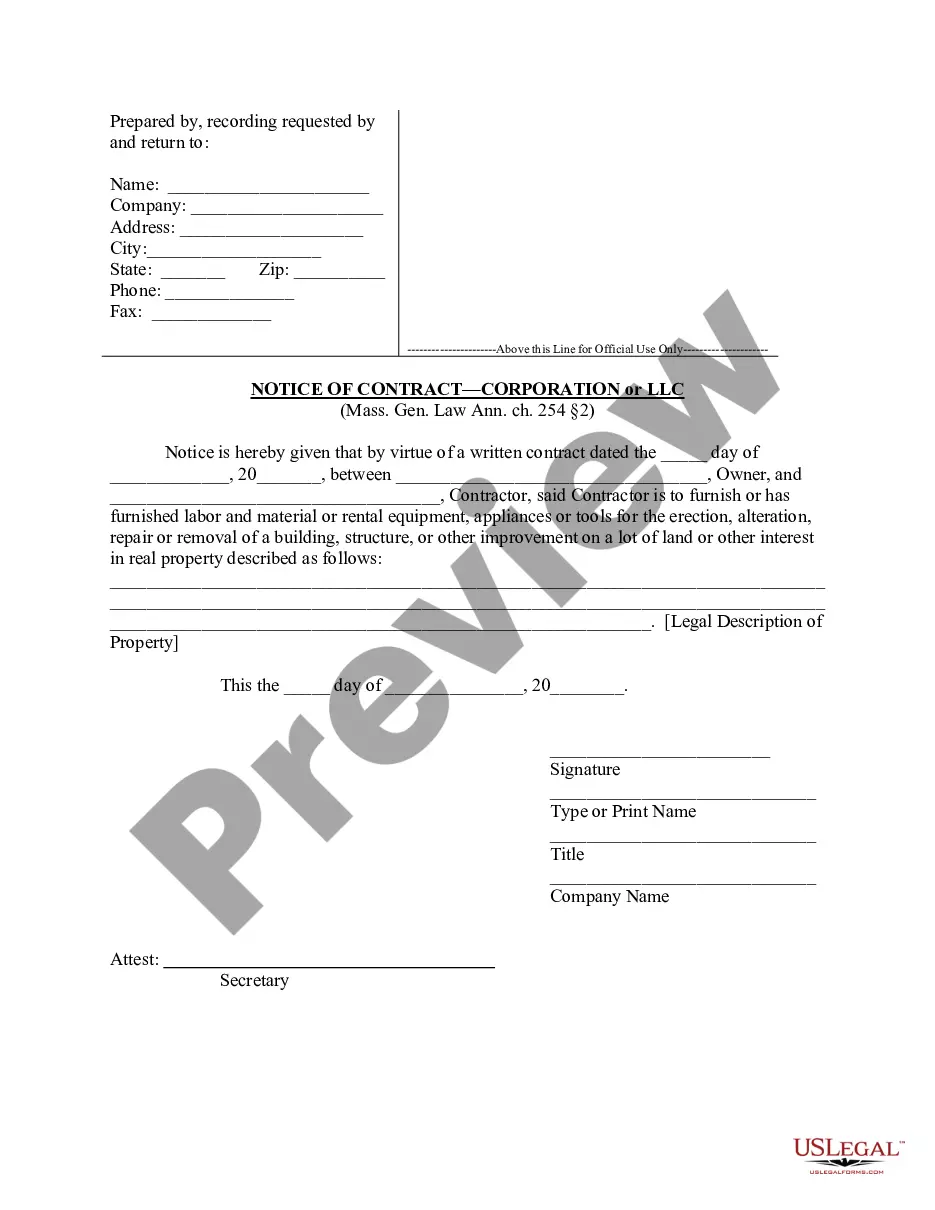

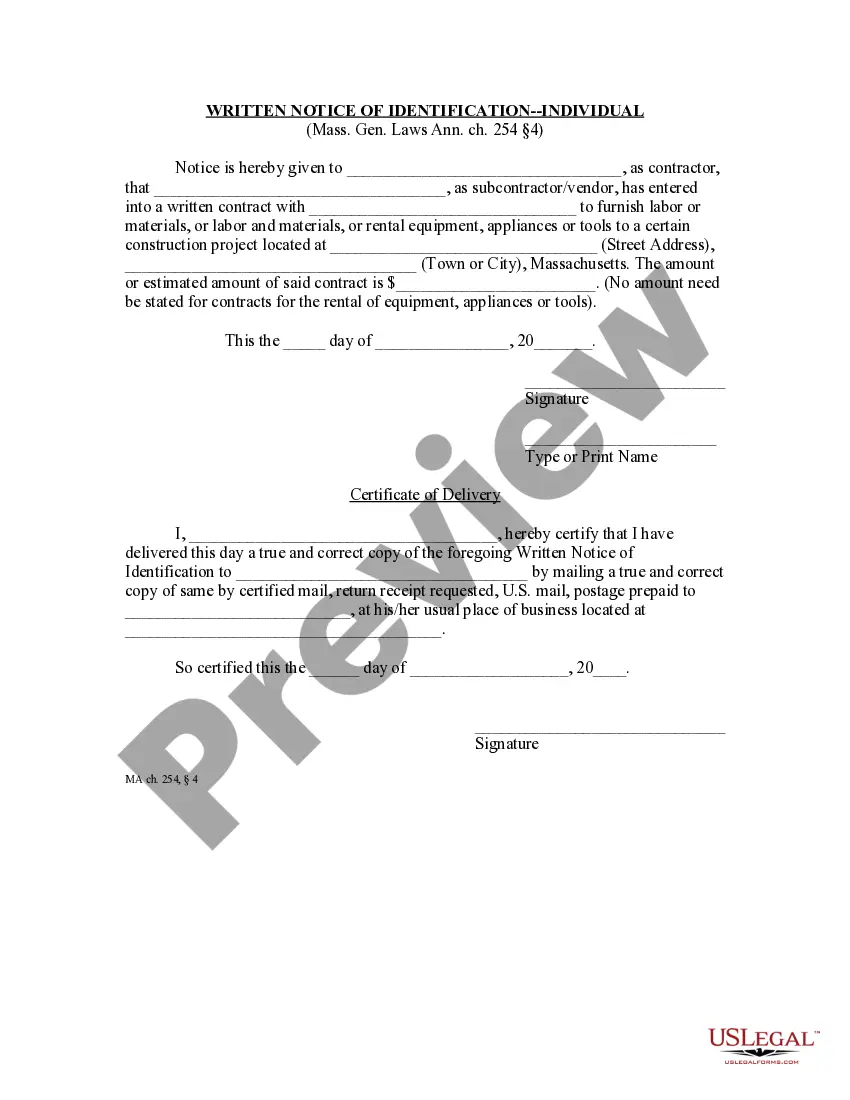

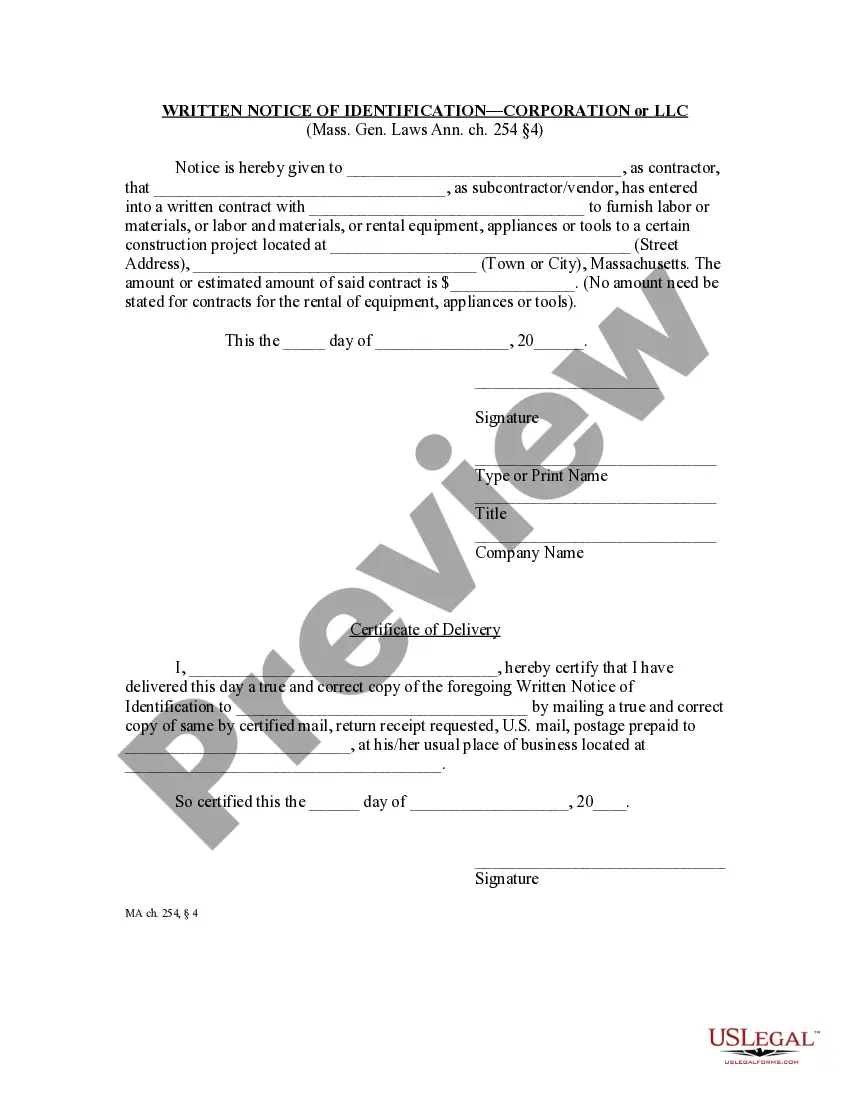

"If the person claiming a lien has no direct contractual relationship with the original contractor, except for liens for labor by persons defined in section one of this chapter, the amount of such lien shall not exceed the amount due or to become due under the subcontract between the original contractor and the subcontractor whose work includes the work of the person claiming the lien as of the date such person files his notice of contract, unless the person claiming such lien has, within thirty days of commencement of his performance, given written notice of identification by certified mail return receipt requested to the original contractor..." Mass. Gen. Laws Ann. ch. 254 §4.

Middlesex Massachusetts Written Notice of Identification by Corporation or LLC

Description

How to fill out Massachusetts Written Notice Of Identification By Corporation Or LLC?

Finding validated templates tailored to your regional statutes can be arduous unless you utilize the US Legal Forms library.

It’s a digital repository of over 85,000 legal documents for both personal and professional purposes and various real-life circumstances.

All documents are properly categorized by usage area and jurisdiction, making it as simple as ABC to find the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC.

Maintaining paperwork organized and compliant with legal requirements is crucial. Take advantage of the US Legal Forms library to keep vital document templates readily available for any requirement!

- Review the Preview mode and document description.

- Ensure you’ve chosen the correct one that meets your needs and fully aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- Should you observe any discrepancies, use the Search tab above to locate the correct one. If it fits your criteria, proceed to the next step.

- Finalize the document purchase.

Form popularity

FAQ

One main difference between an LLC and a corporation is the management structure. LLCs allow for a more informal management setup, giving members the freedom to decide how the business will operate. In contrast, corporations have a more rigid structure with defined roles such as shareholders, directors, and officers. This distinction is vital when filing the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC since it determines how your business is governed and what regulations you must follow.

No, an LLC is not considered a corporation, although both offer limited liability protection to their owners. An LLC is a specific type of business entity that provides flexibility in management and fewer formalities than a corporation. When you prepare your Middlesex Massachusetts Written Notice of Identification by Corporation or LLC, it's important to clarify this distinction. Understanding this can help you comply with local laws and choose the right structure for your business.

The primary difference between an LLC and a corporation lies in their structure and tax treatment. An LLC combines the features of a corporation with the flexibility of a partnership, while a corporation is a distinct legal entity that offers limited liability but must adhere to more stringent regulatory requirements. When filing the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC, it’s essential to understand these differences for proper compliance. Your choice will influence how profits are taxed and the level of paperwork required to maintain operations.

An LLC, or Limited Liability Company, falls under the category of business entities designed to provide personal liability protection to its owners, also known as members. In Middlesex Massachusetts, the Written Notice of Identification by Corporation or LLC is crucial for formal recognition of your business. This category offers flexibility in management and tax benefits that make it appealing for many entrepreneurs. Choosing this structure can significantly impact the way your business operates and is regulated.

While you do not need to renew your LLC like a license, you must submit an annual report each year to maintain your LLC's status in Massachusetts. This ensures that your business is in compliance with state regulations. By including the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC in your filings, you can help streamline this process and affirm your LLC's standing.

If you do not file your annual report for your LLC in Massachusetts, your business could face penalties, including a fine or loss of good standing status. Continued neglect may lead to your LLC being dissolved. It is crucial to remain proactive and ensure that you submit all required documentation, such as the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC, to avoid these complications.

Indeed, you need to file an annual report for your LLC in Massachusetts. This report keeps your business information current and is a legal requirement to maintain your LLC's good standing. Incorporating the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC in your filings can provide necessary clarity and compliance with state guidelines.

The approval process for an LLC in Massachusetts typically takes about 3 to 5 business days after your Articles of Organization are filed. However, processing times can vary depending on the volume of submissions the Secretary's office receives. For timely processing, consider including the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC to ensure all identification steps are properly followed.

An LLC, or Limited Liability Company, is distinct from a corporation in Massachusetts. While both offer limited liability protection to owners, an LLC allows for more flexible management and fewer formalities. It's important to understand the differences when considering the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC, as the filing requirements vary between these two business structures.

To form a single member LLC in Massachusetts, begin by choosing a unique name that complies with the state's naming guidelines. Next, file the Articles of Organization with the Massachusetts Secretary of the Commonwealth. Include the Middlesex Massachusetts Written Notice of Identification by Corporation or LLC as part of your filing to meet identification requirements. Lastly, create an operating agreement to outline your business's management structure, even if it is just for you.