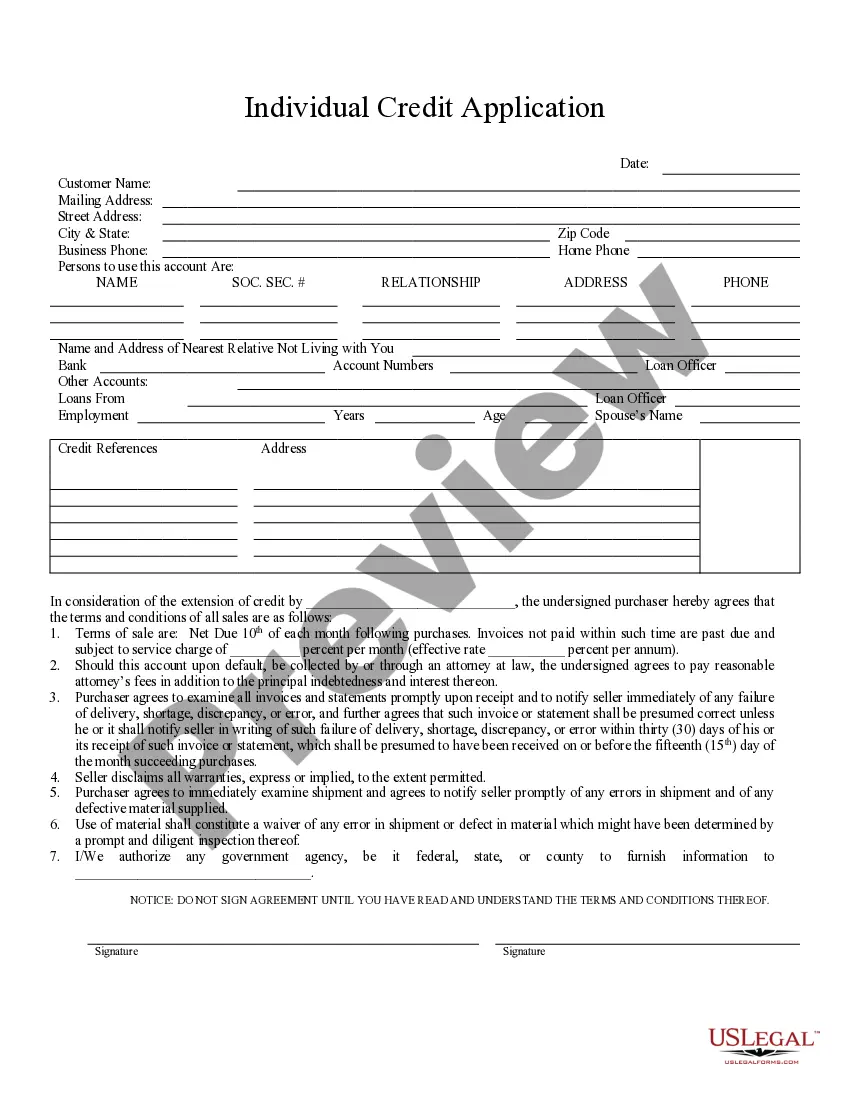

The Boston Massachusetts Individual Credit Application refers to a comprehensive document used for requesting credit, specifically tailored to individuals residing in the city of Boston, Massachusetts. This application serves as a vital tool for individuals seeking financial assistance, such as personal loans, credit cards, or mortgage loans, from banks, lending institutions, or credit unions in the Boston area. The Boston Massachusetts Individual Credit Application typically contains a range of information needed to assess an individual's creditworthiness, including personal details, employment information, financial assets and liabilities, and credit history. Applicants are required to provide their full name, address, social security number, contact information, and employment details, such as their current occupation, employer's name, income details, and length of employment. Additionally, the application may require applicants to disclose their financial assets, including bank accounts, investments, and real estate holdings. They might also have to provide an inventory of their liabilities, such as existing loans, credit card debt, or other financial obligations. This information enables the lender to evaluate an applicant's financial stability and ability to repay the requested credit. Credit history plays a crucial role in the evaluation process. Applicants are generally asked to provide consent for the lender to access their credit reports from major credit bureaus. This allows the lender to review the applicant's past payment behavior, outstanding debts, defaults, bankruptcies, or any other negative credit-related information. Positive credit history, including timely payments and low credit utilization, can significantly enhance an applicant's chances of credit approval. It is important to note that there may be different types or variations of the Boston Massachusetts Individual Credit Application, depending on the specific financial institution or lender. Some institutions may have their own unique application forms, while others might follow a standardized template provided by regulatory bodies or industry associations. Examples of different types of Boston Massachusetts Individual Credit Applications may include: 1. Mortgage Loan Application: This particular application is widespread among individuals seeking financing for purchasing a home or refinancing their existing mortgage in the Boston area. It may contain additional sections related to property details, estimated property value, and loan amount requested. 2. Personal Loan Application: Tailored for individuals looking for unsecured loans to meet personal financial needs, such as education expenses, debt consolidation, or home improvements. This application may focus more on an applicant's income and employment history. 3. Credit Card Application: Specifically designed for individuals interested in obtaining a credit card. Besides the standard personal and financial information, this application might require the applicant to provide details about their desired credit limit, preferred card features, and existing credit card accounts. In conclusion, the Boston Massachusetts Individual Credit Application is a comprehensive document allowing individuals to apply for credit specifically in the Boston area. It collects essential personal, financial, and credit history details to evaluate an applicant's creditworthiness based on their ability to repay, financial stability, and credit history. Different types of applications exist for specific credit needs, such as mortgage loans, personal loans, and credit cards.

Boston Massachusetts Individual Credit Application

Description

How to fill out Boston Massachusetts Individual Credit Application?

Make use of the US Legal Forms and have instant access to any form template you want. Our helpful platform with thousands of templates makes it easy to find and obtain almost any document sample you require. You can save, complete, and sign the Boston Massachusetts Individual Credit Application in just a few minutes instead of browsing the web for hours searching for the right template.

Utilizing our catalog is a wonderful way to improve the safety of your document filing. Our experienced attorneys on a regular basis check all the documents to make certain that the templates are relevant for a particular state and compliant with new laws and polices.

How do you obtain the Boston Massachusetts Individual Credit Application? If you already have a profile, just log in to the account. The Download option will be enabled on all the documents you view. In addition, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, follow the instruction listed below:

- Open the page with the template you require. Make sure that it is the form you were looking for: check its headline and description, and utilize the Preview option if it is available. Otherwise, use the Search field to find the needed one.

- Start the downloading procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order using a credit card or PayPal.

- Download the document. Pick the format to get the Boston Massachusetts Individual Credit Application and change and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy form libraries on the internet. We are always ready to help you in any legal procedure, even if it is just downloading the Boston Massachusetts Individual Credit Application.

Feel free to make the most of our platform and make your document experience as straightforward as possible!