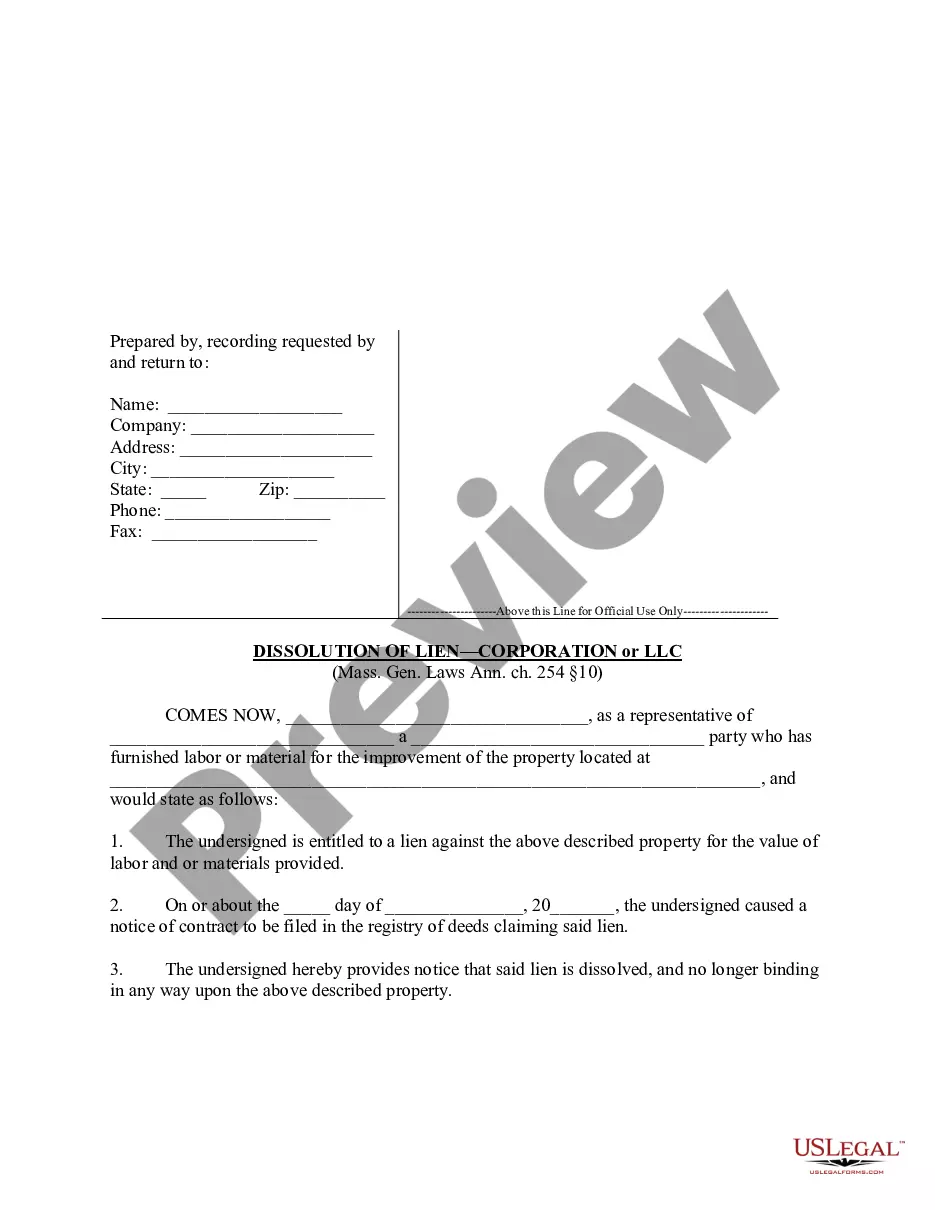

"The lien of any person may, so far as his interest is concerned, be dissolved by a notice signed by him, stating that his lien is dissolved, filed in the registry of deeds where the notice of the contract is filed under which contract the lien is claimed." Mass. Gen. Laws Ann. ch. 254 ?§10.

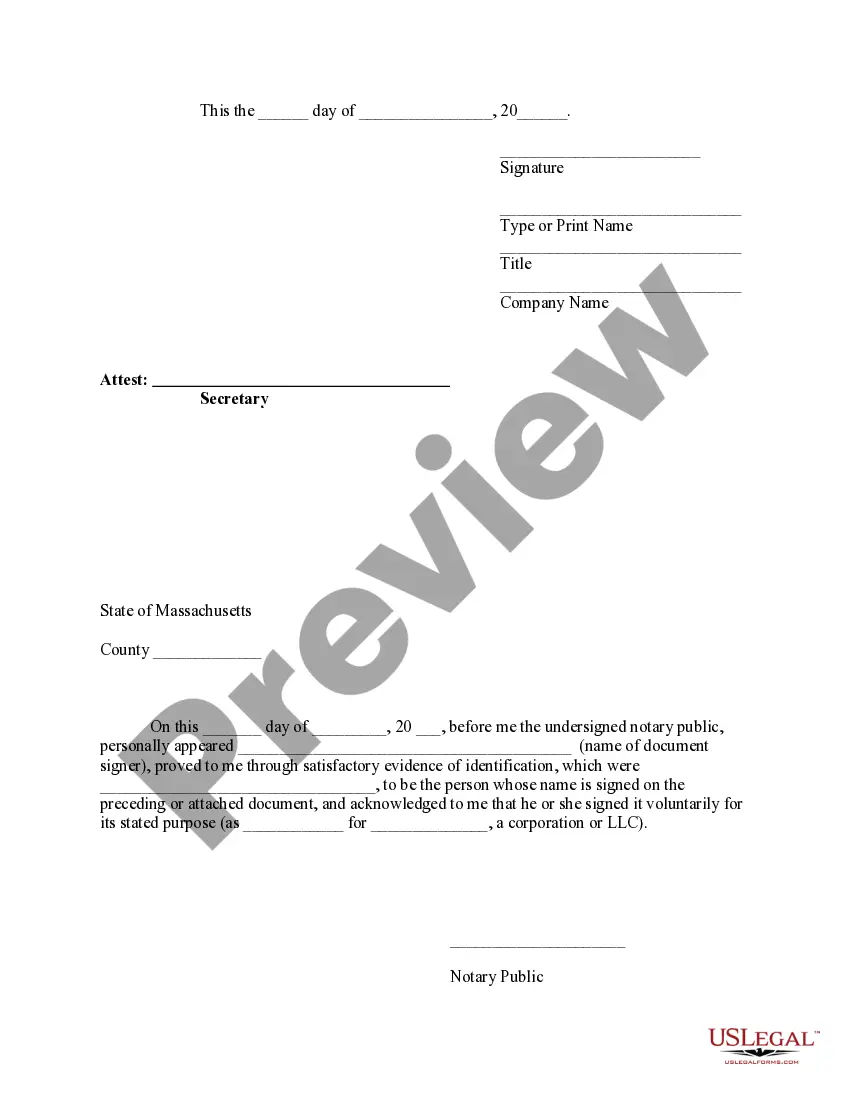

Lowell Massachusetts Dissolution of Lien by Corporation or LLC: Understanding the Process and Types In Lowell, Massachusetts, the dissolution of a lien by a corporation or LLC is a legal process that releases the encumbrance on real property or assets. It allows the company to clear its financial obligations and remove any liens that may be hindering its operations or the transfer of property ownership. This detailed description will delve into the various aspects of the Lowell Massachusetts Dissolution of Lien by Corporation or LLC, highlighting the process, requirements, and different types. Process: 1. Filing a Notice of Dissolution: The corporation or LLC must file a Notice of Dissolution with the Massachusetts Secretary of State, indicating the intent to dissolve the company. This notice should briefly explain the reasons for dissolution and provide essential details of the entity. 2. Resolution and Voting: The shareholders or members of the corporation or LLC must hold a meeting to pass a resolution for dissolution. The vote should be in accordance with the bylaws or operating agreement, requiring a majority or super majority approval. 3. Notification of Creditors: The corporation or LLC must provide written notice to all known creditors informing them about the dissolution. This notice must include instructions on how to submit any outstanding claims against the entity, ensuring sufficient opportunity for creditors to assert valid liens. 4. Settlement of Liens: Once the notice is provided to creditors, the corporation or LLC must resolve any pending liens, pay off outstanding debts, or negotiate settlements to satisfy the creditors' claims. The company should maintain documentation of all settlements and payments made during this process. 5. Filing Certificate of Dissolution: Once all debts and obligations are cleared, the corporation or LLC can file a Certificate of Dissolution with the Massachusetts Secretary of State, officially ending its existence. A filing fee is typically required, and the certificate should include the necessary information, such as the entity's name, date of dissolution, and signatures of authorized representatives. Types of Lowell Massachusetts Dissolution of Lien by Corporation or LLC: 1. Voluntary Dissolution: This type of dissolution occurs when the corporation or LLC decides to dissolve voluntarily due to reasons such as business closure, bankruptcy, or the end of its intended lifespan. The process involves following the aforementioned steps and settling any outstanding liens. 2. Involuntary Dissolution: In certain cases, a corporation or LLC may be involuntarily dissolved by court order. This can happen if the company fails to meet certain legal or financial obligations, engages in illegal activities, or violates regulations. In such cases, the court may decide to dissolve the entity and clear any associated liens. 3. Administrative Dissolution: An administrative dissolution may occur if the corporation or LLC fails to file necessary documents, such as annual reports or filing fees, in a timely manner. The state authorities have the power to dissolve the entity administratively, after which the process of clearing liens is initiated. In Lowell, Massachusetts, the dissolution of liens by a corporation or LLC involves following specific procedures, from filing the Notice of Dissolution to settling outstanding obligations and obtaining the Certificate of Dissolution. Different types of dissolution, including voluntary, involuntary, and administrative, may occur depending on the circumstances of the entity's dissolution. It is crucial for corporations and LCS to adhere to these procedures to ensure a smooth dissolution and clear any liens promptly and efficiently.Lowell Massachusetts Dissolution of Lien by Corporation or LLC: Understanding the Process and Types In Lowell, Massachusetts, the dissolution of a lien by a corporation or LLC is a legal process that releases the encumbrance on real property or assets. It allows the company to clear its financial obligations and remove any liens that may be hindering its operations or the transfer of property ownership. This detailed description will delve into the various aspects of the Lowell Massachusetts Dissolution of Lien by Corporation or LLC, highlighting the process, requirements, and different types. Process: 1. Filing a Notice of Dissolution: The corporation or LLC must file a Notice of Dissolution with the Massachusetts Secretary of State, indicating the intent to dissolve the company. This notice should briefly explain the reasons for dissolution and provide essential details of the entity. 2. Resolution and Voting: The shareholders or members of the corporation or LLC must hold a meeting to pass a resolution for dissolution. The vote should be in accordance with the bylaws or operating agreement, requiring a majority or super majority approval. 3. Notification of Creditors: The corporation or LLC must provide written notice to all known creditors informing them about the dissolution. This notice must include instructions on how to submit any outstanding claims against the entity, ensuring sufficient opportunity for creditors to assert valid liens. 4. Settlement of Liens: Once the notice is provided to creditors, the corporation or LLC must resolve any pending liens, pay off outstanding debts, or negotiate settlements to satisfy the creditors' claims. The company should maintain documentation of all settlements and payments made during this process. 5. Filing Certificate of Dissolution: Once all debts and obligations are cleared, the corporation or LLC can file a Certificate of Dissolution with the Massachusetts Secretary of State, officially ending its existence. A filing fee is typically required, and the certificate should include the necessary information, such as the entity's name, date of dissolution, and signatures of authorized representatives. Types of Lowell Massachusetts Dissolution of Lien by Corporation or LLC: 1. Voluntary Dissolution: This type of dissolution occurs when the corporation or LLC decides to dissolve voluntarily due to reasons such as business closure, bankruptcy, or the end of its intended lifespan. The process involves following the aforementioned steps and settling any outstanding liens. 2. Involuntary Dissolution: In certain cases, a corporation or LLC may be involuntarily dissolved by court order. This can happen if the company fails to meet certain legal or financial obligations, engages in illegal activities, or violates regulations. In such cases, the court may decide to dissolve the entity and clear any associated liens. 3. Administrative Dissolution: An administrative dissolution may occur if the corporation or LLC fails to file necessary documents, such as annual reports or filing fees, in a timely manner. The state authorities have the power to dissolve the entity administratively, after which the process of clearing liens is initiated. In Lowell, Massachusetts, the dissolution of liens by a corporation or LLC involves following specific procedures, from filing the Notice of Dissolution to settling outstanding obligations and obtaining the Certificate of Dissolution. Different types of dissolution, including voluntary, involuntary, and administrative, may occur depending on the circumstances of the entity's dissolution. It is crucial for corporations and LCS to adhere to these procedures to ensure a smooth dissolution and clear any liens promptly and efficiently.