A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

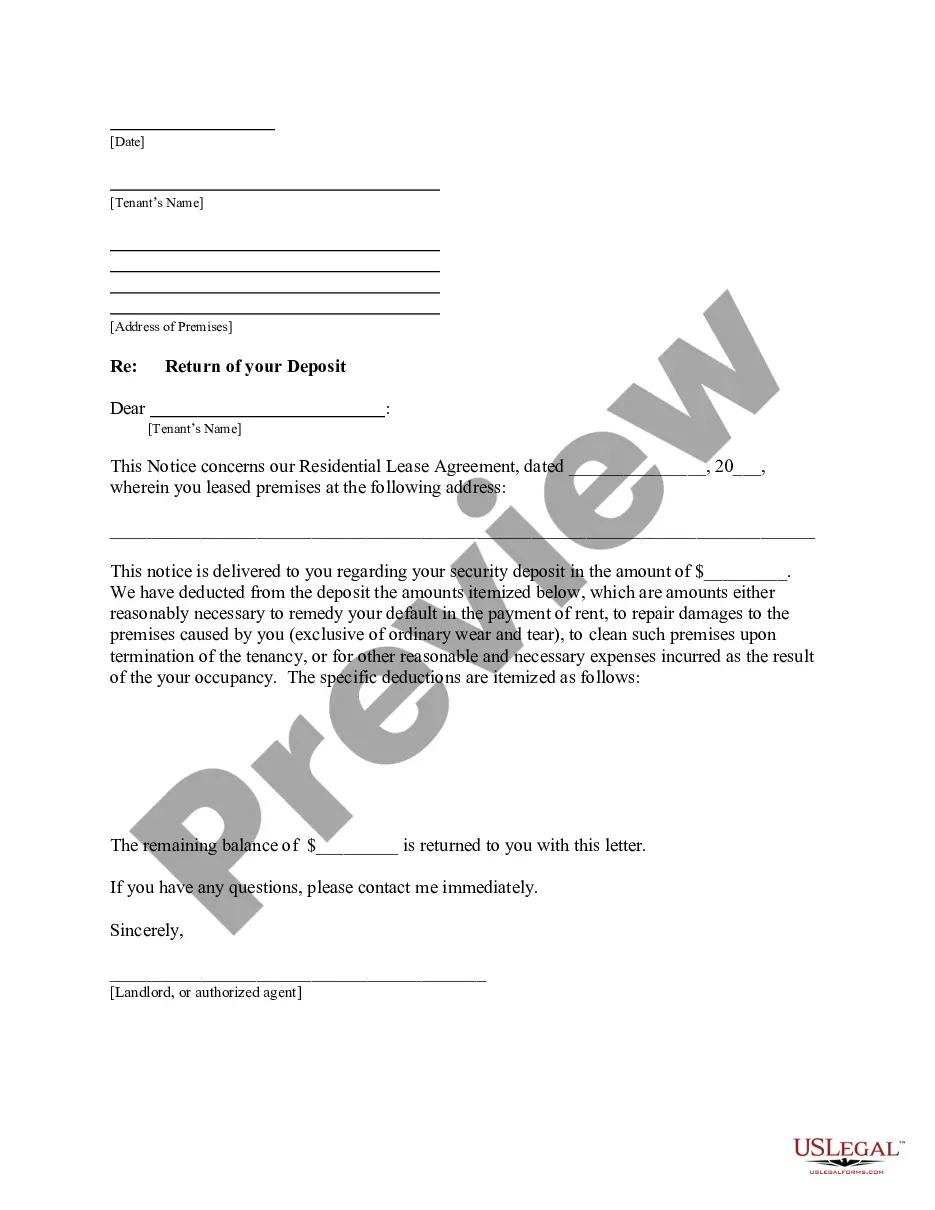

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Cambridge, Massachusetts Letter from Landlord to Tenant Returning Security Deposit Less Deductions — A Comprehensive Guide Introduction: In Cambridge, Massachusetts, landlords are required by law to provide tenants with a written security deposit return letter, outlining any deductions made from the original deposit. This letter serves as a formal communication summarizing the terms of the return, ensuring transparency and clarifying the landlord's reasoning behind any deductions. Key Points to Include: 1. Header — Begin the letter with a professional header containing the landlord's name, address, phone number, and email. 2. Salutation — Start the letter with a polite salutation, addressing the tenant by name. 3. Deposit Details — Clearly state the initial security deposit amount and the specific rental property address. Highlight the applicable dates of occupancy, emphasizing the lease agreement period. 4. Deductions — Enumerate the deductions being made from the original deposit amount in a clear and concise manner. Utilize bullet points for clarity. It is vital to specify the exact dollar amount of each deduction, ensuring accuracy and transparency. 5. Justification — Provide a detailed explanation for each deduction made from the tenant's security deposit. Refer to any move-in/move-out inspection reports or supporting documentation that justify the deductions made. 6. Repairs and Cleaning Expenses — If any costs were incurred to restore the rental property to its original condition or address damages caused by the tenant, detail the nature of the repairs, associated expenses, and supporting evidence. 7. Unpaid Rent or Utilities — If the tenant has any unpaid rent or outstanding utility bills, clearly mention the amount owed and subtract it from the security deposit. Mention any late fees or penalties incurred due to non-payment. 8. Return Amount — Calculate the final amount of the security deposit after the deductions have been made. Clearly state the remaining balance, the method of reimbursement, and the expected timeline for receiving the refund. 9. Contact Information — Provide the landlord's contact information (phone number, email, and address) for any queries or concerns. Encourage the tenant to reach out for further clarification, if needed. 10. Signature and Date — Conclude the letter with the landlord's handwritten signature and the date of issuance. Different Types of Cambridge, Massachusetts Letters from Landlord to Tenant Returning Security Deposit Less Deductions (if applicable): 1. Standard Security Deposit Return Letter: This type of letter is used when the tenant's security deposit is being returned with deductions for valid reasons, such as repairs, cleaning, unpaid rent, or utilities. 2. Itemized Deduction Letter: In cases where there are multiple deductions from the security deposit, a landlord may provide an itemized deduction letter. This letter lists each expense separately with a detailed explanation and supporting evidence. 3. Late Rent Payment Deduction Letter: If the tenant's security deposit is being reduced due to unpaid rent, landlords may provide a separate letter explicitly mentioning the late rent payment deduction. Conclusion: When drafting a Cambridge, Massachusetts letter from landlord to tenant returning a security deposit less deductions, it is crucial to follow legal guidelines and provide a detailed breakdown of the deductions made. By offering transparency and clear communication, landlords can improve tenant relationships and ensure a smooth deposit return process.

Title: Cambridge, Massachusetts Letter from Landlord to Tenant Returning Security Deposit Less Deductions — A Comprehensive Guide Introduction: In Cambridge, Massachusetts, landlords are required by law to provide tenants with a written security deposit return letter, outlining any deductions made from the original deposit. This letter serves as a formal communication summarizing the terms of the return, ensuring transparency and clarifying the landlord's reasoning behind any deductions. Key Points to Include: 1. Header — Begin the letter with a professional header containing the landlord's name, address, phone number, and email. 2. Salutation — Start the letter with a polite salutation, addressing the tenant by name. 3. Deposit Details — Clearly state the initial security deposit amount and the specific rental property address. Highlight the applicable dates of occupancy, emphasizing the lease agreement period. 4. Deductions — Enumerate the deductions being made from the original deposit amount in a clear and concise manner. Utilize bullet points for clarity. It is vital to specify the exact dollar amount of each deduction, ensuring accuracy and transparency. 5. Justification — Provide a detailed explanation for each deduction made from the tenant's security deposit. Refer to any move-in/move-out inspection reports or supporting documentation that justify the deductions made. 6. Repairs and Cleaning Expenses — If any costs were incurred to restore the rental property to its original condition or address damages caused by the tenant, detail the nature of the repairs, associated expenses, and supporting evidence. 7. Unpaid Rent or Utilities — If the tenant has any unpaid rent or outstanding utility bills, clearly mention the amount owed and subtract it from the security deposit. Mention any late fees or penalties incurred due to non-payment. 8. Return Amount — Calculate the final amount of the security deposit after the deductions have been made. Clearly state the remaining balance, the method of reimbursement, and the expected timeline for receiving the refund. 9. Contact Information — Provide the landlord's contact information (phone number, email, and address) for any queries or concerns. Encourage the tenant to reach out for further clarification, if needed. 10. Signature and Date — Conclude the letter with the landlord's handwritten signature and the date of issuance. Different Types of Cambridge, Massachusetts Letters from Landlord to Tenant Returning Security Deposit Less Deductions (if applicable): 1. Standard Security Deposit Return Letter: This type of letter is used when the tenant's security deposit is being returned with deductions for valid reasons, such as repairs, cleaning, unpaid rent, or utilities. 2. Itemized Deduction Letter: In cases where there are multiple deductions from the security deposit, a landlord may provide an itemized deduction letter. This letter lists each expense separately with a detailed explanation and supporting evidence. 3. Late Rent Payment Deduction Letter: If the tenant's security deposit is being reduced due to unpaid rent, landlords may provide a separate letter explicitly mentioning the late rent payment deduction. Conclusion: When drafting a Cambridge, Massachusetts letter from landlord to tenant returning a security deposit less deductions, it is crucial to follow legal guidelines and provide a detailed breakdown of the deductions made. By offering transparency and clear communication, landlords can improve tenant relationships and ensure a smooth deposit return process.