The Boston Massachusetts Employee Earnings Report for Workers' Compensation is a comprehensive document that provides detailed information about the earnings of employees in the city of Boston who are eligible for workers' compensation benefits. This report is primarily used by employers, insurance companies, and government agencies to assess and determine the appropriate compensation for employees who have suffered work-related injuries or illnesses. The report includes various key components, including but not limited to: 1. Employee Information: This section contains the personal details of the employee, such as their full name, social security number, contact information, occupation, and employer information. It serves as a reference point to uniquely identify the employee. 2. Compensation Period: The report identifies the specific time frame for which the earnings are being reported. This period typically corresponds to the time during which the employee was injured or became ill due to work-related activities. 3. Earnings Breakdown: This section provides a comprehensive breakdown of the employee's earnings during the specified compensation period. It includes various types of earnings, such as wages, salaries, bonuses, commissions, overtime pay, and any other forms of income received by the employee. Additionally, it may also capture details regarding the number of hours worked and the pay rate for each type of income. 4. Employer Contributions: In some cases, the report may also include information on employer contributions, such as pension plans, healthcare benefits, and other forms of compensation provided by the employer. These contributions are essential for calculating the overall earnings and determining the appropriate workers' compensation benefits. 5. Deductions and Withholding: This section highlights any deductions or withholding applicable to the employee's earnings during the compensation period. Common deductions include federal and state taxes, social security contributions, healthcare premiums, and any other mandatory deductions specified by relevant laws and regulations. 6. Total Earnings: At the conclusion of the report, a summary is provided, presenting the total earnings of the employee during the specified compensation period. This figure serves as the basis for determining the appropriate workers' compensation benefits. It is important to note that there may be different types of Boston Massachusetts Employee Earnings Reports for Workers' Compensation, depending on specific requirements and regulations. For example, there could be separate reports for employees in different industries or for specific periods, such as quarterly or annually. However, the essential components mentioned above remain consistent across these variations.

Boston Massachusetts Employee Earnings Report for Workers' Compensation

State:

Massachusetts

City:

Boston

Control #:

MA-126-WC

Format:

PDF

Instant download

Public form

Description

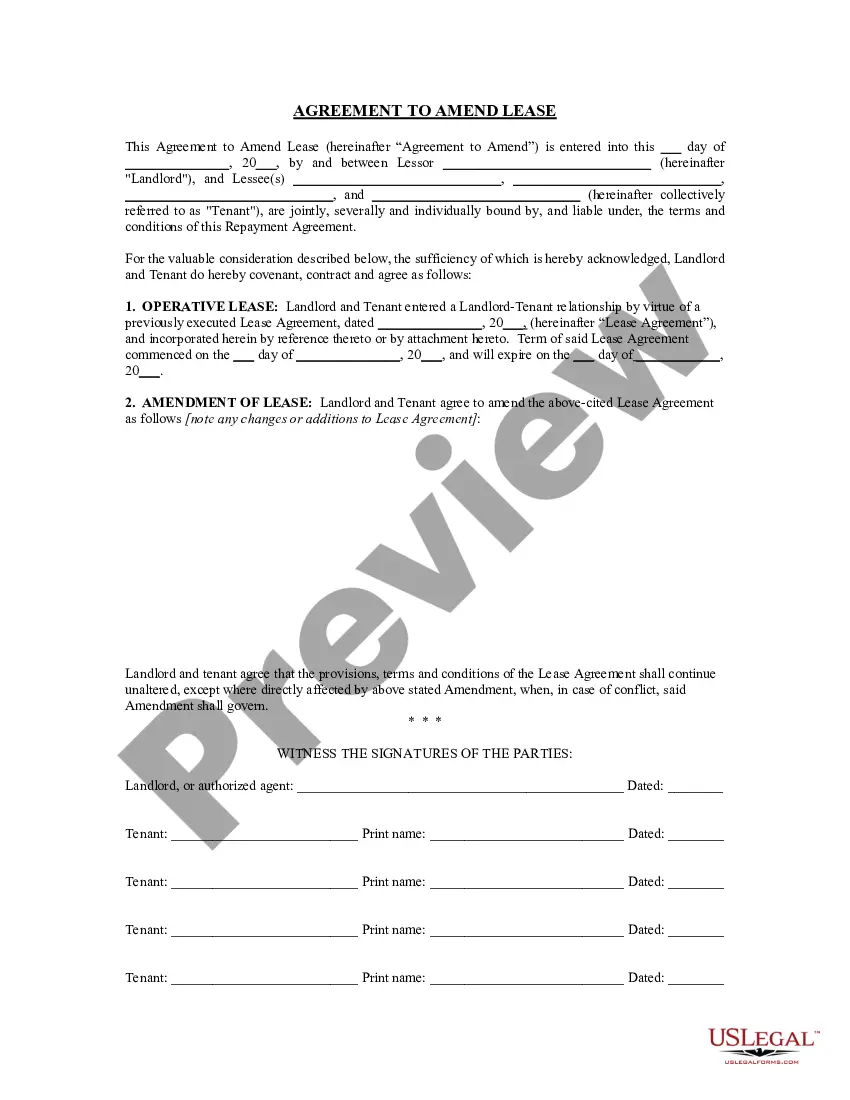

This is one of the official Workers' Compensation forms for the state of Massachusetts.

The Boston Massachusetts Employee Earnings Report for Workers' Compensation is a comprehensive document that provides detailed information about the earnings of employees in the city of Boston who are eligible for workers' compensation benefits. This report is primarily used by employers, insurance companies, and government agencies to assess and determine the appropriate compensation for employees who have suffered work-related injuries or illnesses. The report includes various key components, including but not limited to: 1. Employee Information: This section contains the personal details of the employee, such as their full name, social security number, contact information, occupation, and employer information. It serves as a reference point to uniquely identify the employee. 2. Compensation Period: The report identifies the specific time frame for which the earnings are being reported. This period typically corresponds to the time during which the employee was injured or became ill due to work-related activities. 3. Earnings Breakdown: This section provides a comprehensive breakdown of the employee's earnings during the specified compensation period. It includes various types of earnings, such as wages, salaries, bonuses, commissions, overtime pay, and any other forms of income received by the employee. Additionally, it may also capture details regarding the number of hours worked and the pay rate for each type of income. 4. Employer Contributions: In some cases, the report may also include information on employer contributions, such as pension plans, healthcare benefits, and other forms of compensation provided by the employer. These contributions are essential for calculating the overall earnings and determining the appropriate workers' compensation benefits. 5. Deductions and Withholding: This section highlights any deductions or withholding applicable to the employee's earnings during the compensation period. Common deductions include federal and state taxes, social security contributions, healthcare premiums, and any other mandatory deductions specified by relevant laws and regulations. 6. Total Earnings: At the conclusion of the report, a summary is provided, presenting the total earnings of the employee during the specified compensation period. This figure serves as the basis for determining the appropriate workers' compensation benefits. It is important to note that there may be different types of Boston Massachusetts Employee Earnings Reports for Workers' Compensation, depending on specific requirements and regulations. For example, there could be separate reports for employees in different industries or for specific periods, such as quarterly or annually. However, the essential components mentioned above remain consistent across these variations.

How to fill out Boston Massachusetts Employee Earnings Report For Workers' Compensation?

If you’ve already used our service before, log in to your account and save the Boston Massachusetts Employee Earnings Report for Workers' Compensation on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Boston Massachusetts Employee Earnings Report for Workers' Compensation. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!