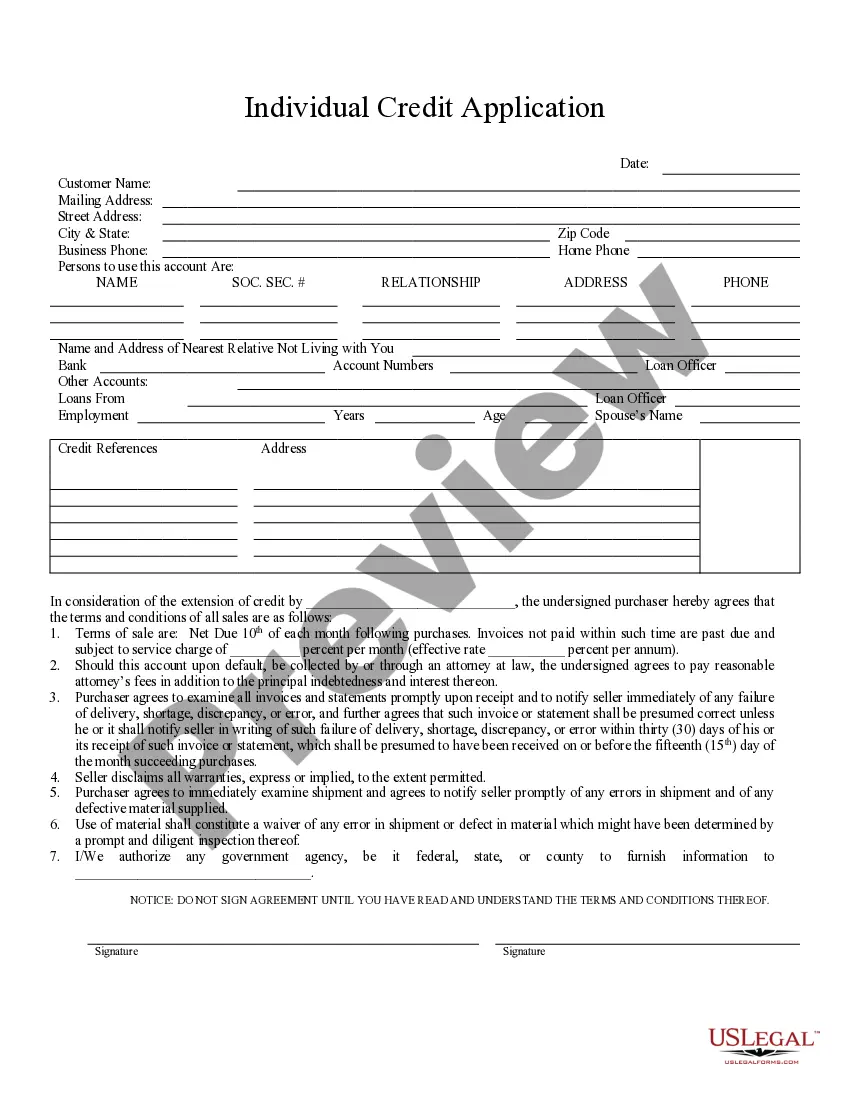

Cambridge Massachusetts Individual Credit Application is a comprehensive document used by individuals in Cambridge, Massachusetts, to apply for credit from financial institutions, such as banks or credit unions. This application enables individuals to request credit for various purposes, such as purchasing a home, financing a vehicle, or obtaining a personal loan. The Cambridge Massachusetts Individual Credit Application collects essential information about the applicant, including personal details like name, address, contact information, and Social Security number. It also requires information about employment history, income sources, and monthly expenses to assess the applicant's financial stability and ability to repay the credit. In addition to the applicant's personal information, some other relevant details often required in a Cambridge Massachusetts Individual Credit Application include: 1. Purpose of Credit: Applicants need to specify the purpose for which they require credit, such as debt consolidation, education expenses, or medical bills. 2. Loan Amount: Applicants must provide the desired loan amount they are requesting, which can be specific for purposes like home or auto loans, or a general amount for personal loans. 3. Collateral Information: In case the credit application requires collateral, applicants need to provide details about the property or assets they are willing to use as security against the credit. 4. Credit History: Applicants should disclose their credit history, including any outstanding debts or bankruptcy filings. This information helps financial institutions assess the applicant's creditworthiness and determine the risk involved in granting credit. 5. Co-Applicant Details: If there is a co-applicant involved in the credit application, such as a spouse or partner, their personal and financial information must also be provided. Some different types of Cambridge Massachusetts Individual Credit Applications may exist depending on the specific financial institution or purpose. These can include: 1. Mortgage Application: Specifically designed for individuals seeking a home loan to purchase a property or refinance an existing mortgage. 2. Auto Loan Application: Tailored for individuals looking to finance a vehicle purchase, whether it's a new or used car, truck, or motorcycle. 3. Personal Loan Application: Used by individuals seeking credit for personal expenses, like home renovations, medical bills, or debt consolidation. 4. Student Loan Application: Designed for students pursuing higher education and needing financial assistance to cover tuition fees, living expenses, or other educational costs. 5. Business Loan Application: For individuals seeking credit to start or expand a small business venture in the Cambridge, Massachusetts area. These types of applications may require additional documentation, such as purchase agreements, property appraisals, income tax returns, or business plans, depending on the purpose and nature of the credit being sought. It is essential for applicants to carefully review and complete all required sections of the application to maximize their chances of approval.

Cambridge Massachusetts Individual Credit Application

Description

How to fill out Cambridge Massachusetts Individual Credit Application?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone without any law background to create such papers cfrom the ground up, mainly because of the convoluted terminology and legal subtleties they come with. This is where US Legal Forms can save the day. Our platform provides a huge catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you need the Cambridge Massachusetts Individual Credit Application or any other paperwork that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Cambridge Massachusetts Individual Credit Application in minutes using our reliable platform. If you are presently an existing customer, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are new to our platform, make sure to follow these steps prior to downloading the Cambridge Massachusetts Individual Credit Application:

- Be sure the form you have found is good for your area considering that the rules of one state or county do not work for another state or county.

- Preview the form and read a brief outline (if provided) of scenarios the document can be used for.

- If the form you chosen doesn’t suit your needs, you can start again and look for the suitable form.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your credentials or register for one from scratch.

- Choose the payment method and proceed to download the Cambridge Massachusetts Individual Credit Application as soon as the payment is done.

You’re all set! Now you can go on and print out the form or fill it out online. Should you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.