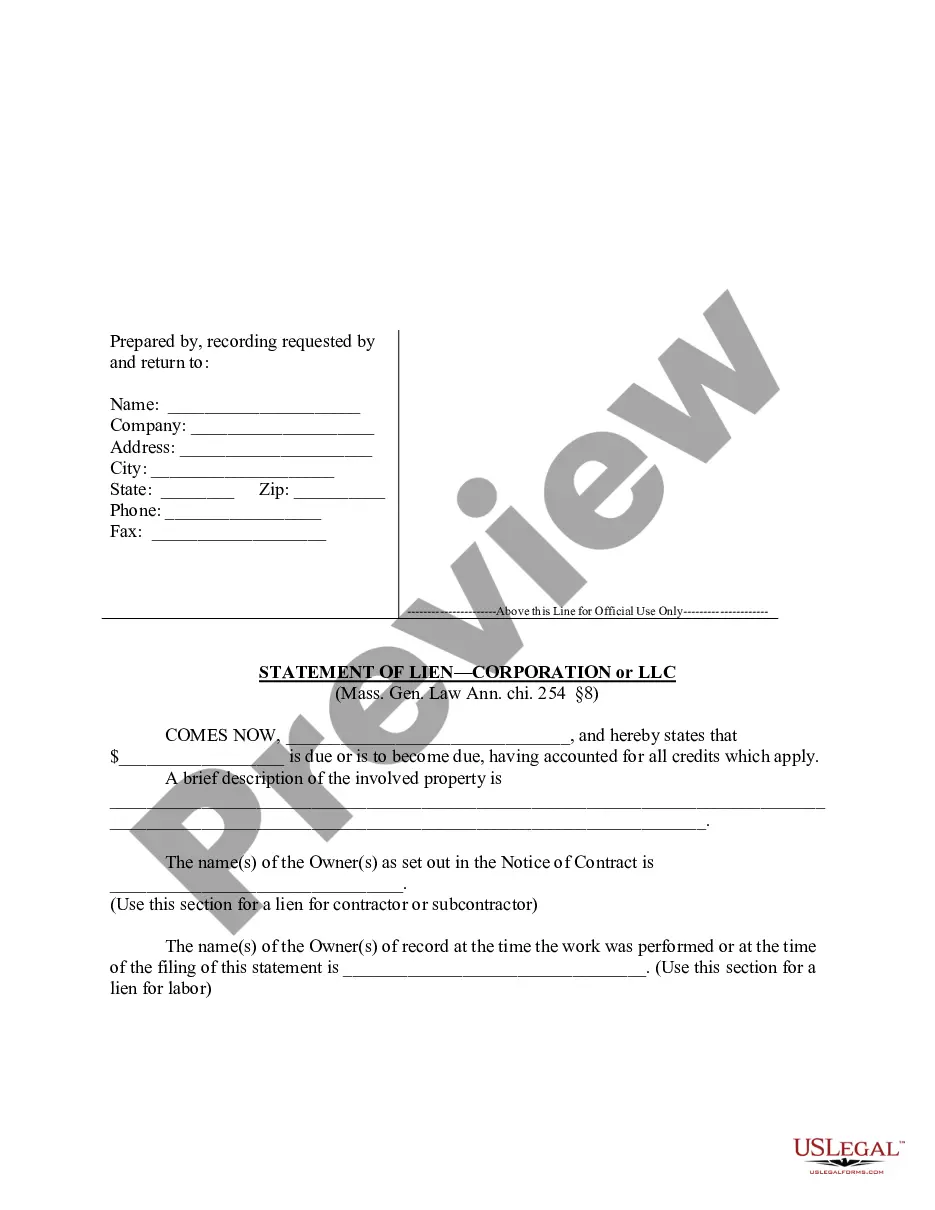

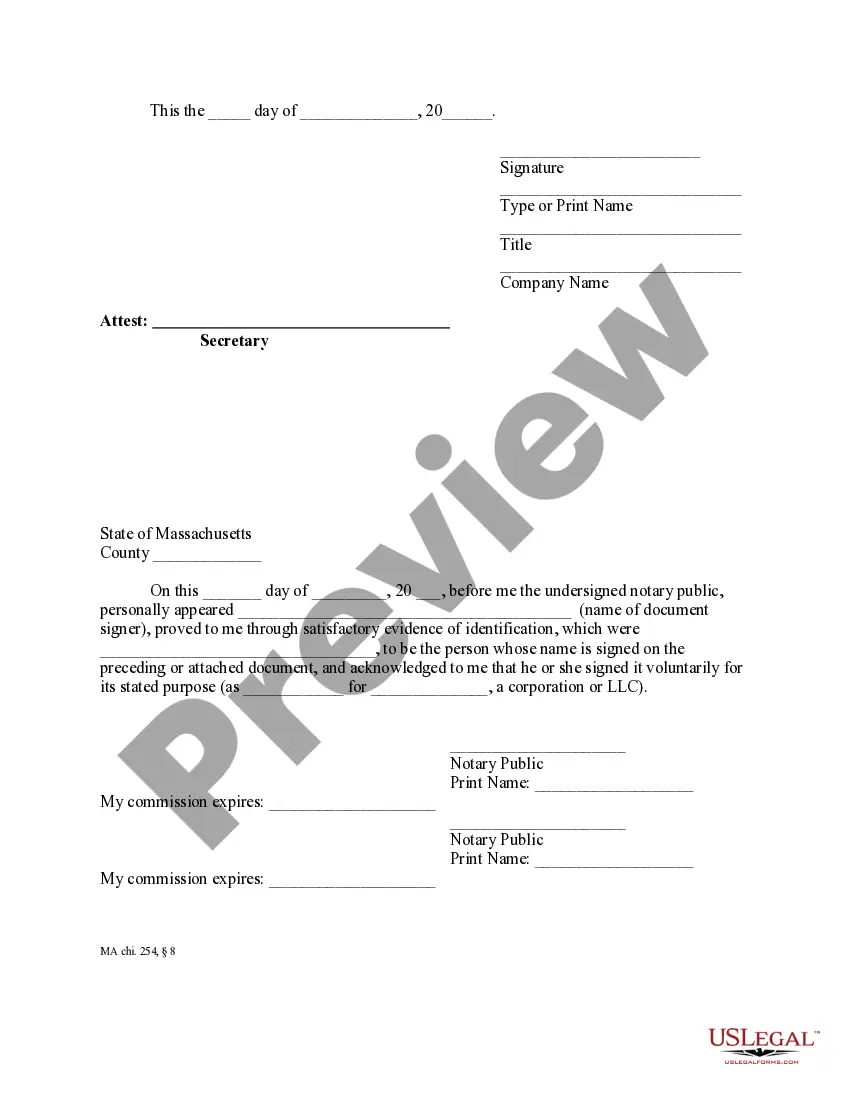

"Liens shall be dissolved unless the contractor, subcontractor, or some person claiming by, through or under them, shall, not later than the earliest of: (i) ninety days after the filing or recording of the notice of substantial completion under section two A; (ii) one hundred and twenty days after the filing or recording of the notice of termination under section two B; or (iii) one hundred and twenty days after the last day a person, entitled to enforce a lien under section two or anyone claiming by, through or under him, performed or furnished labor or material or both labor and materials or furnished rental equipment, appliances or tools, file or record in the registry of deeds in the county or district where the land lies a statement, giving a just and true account of the amount due or to become due him, with all just credits..." Mass. Gen. Laws Ann. ch. 254 §8.

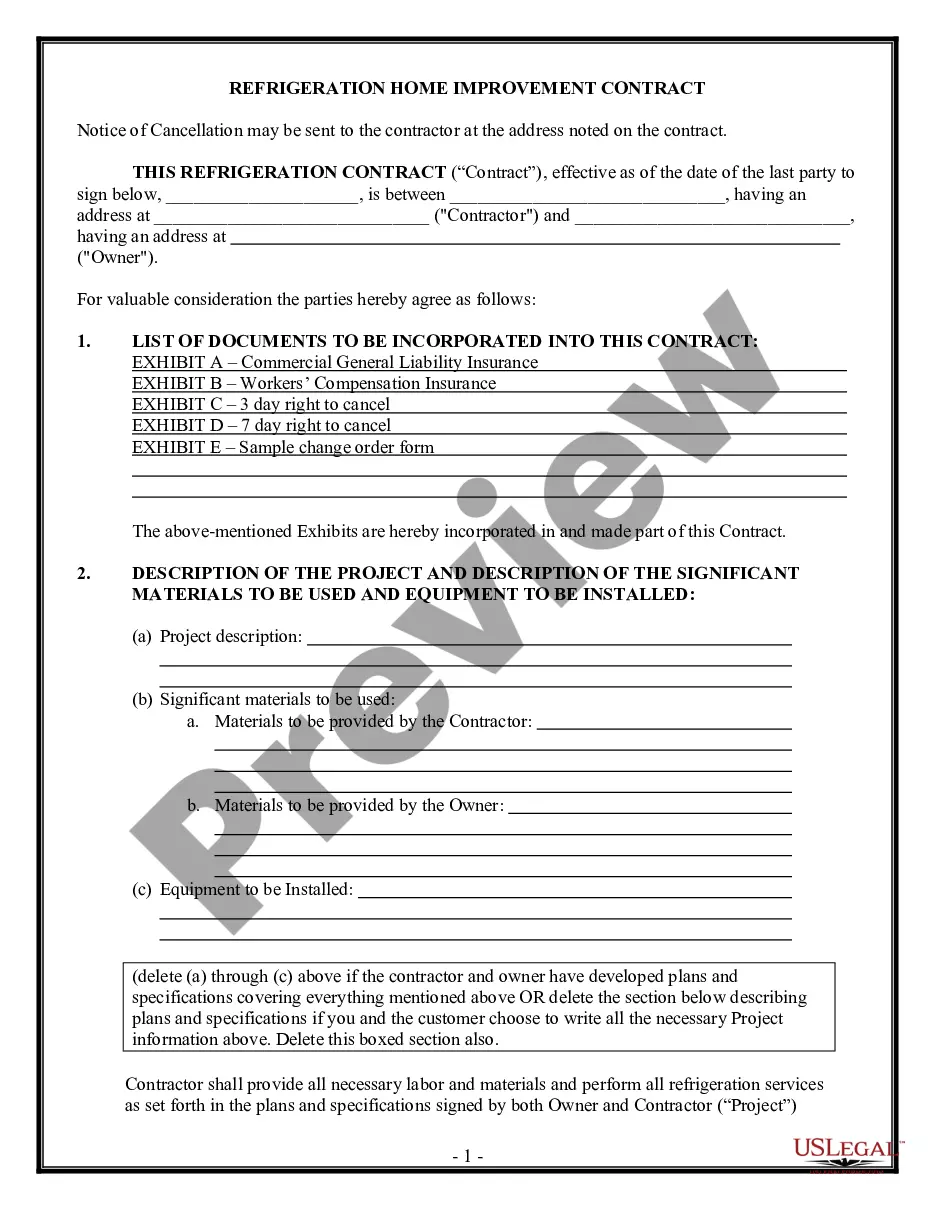

The Boston Massachusetts Statement of Lien by Corporation or LLC is a legal document that allows a corporation or limited liability company (LLC) to file a claim or lien against the property of another individual or entity with the intention to secure a debt or obligation owed to them. The statement of lien serves as a public notice, informing the parties involved, including potential buyers or lenders, of the outstanding debt and the rights of the lien holder. Keywords: Boston Massachusetts, Statement of Lien, Corporation, LLC, legal document, claim, lien, property, debt, obligation, public notice, lien holder. There are different types of Boston Massachusetts Statements of Lien by Corporation or LLC, which are categorized based on the type of lien being filed. Some of these may include: 1. Mechanics Lien: This type of statement of lien is typically filed by construction companies or contractors who have provided labor, materials, or services for a project but have not been fully compensated. By filing a Mechanics Lien, the corporation or LLC seeks to secure the payment for their work by placing a claim on the property that was improved or benefited. 2. Tax Lien: When a corporation or LLC owes unpaid taxes to the local, state, or federal government, a Tax Lien may be filed against their property. This lien ensures that the government has a legal claim on the property as security for the unpaid taxes. 3. Judgment Lien: A Judgment Lien is typically filed after a court judgment has been obtained in favor of the corporation or LLC. This type of lien allows the entity to secure the debt owed to them by placing a claim on the debtor's property. 4. Material man's Lien: This type of statement of lien is similar to a Mechanics Lien, but it specifically applies to suppliers or vendors who have provided materials for a project. If the corporation or LLC is not paid in full for the materials supplied, they can file a Material man's Lien against the property to protect their interests. It is important to note that each type of lien has specific requirements and procedures that must be followed in order to properly file and enforce the lien. This can include specific timelines for filing, notices that must be served to the debtor, or other legal requirements that vary depending on the type of lien being filed. Overall, the Boston Massachusetts Statement of Lien by Corporation or LLC is a significant legal tool that allows businesses to protect their financial interests by securing a debt or obligation owed to them through a claim on the debtor's property.The Boston Massachusetts Statement of Lien by Corporation or LLC is a legal document that allows a corporation or limited liability company (LLC) to file a claim or lien against the property of another individual or entity with the intention to secure a debt or obligation owed to them. The statement of lien serves as a public notice, informing the parties involved, including potential buyers or lenders, of the outstanding debt and the rights of the lien holder. Keywords: Boston Massachusetts, Statement of Lien, Corporation, LLC, legal document, claim, lien, property, debt, obligation, public notice, lien holder. There are different types of Boston Massachusetts Statements of Lien by Corporation or LLC, which are categorized based on the type of lien being filed. Some of these may include: 1. Mechanics Lien: This type of statement of lien is typically filed by construction companies or contractors who have provided labor, materials, or services for a project but have not been fully compensated. By filing a Mechanics Lien, the corporation or LLC seeks to secure the payment for their work by placing a claim on the property that was improved or benefited. 2. Tax Lien: When a corporation or LLC owes unpaid taxes to the local, state, or federal government, a Tax Lien may be filed against their property. This lien ensures that the government has a legal claim on the property as security for the unpaid taxes. 3. Judgment Lien: A Judgment Lien is typically filed after a court judgment has been obtained in favor of the corporation or LLC. This type of lien allows the entity to secure the debt owed to them by placing a claim on the debtor's property. 4. Material man's Lien: This type of statement of lien is similar to a Mechanics Lien, but it specifically applies to suppliers or vendors who have provided materials for a project. If the corporation or LLC is not paid in full for the materials supplied, they can file a Material man's Lien against the property to protect their interests. It is important to note that each type of lien has specific requirements and procedures that must be followed in order to properly file and enforce the lien. This can include specific timelines for filing, notices that must be served to the debtor, or other legal requirements that vary depending on the type of lien being filed. Overall, the Boston Massachusetts Statement of Lien by Corporation or LLC is a significant legal tool that allows businesses to protect their financial interests by securing a debt or obligation owed to them through a claim on the debtor's property.