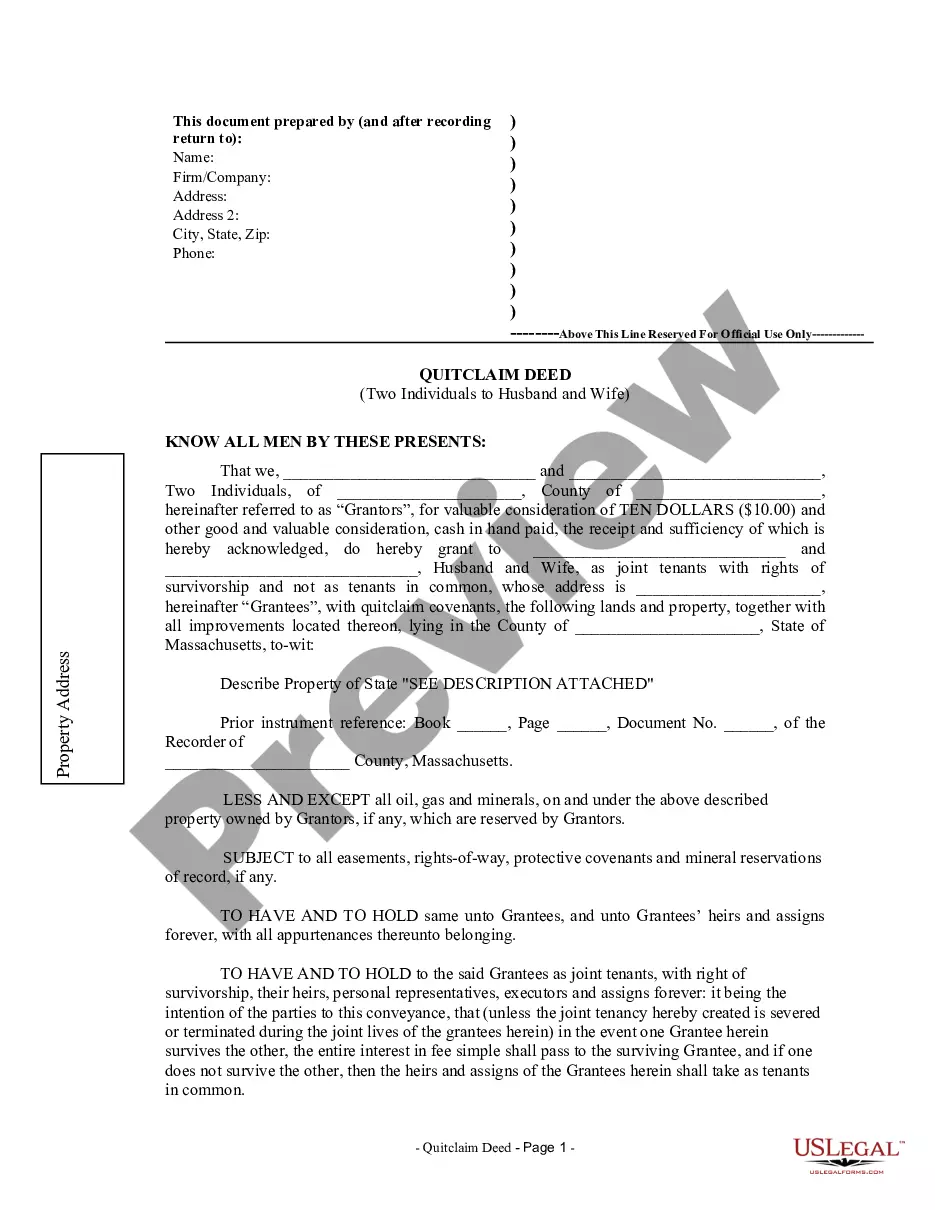

Boston Massachusetts Quitclaim Deed by Two Individuals to Husband and Wife

Description

How to fill out Massachusetts Quitclaim Deed By Two Individuals To Husband And Wife?

Locating authenticated templates relevant to your regional regulations can be difficult unless you utilize the US Legal Forms library.

This is an online archive of over 85,000 legal documents catering to both personal and professional requirements as well as various real-world situations.

All the forms are accurately categorized based on their application area and jurisdictional regions, making the search for the Boston Massachusetts Quitclaim Deed by Two Individuals to Husband and Wife as quick and simple as 1-2-3.

Maintaining documentation organized and compliant with legal standards is critically important. Leverage the US Legal Forms library to always have vital document templates readily available for any requirements!

- Examine the Preview mode and form description.

- Ensure you have selected the right one that fulfills your needs and completely aligns with your local jurisdiction requirements.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to find the right one. If it meets your criteria, proceed to the next step.

- Acquire the document.

Form popularity

FAQ

In Massachusetts, a tenancy by the entirety also has a right of survivorship, but this form of joint ownership is only permitted for married couples. It is treated quite similarly to a joint tenancy with a right of survivorship. If your spouse dies, your interest automatically transfers to you.

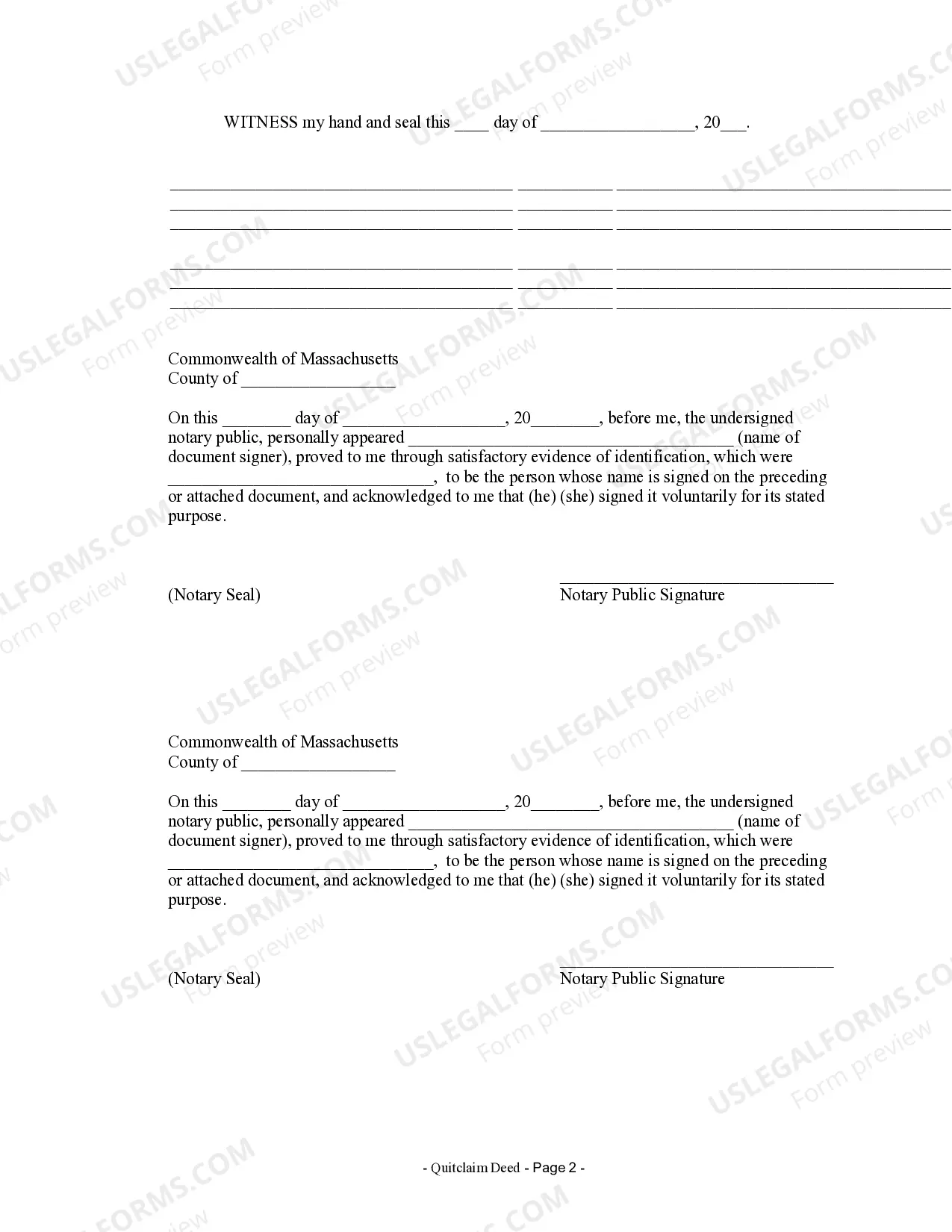

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.

If you are refinancing a loan or taking title to property you want to share with your spouse, make sure the deed reads after your name: Community Property with Right of Survivorship.

We recommend you consult with an experienced real estate lawyer for professional advice as each circumstance is unique. (Please note, the fee for our office to add someone to your deed is $650.00, plus recording costs and documentary stamps ? recordings costs are normally less than $50.00.)

Joint Tenants ? When one joint tenant dies, the surviving joint tenant automatically owns the entire property. This is said to be a ?right of survivorship.? A deed to two or more people must specify that they hold the property ?as joint tenants? to create a joint tenancy.

If you are an individual, the only choice is to take title individually. However, for married couples or friends buying a house together, there are three main ways that they can hold title to real estate: tenancy in common, joint tenancy, and tenancy by the entirety.

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

However, for married couples or friends buying a house together, there are three main ways that they can hold title to real estate: tenancy in common, joint tenancy, and tenancy by the entirety.

In order to change the owner(s) of record name(s) from maiden name to married name, a Marriage Certificate must be recorded at the Hampshire County Registry of Deeds. A deed must be recorded to add a spouse as an owner of record.

Under Massachusetts law, a non-debtor spouse is protected when holding property in a tenancy by the entirety. A creditor can place a lien on the debtor's interest, but the non-debtor is protected from execution against the property during his or her life, as long as it is the non-debtor's principal residence.