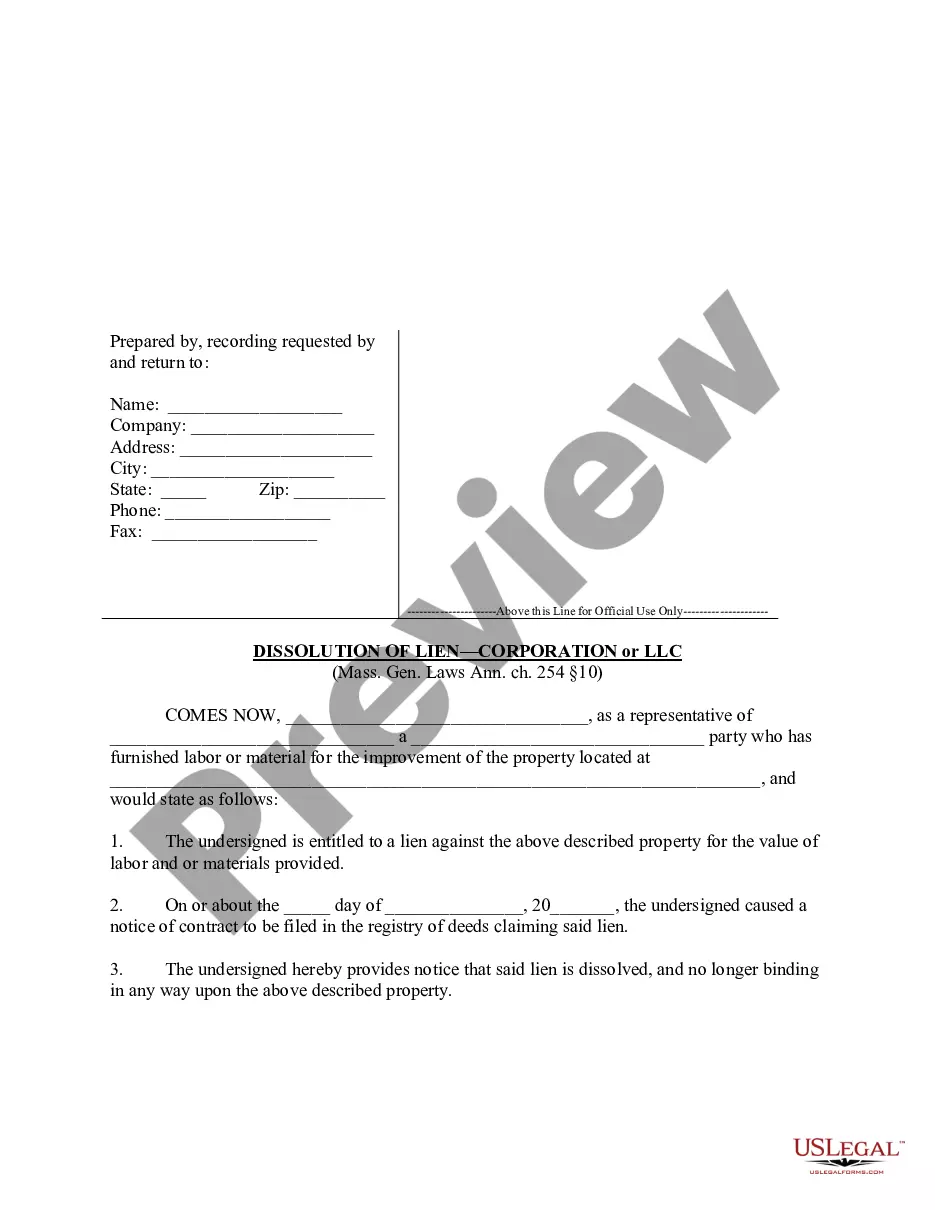

"The lien of any person may, so far as his interest is concerned, be dissolved by a notice signed by him, stating that his lien is dissolved, filed in the registry of deeds where the notice of the contract is filed under which contract the lien is claimed." Mass. Gen. Laws Ann. ch. 254 ?§10.

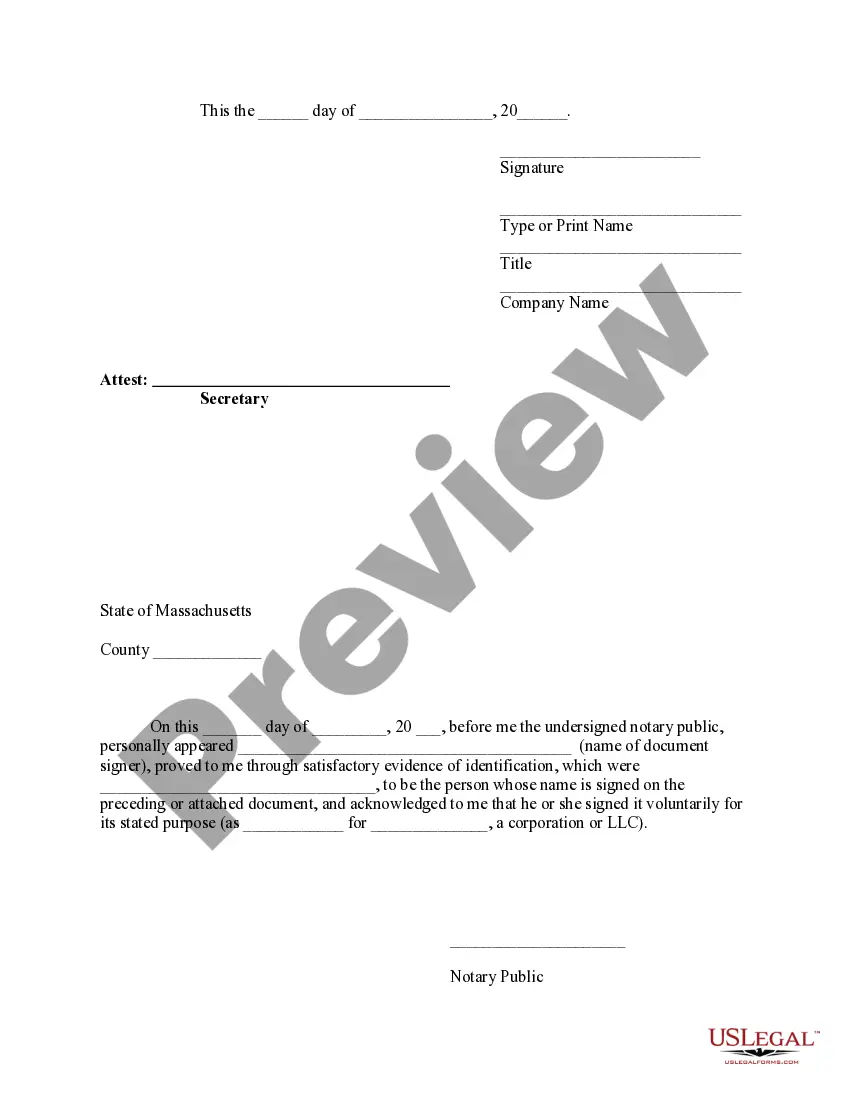

Cambridge Massachusetts Dissolution of Lien by Corporation or LLC: A Comprehensive Overview In Cambridge, Massachusetts, the Dissolution of Lien by Corporation or Limited Liability Company (LLC) is a legal process by which a lien placed on a property is formally released or removed by either a corporation or an LLC. This can occur for a variety of reasons, such as full payment of the debt, settlement negotiations, or expiration of the lien itself. The dissolution of a lien is essential for property owners as it restores their full rights and ownership over the property. There are various types of Cambridge Massachusetts Dissolution of Lien by Corporation or LLC, depending on the circumstances of the lien and the actions taken by the parties involved. Some key types are: 1. Full Payment Dissolution: This type of dissolution occurs when the property owner, corporation, or LLC satisfies the debt for which the lien was initially placed. Upon complete payment, the lien holder is legally obligated to dissolve the lien and release any claim against the property. 2. Settlement Dissolution: In some cases, negotiations between the lien holder and the property owner (corporation or LLC) may result in a settlement agreement. When the agreed settlement is fulfilled, the lien holder dissolves the lien, removing any encumbrance from the property. 3. Expiration Dissolution: Lien holders typically have a limited window to enforce their liens. If the time period specified in the lien document has expired without any action taken by the lien holder, the lien is considered invalid or expired. In such cases, the corporation or LLC can request the dissolution of the lien, establishing the property's clear title. To commence the Dissolution of Lien by Corporation or LLC in Cambridge, Massachusetts, the involved party (corporation or LLC) must follow specific procedures: 1. Documentation: The corporation or LLC must gather and organize all relevant documents related to the lien, including original lien documents, payment receipts, settlement agreements, or timelines indicating expiration, if applicable. 2. Consultation: Seeking professional legal counsel is crucial to ensure compliance with local, state, and federal laws throughout the dissolution process. An attorney experienced in real estate law can guide corporations or LCS through the necessary steps, ensuring a smooth and legally sound dissolution. 3. Filing: The corporation or LLC must file a formal request for dissolution with the appropriate authorities in Cambridge, Massachusetts. This request must include all relevant documentation, supporting evidence, and any fees required by the governing jurisdiction. 4. Notification: Upon filing for dissolution, the corporation or LLC must notify all relevant parties, including the lien holder, any potential creditors, and the property owner. Adequate notice ensures transparency and gives all parties the opportunity to contest or address the dissolution process. 5. Confirmation and Recording: Following a thorough review of the submitted documentation, if the dissolution request is approved, the governing authority issues a formal notice of confirmation. This notice serves as proof of the lien's dissolution and should be appropriately recorded in relevant public records to update the property's title. Overall, the Dissolution of Lien by Corporation or LLC in Cambridge, Massachusetts involves a series of steps aimed at legally releasing the lien on a property. Whether through full payment, settlement, or expiration, it is essential for corporations or LCS to follow the proper procedures to restore the property's clear title and protect their interests. Seeking legal advice and adhering to the specific requirements of Cambridge's legal system will ensure a successful and legitimate dissolution process.Cambridge Massachusetts Dissolution of Lien by Corporation or LLC: A Comprehensive Overview In Cambridge, Massachusetts, the Dissolution of Lien by Corporation or Limited Liability Company (LLC) is a legal process by which a lien placed on a property is formally released or removed by either a corporation or an LLC. This can occur for a variety of reasons, such as full payment of the debt, settlement negotiations, or expiration of the lien itself. The dissolution of a lien is essential for property owners as it restores their full rights and ownership over the property. There are various types of Cambridge Massachusetts Dissolution of Lien by Corporation or LLC, depending on the circumstances of the lien and the actions taken by the parties involved. Some key types are: 1. Full Payment Dissolution: This type of dissolution occurs when the property owner, corporation, or LLC satisfies the debt for which the lien was initially placed. Upon complete payment, the lien holder is legally obligated to dissolve the lien and release any claim against the property. 2. Settlement Dissolution: In some cases, negotiations between the lien holder and the property owner (corporation or LLC) may result in a settlement agreement. When the agreed settlement is fulfilled, the lien holder dissolves the lien, removing any encumbrance from the property. 3. Expiration Dissolution: Lien holders typically have a limited window to enforce their liens. If the time period specified in the lien document has expired without any action taken by the lien holder, the lien is considered invalid or expired. In such cases, the corporation or LLC can request the dissolution of the lien, establishing the property's clear title. To commence the Dissolution of Lien by Corporation or LLC in Cambridge, Massachusetts, the involved party (corporation or LLC) must follow specific procedures: 1. Documentation: The corporation or LLC must gather and organize all relevant documents related to the lien, including original lien documents, payment receipts, settlement agreements, or timelines indicating expiration, if applicable. 2. Consultation: Seeking professional legal counsel is crucial to ensure compliance with local, state, and federal laws throughout the dissolution process. An attorney experienced in real estate law can guide corporations or LCS through the necessary steps, ensuring a smooth and legally sound dissolution. 3. Filing: The corporation or LLC must file a formal request for dissolution with the appropriate authorities in Cambridge, Massachusetts. This request must include all relevant documentation, supporting evidence, and any fees required by the governing jurisdiction. 4. Notification: Upon filing for dissolution, the corporation or LLC must notify all relevant parties, including the lien holder, any potential creditors, and the property owner. Adequate notice ensures transparency and gives all parties the opportunity to contest or address the dissolution process. 5. Confirmation and Recording: Following a thorough review of the submitted documentation, if the dissolution request is approved, the governing authority issues a formal notice of confirmation. This notice serves as proof of the lien's dissolution and should be appropriately recorded in relevant public records to update the property's title. Overall, the Dissolution of Lien by Corporation or LLC in Cambridge, Massachusetts involves a series of steps aimed at legally releasing the lien on a property. Whether through full payment, settlement, or expiration, it is essential for corporations or LCS to follow the proper procedures to restore the property's clear title and protect their interests. Seeking legal advice and adhering to the specific requirements of Cambridge's legal system will ensure a successful and legitimate dissolution process.