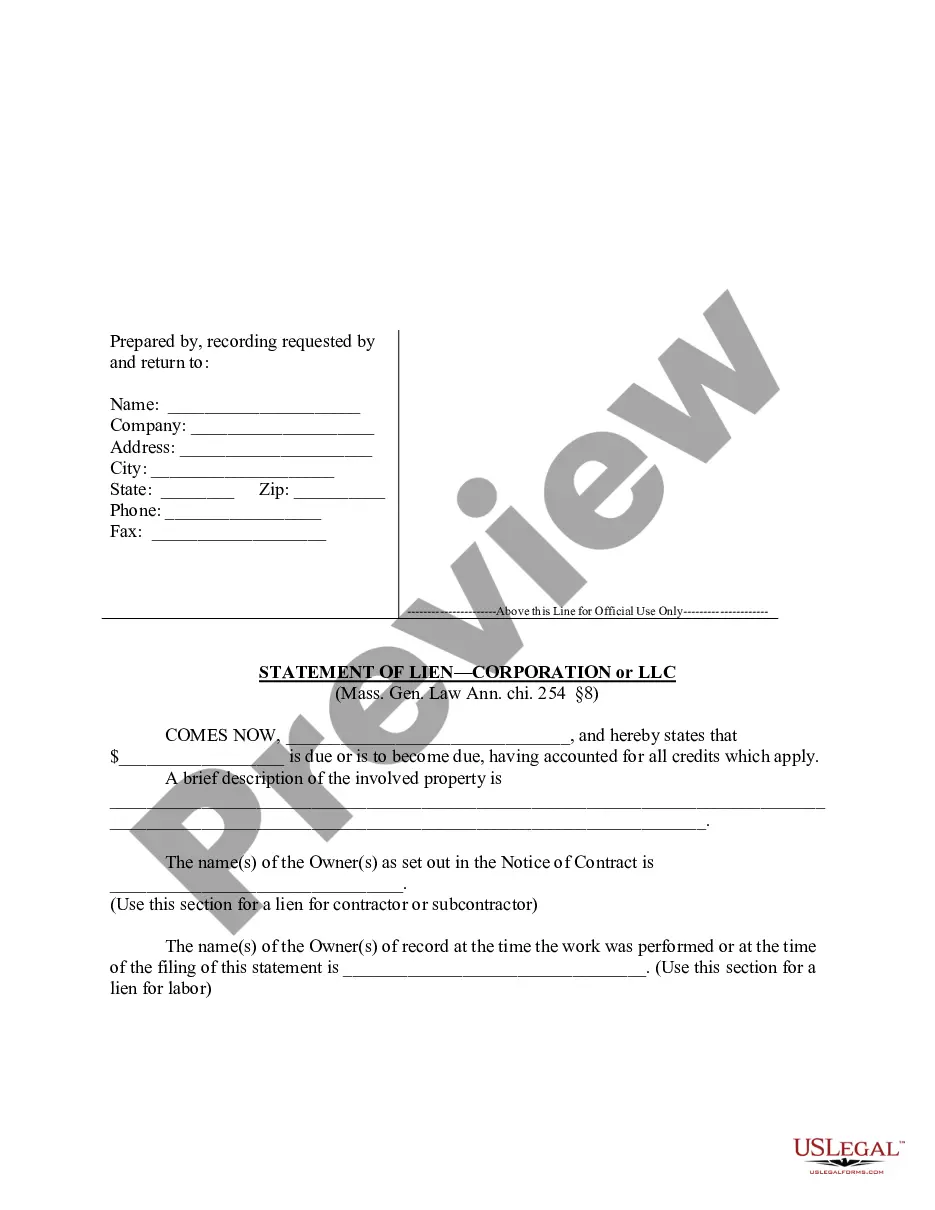

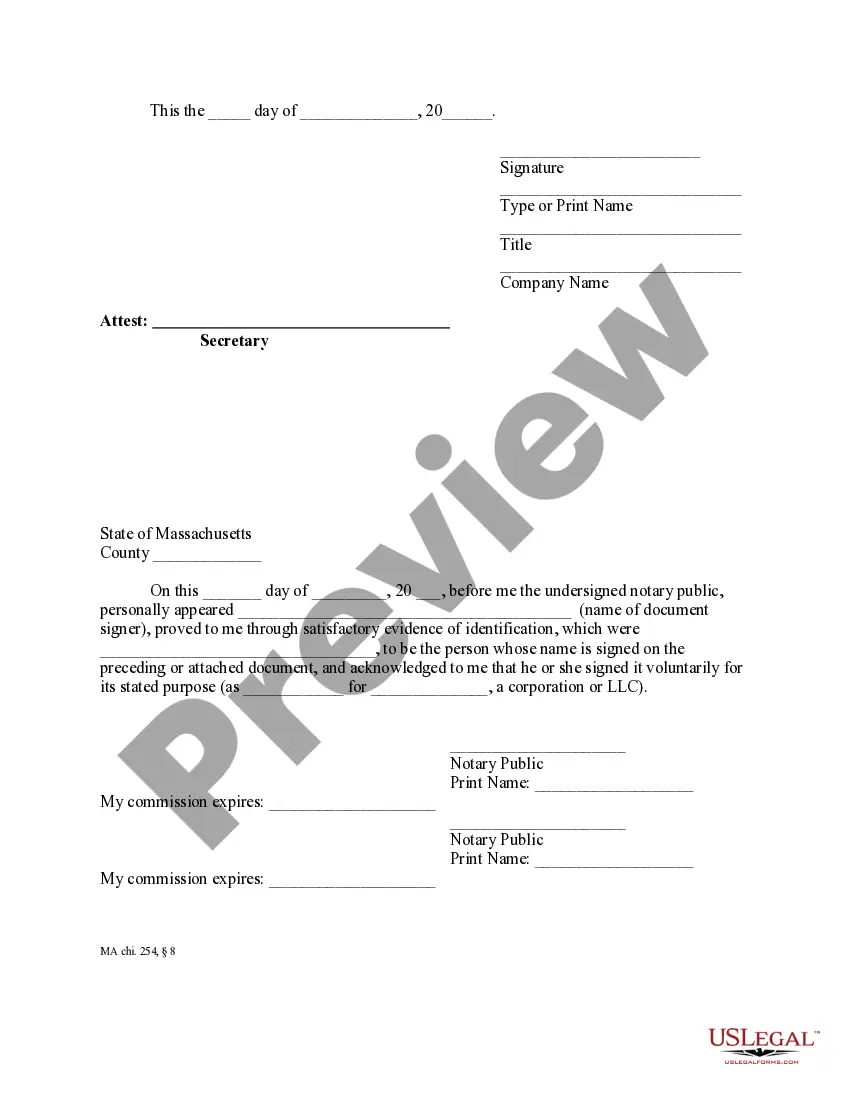

"Liens shall be dissolved unless the contractor, subcontractor, or some person claiming by, through or under them, shall, not later than the earliest of: (i) ninety days after the filing or recording of the notice of substantial completion under section two A; (ii) one hundred and twenty days after the filing or recording of the notice of termination under section two B; or (iii) one hundred and twenty days after the last day a person, entitled to enforce a lien under section two or anyone claiming by, through or under him, performed or furnished labor or material or both labor and materials or furnished rental equipment, appliances or tools, file or record in the registry of deeds in the county or district where the land lies a statement, giving a just and true account of the amount due or to become due him, with all just credits..." Mass. Gen. Laws Ann. ch. 254 §8.

In Lowell, Massachusetts, a Statement of Lien by Corporation or LLC serves as an important legal document filed by business entities when they have a claim against a property for outstanding debts or unpaid obligations. This statement is submitted to the appropriate authorities to establish the lien holder's rights over the property until the debt is satisfied. The Statement of Lien by Corporation or LLC is crucial for protecting the interests of businesses that have provided goods, services, or funds to another party. By filing this statement, the business entity ensures that they have a legal claim over the specified property and increases their chances of recovering the debt owed to them. There are different types of Statement of Lien by Corporation or LLC that can be filed in Lowell, Massachusetts, depending on the specific situation: 1. Mechanic's Lien: A mechanic's lien is commonly filed by contractors, subcontractors, or suppliers who have provided labor or materials for construction or improvement of a property but haven't received full payment. Filing this lien ensures that these parties can claim their outstanding dues from the property's owner or other interested parties upon its sale or transfer. 2. Garbageman's Lien: A garbageman's lien is filed by individuals or businesses that provide repair services, storage, or towing for vehicles. This type of lien allows the claimant to assert their right to receive payment for services rendered or storage fees accumulated. 3. Artisan's Lien: An artisan's lien is typically filed by artisans, such as jewelers, artists, or craftsmen, who have added substantial value to a property through their skills or expertise but haven't been compensated adequately. By filing this lien, these individuals or businesses can protect their rights to secure payment for their work. 4. Supplier's Lien: A supplier's lien is filed by businesses that have provided goods, products, or materials to another entity but haven't received payment. This lien allows them to claim the outstanding balance from the property owner or any interested party upon the disposition of the property. When filing a Statement of Lien by Corporation or LLC in Lowell, Massachusetts, it is critical to adhere to the specific requirements outlined by the state statutes. Failure to comply with these regulations may result in the lien being invalidated or not being prioritized in case of competing claims. It is advisable to consult with an experienced attorney or seek guidance from the appropriate authorities to ensure the accurate completion and submission of the lien statement.In Lowell, Massachusetts, a Statement of Lien by Corporation or LLC serves as an important legal document filed by business entities when they have a claim against a property for outstanding debts or unpaid obligations. This statement is submitted to the appropriate authorities to establish the lien holder's rights over the property until the debt is satisfied. The Statement of Lien by Corporation or LLC is crucial for protecting the interests of businesses that have provided goods, services, or funds to another party. By filing this statement, the business entity ensures that they have a legal claim over the specified property and increases their chances of recovering the debt owed to them. There are different types of Statement of Lien by Corporation or LLC that can be filed in Lowell, Massachusetts, depending on the specific situation: 1. Mechanic's Lien: A mechanic's lien is commonly filed by contractors, subcontractors, or suppliers who have provided labor or materials for construction or improvement of a property but haven't received full payment. Filing this lien ensures that these parties can claim their outstanding dues from the property's owner or other interested parties upon its sale or transfer. 2. Garbageman's Lien: A garbageman's lien is filed by individuals or businesses that provide repair services, storage, or towing for vehicles. This type of lien allows the claimant to assert their right to receive payment for services rendered or storage fees accumulated. 3. Artisan's Lien: An artisan's lien is typically filed by artisans, such as jewelers, artists, or craftsmen, who have added substantial value to a property through their skills or expertise but haven't been compensated adequately. By filing this lien, these individuals or businesses can protect their rights to secure payment for their work. 4. Supplier's Lien: A supplier's lien is filed by businesses that have provided goods, products, or materials to another entity but haven't received payment. This lien allows them to claim the outstanding balance from the property owner or any interested party upon the disposition of the property. When filing a Statement of Lien by Corporation or LLC in Lowell, Massachusetts, it is critical to adhere to the specific requirements outlined by the state statutes. Failure to comply with these regulations may result in the lien being invalidated or not being prioritized in case of competing claims. It is advisable to consult with an experienced attorney or seek guidance from the appropriate authorities to ensure the accurate completion and submission of the lien statement.