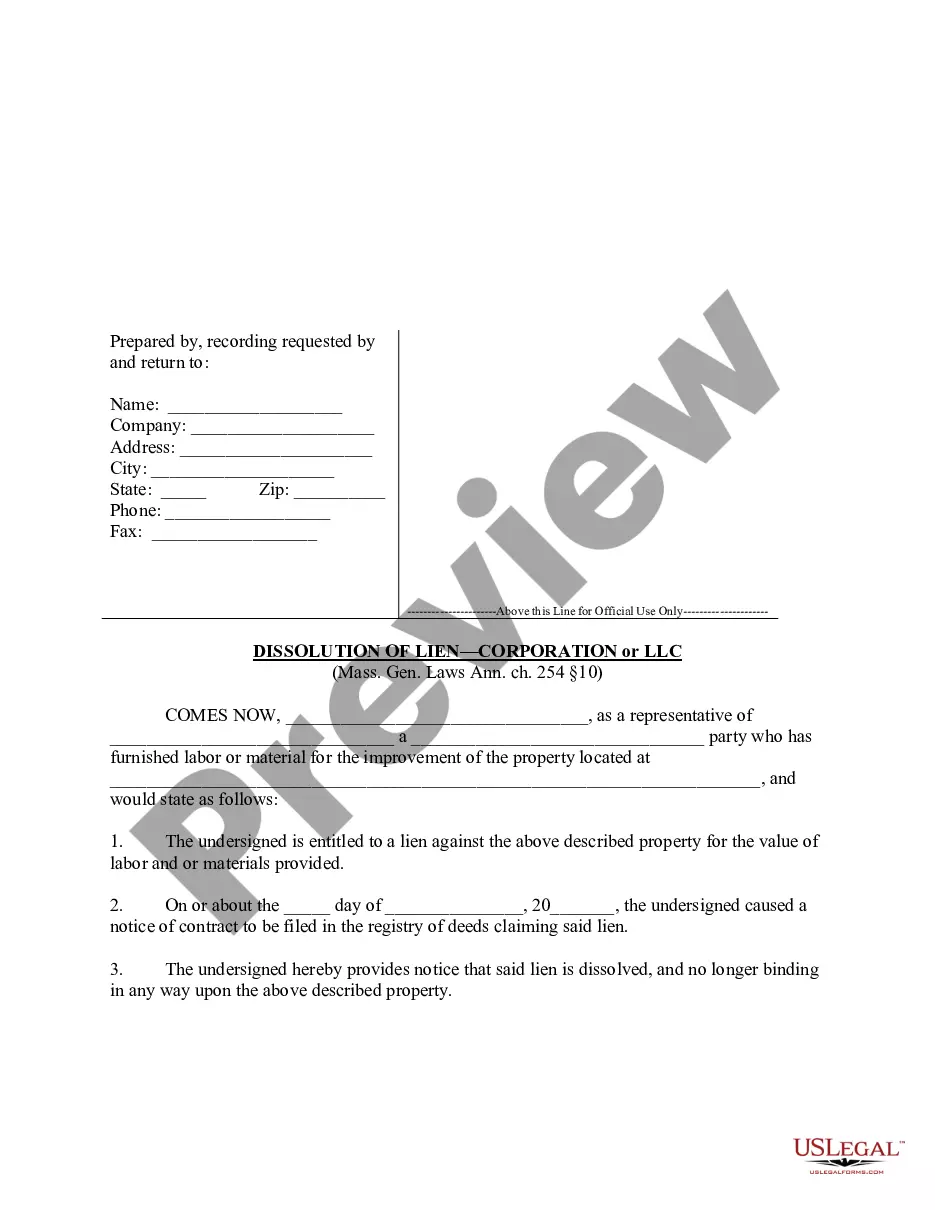

"The lien of any person may, so far as his interest is concerned, be dissolved by a notice signed by him, stating that his lien is dissolved, filed in the registry of deeds where the notice of the contract is filed under which contract the lien is claimed." Mass. Gen. Laws Ann. ch. 254 ?§10.

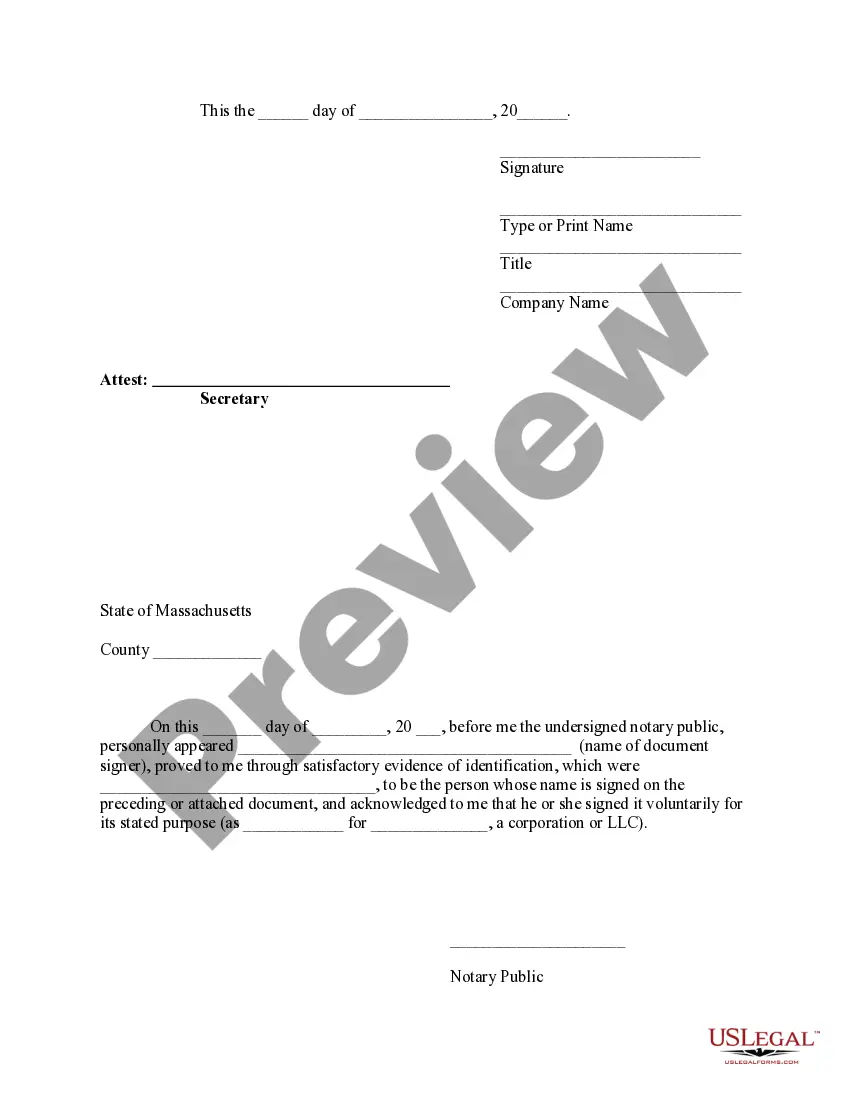

Middlesex Massachusetts Dissolution of Lien by Corporation or LLC is a legal process that allows a corporation or limited liability company (LLC) in Middlesex County, Massachusetts, to release a lien placed on a property or assets. A lien is typically a legal claim against a property or asset to secure the payment of a debt or obligation. When a corporation or LLC wants to dissolve a lien in Middlesex Massachusetts, it needs to follow specific procedures outlined by state laws. The dissolution process ensures that the lien holder's rights are protected and ensures the lien is removed from the public record. There are several types of Middlesex Massachusetts Dissolution of Lien by Corporation or LLC: 1. Voluntary Dissolution: A voluntary dissolution occurs when the corporation or LLC decides to dissolve the lien willingly. This can happen when the underlying debt is paid off, settled, or no longer poses a risk to the lien holder. 2. Involuntary Dissolution: Involuntary dissolution occurs when the corporation or LLC fails to comply with certain legal obligations, such as filing required documents, paying taxes, or maintaining necessary licenses or permits. In such cases, the government or creditors may initiate the dissolution process and seek the removal of the lien. 3. Dissolution by Bankruptcy: If the corporation or LLC files for bankruptcy, the court may order the dissolution of any existing liens. This is done to ensure a fair distribution of assets among creditors and alleviate the corporation or LLC from further financial obligations. 4. Dissolution through Judicial Process: In some cases, the corporation or LLC may seek dissolution of a lien through a judicial process. This usually happens when the lien holder disputes the validity of the lien or if there are legal issues surrounding the debt or obligation. To initiate the Middlesex Massachusetts Dissolution of Lien by Corporation or LLC process, the corporation or LLC must file the necessary forms and documents with the appropriate county court or government agency. These documents typically include a Petition for Dissolution of Lien, supporting evidence, and any required fees. Once the dissolution process is complete, the lien holder will receive notification, and the lien will be officially removed from the public record. This allows the corporation or LLC to regain control over its property or assets, free from the encumbrance of the lien. It is important to consult with legal counsel or a qualified professional experienced in Massachusetts lien law to ensure compliance with all applicable regulations and effectively navigate the Middlesex Massachusetts Dissolution of Lien by Corporation or LLC process. This ensures the corporation or LLC can successfully release the lien and proceed with its business activities without any legal impediments.Middlesex Massachusetts Dissolution of Lien by Corporation or LLC is a legal process that allows a corporation or limited liability company (LLC) in Middlesex County, Massachusetts, to release a lien placed on a property or assets. A lien is typically a legal claim against a property or asset to secure the payment of a debt or obligation. When a corporation or LLC wants to dissolve a lien in Middlesex Massachusetts, it needs to follow specific procedures outlined by state laws. The dissolution process ensures that the lien holder's rights are protected and ensures the lien is removed from the public record. There are several types of Middlesex Massachusetts Dissolution of Lien by Corporation or LLC: 1. Voluntary Dissolution: A voluntary dissolution occurs when the corporation or LLC decides to dissolve the lien willingly. This can happen when the underlying debt is paid off, settled, or no longer poses a risk to the lien holder. 2. Involuntary Dissolution: Involuntary dissolution occurs when the corporation or LLC fails to comply with certain legal obligations, such as filing required documents, paying taxes, or maintaining necessary licenses or permits. In such cases, the government or creditors may initiate the dissolution process and seek the removal of the lien. 3. Dissolution by Bankruptcy: If the corporation or LLC files for bankruptcy, the court may order the dissolution of any existing liens. This is done to ensure a fair distribution of assets among creditors and alleviate the corporation or LLC from further financial obligations. 4. Dissolution through Judicial Process: In some cases, the corporation or LLC may seek dissolution of a lien through a judicial process. This usually happens when the lien holder disputes the validity of the lien or if there are legal issues surrounding the debt or obligation. To initiate the Middlesex Massachusetts Dissolution of Lien by Corporation or LLC process, the corporation or LLC must file the necessary forms and documents with the appropriate county court or government agency. These documents typically include a Petition for Dissolution of Lien, supporting evidence, and any required fees. Once the dissolution process is complete, the lien holder will receive notification, and the lien will be officially removed from the public record. This allows the corporation or LLC to regain control over its property or assets, free from the encumbrance of the lien. It is important to consult with legal counsel or a qualified professional experienced in Massachusetts lien law to ensure compliance with all applicable regulations and effectively navigate the Middlesex Massachusetts Dissolution of Lien by Corporation or LLC process. This ensures the corporation or LLC can successfully release the lien and proceed with its business activities without any legal impediments.