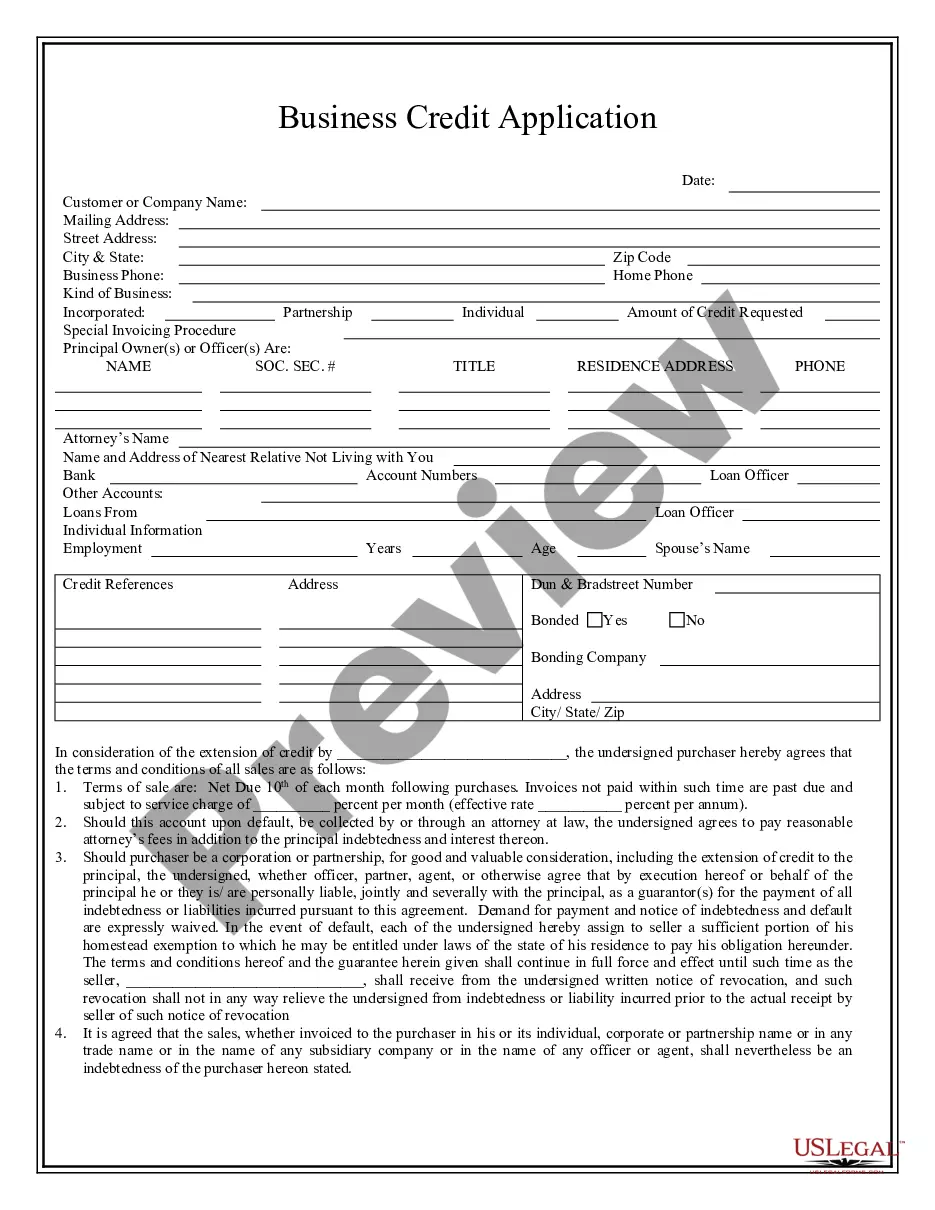

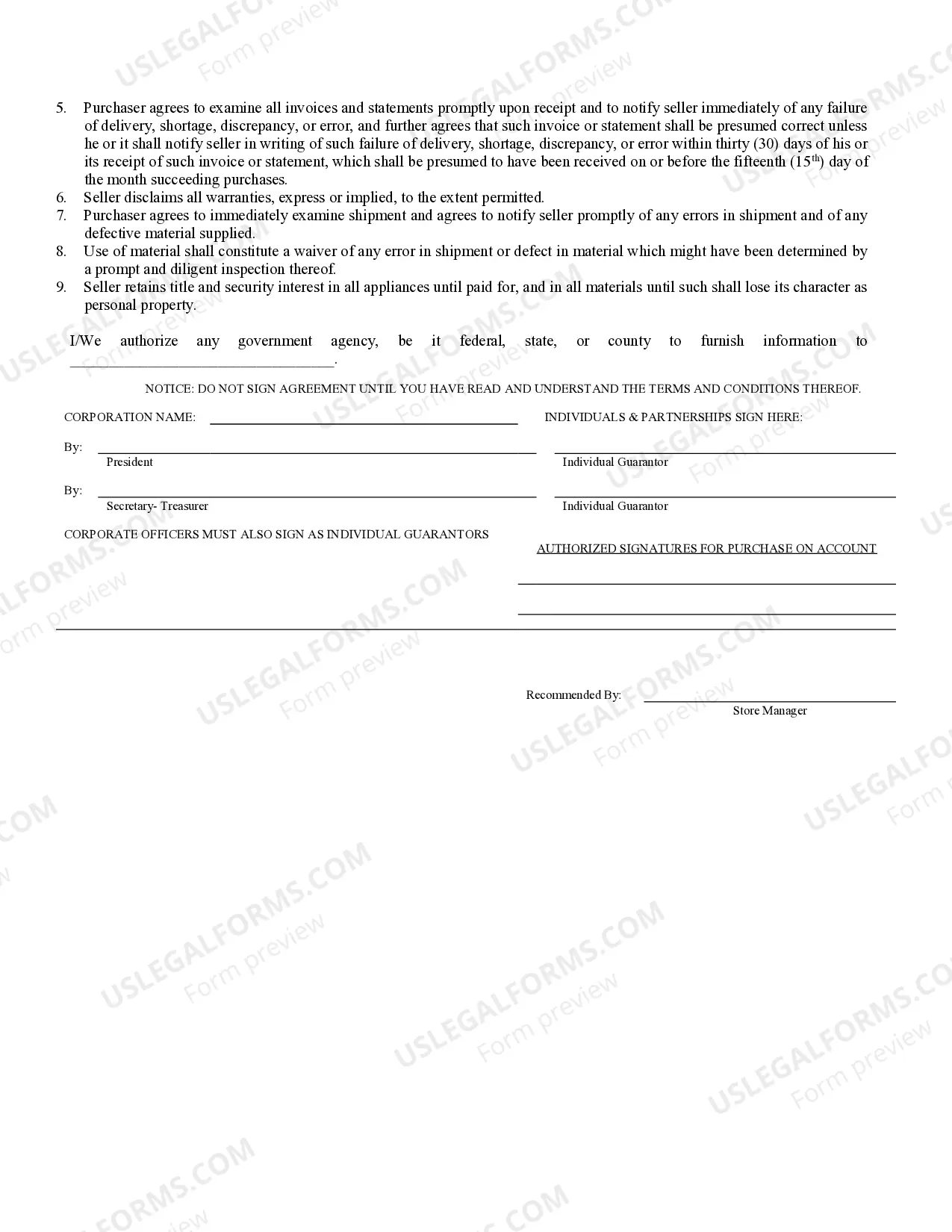

Cambridge Massachusetts Business Credit Application

Description

How to fill out Massachusetts Business Credit Application?

Benefit from the US Legal Forms and gain instant access to any document you require.

Our efficient platform containing a vast array of document samples streamlines the process of locating and obtaining virtually any template you need.

You can download, complete, and validate the Cambridge Massachusetts Business Credit Application in just a few minutes instead of browsing the internet for hours trying to find the appropriate template.

Utilizing our library is an excellent method to enhance the security of your form submissions. Our knowledgeable legal experts consistently examine all documents to ensure that the templates are applicable for a specific state and in accordance with new laws and regulations.

If you have not created an account yet, follow the instructions outlined below.

Feel free to utilize our service and ensure your document experience is as simple as possible!

- How can you access the Cambridge Massachusetts Business Credit Application.

- If you have an existing subscription, simply Log In to your account. The Download option will be visible on each template you view.

- Additionally, you can retrieve any previously saved documents from the My documents section.

Form popularity

FAQ

Most lenders expect a credit score of around 700 for an optimal chance at approval for a business line of credit. However, some may approve applications with lower scores, depending on other aspects of your financial profile. It's wise to improve your credit score as much as possible prior to applying. Using the Cambridge Massachusetts Business Credit Application streamlines this process, guiding you through necessary steps and documentation.

To secure a business line of credit, a credit score of at least 680 is generally recommended. However, lenders may consider various factors beyond just your score, including business revenue and credit history. Therefore, it's essential to maintain a good credit profile and explore your options. The Cambridge Massachusetts Business Credit Application can help you understand specific requirements tailored to your situation.

While there is no fixed score that guarantees business credit, a personal credit score of 680 and above tends to open more opportunities. Most lenders look for a favorable personal credit history when assessing business credit applications. By using a Cambridge Massachusetts Business Credit Application, you can position your business for financial growth and improve your chances of receiving funding. Properly managing your finances can further enhance your qualifications.

Your personal credit score may be considered, especially when your business is new or lacks a credit history. Lenders often use personal credit as a risk factor when evaluating your business credit application. However, as your business develops its credit profile, you can reduce the reliance on personal credit. A Cambridge Massachusetts Business Credit Application enables you to build distinct business credit over time.

With a credit score of 620, you may qualify for several types of business credit cards, although options may be limited. Some cards are specifically designed for businesses with fair credit, making them more accessible. Completing a Cambridge Massachusetts Business Credit Application can guide you to suitable card options tailored for your circumstances. Always compare different offers to find the one that best fits your business needs.

Yes, it is possible to obtain business credit even if your personal credit is not strong. Many lenders and credit issuers consider the business's creditworthiness rather than solely relying on your personal credit score. Utilizing a Cambridge Massachusetts Business Credit Application can increase your chances of approval, especially if your business meets operational and financial requirements. Building separate business credit can help you establish financial independence.

A business credit application is designed to help you secure financing for your business needs. It collects information about your company's financial health, operations, and credit history. By completing a Cambridge Massachusetts Business Credit Application, you can access loans, lines of credit, and business credit cards. This application serves as a gateway to better funding options for your business.

Typically, a new LLC does not start with an established business credit score immediately. Instead, it builds credit over time through transactions and relationships with vendors and lenders. A Cambridge Massachusetts Business Credit Application can help you start this process by establishing an official credit profile. It's essential to maintain good financial practices to improve your score as your business grows.