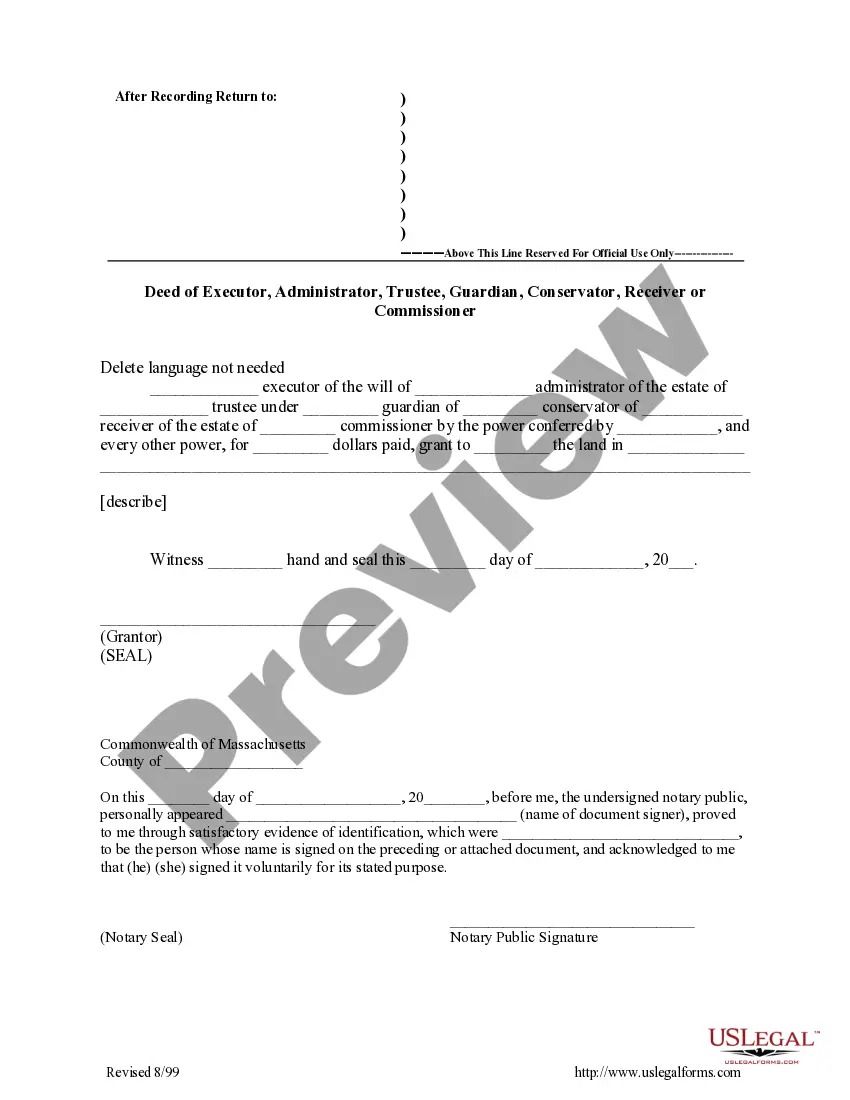

Boston Massachusetts Deed of Executor, Administrator, Trustee, Guardian, Conservator, Receiver or Commissioner

Description

How to fill out Massachusetts Deed Of Executor, Administrator, Trustee, Guardian, Conservator, Receiver Or Commissioner?

We consistently aim to diminish or avert legal complications when engaging with intricate legal or financial matters.

To achieve this, we enroll in legal services that are, by and large, quite costly.

Nonetheless, not every legal issue is similarly intricate.

A majority of them can be managed by ourselves.

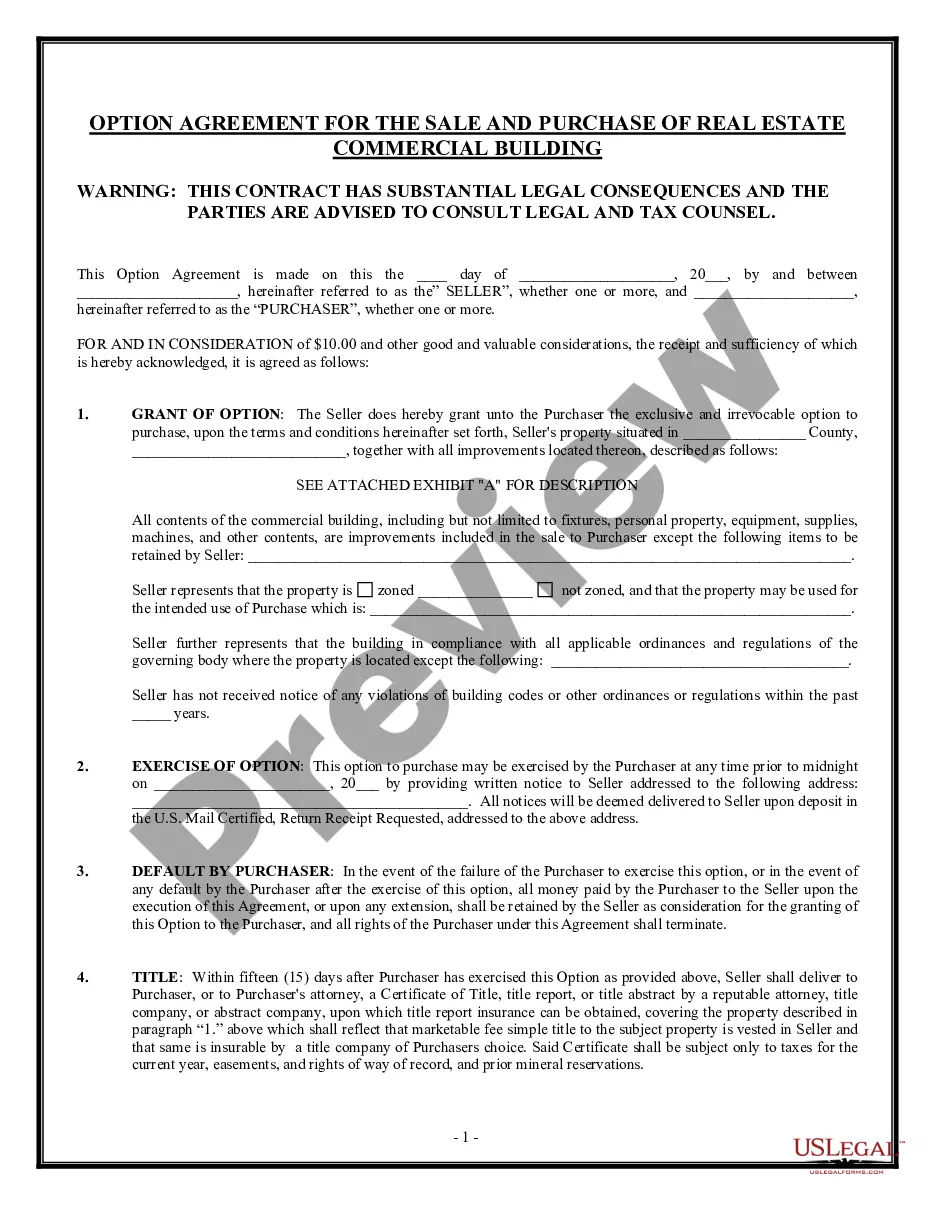

Take advantage of US Legal Forms whenever you need to obtain and download the Boston Massachusetts Deed of Executor, Administrator, Trustee, Guardian, Conservator, Receiver, or Commissioner, or any other form swiftly and securely.

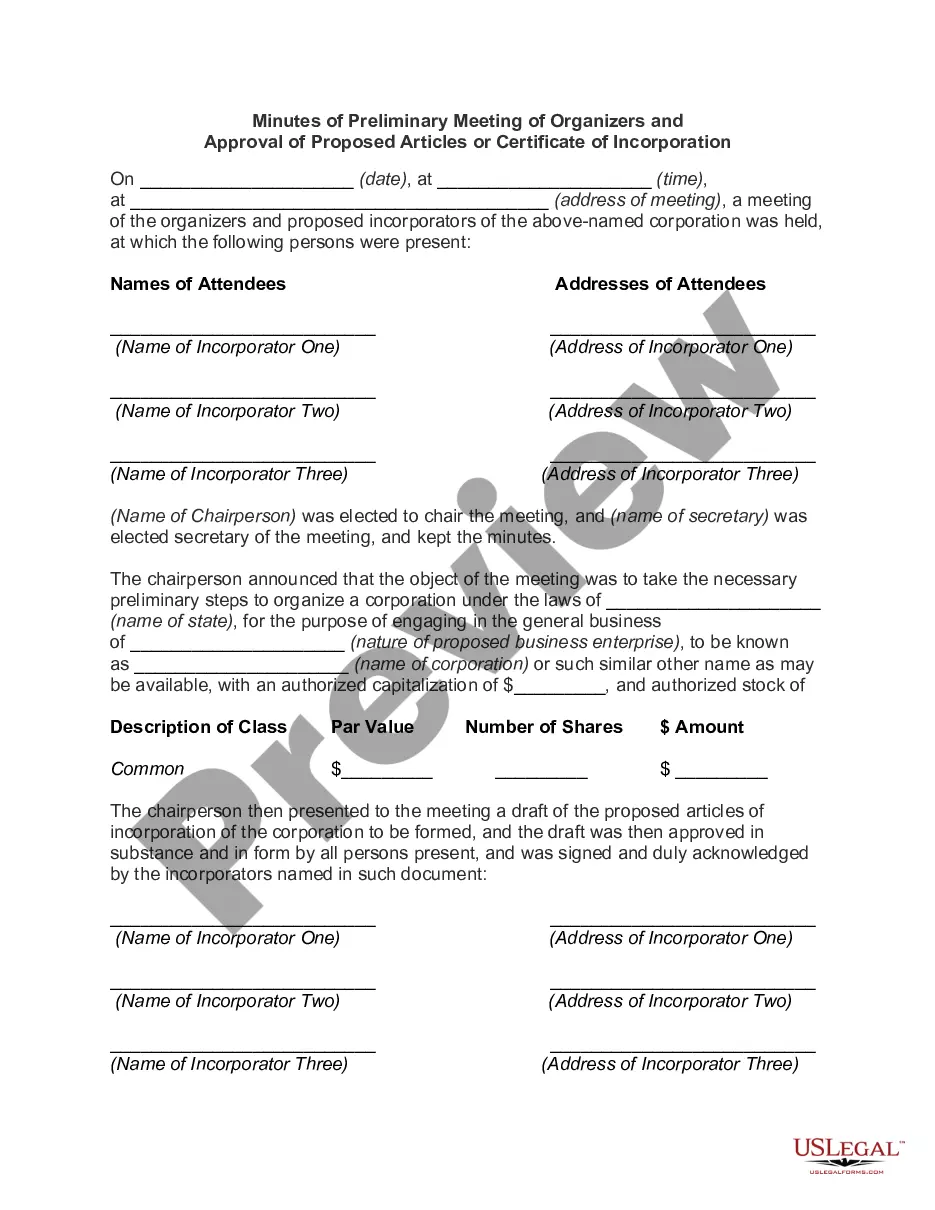

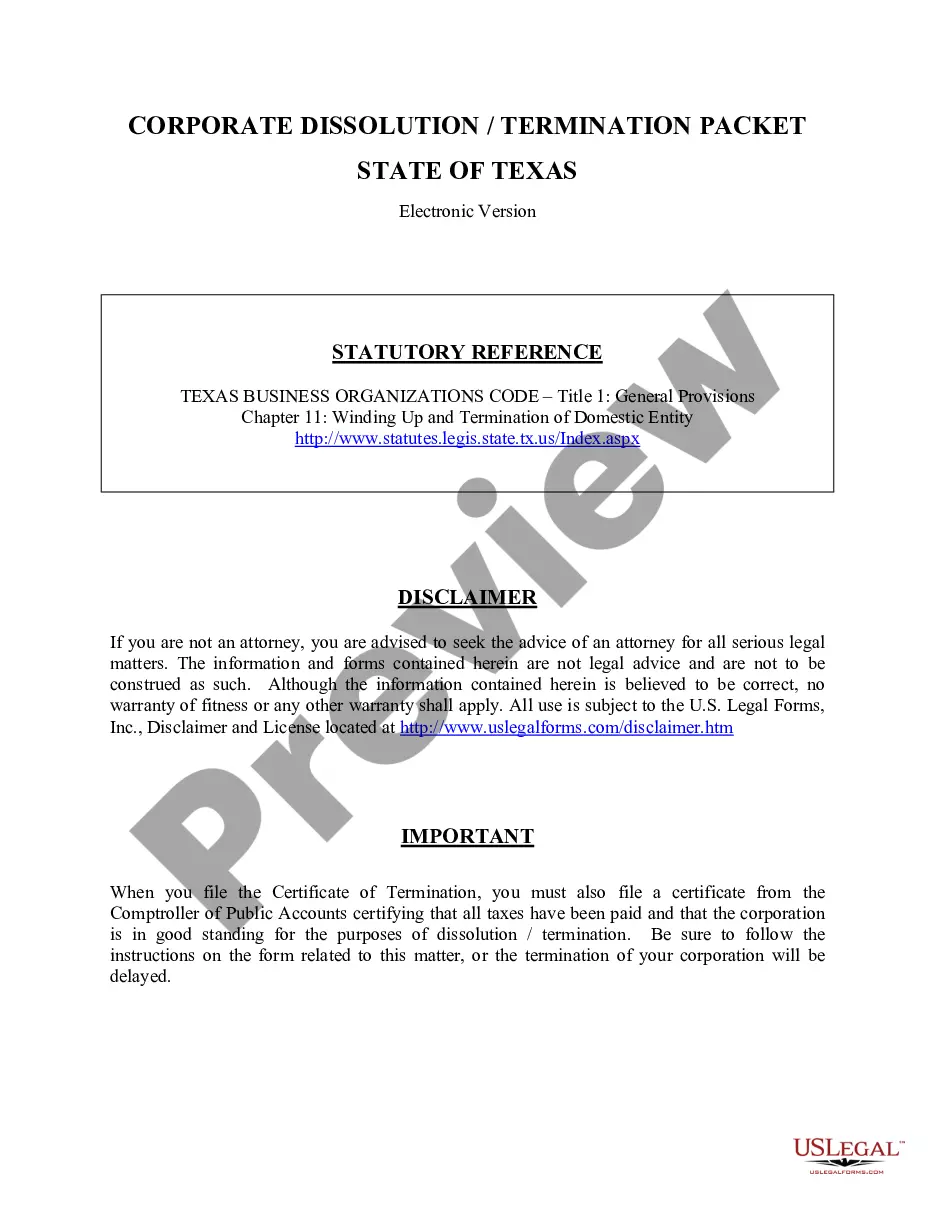

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform enables you to handle your affairs autonomously without the need for legal counsel services.

- We provide access to legal form templates that are not always publicly accessible.

- Our templates are specific to states and regions, which greatly simplifies the searching process.

Form popularity

FAQ

Is there a deadline to probate an estate? The general rule is that an estate has to be probated within 3 years of when the decedent died.

To commence a formal proceeding, an interested person must file a petition for formal probate with the court. The court will then issue a document called a 'citation,' which must be served on heirs and other interested parties at least fourteen days before the return date listed on the citation.

The petitioner, or affiant, must provide detailed information about the estate, the property in question, the decedent, and any other potential heirs.... Step 1 ? Wait Thirty (30) Days. Wait a minimum of thirty (30) days before filing the affidavit. Step 2 ? Complete Documents.Step 3 ? File With Probate Court.

Small estates Even if an estate contains probate assets, you might be surprised to learn you may not need to go through a full formal probate. If the value of the decedent's estate is less than $25,000 and does not contain any real property, than a limited version of probate called Voluntary Administration may qualify.

Letters of Authority: A document issued by the court evidencing the personal representative's authority to act. Nominee: The person seeking to be appointed personal representative. Personal representative: A person at least 18 years of age who has been appointed to administer the estate of the decedent.

There is not any legal timeframe for applying for probate, however much of the estate administration will not be possible until this is received, so it is generally one of the first things that is done. In the case of some small estates, probate may not be necessary.

A late and limited appointed personal representative can't get a license to sell the decedent's real estate. The personal representative can only confirm ownership of probate assets in the successors and pay administration expenses.

Once the Grant has been received the personal representative has a duty to collect in the assets of the deceased, pay the liabilities and distribute the estate to the beneficiaries. They have many powers to assist them when dealing with an estate e.g. power to sell property, insure property and invest monies, etc.

The administrator normally must be the deceased's spouse or next of kin, but it could be anyone with an interest in the estate. The laws about this are different in each state. A letter of administration is issued to the administrator, giving them the legal authority to act on behalf of the estate.

Letters of authority entitle the nominated representative to administer the estate without following the full procedure set out in the Administration of Estates Act.