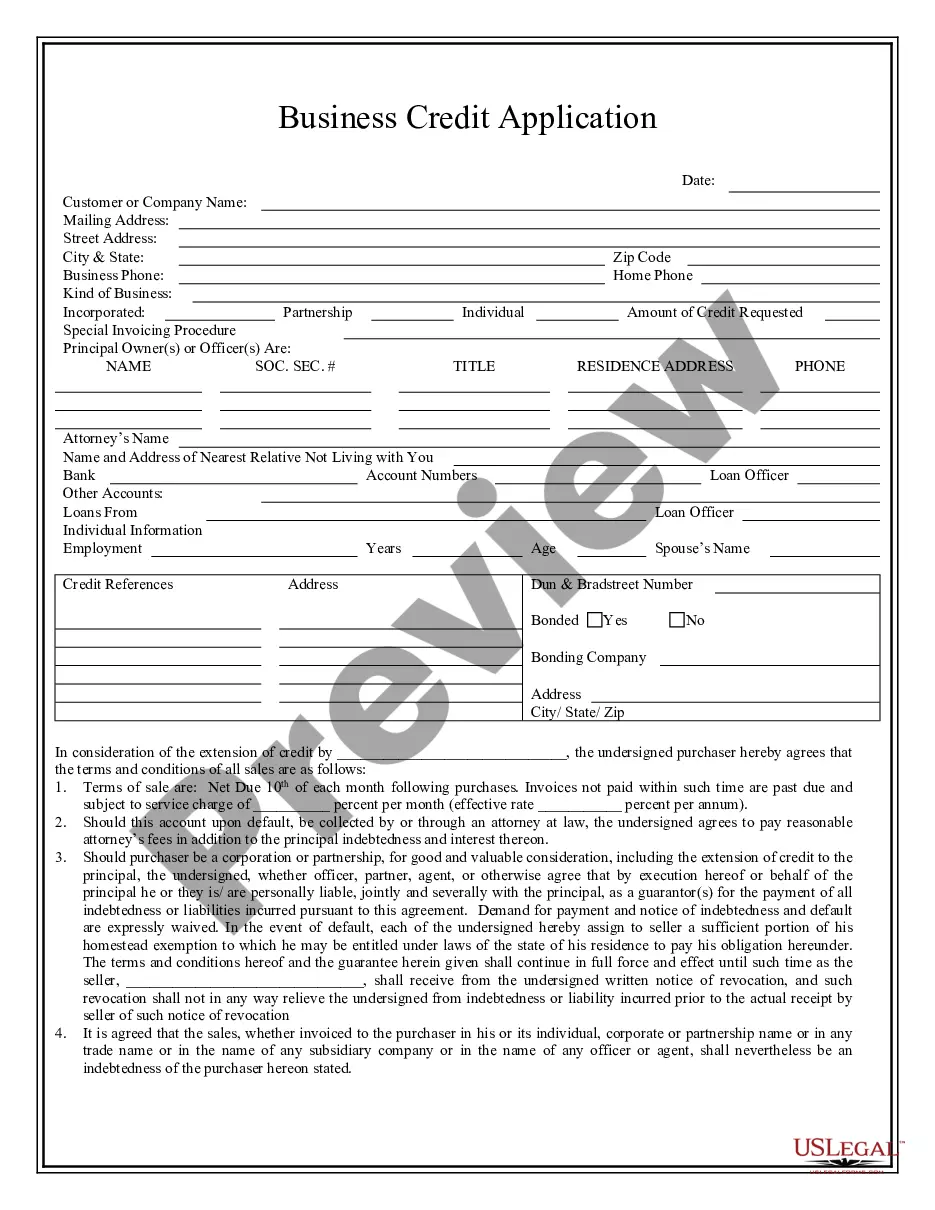

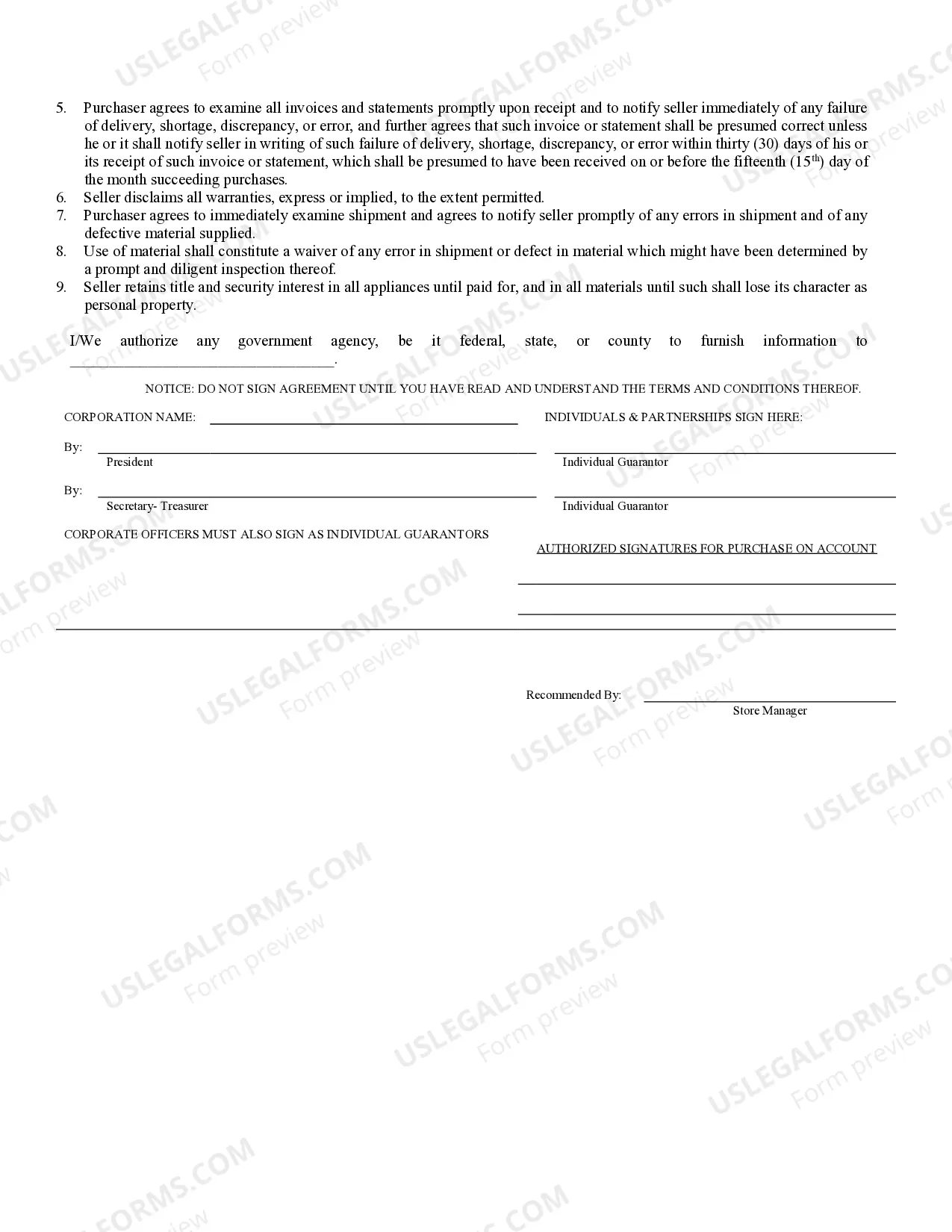

Lowell Massachusetts Business Credit Application is a formal document used by businesses located in Lowell, Massachusetts, to apply for credit with financial institutions or lenders. This application is designed to gather essential information about the business and its financial stability, allowing lenders to assess the applicant's creditworthiness accurately. A typical Lowell Massachusetts Business Credit Application collects the following information: 1. Business Information: This section requires the business's legal name, trade name if applicable, address, contact details, tax identification number, and years in operation. 2. Ownership and Structure: Here, the applicant provides details on the business's legal structure, such as whether it is a sole proprietorship, partnership, limited liability company (LLC), or corporation. It may also require information regarding the owners and their percentage of ownership. 3. Financial Statements: Lenders often request financial statements, such as balance sheets, income statements, and cash flow statements, to evaluate the business's financial health. These statements help determine the business's ability to repay the credit. 4. Business History: This section elicits information about the business's history, including previous credit experiences, bankruptcies, or any outstanding legal judgments. It may also ask for a brief description of the company's operations, products or services offered, and target market. 5. Requested Credit Amount and Purpose: The applicant specifies the amount of credit they are seeking, along with the purpose of the credit. For instance, the funds may be intended for purchasing inventory, expanding operations, or covering operational expenses. 6. Guarantors and Collateral: A Lowell Massachusetts Business Credit Application may require information about individuals willing to personally guarantee the credit in case the business defaults. Additionally, details regarding available collateral can also be requested, as it serves as added security for the lender. Different types of Lowell Massachusetts Business Credit Applications may exist, depending on the specific lenders or financial institutions involved. Some variations might include industry-specific credit applications tailored for specific sectors such as manufacturing, retail, construction, or healthcare. Additionally, different lenders may have their unique application forms or requirements based on their internal policies and risk assessment criteria. In conclusion, the Lowell Massachusetts Business Credit Application is a comprehensive document that enables businesses in Lowell, Massachusetts, to apply for credit. By providing detailed information about the business's financial background, ownership, and credit needs, lenders can evaluate the creditworthiness of the applicant and make informed decisions based on the application.

Lowell Massachusetts Business Credit Application

Description

How to fill out Lowell Massachusetts Business Credit Application?

If you are looking for a valid form template, it’s difficult to choose a better place than the US Legal Forms website – one of the most considerable online libraries. With this library, you can get thousands of form samples for business and personal purposes by categories and states, or key phrases. With the high-quality search option, finding the most up-to-date Lowell Massachusetts Business Credit Application is as elementary as 1-2-3. Furthermore, the relevance of each and every document is verified by a team of expert lawyers that regularly review the templates on our platform and update them based on the most recent state and county laws.

If you already know about our system and have a registered account, all you need to get the Lowell Massachusetts Business Credit Application is to log in to your account and click the Download option.

If you utilize US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have discovered the sample you require. Look at its description and utilize the Preview option to explore its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to find the appropriate file.

- Confirm your choice. Select the Buy now option. Following that, pick your preferred pricing plan and provide credentials to register an account.

- Make the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Pick the file format and download it to your system.

- Make modifications. Fill out, modify, print, and sign the received Lowell Massachusetts Business Credit Application.

Each and every form you save in your account does not have an expiry date and is yours permanently. It is possible to gain access to them using the My Forms menu, so if you want to have an extra copy for enhancing or creating a hard copy, feel free to return and download it again anytime.

Make use of the US Legal Forms extensive library to gain access to the Lowell Massachusetts Business Credit Application you were looking for and thousands of other professional and state-specific samples in a single place!