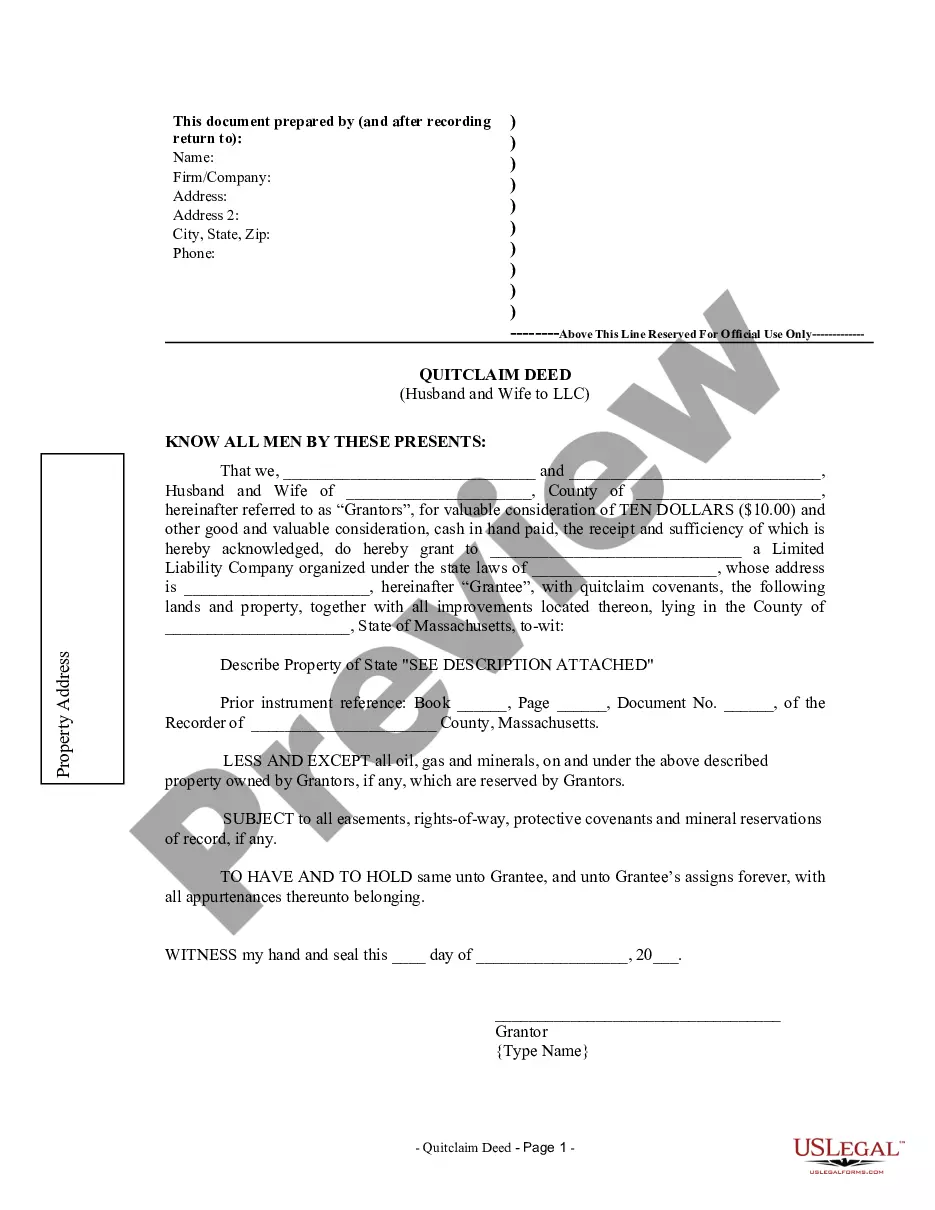

A Boston Massachusetts Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers property ownership from a married couple to a Limited Liability Company (LLC) using a quitclaim deed. This type of deed is commonly used when spouses want to transfer ownership of a property they jointly own to their LLC. A quitclaim deed is a deed that transfers any interest or rights the granter (person transferring ownership) has in the property to the grantee (person receiving ownership). It is important to note that a quitclaim deed does not guarantee or provide any warranties regarding the property's title or potential liens. Instead, it only transfers whatever interest or ownership the granter has at the time of the deed's execution. In the context of a Boston Massachusetts Quitclaim Deed from Husband and Wife to LLC, the specific wording and requirements may vary depending on the circumstances and the specific needs of the parties involved. However, there are a few common elements that such a deed typically contains: 1. Identifying Information: The deed will identify the husband and wife as the granters and the LLC as the grantee. It will include their full legal names, addresses, and any other necessary identifying information. It may also include the date of the deed's execution. 2. Property Description: A thorough description of the property being transferred is crucial. This typically includes the property's legal description, its address, and any other relevant details necessary to accurately identify the property. 3. Rights and Interests: The deed will outline the specific rights and interests being transferred from the husband and wife to the LLC. It may state that the transfer includes all rights to the property, including ownership, possession, and any other inherent rights. 4. Consideration: While a quitclaim deed does not necessarily require consideration (such as a monetary payment), it is common practice to state the consideration in the deed. This can include a nominal amount or simply state that the transfer is being made for "valuable consideration." Different variations of a Boston Massachusetts Quitclaim Deed from Husband and Wife to LLC may exist based on specific requirements or circumstances. One possible variation is a joint tenancy with right of survivorship, where the husband and wife, as joint tenants, transfer their ownership interest to the LLC. Another variation may include special provisions or conditions tailored to the needs of the parties involved, such as restrictions on use or development, or specific tax or financial considerations. It is crucial to consult with a qualified real estate attorney or legal professional when creating or executing any type of quitclaim deed, as the specific requirements, legal implications, and potential tax consequences can vary depending on state laws and individual circumstances.

Boston Massachusetts Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Boston Massachusetts Quitclaim Deed From Husband And Wife To LLC?

We always want to minimize or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for attorney solutions that, usually, are extremely costly. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of legal counsel. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Boston Massachusetts Quitclaim Deed from Husband and Wife to LLC or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Boston Massachusetts Quitclaim Deed from Husband and Wife to LLC complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Boston Massachusetts Quitclaim Deed from Husband and Wife to LLC is proper for your case, you can select the subscription plan and make a payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!