A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

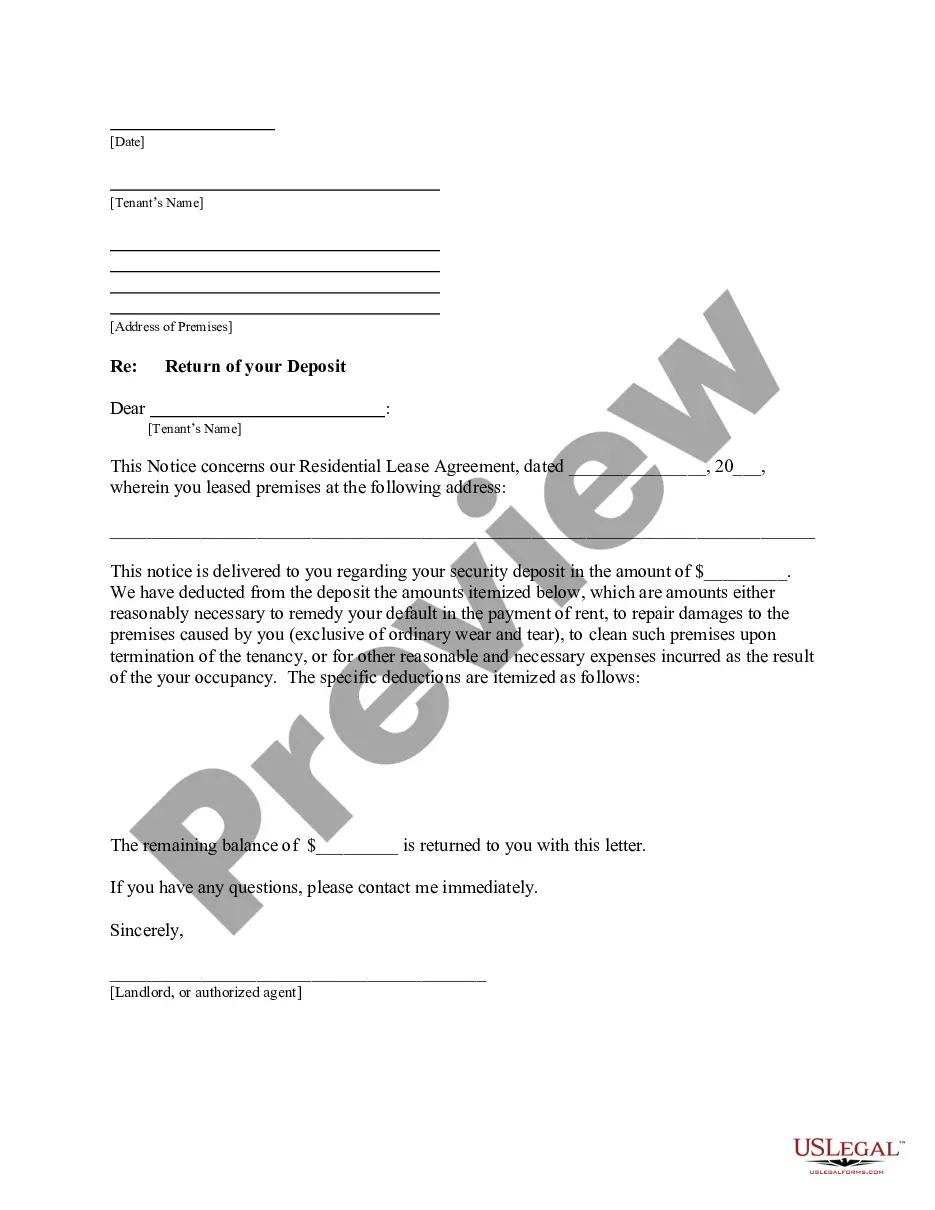

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Boston Massachusetts Letter from Landlord to Tenant Returning Security Deposit Less Deductions (Variations: Notice to Tenant Regarding Security Deposit Deductions, Final Security Deposit Statement) Introduction: A Boston Massachusetts Letter from Landlord to Tenant Returning Security Deposit Less Deductions is a formal document that is used by landlords in Boston to notify tenants about the final disposition of their security deposit. This letter provides an itemized breakdown of any deductions made from the original security deposit, along with an explanation for each deduction. It serves as a legal record of the deductions made and helps maintain transparency between landlords and tenants. Keywords: Boston Massachusetts, letter, landlord, tenant, returning security deposit, deductions, itemized breakdown, explanation, legal record, transparency. Content: 1. Headline: The letter should begin with a clear headline indicating that it is a notice of the return of the security deposit with deductions. It should include the names of both the landlord and the tenant, the property address, and the date. 2. Opening paragraph: The opening paragraph should express gratitude for the tenant's tenure and briefly mention the reason for the letter. It is important to maintain a professional and courteous tone throughout the letter. 3. Paragraph of Deposit Amount: Provide a brief paragraph that states the original amount of the security deposit paid by the tenant at the beginning of the tenancy. Mention the date of receipt and any relevant details regarding the deposit. 4. Itemized Deductions: Provide an itemized breakdown of the deductions made from the security deposit, along with the corresponding costs. Each deduction should be clearly explained to ensure transparency. Common deductions may include: — Unpaid rent: Clearly state the outstanding rent owed by the tenant, if applicable. Provide a detailed summary of the rent arrears, including dates and amounts. — Repairs and Maintenance: Explain any repairs or damages that occurred during the tenancy for which the tenant is responsible. Include documentation, such as invoices, receipts, or photographs, as evidence of the expenses incurred. — Cleaning fees: Detail any necessary cleaning services required to restore the property to its original condition. Mention the specific areas that needed cleaning and related expenses. — Utility charges: If applicable, detail any unpaid or outstanding utility bills the tenant is responsible for according to the lease agreement. 5. Total Deductions: Summarize the total deductions made from the security deposit by adding up the individual amounts mentioned in the itemized list. Clearly state the final amount being withheld from the original deposit. 6. Return of Balance: State the final amount that will be returned to the tenant after deducting the total expenses. Provide instructions on how the tenant will receive this balance (e.g., by check, direct deposit) and the timeframe for its return. Alternatively, if there is no balance remaining, clearly state that the deductions equal or exceed the original security deposit amount. 7. Contact Information: Include the landlord's contact information in case the tenant has any questions or requires further clarification about the deductions or the return of the balance. 8. Closing: End the letter with a polite closing, such as "Sincerely," followed by the landlord's name and signature. This adds a personal touch and reinforces the professionalism of the letter. Keywords: opening paragraph, deposit amount, itemized deductions, unpaid rent, repairs and maintenance, cleaning fees, utility charges, total deductions, return of balance, contact information, closing. Note: It is advisable to consult with local housing laws or seek legal advice to ensure compliance with specific Boston and Massachusetts regulations regarding the return of security deposits.

Title: Boston Massachusetts Letter from Landlord to Tenant Returning Security Deposit Less Deductions (Variations: Notice to Tenant Regarding Security Deposit Deductions, Final Security Deposit Statement) Introduction: A Boston Massachusetts Letter from Landlord to Tenant Returning Security Deposit Less Deductions is a formal document that is used by landlords in Boston to notify tenants about the final disposition of their security deposit. This letter provides an itemized breakdown of any deductions made from the original security deposit, along with an explanation for each deduction. It serves as a legal record of the deductions made and helps maintain transparency between landlords and tenants. Keywords: Boston Massachusetts, letter, landlord, tenant, returning security deposit, deductions, itemized breakdown, explanation, legal record, transparency. Content: 1. Headline: The letter should begin with a clear headline indicating that it is a notice of the return of the security deposit with deductions. It should include the names of both the landlord and the tenant, the property address, and the date. 2. Opening paragraph: The opening paragraph should express gratitude for the tenant's tenure and briefly mention the reason for the letter. It is important to maintain a professional and courteous tone throughout the letter. 3. Paragraph of Deposit Amount: Provide a brief paragraph that states the original amount of the security deposit paid by the tenant at the beginning of the tenancy. Mention the date of receipt and any relevant details regarding the deposit. 4. Itemized Deductions: Provide an itemized breakdown of the deductions made from the security deposit, along with the corresponding costs. Each deduction should be clearly explained to ensure transparency. Common deductions may include: — Unpaid rent: Clearly state the outstanding rent owed by the tenant, if applicable. Provide a detailed summary of the rent arrears, including dates and amounts. — Repairs and Maintenance: Explain any repairs or damages that occurred during the tenancy for which the tenant is responsible. Include documentation, such as invoices, receipts, or photographs, as evidence of the expenses incurred. — Cleaning fees: Detail any necessary cleaning services required to restore the property to its original condition. Mention the specific areas that needed cleaning and related expenses. — Utility charges: If applicable, detail any unpaid or outstanding utility bills the tenant is responsible for according to the lease agreement. 5. Total Deductions: Summarize the total deductions made from the security deposit by adding up the individual amounts mentioned in the itemized list. Clearly state the final amount being withheld from the original deposit. 6. Return of Balance: State the final amount that will be returned to the tenant after deducting the total expenses. Provide instructions on how the tenant will receive this balance (e.g., by check, direct deposit) and the timeframe for its return. Alternatively, if there is no balance remaining, clearly state that the deductions equal or exceed the original security deposit amount. 7. Contact Information: Include the landlord's contact information in case the tenant has any questions or requires further clarification about the deductions or the return of the balance. 8. Closing: End the letter with a polite closing, such as "Sincerely," followed by the landlord's name and signature. This adds a personal touch and reinforces the professionalism of the letter. Keywords: opening paragraph, deposit amount, itemized deductions, unpaid rent, repairs and maintenance, cleaning fees, utility charges, total deductions, return of balance, contact information, closing. Note: It is advisable to consult with local housing laws or seek legal advice to ensure compliance with specific Boston and Massachusetts regulations regarding the return of security deposits.